Nikada

Investment thesis

I’ve been following Kingsway Financial Services (NYSE:KFS) closely and I’ve written two articles about the company on SA. The latest of them was in October 2023 and back then I said that new acquisitions under the KSx platform should still improve the company’s EV/EBITDA ratio.

I think this could be a good time to revisit Kingsway considering the company released its Q4 2023 financial results on March 5. In my view, they were underwhelming as the adjusted EBITDA run-rate for the operating companies of the group remained below my $20 million estimate. The performance of new acquisitions has been disappointing and I’m cutting my rating on Kingsway’s stock to neutral. Let’s review.

Introduction to the business

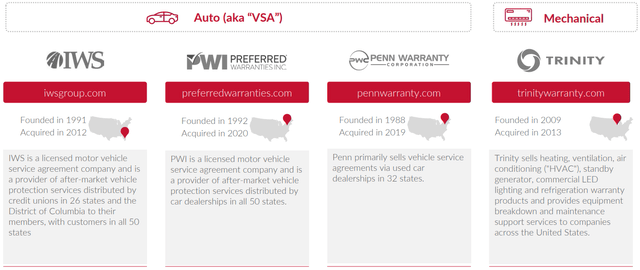

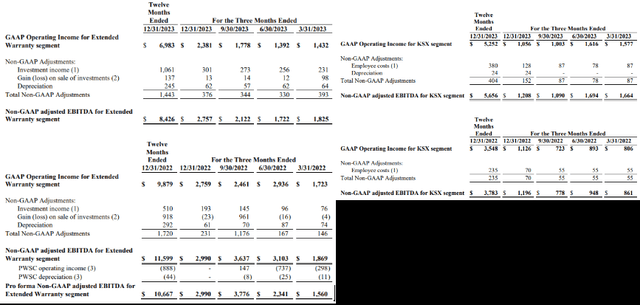

If you’re not familiar with the company or my earlier coverage, here’s a brief description of the business. Kingsway has a mature extended warranty business and since 2021 it has been shifting its focus to investing in small and growing companies with recurring revenues and high margins that have an asset-light business model under a program named Kingsway Search Xcelerator ((KSx)). The warranty business includes four companies, three of which are focused on the auto sector. This segment has an adjusted EBITDA run-rate is about $10 million.

Kingsway Financial Services

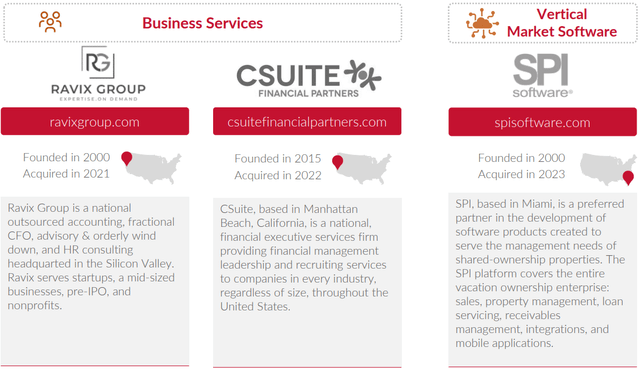

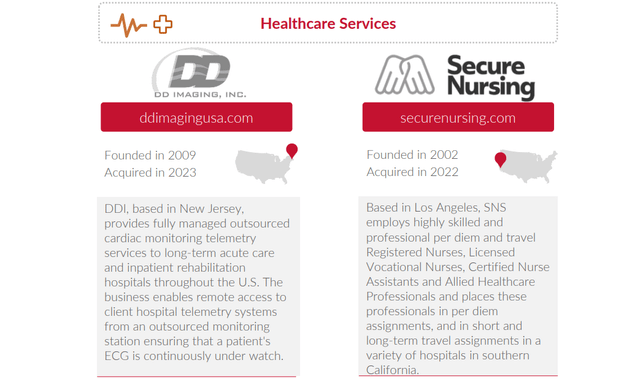

Under the KSx platform, Kingsway has so far acquired a total of five firms and their adjusted EBITDA run-rate is about $8 million. KSx focuses on businesses with annual adjusted EBITDA of $1.5 to $3 million and Kingsway aims to buy two to three new companies per year. The portfolio of KSx currently includes outsourced accounting and HR company Ravix, financial executive solutions firm CSuite, staffing agency Secure Nursing Service, software developer Systems Products International, and clinical trial site management and recruitment solutions company National Institute of Clinical Research. The EV/EBITDA paid for these purchases has ranged from 4x to 9x. KSx focuses on businesses with annual adjusted EBITDA of $1.5 to $3 million.

Kingsway Financial Services

Kingsway Financial Services

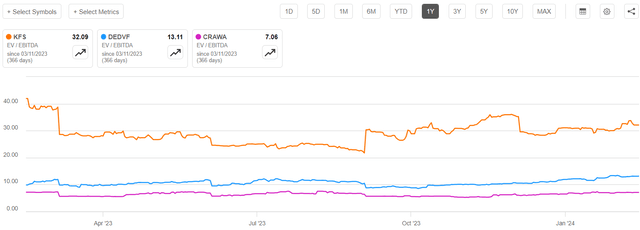

Overall, the KSx business reminds me of the buy, build, and hold strategy used by the likes of Decisive Dividend Corporation (DE:CA)( OTCPK:DEDVF) and Crawford United Corporation (OTCPK:CRAWA) which I’ve covered it here and here.

