Making a secure asset with out debt mutualisation: The chance of a European Debt Company

Massimo Amato, Everardo Belloni, Carlo Favero, Lucio Gobbi, Francesco Saraceno 22 April 2022

Within the debate on reforming the EU, two wants emerge: securing fiscal area for EMU international locations, and guaranteeing {that a} extra proactive fiscal coverage stays sustainable even when financial coverage reverts to regular (Buti and Messori 2022).

Debt is at record-high ranges, however the EU’s future challenges contain principally public infrastructural investments, with a trade-off between development and stability. Inside this context, new fiscal guidelines and ample types of debt administration should be established collectively (D’Amico et al. 2022a, 2022b).

In a brand new paper (Amato et al. 2022), we offer a quantitative simulation-based evaluation of the affect on costs and portions of presidency debt within the euro space of the working of a European Debt Company (EDA), positioned within the present EU debate in Amato and Saraceno (2022).

The EDA working mannequin

The EDA collects liquid funds in the marketplace by issuing finite maturity bonds. When the EDA begins its operations, member states cease issuing bonds. The company offers credit score to member states to finance the reimbursement of their maturing bonds in addition to their major price range deficit. This credit score facility takes the type of perpetual loans, priced utilizing a risk-adjusted unit price differentiated in line with the member states’ creditworthiness. EDA bonds are traded, whereas perpetual loans should not traded,1 thus overcoming the difficulties of making a marketplace for perpetuities. An ample preliminary capital endowment and a pricing coverage aimed toward attaining intertemporal monetary equilibrium would enable EDA to get pleasure from AAA standing. The perpetual loans’ instalments charged by the EDA can be calculated (1) by contemplating their elementary danger solely, and (2) by together with an amortisation quota of the mortgage itself. However ‘perpetual’ doesn’t imply ‘irredeemable’, because the EDA has the chance to scale back its stability sheet by drawing assets from its reserves. By progressively elevating a display between markets and member states, the EDA would finally filter all member states’ liquidity and refinancing danger, reworking all of the euro space debt right into a secure debt.

However, because the EDA would differentiate the worth of its loans, the price of debt for every member state would depend upon an evaluation of its elementary danger, leaving every member state absolutely accountable for its fiscal coverage selections.

The working mannequin of the EDA is mirrored in its stability sheet construction (see Determine 1, from Amato et al. 2021).

Determine 1 The EDA’s stability sheet

A simulation train

We compute historic sequence of the unit prices of loans with EDA for every member state by making use of the pricing framework for dangerous perpetual loans. We assume that within the first interval, preliminary capital is conferred to EDA equal to the European Stability Mechaism (ESM) capital, reallocated amongst member states in line with the ESM weights. Reserve dynamics rely then on the brand new inflows, annual funds on the perpetual loans, and the remuneration of the inventory. Reserves are remunerated by the ECB on the charge paid by EDA on its bonds. Heterogeneous and unbiased pricing of every nation’s loans (which we label ‘idiomatic elementary pricing’) generates a complete cost that’s structurally larger than the equilibrium cost computed by ‘pooling’ the debt of all member states within the EDA. So, the EDA accumulates reserves in extra of the debt in bonds that may be exactly attributed to every nation. Within the simulation, the EDA absorbs all of the member states’ excellent bonds in a decade.

