Matteo Colombo

Investment Summary

Lithium was one of the many investment buzzwords of 2021—’22 when the spot price of the battery metal completed a meteoric rise of CNY 22,921/tonne to its peak of CNY 592,443/tonne by November ’22, rising some 2,480%.

Naturally, the equity stock of all the lithium majors—especially the Australian names—followed in lockstep, serving up attractive returns for investors who owned these assets.

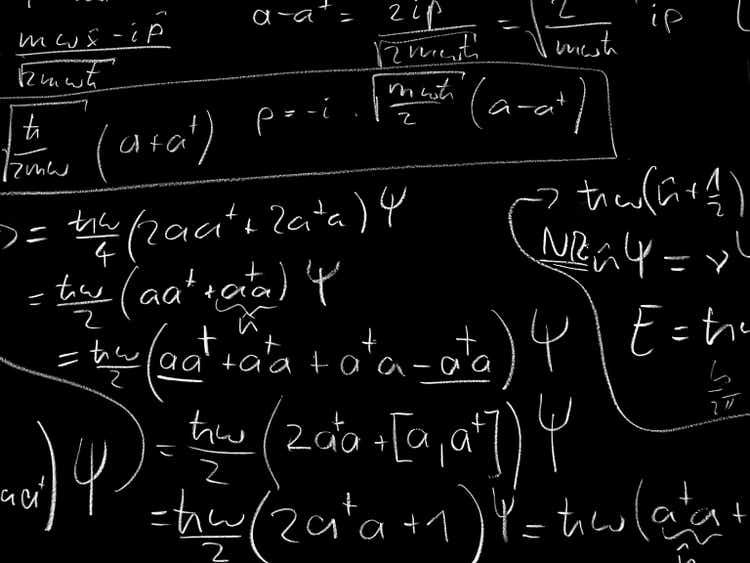

Allkem Limited (TSX:AKE:CA) (OTCPK:OROCF) was one such name and it has whipsawed in a wide range over the last 2 years, as seen in Figure 1. OROCF is a prominent lithium company, resulting from the merger of Australian companies Orocobre Limited and Galaxy Resources in August 2021. In May this year, OROCF and Livent (NYSE:LTHM) then merged in a $10.6Bn deal. OROCF now owns 56% of the new company, with LTHM shareholders claiming the balance.

Figure 1.

Data: Updata

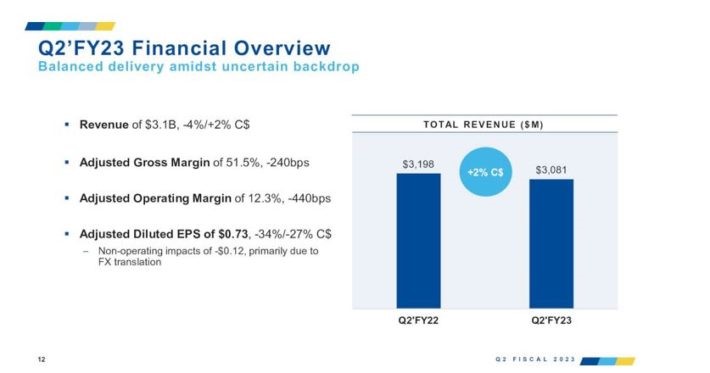

Figure 1(a).

Data: Updata

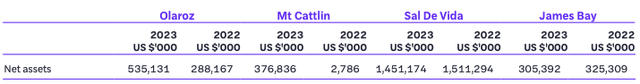

The company holds a portfolio of top-tier lithium assets used in the production of battery materials. This includes its lithium brine operations in Argentina, a hard-rock lithium operation in Australia, and a lithium hydroxide conversion facility in Japan. A view of its net assets at each sight is seen at Figure 2.

