anyaberkut/iStock via Getty Images

Co-produced with Treading Softly.

What do you own today that you have held onto for decades? It’s rare in the modern era that we hold onto items or possession for a long period of time.

Manufacturers have created items with planned obsolescence which helps keep them turning a profit and consumers continuing to come back for more.

Yet, like my 9th grade Physical Education shirt, some items survive the test of time and continue to serve their designed purpose. While I did have to part ways with my old PE shirt years ago, some possessions get passed from generation to generation as heirlooms. Often trinkets or pieces of jewelry that carry more sentimental value than monetary value continue to be cherished or begrudgingly held onto.

When looking into the market, few investors have a decade or longer timeframe in mind. The average investor weighs their holding period in days or weeks rather than years or decades. Yet the most successful investors tend to be those who hold for a very long time.

Today, I want to highlight two income investments that you’d be wise to buy and hold for decades to come. They will provide a steady stream of high-quality income into your portfolio.

Let’s dive in!

Pick #1: WPC – Yield 5.6%

Amid all the Chicken Little, the sky is falling panic, W. P. Carey Inc. (WPC) did what it does best – it raised its dividend. For those keeping track, this is the 25th consecutive year WPC raised its dividend, and for 22 of those years, WPC has raised the dividend every quarter.

When turmoil strikes the market, we like to turn our focus to lower-risk options. This means companies that we can have a lot of confidence in can navigate difficult economic conditions.

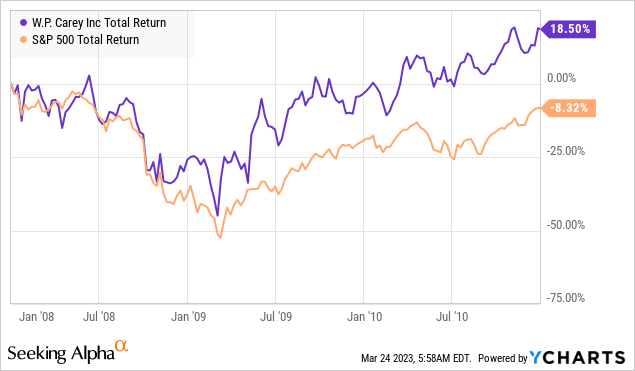

The big fear that investors have for real estate investment trusts, or REITs, is a credit freeze. REITs use leverage, and an inability to refinance loans is a potential risk. WPC has been through a credit freeze before. For WPC, it wasn’t so scary.

From 2008-2011, WPC fell about as much as the S&P 500 (SP500) but recovered much more quickly. WPC achieved this feat while raising the dividend every quarter.

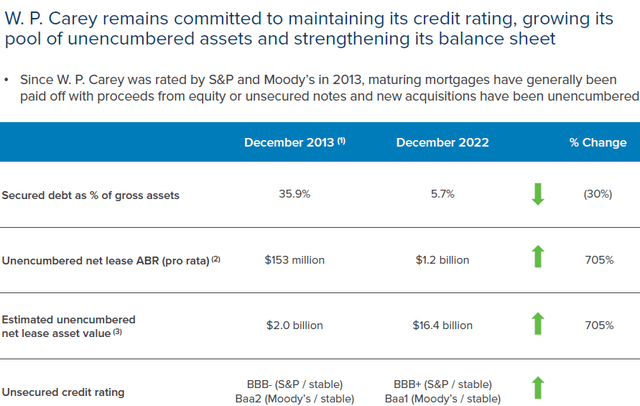

And to think, WPC had a vastly inferior balance sheet back then. I often hear people commenting about how low-interest rates have fueled “speculative debt” and encouraged companies to become irresponsible with their leverage. Well, I can’t talk about every company in the world, but for WPC, this has not been the case. WPC’s balance sheet is much stronger than it was a decade ago. Source.

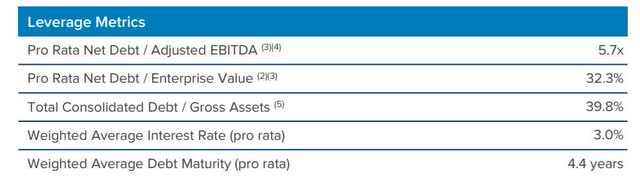

WPC Q4 2022 Capitalization & Leverage

WPC has made its balance sheet much more flexible, with under 6% of its debt secured and over $16 billion in unencumbered asset value. These improvements helped drive credit rating increases from BBB- to BBB+.