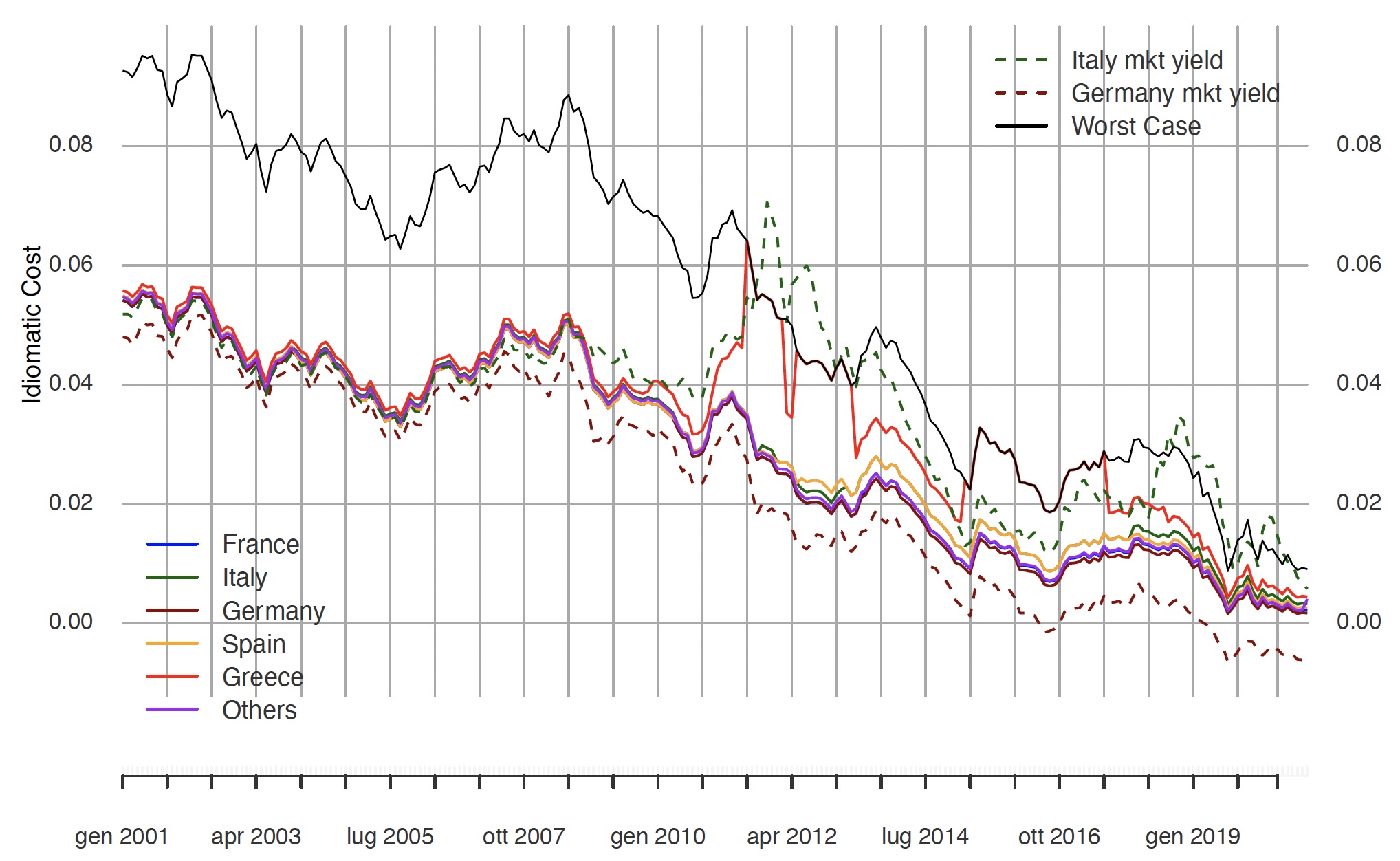

Determine 2 exhibits the historic sequence of those prices, recalculated for every member state based mostly on the counterfactual speculation {that a} debt company has been operational since 2002, and compares them with the fee for a hypothetical nation with the credit score grade ‘subsequent to default’ and the yields of ten-year authorities bonds for Germany (decrease yellow dotted line) and Italy (higher inexperienced dotted line).

Determine 2 Ten-year authorities bond yields (Italy and Germany) and simulated annual prices of perpetual loans (idiomatic prices) for chosen member states and a hypothetical (worst case) subsequent to default nation

These prices are ‘risk-sensitive’, however the idiomatic pricing of danger may be very completely different from the pricing noticed in ten-year bond yields for Germany and Italy through the pattern. Importantly, idiomatic prices don’t manifest ‘diverging symmetries’ in favour or towards a selected member state, and neither do they characteristic ‘extreme fluctuations’ of their authorities debt market costs.

