simonkr

Introduction

Generally speaking, I am no fan of office real estate. I don’t like the macroeconomic situation, and I dislike most offices.

However, that doesn’t mean there aren’t a few great opportunities in this industry.

One of these companies is the Kilroy Realty Corporation (NYSE:KRC), which may be my favorite office REIT, excluding Alexandria Real Estate (ARE), which is essentially a specialized biotech REIT.

Last year, I wrote two articles on the stock. The first one was written on June 19. The second article was published on September 21.

Since the first article, the stock is up 36%, including dividends, beating the S&P 500 by roughly 28 points.

In this article, I will discuss the current risk/reward and explain why I would be a buyer of KRC if I were looking for non-healthcare office exposure.

However, as you will find out in this article, this is not a call to throw your money into office real estate. This remains a high-risk sector that needs to be handled with care.

Hence, I’m starting this article with a look at the bigger picture.

What’s Up With Office Real Estate?

Office real estate was the first sector to suffer when rates started to rise.

Roughly 1-2 years after the pandemic started hurting office demand, elevated lending costs further damaged the health of the industry.

According to Wells Fargo’s 3Q23 commercial real estate report, the office real estate market faces significant challenges, with the national vacancy rate reaching 13.3% in Q3, the highest level since at least 2001.

Wells Fargo

The knock-on effects of hybrid work continue to depress demand, leading to negative net absorption for six consecutive quarters.

Wells Fargo

Meanwhile, the availability rate, accounting for space available for sublease, is even higher at 16.6%.

Supply continues to grow as new projects are completed, with net completions totaling 7.5 million square feet in Q3.

According to CoStar data used by Wells Fargo, the average new lease size is running approximately 20% below its pre-pandemic average.

As a result, a noticeable trend toward a flight to quality is observed, with businesses consolidating into smaller spaces in premium buildings. This is great for KRC, but more on that later.

Slower employment growth among traditional office-using industries poses a further challenge to office demand, with a mere 0.6% year-over-year increase in October.

Furthermore, CRE transaction volume contracted significantly in Q3, with office transactions experiencing over a 60% decline year-over-year.

Credit availability remains a concern for office developers, with reduced credit access and tightened lending standards.

As a result, the office market posted a notable upshift in CMBS delinquency rates, increasing by 85 bps from July to October, indicating financial challenges.

Wells Fargo

In other words, the office market remains a huge problem, which means being picky in this industry is a must.

What Makes Kilroy Realty So Special

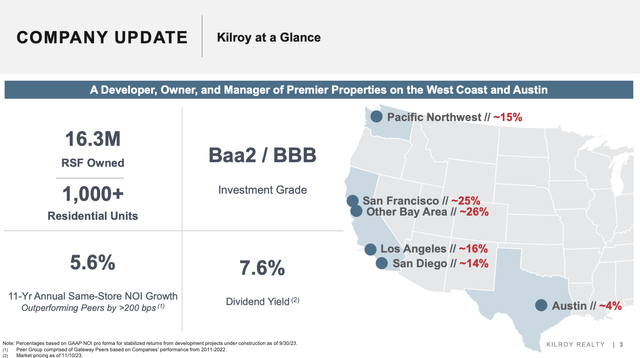

Kilroy Realty is a California-focused REIT. It owns prime office real estate in the San Francisco Bay Area and Southern California, with diversification in the State of Washington and Austin, Texas.

Kilroy Realty Corporation

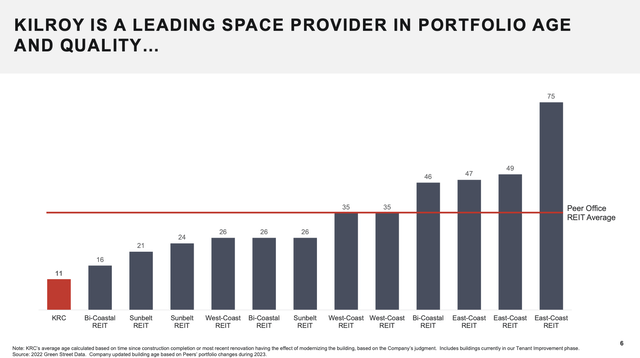

What sets Kilroy apart from its peers is the quality of its offices. The company has, by far, the youngest office portfolio, which comes with tremendous benefits.

Especially in this market and the ongoing efforts to get people back to the office, it is key to offer highly differentiated offices instead of older, “boring” offices.

