Published on November 1st, 2022, by Felix Martinez

During the Great Depression of the 1930s, the term “widow-and-orphan stock” was created. The kind of stocks that took on this nickname were stocks that can weather turbulent economic conditions, generating a steady stream of income for those who are most vulnerable, like widows and orphans — hence the term.

These kinds of stocks were mature companies with strong market shares. They also had the characteristic of paying high dividends. These companies are typically in well-established industries, like utilities, consumer staples, or telecommunications.

These types of companies enjoy steady cash flow, generate consistent earnings, and have a strong market share with little to no competition. Because of this, they often pay out high dividend yields even when markets are experiencing low growth rates.

You can see the full downloadable spreadsheet of all 47 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

In today’s article, we will look at 10 stocks that would be considered widow-and-orphan stocks. All of these stocks are in the Consumer Staples, Utilities, and Communication Services industries. They have been paying a rising dividend for more than 18 years. They also have a current dividend yield of at least 4%.

Table of Contents

Retirement Stock for Income #1: Verizon Communications Inc. (VZ)

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenue, and broadband and cable services account for about a quarter of sales. The company’s network covers about 300 million people and 98% of the U.S.

On October 21st, 2022, the company reported the fiscal year’s third quarter and first nine months’ results. Revenue was up 4% year-over-year to $34.2 billion for the quarter compared to the third quarter in 2021. Adjusted earnings-per-share equaled $1.32 and compared unfavorably to $1.41 per share in the same prior year period.

Source: Investor Presentation

The company had broadband net additions of 377,000, including 342,000 fixed wireless net additions. This was also the fifth consecutive quarter that the business reported more than 150,000 postpaid phone net additions.

The cash flow from operations was down for the year’s first nine months from $31.2 billion to $28.2 billion. In the first nine months, capital expenditures were up $1.9 billion to $15.8 billion. Free cash flow for the quarter was down from $17.3 billion to $12.4 billion for the first nine months of the year.

Verizon expects to generate adjusted earnings per share between $5.10 and $5.25 for fiscal 2022.

Widow and Orphan Stock #2: UGI Corp. (UGI)

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire U.S. and other parts of the world.

It was founded in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $8.4 billion and should generate about $9.6 billion in revenue this year. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI

Utilities.

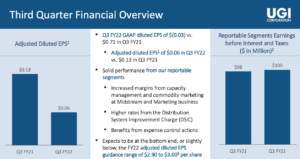

Source: Investor Presentation

UGI reported FQ3 results on August 3rd, 2022. Adjusted earnings-per-diluted share for the quarter came in at $0.06, down from $0.13 per diluted share in the year-ago quarter. GAAP diluted EPS came in at $(0.3), down from $0.72 in the year-ago period, while revenue increased by 35.9% year-over-year to $2.03 billion.

The reportable segment’s earnings before interest expense and income taxes stood at $100 million from $98 million in the year-ago period. The company also reported available liquidity of ~2.1 billion as of June 30th, 2022.

Meanwhile, the company now expects fiscal 2022 adjusted diluted earnings-per-share guidance range of $2.90 to $3.00 per share and also added that even with continued economic uncertainty, they are still focused on their strategy to continue meeting shareholder commitments and long-term financial targets of 6% to 10% EPS growth and 4% dividend growth.

Widow and Orphan Stock #3: Fortis Inc. (FTS)

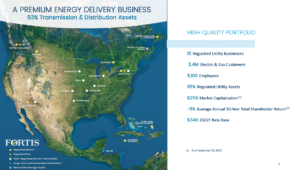

Fortis is Canada’s largest investor-owned utility business with operations in Canada, the United States, and the Caribbean. It is cross-listed in Toronto and New York. Fortis trades with a current after-tax yield of 3.65% (about 4.3% before the 15% withholding tax applied by the Canadian government).

At the end of 2021, Fortis had $ 42.5 billion of assets. 63% were in the U.S., 34% in Canada, and 3% in the Caribbean; 82% of assets were regulated electric utility assets, 17% were regulated gas, and only 1% were nonregulated.