The simulation exhibits that the low diminished volatility in loans costs has helpful penalties for the dynamics of member states’ debt.

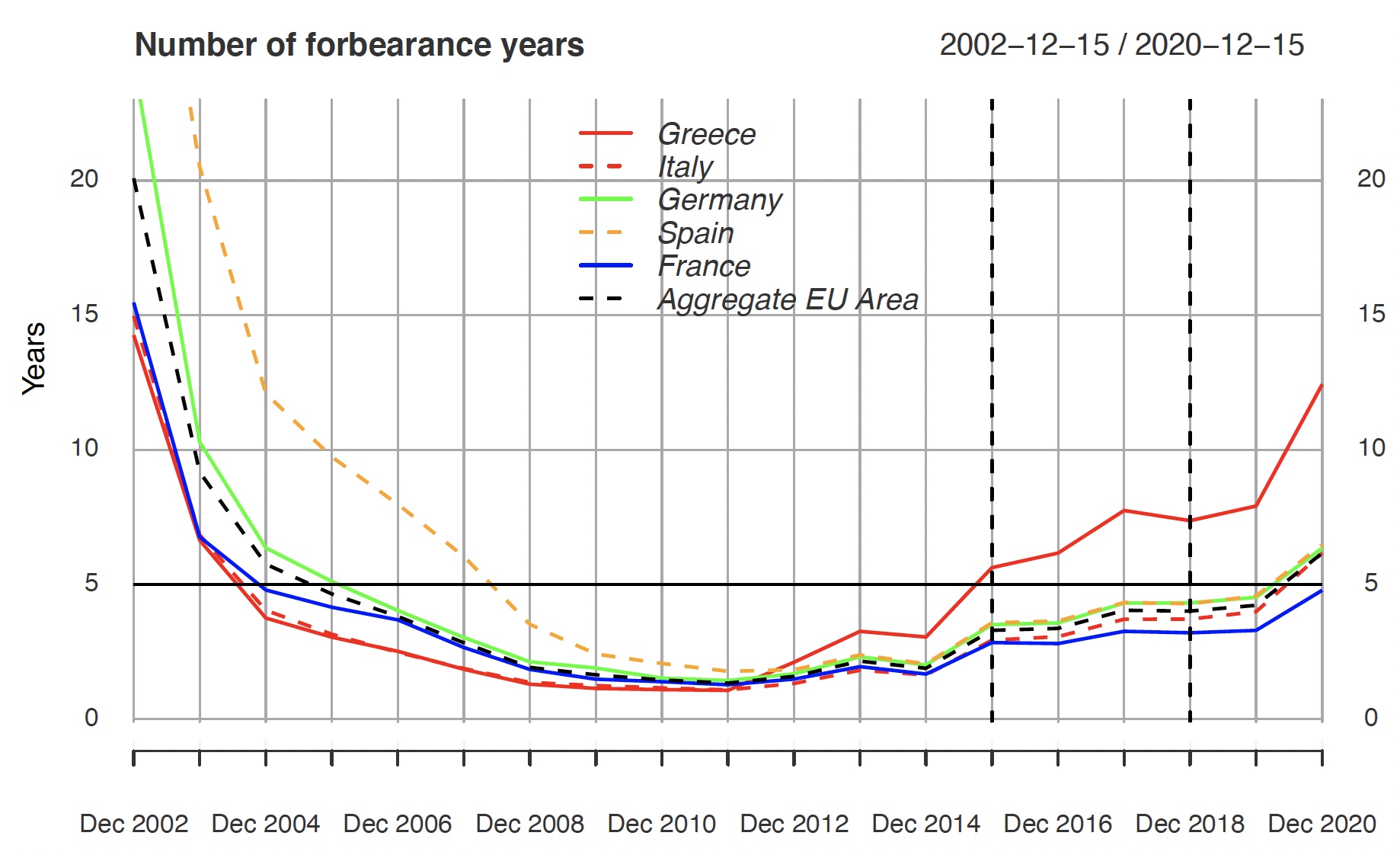

The reserves collected by the EDA below its pricing scheme will guarantee (along with an preliminary capital endowment) the EDA intertemporal monetary equilibrium. We measure the required danger capital when it comes to the variety of forbearance years of annual instalments allowed by every member state’s whole reserves. We use this wording as a result of in ‘dangerous instances’ when a member state will get near a credit score danger class near default, reserves collected with EDA can be utilized by the member state to entry a ‘forbearance facility’. Throughout forbearance, reserves collected with the EDA are used for servicing and restructuring debt and no new loans are issued. The process provides the member state time and assets to implement the required fiscal stabilisation coverage easily.

Throughout forbearance, using reserves for debt reimbursement will increase the debt of member states with the EDA. Apparently, the EDA might want to difficulty bonds in the marketplace to finance solely the a part of the member state’s whole deficit that’s not paid by utilizing their reserves with EDA. Debt reimbursement permits member states to adjust to fiscal guidelines. Additionally, discover that bonds issued by the EDA develop sooner than loans with the EDA outdoors forbearance, whereas throughout forbearance, the alternative occurs. The existence of the EDA will facilitate clean compliance with debt limits, as set by the fiscal guidelines. These guidelines might be outlined naturally by focusing on the ratio of bonds issued by EDA to GDP.

Determine 3 reviews the variety of forbearance years allowed by the EDA reserves.

Determine 3 Simulated EDA obtainable capital measured when it comes to funds ‘forbearance years’ for chosen member states