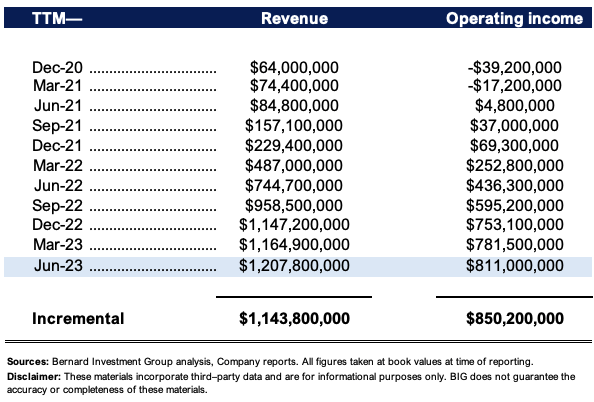

The company recently posted its full-year ’23 results and the numbers were firm in my view. Multiple inflection points at each of its core assets, updated resource estimates, and record revenues just to name a few. Further, the company is a qualified growth name, growing TTM revenues by $1.14Bn incrementally since 2020, as seen in Figure 2(a).

Despite this, the lithium trade appears to have unwound as new supply has entered the market and spot pricing has pared right back to more ‘respectable’ ranges. It now fetches CNY 178,500/tonne. You can see the performance of the Global X Lithium & Battery Tech ETF (LIT) in Figure 1(a), noting the selloff in both instruments. It’s worth noting OROCF is listed on the Australian Stock Exchange as well under the ticker “AKE”. This report will unpack all the moving parts in the OROCF investment debate, with close detail to its FY’23 numbers. Net-net, I rate OROCF a hold on valuation grounds.

Figure 2.

Source: OROCF FY’23 Annual Report

Figure 2(a). OROCF TTM Growth Numbers by Quarter

BIG Insights

Insights from FY’23

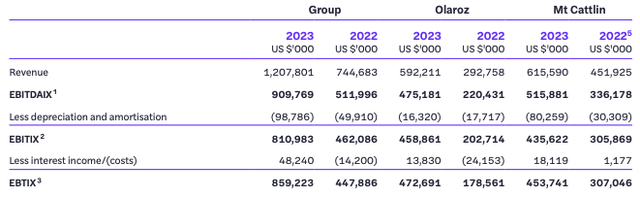

OROCF booked a 62% YoY growth in total income to $1.2Bn in FY’23. The revenue upsides arose from market pricing throughout ’23 coupled with particularly notable gains within its Olaroz and Mt Cattlin assets. It produced 16,703 tonnes of lithium carbonate (“Li2CO3”) at its Olaroz site and 130,984 dry metric tonnes (“dmt”) of spodumene at its Mt Cattlin operations.

Despite the revenue growth, cash unit cost of sales at Olaroz was $5,014/tonne, up from $4,282/tonne last year. This was largely attributed to (i) inflation, and (ii) the corresponding increase in costs for raw materials and energy inputs. Like so many other industries, critical resource players were impacted by the global fluctuations in commodity prices and tightening of supply chains seen amid the fiasco last year. OROCF finished the year with $464mm in CapEx to its core operations, and left the year well capitalized with $648mm on the balance sheet.

Figure 3. Revenue and pre-tax income breakdown. Mt Cattlin and Olaroz were both up in revenues and income from FY’22.

Source: OROCF FY’23 Annual Report

Additionally, OROCF’s overall cost structure was impacted by the removal of export incentives in Q3 last year. This increased the all-in sustaining cost and followed through to gross margin compression, but the company still booked $1.1Bn in gross on the $1.2Bn in sales.

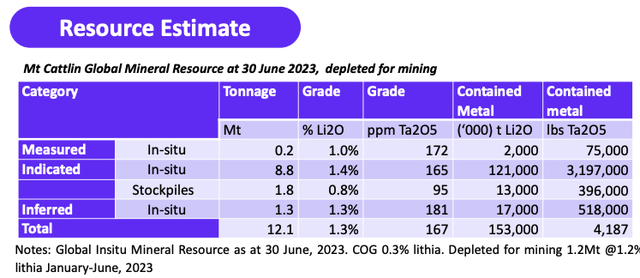

Figure 4. MT Cattlin revised resource estimates. After extending its drilling program beyond 31,000mm, the site now claims ore estimates of 7.1 Mt.

Source: OROCF FY’23 Annual Report

As to the divisional highlights, the breakdown of its Mt Cattlin and Olaroz sites are as follows:

- Mt Cattlin

- Total revenue was $615.6mm, comprised of (i) $513.7mm, generated from shipments of 105,291 dmt of spodumene concentrate, and (ii) another $99.7mm generated from low-grade product sales.