Kilroy Realty Corporation

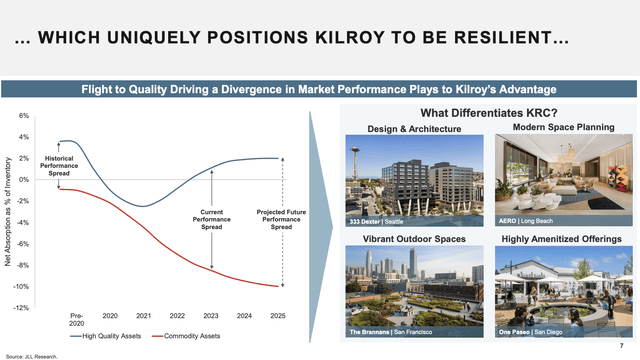

As we can see below, high-quality offices have enjoyed a strong comeback, which is set to outperform “commodity assets” on a prolonged basis.

Kilroy Realty Corporation

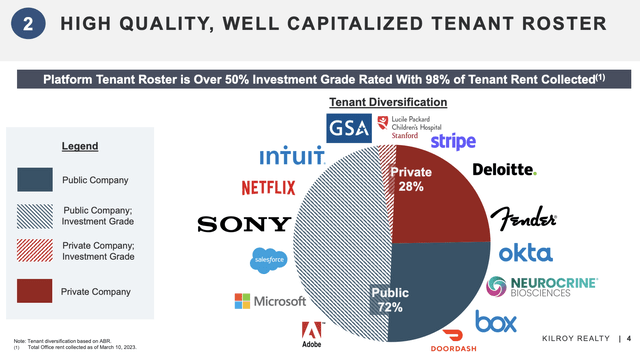

It also helps that the company has top-tier tenants, including some of the biggest tech companies.

Kilroy Realty Corporation

During its 3Q23 earnings call, the company noted the shift towards in-person work is driving increased physical occupancy levels, foot traffic, and commuter activity.

This trend is particularly strong in regions like New York City, where large corporations are actively encouraging employees to return to the office, leading to a sense of urgency and vibrancy in the city.

The West Coast, with a focus on San Diego, stands out as a region where higher physical occupancy has translated into significant leasing activity.

The company believes that San Diego’s remarkable increase of 20 percentage points in physical occupancy, reaching above 80%, serves as a testament to the positive impact on leasing demand.

For example, the success of the One Paseo campus in San Diego, with 95% occupancy and market-leading rents, supports my case for the importance of modern assets in prime locations for attracting tenants.

Kilroy Realty Corporation (One Paseo Campus)

Furthermore, with regard to its other markets, the company noted that it is pleased with changes in cities like San Francisco.

Examples include the re-election of District Attorney Jenkins, increased hiring of police officers, and supportive measures for businesses, such as delays to payroll tax increases and discounts for new businesses relocating to the city.

With 188,000 square feet of leases signed in the third quarter and an additional 117,000 square feet post-quarter end, Kilroy is actively capitalizing on the increased (regional) demand for office space.

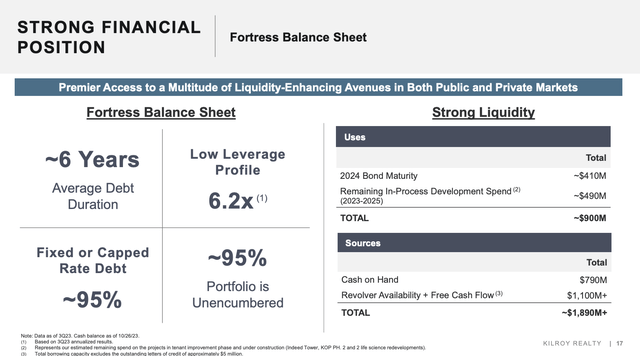

Moreover, Kilroy believes that it is protected against an elevated rate environment.

I agree with that, as the company has a strong balance sheet with a 6.2x leverage profile, 95% unencumbered assets, 95% capped/fixed rates, and a weighted average debt duration of 6 years, which buys a lot of time!

Kilroy Realty Corporation

So, what does all of this mean for shareholder value?

Dividends And The Total Return Picture

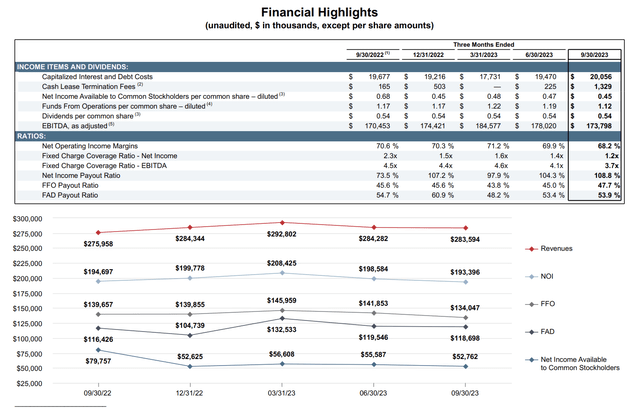

With everything said so far, third-quarter funds from operations (“FFO”) came in at $1.12 per share, marking a $0.07 decrease from the previous quarter.

This decline was primarily attributed to lower net operating income (“NOI”) resulting from the Pac-12 and Amazon move-out, along with increased expenses related to executive retirement costs.

