Standart/iStock by way of Getty Photos

In 2021, Russia already was experiencing sturdy inflation. Now, with the consequences of the battle in Ukraine, that has been kicked into excessive gear. Hyperinflation is a time period usually thrown round too evenly, however below the present financial scenario, hyperinflation inside Russia is an affordable concern. Hyperinflation is uncommon, and the conditions that trigger them are distinctive in historical past, however historical past additionally rhymes. Recurring elements of hyperinflation are capital manufacturing destruction, important printing & borrowing, and web capital outflows. Russia is ready up with this trifecta for financial collapse.

Capital Manufacturing Destruction

Capital manufacturing destruction is when the general manufacturing of the nation decreases. The German Weimar Republic (Put up WW1 Germany, 1918-1933) had important hyperinflation, largely attributable to capital destruction. The Republic misplaced important land as a result of treaty of Versailles, notably the Alsace-Lorraine, and the economic area Higher Silesia in addition to others. Finally, the ceding of land lowered the manufacturing capability of the Republic. Comparable historic manufacturing destruction instances that resulted in hyperinflation are Yugoslavia (1992-1994), Hungary (1945-1946), Greece (1941-1945), simply to call a number of.

It’s possible you’ll be saying the battle just isn’t in Russia so its manufacturing just isn’t being lowered, the issue is the sanctions imposed by nearly all of the developed world hinders manufacturing. Russia is a web exporting nation, however that doesn’t imply they don’t import essential merchandise. Some of the notable sanctions decreasing manufacturing capability is the focused oil refining know-how sanction.

As sanctions intensify, the power for Russia to keep up inside manufacturing will turn out to be harder. For instance, Russia imported USD 230m in seeds in 2020, although Russia’s functionality to develop the seeds gained’t have diminished, they are going to be unable to with out the imported seeds, in the end reducing manufacturing functionality.

Oil and pure gasoline product sanctions have been contentious, aside from Canada, no nation has blocked importing. Many believed earlier than the battle the vitality dependence of Europe, and notably Germany would cease interference in Russian conflicts. However, little national-level sanctions doesn’t imply vitality exports haven’t been hit. Some firms together with BP p.l.c. (BP) have damaged relations with Russia, in BP’s case, exiting their 20% Rosneft (OTC:OTCPK:RNFTF) stake. Moreover, many merchants have stopped buying Russian oil, inflicting the biggest recorded low cost on Urals oil. The counterpoint to the low cost is Brent crude is buying and selling close to all-time highs set in 2008, which lessens the blow to Russia. The issue is that if worldwide degree sanction is available in place, Russian oil might commerce at such a steep low cost that the inflated Brent value might not matter.

Providers are additionally being denied in Russia, whether or not attributable to beliefs or authorized restrictions. For instance, accounting corporations KPMG and PwC have each ceased operations in Russia as a result of humanitarian violations of Russia. Netflix (NFLX) has stopped initiatives inside Russia attributable to a legislation requiring media to show Russian Propaganda. Notably, PayPal (PYPL), Visa (V), and Mastercard (MA) have stopped some operations additional harming the already fragile Russian transaction system.

Russia is imposing retaliatory sanctions, which embrace halting the supply of rocket engines to the US. The difficulty is the Russian financial system is so strained the sanctions will solely lead to extra ache for the Russian individuals. Right now and most certainly going ahead, Russian-imposed restrictions on imports and exports will make little distinction, however it’s attention-grabbing to see because it exhibits Putin is unlikely to again down attributable to financial impression.

