duckycards/iStock by way of Getty Photographs

Foreword

About Massive Cap Worth

A Worth rating for big cap shares from YCharts places collectively complementary methods discovered throughout their inventory analysis. As a price rating, it seems on the worth of a inventory relative to a variety of measurements that decide intrinsic agency worth. Solely the most important 10% of firms primarily based on market cap are allowed on this portfolio.

What it’s: The Worth Rating is a composite rating. It tells you the way a lot you’re getting by way of earnings, money flows, property, gross sales, and so on. for the inventory worth that you simply pay. It’s a relative measurement, so it says nothing concerning the total stage of the market. Somewhat, it solutions the query: “Given the present market stage, which shares provide the most present worth to your greenback of funding?” Tens are probably the most worth, and 1s are the least.

The best way to use it: Use it to search out firms which are promoting at a low worth relative to their property and earnings.

Limitations of the Worth Rating: Be careful for firms with plenty of uncertainty or unhealthy prospects for the longer term (e.g., Pharma firms with expiring patents, industries on the decline, and so on.).

In regards to the Ben Graham Formulation

The Ben Graham Formulation technique accommodates ultra-stable shares that can occasionally lose cash if held over an extended time period. It was developed primarily based on a display in Graham’s ebook, “The Clever Investor.” For individuals who have the ebook, it’s the “Defensive Investor” display. It selects shares which are massive by way of gross sales and whole property, have a powerful monitor document of earnings and dividend funds, have an affordable present ratio and stage of long run debt, and have a low valuation given by PE Ratios and Value to Ebook Worth ratios. -YCharts