Our counterfactual simulations present that within the first years of EDA operations, whereas the EDA is progressively buying member states’ maturing bonds, the preliminary endowment plus the collected reserves give loads of forbearance capability to all member states and attain a minimal simply between one and two forbearance intervals, initially of the absolutely operational section, which begins in 2011. Reserves then continue to grow to ensure all member states a forbearance capability of at the very least above 5 years throughout the first ten years of the complete working interval of the EDA.

The case of the fee for Greece is especially attention-grabbing. This disaster was ignited by the revelation, on the finish of 2009, that Greece’s price range deficit was far bigger than the unique estimates (the final revision introduced it to fifteen.4% of GDP). Greece’s borrowing prices spiked as credit-rating companies downgraded the nation’s sovereign debt to junk standing in early 2010. The prices that the EDA would have charged in these circumstances present a degree and volatility that aren’t comparable with these of the noticed market costs on Greek ten-year bonds. On the event of the primary wave of the Greek disaster on the finish of 2009, even when the obtainable reserves wouldn’t have allowed Greece to entry forbearance, requiring extra solvency capital to be offered externally,2 the EDA would definitely have helped in containing contagion. Nevertheless, on the event of the second wave of the disaster in 2015, following the missed cost of the IMF bailout in June 2015, a completely operational EDA would have allowed over 5 years of forbearance to Greece, which might have been very useful to scale back the ache of fiscal stabilisation.

Conclusions: The advantages of an EDA

Establishing an EDA would strongly cut back market instability and the price of debt. That is in fact significantly interesting for high-debt international locations and raises the political financial system difficulty of the feasibility of our proposal. Leandro and Zettelmeyer (2018) present a helpful taxonomy of the traits {that a} debt administration instrument ought to must be politically viable and environment friendly in maximising monetary stability and minimising borrowing prices. Whereas noting that the EDA complies with all these necessities, we argue that the EDA would profit EMU core international locations as effectively, and due to this fact be helpful for the only foreign money as an entire.

