Philippe TURPIN

By Mike Maharrey

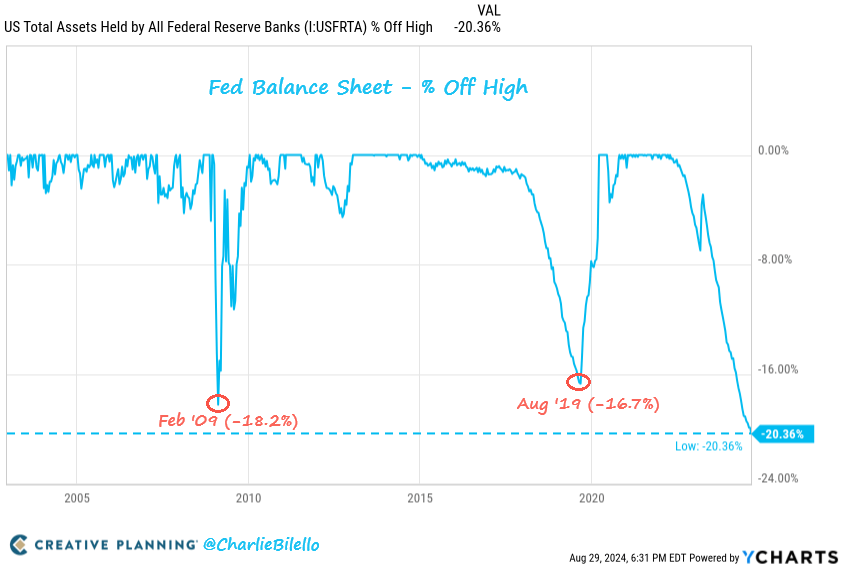

I ran throughout a submit on X by monetary planner Charlie Bilello in regards to the trajectory of the Federal Reserve stability sheet. It identified that the stability sheet is 20 % beneath its April 2022 peak, “the largest drawdown on document.”

This struck me as a really odd flex, given the context of that drawdown.

To be honest, Bilello did not provide any commentary on stability sheet discount, however I felt like I used to be purported to be impressed by the Fed’s efforts.

I am not.

Why Does the Steadiness Sheet Matter?

The Federal Reserve’s stability sheet is a vital financial coverage device. The mainstream tends to concentrate on rate of interest coverage, however the stability sheet might have a fair greater influence on the cash provide and inflation than rate of interest manipulation.

The stability sheet serves because the mechanism for quantitative easing (QE).

Artificially low rates of interest drive cash provide development via the growth of credit score. Low charges incentivize borrowing and “stimulate” the financial system. As a result of we have now a fractional reserve banking system, banks can mortgage more cash than they’ve. This leads to cash provide development. (By definition inflation.)

By way of QE operations, the stability sheet serves as a direct pipeline to the cash provide. When the Fed buys belongings – primarily U.S. Treasuries and mortgage-backed securities – it does so with cash created out of skinny air. These belongings improve the stability sheet and the brand new cash will get injected into the financial system. QE can enhance the cash provide with the accompanying inflationary pressures way more shortly than rate of interest coverage alone.

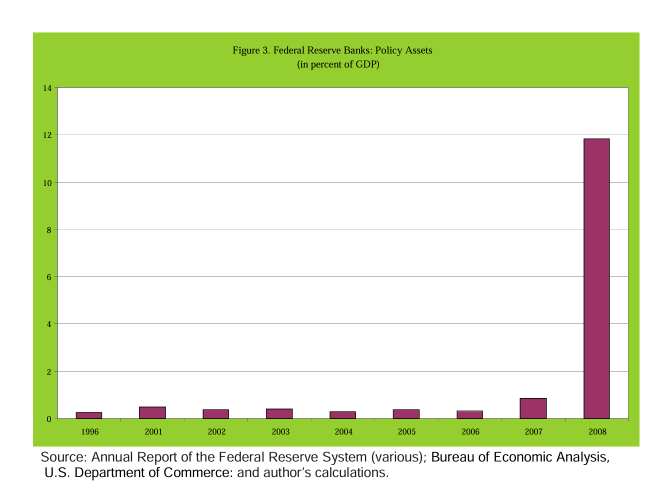

The Fed did not use the stability sheet as a coverage device to any nice extent earlier than the 2008 monetary disaster. However when the Fed slashed charges to zero, and it grew to become clear that the scope of the disaster went far past the central financial institution’s potential to regulate, Ben Bernanke turned to quantitative easing for the primary time.

In impact, the Federal Reserve aggressively monetized U.S. debt. In follow, it purchased Treasury notes and bonds on the open market with newly “printed” cash. This created a synthetic demand for U.S. debt, permitting the federal authorities to borrow more cash than it in any other case may have. These bonds grew to become belongings on the Fed stability sheet.

On the time, Bernanke emphatically framed QE as an emergency measure. He advised Congress that the central financial institution was not monetizing the debt and was not offering a everlasting supply of financing for the federal government. He stated the Treasuries would solely stay on the Fed’s stability sheet briefly. He assured Congress that when the disaster was over, the Federal Reserve would promote the bonds it purchased throughout the emergency.

This by no means occurred.

A Broader Take a look at the Fed Steadiness Sheet

Whenever you body the latest stability sheet drawdown (quantitative tightening or QT) in proportion phrases as Bilello did in his chart, it creates the impression that the central financial institution took an aggressive coverage stance in opposition to inflation. The implication appears to be that it was a daring transfer by the Fed that might have far-reaching results.