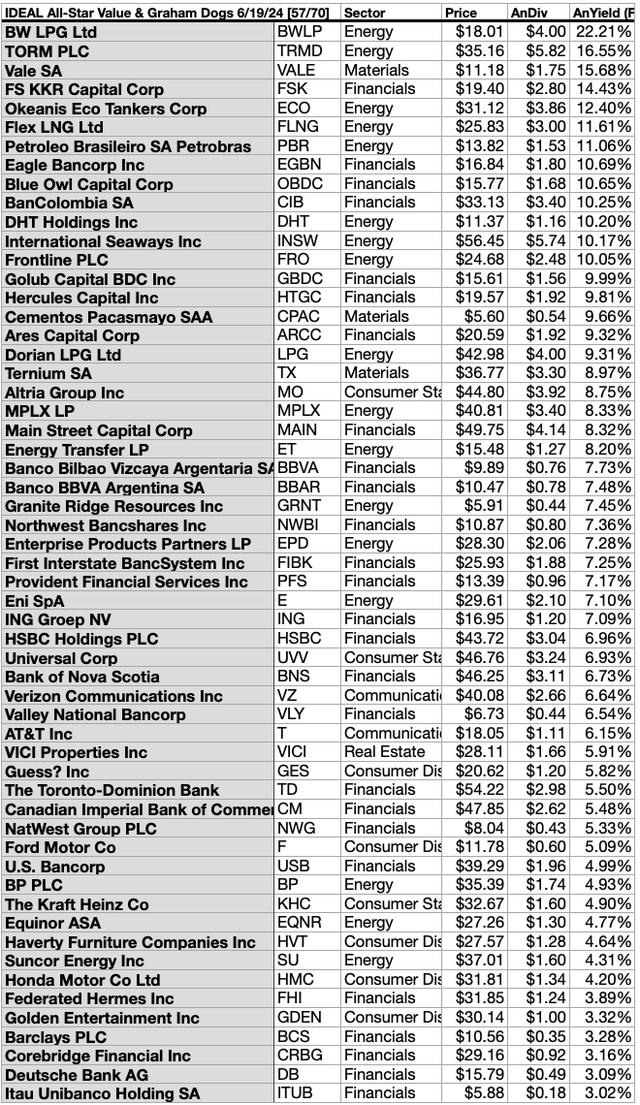

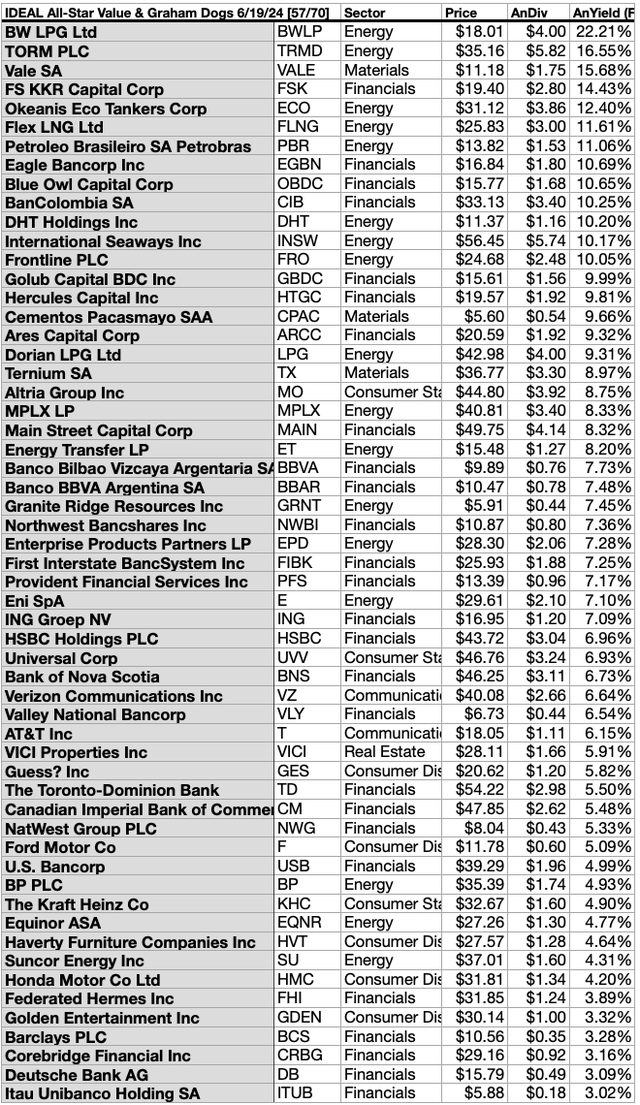

Whereas 13 out of this assortment of 70 All-Star-Worth Dividend shares are too expensive to justify their skinny dividends, the remaining 57 of them, by yield, reside as much as the perfect of providing annual dividends (from a $1K funding) exceeding their worth per share.

57 Excellent Worth Graham Canines for June

Supply: YCharts.com

Within the present market, the dividends from $1k investments in 57 of the 70 shares listed above, met or exceeded their single share costs as of 6/19/24.

As we at the moment are previous the fourth anniversary of the 2020 Ides of March dip, the time to snap up a number of the 57 best top-yield All-Star-Worth Graham canine is now… except one other massive bearish drop in worth looms forward. (At which period, your technique may very well be so as to add to your place in any of those you then maintain.)