With debt to assets under 40% and debt/EBITDA of 5.7x (44.6% and 6.72x in 2012), WPC has become more conservative over the past decade.

WPC Q4 2022 Capitalization & Leverage

WPC has grown responsibly and is much stronger today than ever.

For a while, WPC stock was trading above our recommended Buy Under price. Now it has dipped back down below $80. If you don’t already own a full allocation in this blue chip, it is one you should consider topping off.

Pick #2: DMB – Yield 4.4%

BNY Mellon Municipal Bond Infrastructure Fund (DMB) is a closed-end fund, or CEF, that invests in municipal bonds. Municipal bonds are fixed-income investments that have low default rates and long maturities. The low default rate is always a great thing, but what has pained this fund (and other municipal funds) is interest rates.

Higher interest rates mean lower bond prices. The further out the maturity, the greater the impact. We’ll be clear, DMB is going to continue to trade at a low price until the Fed backs off on rate hikes. Any renewed hawkishness from the Fed, any belief that the Fed might hike even more than already expected, could be a headwind for DMB’s bond prices.

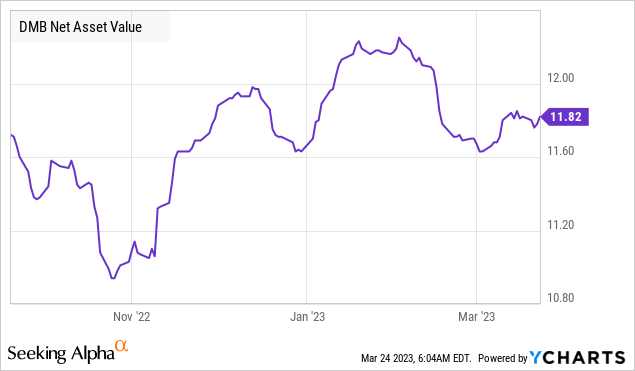

DMB cut its dividend back in October as the pressure from rising borrowing costs impacted its earnings. With NAV having recovered since October lows, it appears that the cut was sufficient to preserve upside in NAV.

Rising interest rates will continue to be a headwind. However, on the other hand, flat to declining interest rates would be a major tailwind. This is why DMB was green when so much of the market was red following the failure of Silicon Valley Bank. Distress in the financial system increases the odds that the Fed will choose to “take it slow,” and they hiked only 25 bps. If problems keep cropping up, the Fed could outright pivot.

DMB’s NAV has declined, but its share price has fallen even more as investors have been bearish on fixed income. DMB is currently trading at an 8% discount to NAV. When the market stops running away from fixed income and runs towards it, DMB will benefit from both rising NAV and the market price racing up to close the discount.

Everyone loves to talk about “buying low” in order to sell high. Well, buying low means buying an asset class when others don’t want anything to do with it. We’ve been buying DMB throughout the back half of 2022 and are still adding today.

Even the Fed can’t predict when they will pivot, but everyone knows that it will happen. When it does, we want to have our positions filled out in DMB stock because it will be too late to buy.

DMB provides Federal tax-free income, so while the yield might appear low on the surface, an investor in the 32% tax bracket would need to hold an investment yielding 6.5% to get the equivalent after-tax yield.

Conclusion

Having two excellent picks is great, but I long have championed having a high level of diversification in one’s portfolio by holding at least 40 different individual investments in your portfolio. Our High Dividend Opportunities “Model Portfolio” provides investors with plenty of options, having more than 45 picks yielding above 9% overall. You can make your own portfolio from the options available in the market; we just try to make it easier for anyone getting started or wanting to fine-tune their holdings!

As an income investor, I look to buy and hold for long periods of time. This is why I can have such a relaxing retirement. The storms come and go, and the market rises and falls, but none of that matters as long as my income craft sails long and produces excellent high levels of income into my account.

Once you know you hold quality, you don’t need to stress about the dips, climbs, or trends. You can enjoy an excellent income and forget the market. Perhaps take that dream trip to Mexico, see the beautiful mountains in Switzerland, or meet another old faithful by visiting Yellowstone national park.

You can let the market handle itself when you’re an income investor. That’s the beauty of our Income Method. It means less stress and more fun.