- Production was 130,984 dmt at $909 per dmt, more than double last year. This was due to the development of the 2NW pit, along with general mining costs. Still, the spodumene market experienced a tightening of supply, which sparked a demand spike, resulting in an average realized price of $4,879/tonne, compared to $2,221/tonne in ’22.

- Concentrations were lower as well, producing grades of 5.3% Li2O, down from higher grades seen last year.

- Mt Cattlin ore reserve was also revised to 7.1mm tonnes (“Mt”) at 1.20% Li2O, which is projected to extend the mine life out by 4-5 years. This followed an updated mineral resource estimate (“MRE”) after extending its drilling program to >31,000m.

- Olaroz

- OROCF also owns a 66.5% effective equity interest in the Olaroz Lithium Facility located in Argentina. FY’23 production was another record of 16,703 tonnes of lithium carbonate at the site, as mentioned earlier, up ~30% YoY. Olaroz put up record revenues of $592mm on this, compared to $292.8mm in the previous year. The profit on this was ~$235mm, up 144% YoY.

- Growth was underscored by 1) the sale of 13,186 tonnes of product, with 39% being battery-grade, and 2) an average realized price of $43,981/tonne, 88% higher than FY’22.

- OROCF is eyeing another step up in production at Olaroz in FY’24, targeting 210,000—230,000 tonnes of Li2CO3. The cost per dmt is expected to be ~$850/tonne, baking in the higher strip ratio that will accompany its stage 4 development.

- As part of stage 2 at Olaroz, the latest estimates increased the MRE by 27% to 20.7Mt. This includes (i) 7.6Mt of measured resource, (ii) 7.1Mt of indicated resource, and (iii) 6Mt of inferred resource. The Maria Victoria tenements that it acquired—located in the northern section of the site—contributed 2.8Mt of the overall increase.

- James Bay

- Finally, the company identified a new high-grade zone at its James Bay asset through resource extension drilling.

- This considerably strengthened the MRE by 173%, which now stands at 110.2Mt at 1.30% Li2O. The new high-grade zone is expected to significantly increase the overall mineral resource, further enhancing the company’s proven base.

- Plant engineering is now 81% complete at James Bay as per management, but it is still awaiting provincial approval from COMEX and IBA, but no timelines have been provided.

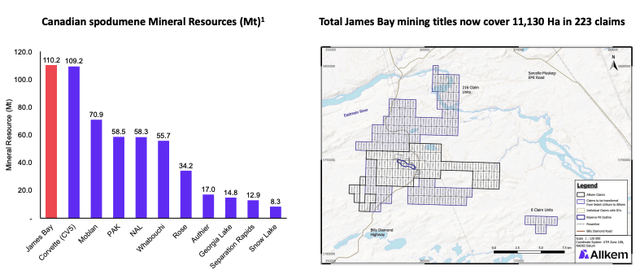

Figure 5. James Bay resource updates adding to OROCF’s portfolio of top-tier lithium assets.

Source: OROCF FY’23 Annual Report

Technical considerations

Given OROCF’s exogenous sensitivity to lithium prices, analyzing the market-generated data is a fruitful exercise. Figures 6 to 8 capture this well.

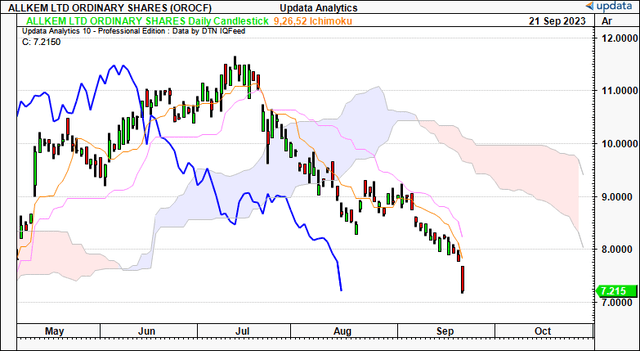

Figure 6 shows the daily cloud chart, and therefore looks out to the coming weeks. As you can see, both price and lagging lines are positioned well below the cloud, having crossed the base in August. This isn’t a bullish price structure by any means, and OROCF is trading at its lowest marks since May this year. You’d need it to cross back in the $9.00 zone to suggest it is catching a bid.