Kilroy Realty Corporation

On a same-store basis, the third-quarter cash NOI remained relatively flat.

However, cash same-store NOI experienced a 5% decline. The stabilized portfolio’s occupancy decreased to approximately 86%, with an 88% leasing rate due to the aforementioned move-outs.

Nonetheless, despite these headwinds, the dividend remains safe, as Kilroy has always maintained a subdued payout ratio.

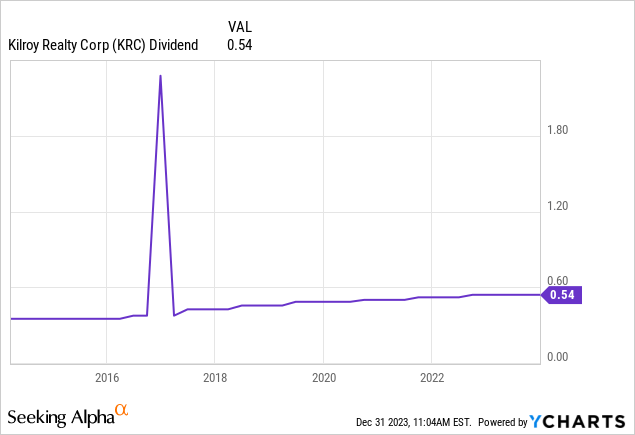

KRC currently pays $0.54 per share per quarter. This translates to a yield of 5.4%.

- This dividend is protected by a 2024E adjusted FFO payout ratio.

- The most recent hike was 3.8% on September 8, 2022.

- The five-year dividend CAGR is 3.8%, which shows that the company (and its peers) have become careful not to hike too aggressively in times of uncertainty.

All of this means that once the market improves, KRC will be in a good spot to meaningfully hike its dividend again.

In this case, I used 2024 analyst expectations to assess the dividend payout ratio, as analysts expect the company to report an 11% lower AFFO in 2024, followed by a 1% decline in 2025.

However, the company may very well do better, as it also hiked its full-year 2023 guidance after the third quarter.

The previous 2023 FFO guidance of $4.43 to $4.53 per share, with a midpoint of $4.48, was adjusted quite meaningfully.

The revised range is $4.55 to $4.60, with a new midpoint of approximately $4.58, representing a roughly 2% increase from the prior guidance.

Key drivers behind this increase include improved parking income, earlier revenue recognition on certain leases, higher interest income, and adjustments to disposition guidance.

With that said, a potential office market rebound would not just put KRC in a great spot to boost its dividend but also unlock tremendous value on the stock market.

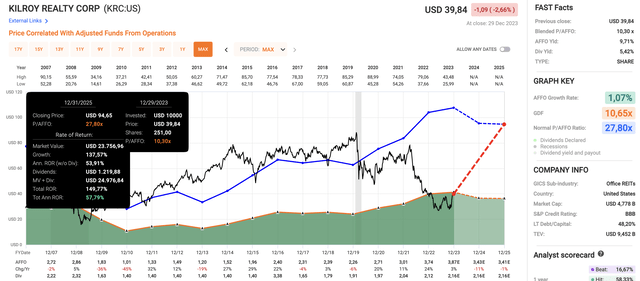

Based on the data in the chart below (which also includes the aforementioned AFFO growth expectations):

- KRC is trading at a blended P/AFFO ratio of 10.3x.

- Its normalized P/AFFO multiple is 27.8x, as the company has a great track record of growing AFFO. Outside of recessions, it has a habit of aggressively growing AFFO, as we can see in the chart below (2011-2018, 2020-2022).

- When incorporating 2024 and 2025 growth expectations, the stock has a fair value of roughly $95 at a 27.8x multiple. That’s roughly 130% above its current price.

FAST Graphs

The current consensus price target is $39.

Needless to say, I am not going to make the case that KRC will double soon.

Based on everything said so far, I believe that in light of horrible industry fundamentals, KRC is doing well, thanks to prudent management, top-tier assets, and a healthy balance sheet.

I am sticking to a Buy rating, although it is a rating that comes with a warning label.

KRC is highly volatile. Its industry is still in a downtrend, and I cannot rule out a temporarily lower stock price before it potentially moves much higher.

Hence, if you’re interested in buying office exposure, be careful. Keep your positions small and try to mainly buy after corrections.

Takeaway

With a California-focused portfolio, KRC boasts modern, high-quality offices that align with the evolving demands of in-person work.

The company’s strategic tenant selection, strong balance sheet, and prudent management position it as a resilient player in a challenging market.

Despite industry headwinds, KRC’s dividend remains secure, offering a 5.4% yield.

As the office market faces uncertainties, KRC’s potential for dividend growth and stock value appreciation presents a cautiously optimistic opportunity for investors, though the volatile nature of the industry calls for careful consideration and adjusted position sizes.