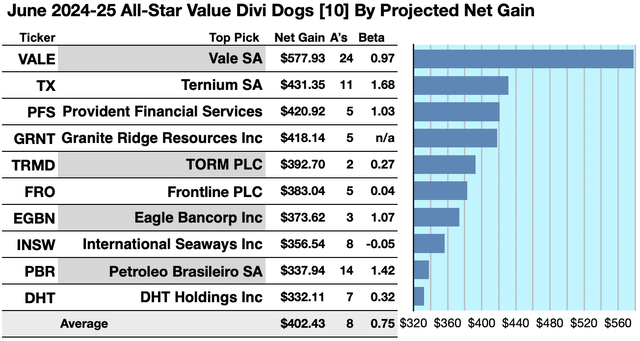

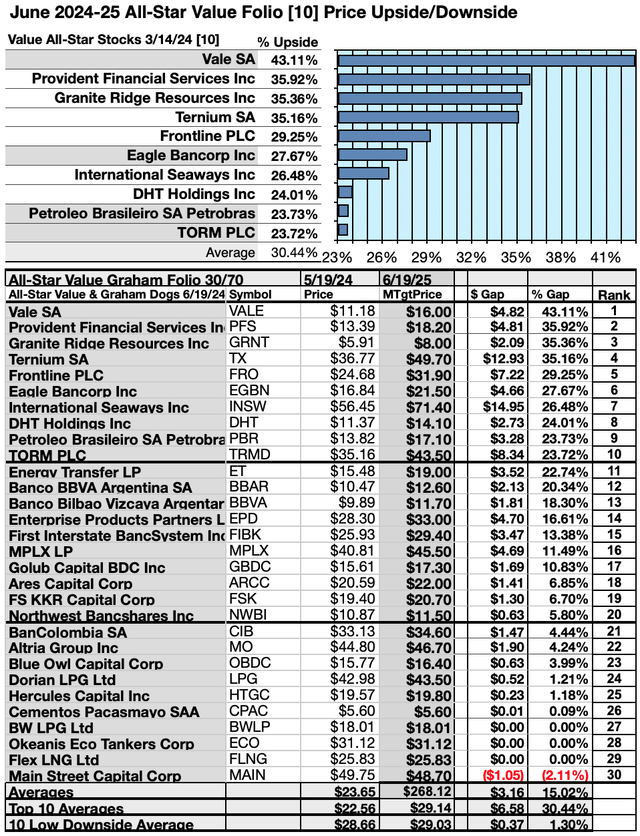

Actionable Conclusions (1-10): Analysts Estimate 33.421% To 57.79% Prime Ten All-Star-Worth Graham Web Beneficial properties To June 2025

4 of the ten top-picks by yield had been verified as additionally being among the many high ten gainers for the approaching yr primarily based on analyst 1-year goal costs. (They’re tinted grey within the chart under). Thus, this yield-based forecast for All-Star-Worth derived dividend canine (as graded by Brokers) was 40% correct.

Estimated dividend-returns from $1000 invested in every of the highest-yielding shares and their mixture one-year analyst median target-prices, as reported by YCharts, created these 2024-25 data-points. (Notice: goal costs by lone-analysts weren’t used.) Ten possible profit-generating trades projected to June 2025 had been:

Supply: YCharts.com

Vale S.A. (VALE) netted $577.93 primarily based on the median of goal worth estimates from 24 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 3% underneath the market as a complete.

Ternium S.A. (TX) was projected to internet $431.35, primarily based on dividends, plus the median of goal worth estimates from 11 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 68% higher than the market as a complete.

Provident Monetary Companies, Inc. (PFS) was projected to internet $420.92, primarily based on the median of goal worth estimates from 5 analysts, plus the estimated annual dividend, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 3% higher than the market as a complete.

Granite Ridge Assets, Inc. (GRNT) was projected to internet $418.14, primarily based on the median of goal worth estimates from 5 analysts, plus the estimated annual dividend, much less dealer charges. A Beta quantity was not accessible for GRNT.

TORM plc (TRMD) was projected to internet $392.70, primarily based on the median of goal worth estimates from 2 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 73% underneath the market as a complete.

Frontline plc (FRO) was projected to internet $383.04, primarily based on dividends, plus the median of goal worth estimates from 5 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 7% higher than the market as a complete.

Eagle Bancorp, Inc. (EGBN) was projected to internet $373.82 primarily based on the median of goal worth estimates from 3 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 7% greater than the market as a complete.

Worldwide Seaways, Inc. (INSW) was projected to internet $356.54, primarily based on a median of goal estimates from 8 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility -0.05% reverse the market as a complete.

Petroleo Brasileiro Petrobras (PBR) was projected to internet $337.94, primarily based on dividends, plus the median of goal worth estimates from 14 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 42% higher than the market as a complete.

DHT Holdings, Inc. (DHT) was projected to internet $332.11, primarily based on dividends, plus the median of goal worth estimates from 7 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to threat/volatility 68% lower than the market as a complete.

The common net-gain in dividend and worth was estimated to be 40.24% on $10k invested as $1k in every of those ten shares. The common Beta confirmed these estimates topic to threat/volatility 25% underneath the market as a complete.

Supply: Open supply canine artwork from dividenddogcatcher.com

The Dividend Canines Rule

Shares earned the “canine” moniker by exhibiting three traits: (1) paying dependable, repeating dividends, (2) their costs fell to the place (3) yield (dividend/worth) grew larger than their friends. Thus, the best yielding shares in any assortment grew to become referred to as “canine.” Extra exactly, these are, in truth, greatest known as, “underdogs.”

