The mixture of (relatively) high interest rates and economic volatility with the fact most homeowners have fixed, low-interest rate debt had induced what real estate economist Bill McBride refers to as the “sellers strike.” As should be expected on the heels of such stubbornness, developers are beginning a “builders strike” to follow suit.

As CNBC reported at the end of October, “Housing starts for single-family homes dropped nearly 19% year over year in September, according to the U.S. Census. Building permits, which are an indicator of future construction, fell 17%. PulteGroup, one of the nation’s largest homebuilders, reported its cancelation rate jumped from 15% in the second quarter of this year to 24% in the third.”

Rick Palacios Jr., the director of research at John Burns Real Estate Consulting, has an interesting thread on builder sentiments from around the county. It’s not exactly good.

Home builder commentary from our survey this month was about as negative as I’ve seen to date. Here’s some of the market color that jumped out…

— Rick Palacios Jr. (@RickPalaciosJr) November 9, 2022

A few samples include a builder in Boston saying, “October was exceptionally weak,” in Baltimore, “The market is terrible,” and in Wilmington, “The market is falling off a cliff,” etc.

You get the idea.

Overall, single-family housing starts are falling rapidly. However, multifamily housing starts are, somewhat surprisingly, remaining relatively stable. It’s likely that multifamily building is propped up to a certain extent by government-subsidized LIHTC projects, but even still, they will likely decrease soon.

Of course, a major slowdown in building is to be expected. New construction is always heavily dependent on interest rates, and the Federal Reserve has brought the discount rate that underlies the mortgage market from 0.25% to 4.5% in less than a year.

The reason the real estate market is unlikely to collapse is because, unlike in 2008, homeowners have low-interest fixed-rate debt, lending standards are relatively strong, and most have a decent amount of equity in their homes. Absolutely none of that has anything to do with the calculus developers use when deciding whether to build a property. In other words, the fundamentals holding up the housing market don’t apply to the market for new construction. Thereby, new construction is falling drastically and could possibly collapse.

In other words, the builders are frustrated, and they are going on strike.

However, they can’t do so before finishing and liquidating what could become a minor boondoggle in the American economy: a new construction glut.

The Coming New Construction Glut

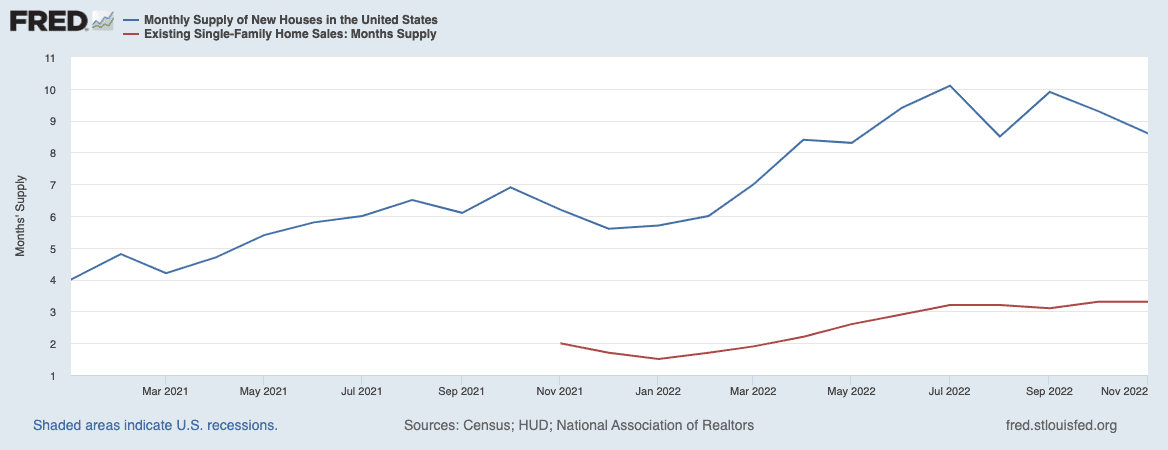

Already, a record 29% of homes for sale in the United States are new construction. Buyer cancellations increased 7.5% for new builds from September to October and showed no signs of abating. Months of inventory for new construction have increased over 50% from January of 2022 to October, from 5.7 months to 8.9 months. (Generally, six months of inventory is considered a balanced market).

And while the amount of time it takes to sell new houses has typically outpaced existing inventory, the gap between the two has become quite pronounced. In October, there were only 3.3 months of inventory for existing inventory (still a seller’s market), only one-third of what it was for new construction.

Unfortunately, there’s no real reason to believe this is going to get better before it gets worse. While inflation has cooled a bit, the Fed has indicated they plan to keep rates high (relatively speaking) at least through 2023.