Figure 6.

Data: Updata

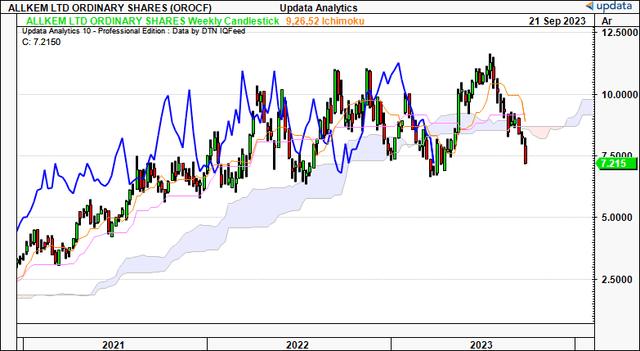

On the weekly cloud chart in Figure 7, we are looking out to the coming months. It was holding up well on the weekly until this latest price action, where it too has crossed beneath the cloud. The lagging line had tested the cloud base earlier in the year and managed to thrust off this mark. But this latest cross is a potentially damaging sign for those wanting to go long the stock. You’d need it to cross above $9.70 by January for a bullish reversal.

Figure 7.

Data: Updata

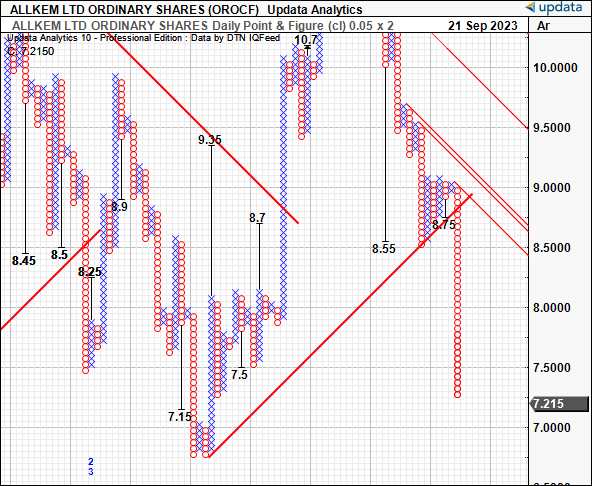

We have neutral targets to the $8.75 region on the point and figure studies below. This appears to be a key level for OROCF based on price action seen throughout its recent history. I’d be looking to the $8.50–$8.75 region as the next potential objectives based on this view.

Figure 8.

Data: Updata

Valuation and conclusion

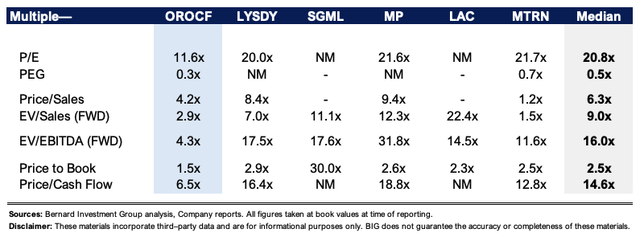

The stock sells at 11.5x earnings and 4.8x forward EBIT. It also sells at 2.9x forward sales. The former 2 multiples are priced at a discount to the sector, 23% and 58% respectively. The large unwind in lithium has surely got something to do with this, and there doesn’t look to be a catalyst to see it change. But you’re also getting a 15.3% cash flow yield buying OROCF today which is something to consider as well, so there is potential value in that level of cash yield. Consensus is calling for $1.63Bn in sales for FY’24, and assigning the 2.9x multiple to this gets me to $7.46/share, roughly in line with where OROCF trades today. Hence, it would appear the market has captured most of the company’s growth in its current valuation.

Figure 9.

BIG Insights

In short, lithium majors have sold off sharply in ’23, along with the unwind in lithium spot and demand for the battery metal. This has led to less than pleasing stock returns into the back end of FY’23 for investors to position against. Critically, OROCF came in with a strong set of numbers in its fiscal ’23, well supported by developments and resource updates at its core assets. Despite this, there is no telling where the market can head from here, and I’m looking to more predictable cash flows at this juncture. Net-net, rate hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.