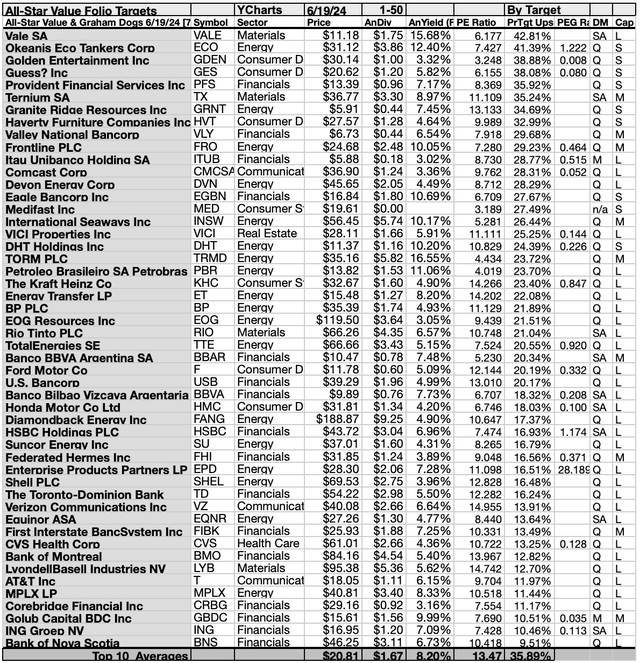

Prime 50 All-Star-Worth Graham Picks By Dealer 1Yr Value Targets

Supply: YCharts.com

This scale of broker-estimated upside (or draw back) for inventory costs supplies a scale of market recognition. Notice: no dealer protection or 1 dealer protection produced a zero rating on the above scale. This scale may be taken as an emotional part versus the strictly financial and goal dividend/worth yield-driven report under. As famous above, these scores may be taken as contrarian.

Prime 50 All-Star-Worth Graham Picks By Annual Dividend Yield

Supply: YCharts.com

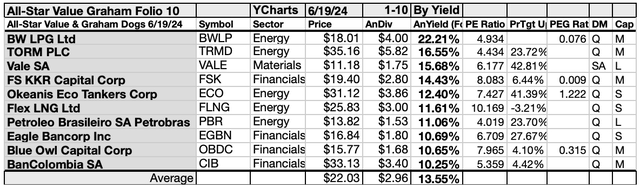

Actionable Conclusions (11-20): Ten Prime Shares By Yield Are The June Canines of The All-Star-Worth Graham Pack

Prime ten All-Star-Worth shares chosen 6/19/24 by yield represented simply three of 11 Morningstar sectors. First place was secured by the primary of 5 vitality sector representatives, BW LPG Ltd. (BWLP) [1]. The opposite 4 Power members positioned second and fifth via seventh: TORM PLC [2], Okeanis Eco Tankers Corp. (ECO) [5], Flex LNG Ltd. (FLEX) [6], and Petroleo Brasileiro S.A. Petrobras (PBR) [7].

Then third place was nabbed by the lone supplies sector member, Vale SA [3].

Thereafter, 4 monetary providers sector members positioned fourth, and eighth to tenth: FS KKR Capital Corp (FSK) [4], Eagle Bancorp Inc. [8], Blue Owl Capital Corp. (OBDC) [9], and Bancolombia S.A. (CIB) [10], to finish this All-Star-Worth Graham high ten, by yield, for June.

Supply: YCharts.com

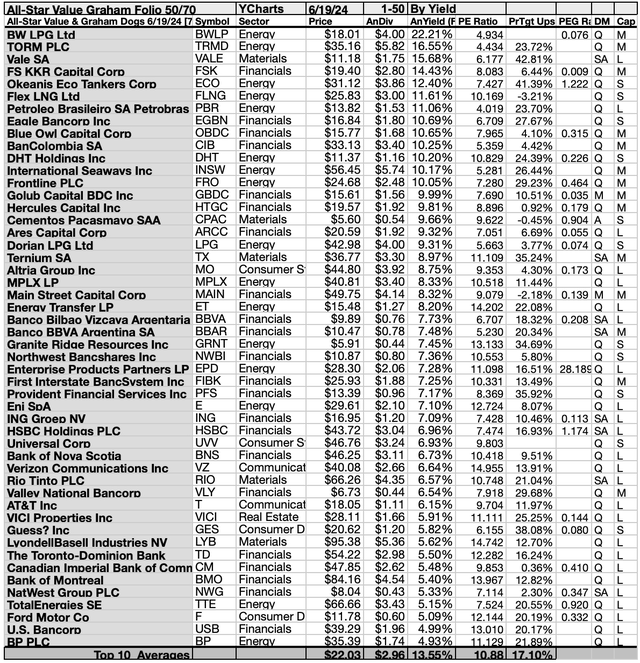

Actionable Conclusions: (21-30) Ten All-Star-Worth Graham Dividend Shares Confirmed 13.9% To 26.1% Upsides To Could, 2025, With (31) 4 Losers Sagging 0.61 to 31.56%