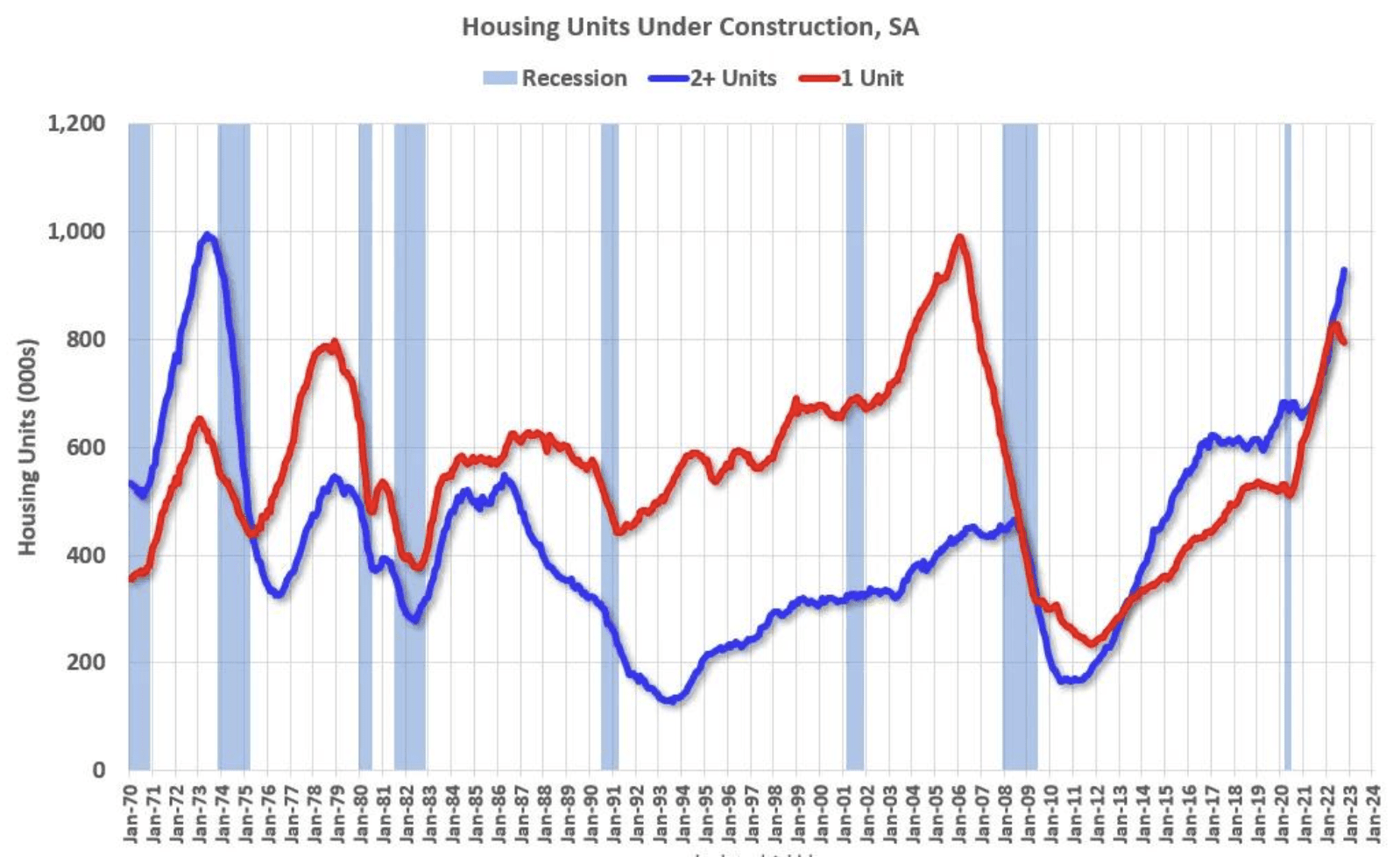

But possibly more importantly, as Bill McBride points out, there are more housing units under construction now than there ever have been before!

“Red is single-family units. Currently, there are 794 thousand single-family units (red) under construction…Blue is for 2+ units. Currently, there are 928 thousand multifamily units under construction. This is the highest level since December 1973!”

“Combined, there are 1.722 million units under construction. This is the all-time record number of units under construction.”

The increase in construction was in large part due to the nationwide housing shortage, which is predominantly what fueled skyrocketing housing prices over the previous few years. In addition to that, supply chain issues have delayed many projections causing a backlog of properties to remain under construction longer than was intended.

Unfortunately, unlike homeowners who are rarely compelled to sell, builders have little choice. Sure, many will turn to rent these new builds, but the rental market is already starting to become saturated. For most, they’ll have no choice but to sell in what is a buyer’s market and what is likely to become substantially more of one.

Conclusion

With notable exceptions (most notably that which is government-subsidized, like LIHTC), it’s probably not the best time to start new development projects. If you are a developer in the middle of such a new build, it would be worth at least considering if it’s economically feasible to rent the property (or some of the properties if developing a subdivision).

If selling is the only option, it would be wise to get ahead of the curve. While existing home prices probably will only fall a moderate amount over the next year, new home prices will likely sink substantially more. You don’t want to be caught chasing the market downward while you hold onto inventory. I would recommend leading the market and cutting your price upfront. Offering attractive incentives, such as interest-rate buy-downs (where the builder pays the lender to lower the interest rate for the buyer in the first year or more), should also be something to consider.

Every investor and developer will take hits in this business at some point or another. It’s better to come to terms with that now than try to hold out hope that you can sell at the same price you could have when the typical homeowner was buying with interest rates in the 3% range. To hope the market shifts back to what it was six months ago will likely leave you holding the bag as holding costs eat away any profit you could have made. And after that, you’ll likely have to eventually sell for even less than the discount you could have offered upfront.

On the other hand, if you are looking to buy a home—particularly one to live in—and are frustrated with this meme being far closer to reality than such a buyer would prefer:

New homes would be something to look into. Particularly look for one’s offering rate buy downs. Either way, you will certainly have the upper hand in negotiations.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Learn more about Fundrise

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.