Source: Investor Presentation

The company reported third-quarter earnings results on October 28th, 2022. Third quarter Non-GAAP EPS of C$0.71 beats estimates by C$0.21. The company generated total revenue of C$2.55 billion, an increase of 16.4% year-over-year. This also beats estimates by C$160 million.

The company also announced that it would be unveiling its largest five-year capital plan of C$22.3billion, an increase of C$2.3 billion over its prior plan. They also announced that the annual dividend growth guidance will be in the range of 4-6% through 2027.

Widow and Orphan Stock #4: Altria Group (MO)

Altria Group was founded by Philip Morris in 1847. Today, it is a consumer staples giant. It sells the Marlboro cigarette brand in the U.S. and a number of other non-smokable brands, including Skoal, Copenhagen, and until recently the Ste. Michelle brand of wine.

Altria also has a 10% ownership stake in global beer giant Anheuser Busch InBev, in addition to large stakes in Juul, the manufacturer of a vaping product and distributor, as well as cannabis company Cronos Group (CRON). It currently trades at a market capitalization of $81.4 billion.

Source: Investor Presentation

On October 27th, 2022, Altria reported third-quarter results. Adjusted diluted earnings-per-share increased 4.9% to $1.28 year-over-year. Net revenue stood at $6.6 billion, down by 3.5% year-over-year.

Reported diluted earnings per share stood at $0.12, up by 100% year-over-year. The company also repurchased 8.5 million shares at an average price of $43.68, for a total cost of $368 million. Through the first nine months, the company repurchased 29.9 million shares at an average price of $48.60, costing approximately $1.45 billion.

The company also narrowed full-year 2022 adjusted diluted earnings-per-share guidance of $4.81-$4.89, representing an adjusted diluted earnings-per-share growth rate of 4.5% to 6%.

Widow and Orphan Stock #5: Canadian Utilities Ltd. (CDUAF)

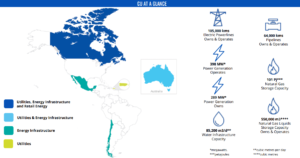

Canadian Utilities is a $7.1 billion company with approximately 5,000 employees. ATCO owns 53% of Canadian Utilities. Based in Alberta, Canadian Utilities is a diversified global energy infrastructure corporation delivering solutions in electricity, pipelines and liquid, and retail energy.

The company prides itself on having Canada’s longest consecutive years of dividend increases, with a 50-year streak. Unless otherwise noted, U.S. dollars are used in this research report.

Source: Investor Presentation

On October 27th, 2022, Canadian Utilities reported its Q3-2022 results for the period ending September 30th, 2022. Revenue for the quarter amounted to $664 million, 13.6% higher year-over-year (in constant currency), while adjusted EPS came in at $0.33 compared to a loss of $0.24 in Q3-2022.

Higher revenue was mainly the result of rate relief provided to customers in 2021 in light of the COVID-19 global pandemic and, subsequently, the decision to maximize the collection of 2021 deferred revenue in 2022. Higher revenue was also due to higher electricity and natural gas commodity prices, customer growth at ATCOenergy, and additional revenue from the Alberta Hub natural gas facility acquired last year.

Widow and Orphan Stock #6: Edison International (EIX)

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, California. Edison International has a market capitalization of $27.3 billion. Total revenue is around $22.3 billion.

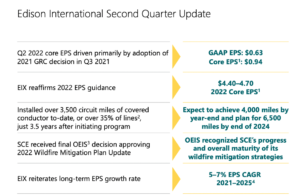

Source: Investor Presentation

Edison International reported its second-quarter earnings results on July 28th, 2022. The company reported a Q2 net income of $0.63 per share, down from $0.84 per share in the year-ago period. Core earnings per share remained flat at $0.94 year-over-year.