To quantify top-yield rankings, analyst median-price goal estimates supplied a “market sentiment” gauge of upside potential. Added to the easy high-yield metrics, analyst median worth goal estimates grew to become one other software to dig-out bargains.

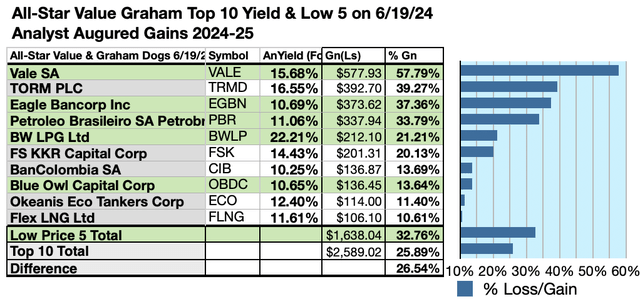

Analysts Estimated A 26.54% Benefit For five Highest Yield, Lowest Priced of Prime-Ten All-Star-Worth Graham Canines To June 2025

Ten high All-Star-Worth Graham shares had been culled by yield for this month-to-month replace. These (dividend/worth) outcomes supplied by YCharts did the rating.

Supply: YCharts.com

As famous above, top-ten All-Star-Worth Graham Canines chosen 6/19/24, displaying the best dividend yields, represented three of 11 sectors within the Morningstar scheme.

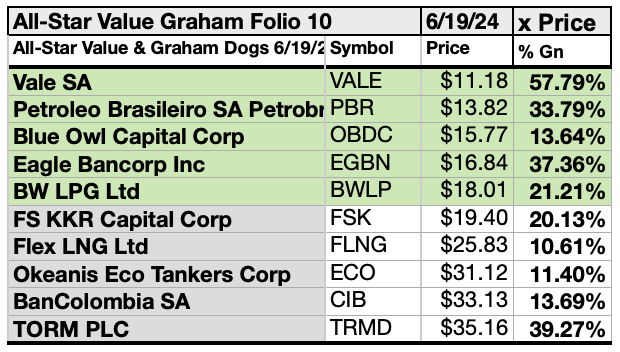

Actionable Conclusions: Analysts Estimated 5 Lowest-Priced Of Ten Highest-Yield All-Star-Worth Graham Dividend Shares (33) Delivering 32.78% Vs. (34) 25.89% Web Beneficial properties from All Ten by June, 2025

Supply: YCharts.com

$5,000 invested as $1k in every of the 5 lowest-priced shares within the high ten All-Star-Worth dividend pack, by yield, had been predicted by analyst 1-year targets to ship 26.54% extra acquire than $5,000 invested as $.5k in all ten. The very lowest-priced All-Star-Worth top-yield inventory, Vale SA, was projected to ship the perfect internet acquire of 57.79%.

Supply: YCharts.com

The 5 lowest-priced top-yield All-Star-Worth Graham dividend shares for June had been: Vale SA; ;Petroleo Brasileiro SA Petrobras; Blue Owl Capital Corp; Eagle Bancorp; BW LPG Ltd, with costs starting from $11.18 to $18.01

The 5 higher-priced top-yield All-Star April leaders had been: FSK KKR Capital Corp; Flex LNG; Okeanis Eco Tankers; Bancolombia SA (CIB); TORM PLC, whose costs ranged from $19.40 to $35.16.

This distinction between 5 low-priced dividend canine and the overall discipline of ten mirrored Michael B. O’Higgins’ “fundamental technique” for beating the Dow. The size of projected features primarily based on analyst targets added a novel ingredient of “market sentiment” gauging upside potential. It supplied a here-and-now equal of ready a yr to search out out what may occur available in the market. Warning is suggested, since analysts are traditionally solely 15% to 85% correct on the route of change and simply 0% to fifteen% correct on the diploma of change.