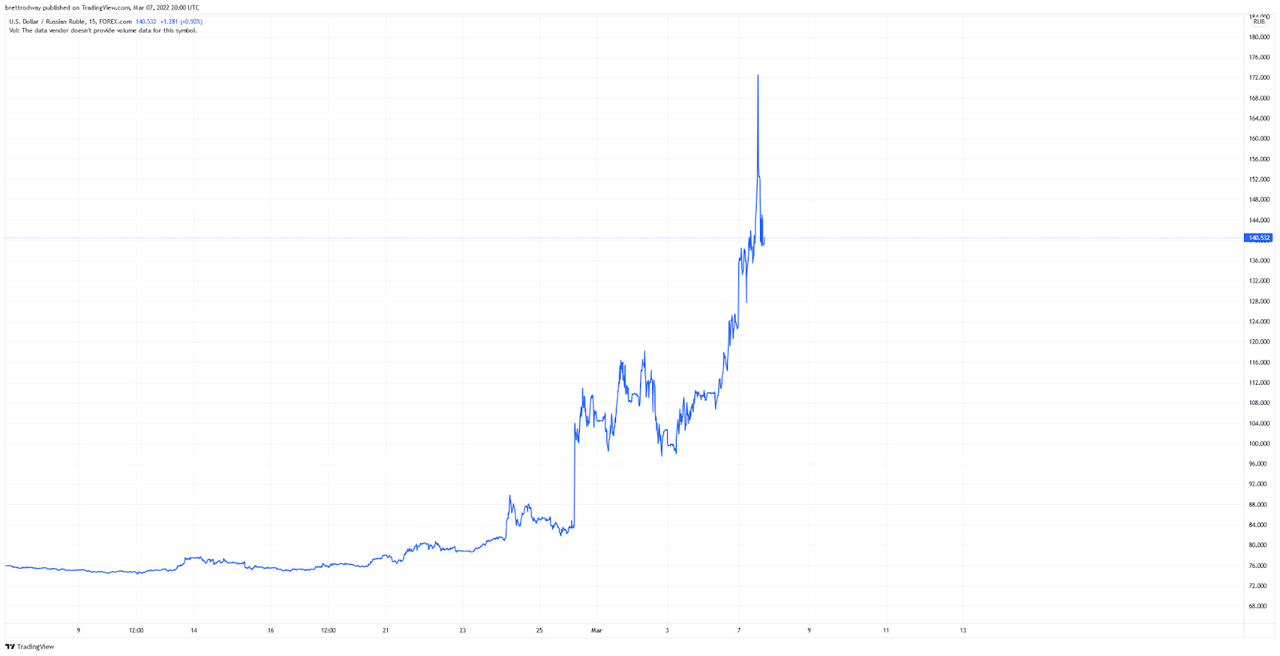

USD RUB Trade Price (TradingView)

The preliminary sanctions have already brought about the Ruble to drop from 75 RUB/USD to a low of 170 RUB/USD on the time of writing, and can most certainly depreciate and turn out to be much more unstable by the point you’re studying this. The numerous decline in buying energy for the Russians who’re nonetheless capable of import the supplies they should produce can be required to pay a big premium, in the end reducing manufacturing capability.

In abstract, the Russian manufacturing system is going through demise by a thousand cuts.

Labor Disruptions

Labor is taken into account an element of manufacturing in economics, and the lack of labor will decrease the power to supply. Russia is going through a labor discount attributable to a number of entwined elements; labor strikes, protests, army deaths, and Russians fleeing the nation.

Protests are occurring in Moscow and different main cities, however have been cracked down on rapidly resulting in hundreds of arrests.

Labor strikes will are available in two kinds, in opposition to poor wages which have already been seen, and as a protest in opposition to the battle. Labor disruption is embedded in Russian society, a driving drive to the revolution that in the end led to the Soviet Union. The query is: Will Russians flip to mass labor strikes once they really feel the consequences of the battle and sanctions?

“Struggle is younger males dying and outdated males speaking”, Franklin D. Roosevelt. Russian conscription requires males aged 18-27 to serve a 12-month army service, so if a protracted battle happens, this demographic can be absorbed by the battle. Dealing with potential demise or damage, some are fleeing the nation to keep away from conscription, and can most certainly be unable to return any time quickly. The extreme lack of males throughout WW2 has had long-lasting implications on Russian demographics. Demographics change the labor make-up, for wartime and post-war Russia, this brought about extra aged, youth, and girls to work.

Even those that aren’t topic to the present conscription vary are trying to flee the nation. Whether or not or not it’s for political dissonance being struck down, detrimental financial outlook, or fears of a broadening battle, individuals are leaving or seeking to go away the nation.

Regardless of being comparatively small in comparison with the nation’s inhabitants of 144 million, if the battle turns into a protracted incursion, labor disruptions will extra seemingly than not intensify, and if civil unrest explodes, it will likely be a significant component.

Web Capital Outflows

Capital outflow is monetary belongings leaving the nation. Web capital outflow contains the capital inflows which is an offsetting issue. As capital inflows lower, the result’s a decrease web influx, or on this case, a better web outflow. Russia is going through each fewer inflows and higher outflows.

The diploma of capital outflow already has the Central Financial institution of Russia (CBR) panicking, imposing numerous measures to cease the capital outflow in an try to stabilize the Ruble.