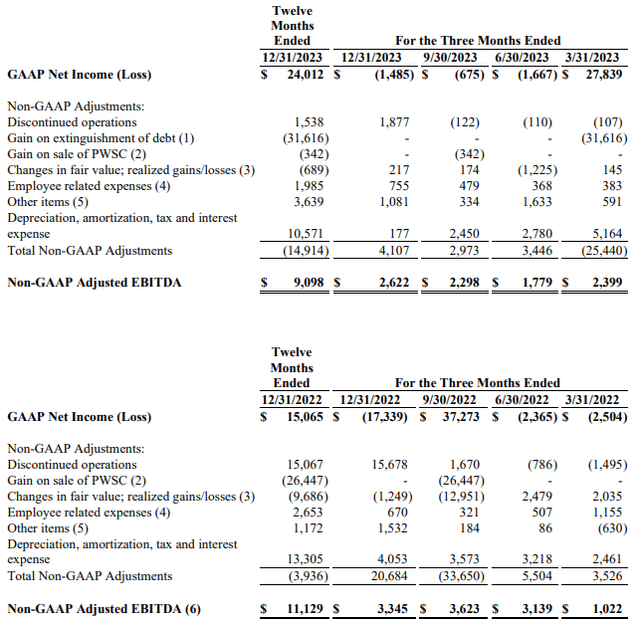

The Q4 2023 financial results

Kingsway said during its Q4 2023 earnings call that the adjusted EBITDA run-rate for its operating companies was at $17 million to $18 million on a TTM basis. I find this disappointing considering this number represents a downgrade from the $18 million to $19 million in my previous article and I was expecting it to surpass $20 million in Q4 due to the acquisitions of Systems Products International, and National Institute of Clinical Research in September and October, respectively. While adjusted EBITDA for Q4 2023 rose by 14.1% quarter on quarter to $2.6 million, this level remained below Q4 2022 as G&A expenses rose, the adjusted EBITDA of the KSx segment barely improved compared to a year earlier, and the warranty business struggled due to a lack of gains on sale of investments.

Kingsway Financial Services

Kingsway Financial Services

I was expecting a significant improvement in the KSx segment in Q4 2023 considering Systems Products International, and National Institute of Clinical Research had a combined EBITDA of $1.5 million on a TTM basis when they were acquired. According to Kingsway’s 2023 financial report, the two companies contributed operating income of just $0.2 million from their dates of acquisition through December 31 (page 26 here).

On a positive note, the balance sheet of Kingsway was in a better condition at the end of December than I expected after the Q2 2023 results. The company finished Q4 2023 with a net debt of $35.3 million compared to $37.9 million a year earlier. Systems Products International was acquired for $2.8 million while National Institute of Clinical Research was bought for close to $11 million and I was expecting net debt to surpass $40 million at the end of December 2023. A major contributor to the strengthening of the balance sheet was a $3.4 million net gain on equity investments in 2023 which resulted mainly from the sale of shares in Limbach Holdings (NASDAQ:LMB) in Q3 (page 58 here).

Future of the company

I expect the financial performance of the extended warranty segment of Kingsway to improve slightly in 2024 due to the rollover of maturing bonds in the current high interest rate environment. This business has an investable float of around $45 million with an average duration of two to three years that is designed to match expected claims exposure. Looking at KSx, I expect Kingsway to make at least two small acquisitions over the remainder of 2024 which should enable it to boost the adjusted EBITDA run-rate for its operating companies to above $20 million for the year. In addition, I think it’s likely that the company will keep a lid on its debt and that it should finish the year with a net debt of below $30 million. Kingsway hasn’t paid a dividend since 2009 and I don’t expect this to change anytime soon with the capital allocation strategy being focused on M&A and debt reduction.

Valuation

In my view, Kingsway doesn’t look cheap following the weak Q4 2023 financial results. The company has an enterprise value of $276.9 million as of the time of writing which translates into an EV/EBITDA ratio of 32.1x. Kingsway has rarely traded over the over 30x mark for long periods of time in the past year. While the adjusted EBITDA run-rate for the operating companies is $17 million to $18 million, much of that is being eaten up by SG&A expenses at the corporate level and the EV/EBITDA ratio is significantly above the levels of companies with a buy, build, and hold strategy where it wants to pivot to through KSx (eg Decisive Dividend and Crawford United). Even if we assume the extended warranty business could fetch around 20x EV/adjusted EBITDA or about $168.2 million based on the 2023 results, the remaining business would still be more expensive than peers.

Seeking Alpha

Investor takeaway

Kingsway booked weak Q4 2023 financial results as the adjusted EBITDA run-rate for its operating companies declined despite the purchase of Systems Products International, and National Institute of Clinical Research. I expect the financial performance of the extended warranty business to improve in 2024 and the company to make at least two small acquisitions during the coming months. However, the valuation is starting to look stretched as the EV/EBITDA ratio has surpassed 30x.