However while you put stability sheet discount within the context of stability sheet growth, it appears extra like Powell & Firm simply spit within the ocean.

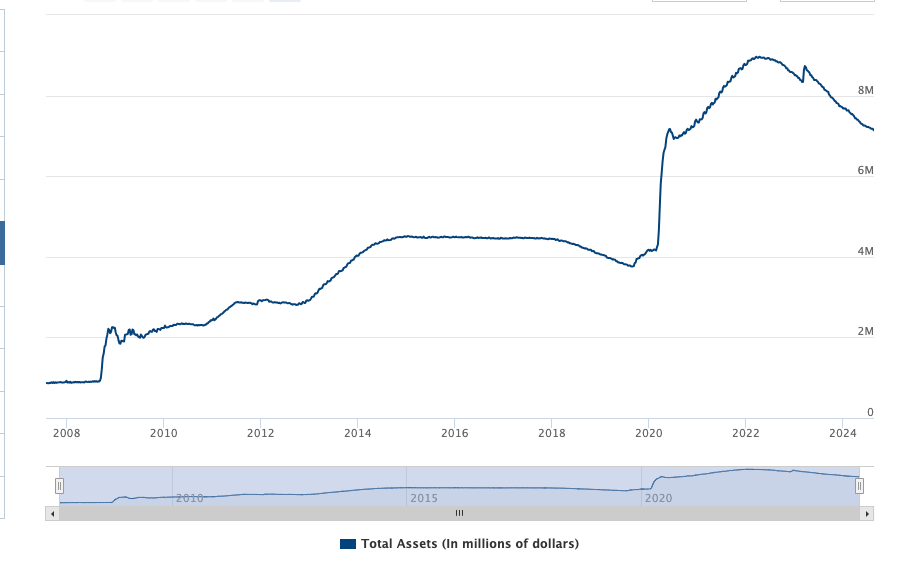

In 1996, the stability sheet stood at just below $500 billion. By August 2008, the Fed stability sheet was just below $910 billion. In 28 years, the stability sheet expanded at a gradual, regular tempo in greenback phrases because it stored tempo with GDP development. By way of these years, the stability sheet stayed beneath 1 % of GDP.

Because the Worldwide Financial Fund put it, “Evident on this Determine … is the extraordinarily small FRB function in intermediating credit score within the U.S. economy-until 2008.“

Within the first spherical of QE within the wake of the monetary disaster starting within the fall of 2008, the Fed expanded the stability sheet to $2.25 trillion, practically 12 % of GDP. In proportion phrases, the stability sheet grew by simply over 147 %.

And this was simply spherical one.

There was a small drawdown within the first couple of months of 2009. It is the primary stability sheet discount famous on Bilello’s chart at 18.25 %.

However that was one thing of a feint. Bernanke ramped up the QE machine two extra occasions throughout the Nice Recession. At its peak in early 2015, the stability sheet stood at a staggering (on the time) $4.5 trillion. Between the autumn of 2008 and January 2015, the stability sheet expanded by 394.5 %.

In February 2011, Bernanke stated, “In the end, on the proper time, the Federal Reserve will normalize its stability sheet.”

If “regular” meant again to the pre-Nice Recession degree and beneath 1 % of GDP, that point by no means got here. (And it virtually actually by no means will.)

The central financial institution did lastly provoke quantitative tightening in early 2018. Within the spring, the Fed claimed that stability sheet discount was “on autopilot.” That lasted about 18 months. When the inventory market crashed within the fall of 2018 and the financial system obtained shaky, the Fed panicked. By August 2019, when QT ended, the stability sheet was nonetheless at $3.76 trillion.

That is the second drawdown on Bilello’s chart coming in at 16.7 %.

Bear in mind, the Fed had expanded the stability sheet by practically 400 %. This wasn’t “normalization” in any sense of the phrase, Bernanke’s guarantees however.

The Fed started increasing the stability sheet once more even earlier than the pandemic. By the point the pandemic obtained going, the stability sheet was solely about $300 billion beneath the Nice Recession peak.

As soon as governments began shutting down the financial system, quantitative easing went into hyperdrive.

In February 2020 as COVID-19 gripped the world, the stability sheet stood at round $4.2 trillion – 20 % of GDP. When it was all stated and carried out, the stability sheet had ballooned to only beneath $9 trillion ($8.95 trillion). That was about 49 % of GDP.

Within the interval between the onset of the 2008 monetary disaster and the top of the pandemic, the Fed expanded the stability sheet by 889 %.

The Fed introduced its stability sheet discount in March 2022 after conceding that worth inflation wasn’t “transitory.” It wasn’t precisely bold. Given the parameters of the plan, it will take 7.8 years simply to run off the quantity added throughout the pandemic.

After all, we’re nowhere close to that. For the reason that pandemic peak, the central financial institution has run off about $1.76 trillion. As Bilello notes, this represents a 20 % discount – an all-time document. That feels like quite a bit till you keep in mind that it added virtually $5 trillion in just below two years.

However the stability sheet nonetheless stands at simply over $7.1 trillion — nonetheless 680 % above the pre-2008 monetary disaster degree.

Now you perceive why I am not impressed.

By the way in which, in Might, the Fed quietly introduced that it will start to taper stability sheet discount. In different phrases, they’re about completed with the drawdown.

Perhaps sometime they will get round to fulfilling Bernanke’s promise – when it is the “proper time.”

My guess is that shall be by no means.

Authentic Publish

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.