The Moscow Trade was closed the week of Feb twenty eighth and isn’t anticipated to open till March ninth, and when it does, foreigners will be unable to promote belongings. Successfully any foreigners have had their fairness frozen, and at this level, it isn’t unlikely for the belongings to be seized completely in the event that they even have any worth left that’s. As well as, brief gross sales are banned permitting extra present holders to exit positions.

Depository Receipts have plummeted in value. The difficulty is there are excessive doubts that any asset rights could be revered, successfully you may be shopping for nothing. As nicely with the Moscow Trade closed, the liquidity is subsequent to nil.

On the fixed-income aspect, bonds have successfully defaulted for foreigners. Russia is simply keen to pay Rubles for bonds as an alternative of the said international forex. The difficulty for foreigners is they are going to be unable to promote the unstable Rubles for his or her desired forex, in addition to being caught inside Russia with minimal funding alternatives. To make issues worse for the broader market, some credit score default swaps might not set off since some bonds do state Ruble fee may be executed.

Traders can be unable to speculate new funds right into a market that doesn’t respect property rights, restricted liquidity should you’re even capable of promote. Finally capital inflows from fairness and stuck earnings traders can be drastically decrease for a very long time.

CBR has elevated forex market operations from USD 3B to USD 5B. That is the place Russia’s battle chest of international forex is available in, the issue is half resides outdoors of Russia, and will be unable to manage the decline.

One of many CBR’s preliminary controls has already failed, a ceiling was set for the USD and EUR alternate charges. The proposed charges had been 90 RUB/USD and 101 RUB/EUR, which have completely failed. So, the CBR has applied stronger capital controls.

Corporations should promote 80% of international income to CBR, in different phrases, 80% or higher of the nation’s international forex will now mechanically be offered for Rubles to prop it up. As sanctions ramp up inflicting worldwide commerce to lower the impact of this capital management can be lessened.

The restrictions go right down to the non-public degree, Russians are actually solely allowed to export the equal of $10,000 of foreign exchange every month. The CBR is doing this to restrict capital flight, however some Russians are utilizing options comparable to cryptocurrencies to flee the depreciating Ruble. Different Russians merely emptied ATMs and banks of international forex earlier than the capital controls had been applied. Residents are seeing the writing on the wall, the Ruble is dying.

In abstract, capital inflows have disappeared whereas a flood of outflows has pushed the CBR to a panic mode.

Printing & Borrowing

Most individuals affiliate hyperinflation with cash printing as a result of it’s the inevitable results of extreme manufacturing destruction and capital outflow. The federal government wants to have the ability to pay for its elevated wartime bills whereas having a decrease taxation base. The opposite choice is to problem sovereign debt, which grants time to regain management over the forex.

The CBR pre-emptively constructed a battle chest of international forex to buffer the printing and borrowing occasion, however attributable to capital restrictions, the battle chest’s energy was instantly diminished. As soon as the battle chest is totally diminished, the Ruble may have no assist, resulting in printing and borrowing.