The EDA would enable a smoother and extra environment friendly working of economic markets and enforcement of fiscal self-discipline, whereas additionally contributing to streamlining the EMU macroeconomic coverage governance. These goals might be achieved as EDA has the potential to:

(i) remove liquidity and reprice danger, concentrating solely on elementary danger, thus avoiding ‘dangerous equilibria’ (Blanchard and Pisani Ferry 2020);

(ii) set up a extra environment friendly self-discipline mechanism by a fairer danger evaluation;

(iii) structurally keep away from mutualisation;

(iv) present a very European secure asset, essential for the financial and political positioning of the EU within the new geopolitical context;

(v) systematically keep away from juniority danger (see additionally Codogno and van den Noord 2019);

(vi) finish the doom loop (a precondition for a full banking union and for normalising EMU bond markets);

(vii) enable the ECB to deal with its predominant mandate (Micossi 2021, D’Amico et al. 2022);

(viii) present a clear, environment friendly division of labour throughout the fee by separating the obligations for debt sustainability and debt administration and by offering a debt administration establishment that facilitates the implementation of fiscal guidelines.

Our EDA proposal has been guided by the three-fold must (1) minimise borrowing prices for member states, (2) stabilise sovereign debt markets, and (3) maximise its acceptability within the EU political debate. That is why our proposal is centred on the absence of debt mutualisation and continued accountability of member states for his or her fiscal self-discipline. Good for the EMU as an entire, the EDA would even be good for core international locations. The truth that the EDA would stabilise monetary markets, assist normalise financial coverage and relieve the strain on frugal international locations (particularly Germany’s) bond markets contributes to creating the proposal politically viable for all.

References

Amato, M, E Belloni, P Falbo and L Gobbi (2021), “Europe, Public Money owed, and Secure Property: The Scope for a European Debt Company”, Economia Politica 38(3): 823–61.

Amato, M, E Belloni, C Favero and L Gobbi(2022) “Making a Secure Asset with out Debt Mutualization: the Alternative of a European Debt Company”, CEPR Dialogue Paper 17217

Amato, M and F Saraceno (2022), “Squaring the Circle: How you can Assure Fiscal Area and Debt Sustainability with a European Debt Company”, Baffi-Carefin Working Papers 172 and Luiss College of Political Financial system WP 1/2022.

Blanchard, O J, A Leandro and J Zettelmeyer (2021), “Redesigning EU Fiscal Guidelines: From Guidelines to Requirements”, Financial Coverage 36(106): 195–236.

Blanchard, O J and J Pisani-Ferry (2020), “Monetisation: Do Not Panic”, VoxEU.org, 10 April.

Buti M and M Messori (2022), “Reconciling the EU’s Home Coverage Agenda”, VoxEU.org, 11 April.

Codogno, L and P van den Noord (2019), “The Rationale for a Secure Asset and Fiscal Capability for the Eurozone”, LEQS Paper 144.

D’Amico, L, F Giavazzi, V Guerrieri, G Lorenzoni and C-H Weymuller (2022a), “Revising the European Fiscal Framework, Half 1: Guidelines”, VoxEU.org, 14 January.

D’Amico, L, F Giavazzi, V Guerrieri, G Lorenzoni and C-H Weymuller (2022b), “Revising the European Fiscal Framework, Half 2: Debt Administration”, VoxEU.org , 15 January.

Eichengreen B, A El-Ganainy, R Esteves and Okay J Mitchener (2021), In Protection of Public Debt, Oxford College Press.

Kelton, S (2020), The Deficit Fantasy. Fashionable Financial Principle and the Beginning of the Individuals’s Financial system, New York: Public Affairs.

Leandro, A and J Zettelmeyer (2018), “The Seek for a Euro Space Secure Asset”, PIIE Working Paper 3.

Micossi, S (2021), “On the Promoting of Sovereigns Held by the ESCB to the ESM: A Revised Proposal”, CEPS Coverage Insights 2021–17.

Endnotes

1 Financing member state debt with perpetual loans explicitly recognises the distinction between authorities debt and family debt (Eichengreen 2021, Kelton 2020), leveraging on the perpetual nature of public debt (Amato and Saraceno 2022) .

2 This is without doubt one of the explanation why, through the first section of its existence, the EDA might be supplemented by a brief scheme to unburden the ECB, for instance as steered by Micossi (2021), by conferring the Covid debt to the ESM.