Afterword

If one way or the other you missed the suggestion of the 57 shares ripe for selecting at the beginning of the article, here’s a repeat of the listing on the finish:

57 Excellent Worth All-Star Canines

Supply: YCharts.com

Within the present market bounce, dividends from $1K invested within the fifty-seven shares listed above met or exceeded their single share costs as of 6/19/24

As we’re well-beyond 4 years because the 2020 Ides of March dip, the time to snap up some top-yield All-Star-Worth canine is now… except one other massive bearish drop in worth looms forward. (At which period your technique could be so as to add to your holdings.)

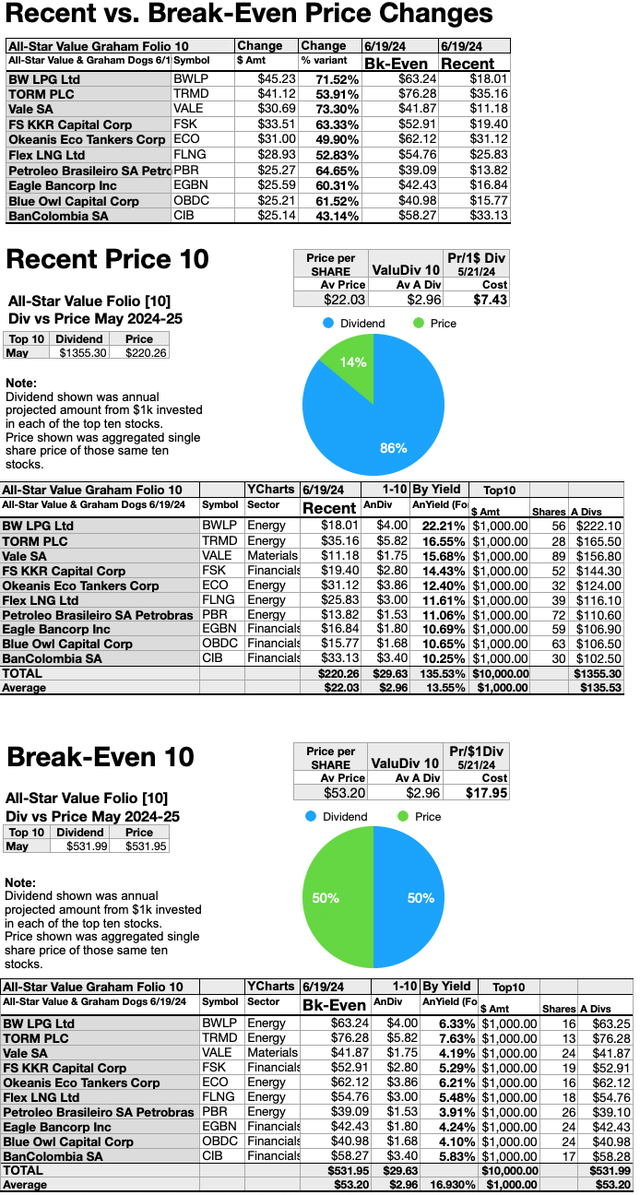

Current vs. Break-Even Prime-Ten All-Star-Worth Inventory Costs

Since the entire top-ten All-Star-Worth Dividend shares at the moment are priced lower than the annual dividends paid out from a $1K funding, the next high chart reveals the greenback and p.c variants to all ten high canine conforming to (however not exceeding) the dogcatcher best.

These at latest costs are the topic of the center chart, with the breakeven pricing of all ten delivered within the backside chart.

Supply: YCharts.com

You may take a look at the highest chart as an indicator of how excessive every inventory may rise within the coming yr or two. Nonetheless, it additionally reveals how a lot the worth may rise (in both {dollars} or share) earlier than it precisely conforms to the usual of dividends from $1K invested, equaling the present single share worth.

The web acquire/loss estimates above didn’t consider any overseas or home tax issues ensuing from distributions. Seek the advice of your tax advisor relating to the supply and penalties of “dividends” from any funding.

Shares listed above had been prompt solely as doable reference factors to your All-Star-Worth Graham Dividend canine inventory buy or sale analysis course of. These weren’t suggestions.

Open supply canine artwork from Dividend Canine Catcher; Supply knowledge from YCharts.com.