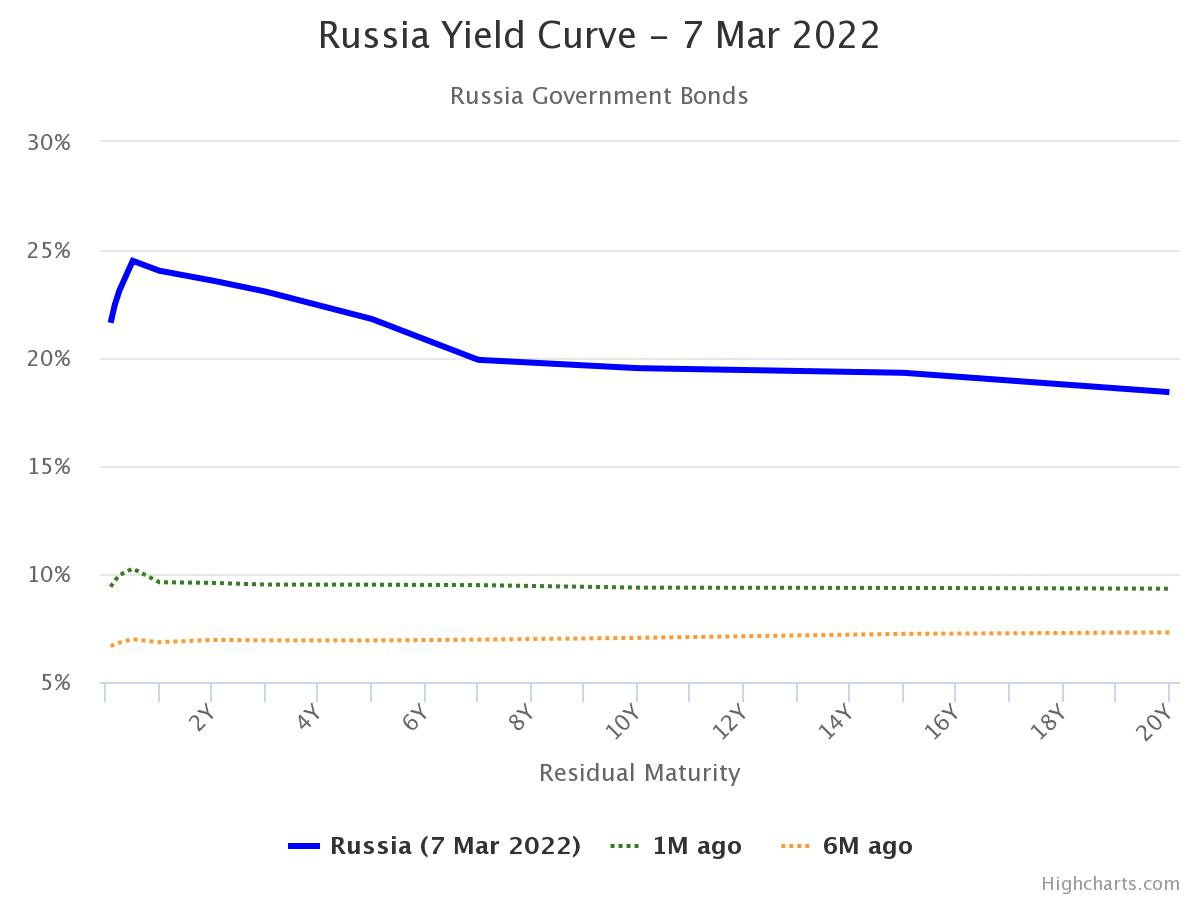

To draw deposits, the CBR raised rates of interest to twenty% from 9.5%, which had been already up from 8.5% a few weeks prior. The 10Y bond yield is hovering across the 20% charge at present, displaying some long-term assist.

Russia Yield Curve March, seventh 2022 (World Authorities Bonds)

However, the yield curve is already inverted, a traditional signal of recession, 1Y bonds are buying and selling at a 24.5% yield. The difficulty with heightened charges is the financial system must be stimulated as nicely, as a result of decline in manufacturing functionality. The CBR has an especially tough balancing sport forward of them.

A brand new problem arises when the debt matures. The primary query is whether or not any defaults will happen, notably in opposition to foreign-held debt. The subsequent query is whether or not to roll the debt, most certainly at a better and better charge, or print to repay the debt. The longer the debt is rolled at a constantly heightened rate of interest, the extra seemingly a default or printing to pay will happen.

If the CBR’s hand is pressured into steady printing, hyperinflation will happen.

The Unlucky End result

The longer the battle and subsequently the sanctions go on, the extra seemingly hyperinflation will happen. If hyperinflation happens, extra ache will happen in opposition to the residents of Russia who had been pressured into this battle by Putin. Even when hyperinflation doesn’t happen, the financial prospects of Russia are going to be severely broken for years if not a long time to come back.

Setting a Place

The difficulty with deciding a place is you do not need to personal an asset or brief an asset that’s below Russian jurisdiction. The market agrees with this because the MSCI Russian ETF (ERUS) which depends on American depository receipts is buying and selling at $0.06, or -99.86% YTD, successfully nugatory.

Russian-based ETFs comparable to (RSX) has been halted attributable to regulatory issues, and are unlikely to open again up. Even ETFs the place Russian equities are a portion are being reconstructed to take away Russian publicity. Bonds are seeing the same story, being eliminated or discounted to near-zero when in an ETF wrapper.

Shorting the Ruble is the most effective and best technique to instantly capitalize on this, however make sure that should you’re taking part in with futures that the implied curiosity is affordable as a result of, throughout unstable instances, the speed might shoot up.

For oblique strategies that are much less dangerous, you may go lengthy on corporations and commodities that Russia exports. Oil (CL1:COM), gold (XAUUSD:CUR), copper (HG1:COM), and metallurgical coal are all important exports of Russia. In order for you an oblique fairness, search for producers with no Russian publicity comparable to ConocoPhillips (COP) for Oil, or Teck Sources (TECK) which produces copper, metallurgical coal, in addition to different commodities.