Revenue grew 20.8% to $4.01 billion year-over-year. During the quarter, Edison International installed more than 3,500 circuit miles of covered conductors to date. Meanwhile, the company continues to reaffirm its 2022 earnings guidance of $4.40 to $4.70 and long-term earnings per share growth rate target of 5% to 7%.

Widow and Orphan Stock #7: Northwest Natural Holding Co. (NWN)

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest, and it has done that well, affording it the ability to raise its dividend for 66 consecutive years. NW Natural trades with a market capitalization of $1.7 billion.

Source: Investor Presentation

NW Natural reported Q2 results on August 4th, 2022. The company reported a net income of $0.05 compared to a net loss of $0.02 in the year-ago period. Revenue increased 30.9% to $194.96 million year-over-year. NW Natural added 10,200 natural gas meters over the past 12 months, equating to a 1.3% growth rate.

Meanwhile, the management reaffirmed its guidance for 2022, with earnings-per-share expected to come in at between $2.45 and $2.65 and a long-term earnings-per-share growth rate target of 4% to 6%.

Widow and Orphan Stock #8: Southern Company (SO)

Southern Company is a major energy utility that serves ~9 million customers in the U.S. via its subsidiaries. It has a market capitalization of $69.3 billion.

Southern is one of the most resilient companies to the pandemic. In fact, the company greatly benefited from the record-low interest rates that resulted from the pandemic. Due to cost overruns and its acquisition of AGL Resources for $12 billion in 2016, Southern has almost doubled its net debt in the last six years.

In addition, it has a heavy debt maturity schedule. As it refinances its debt on a regular basis, it greatly benefits from low rates. On the other hand, the Federal Reserve has begun raising interest rates aggressively, and thus the interest expense of Southern will increase.

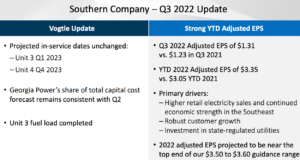

Source: Investor Presentation

On October 27th, 2022, the company reported third-quarter earnings results. Net income for the quarter was$1.5 billion, or $1.36 per share, compared with $1.1 billion, or $1.04 per share, in 2021. For the nine months ended September 30th, 2022, Southern Company reported earnings of $3.6 billion, or $3.38 per share, compared with $2.6 billion, or $2.46 per share, for the same period in 2021.

Revenue for the quarter was up 34.3% year-over-year. This also beats estimates by $1.53 billion. Adjusted earnings drivers for the third quarter of 2022, as compared with the same period in 2021, were higher revenues associated with increased usage, rates, and pricing at the company’s regulated utilities, partially offset by higher non-fuel operations and maintenance costs.

Widow and Orphan Stock #9: Universal Corp (UVV)

Universal Corporation is the world’s largest leaf tobacco exporter and importer. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars.

Universal Corporation was founded in 1886 and is headquartered in Richmond, Virginia. With 51 years of dividend increases, Universal Corporation is a Dividend King.

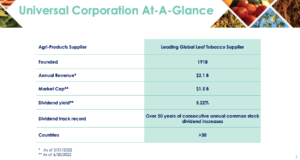

Source: Investor Presentation

Universal Corporation reported its earnings in August in its first quarter (fiscal 2023). The company generated revenues of $430 million during the quarter, which was 23% more than Universal Corporation’s revenue during the previous year’s period.

Management explains that revenue rose due to a stronger product mix primarily. Universal’s gross margin was up slightly compared to the previous year’s period, which is why operating income, adjusted for one-time expenses, was up year-over-year, unlike the previous quarter.

Universal’s adjusted earnings-per-share totaled $0.25 during the quarter, which was down on a year-over-year basis, despite higher operating income. The difference can be attributed to higher taxes and higher interest expenses.

Widow and Orphan Stock #10: Avista Corp (AVA)

Avista Corp. is an electric and natural gas utility operating primarily in the states of Washington, Idaho, Oregon, and Alaska. In addition to its regulated utility business, the company also operates other businesses, including venture funds, real estate investments, and other investments.

Founded in 1889, this $2.95 billion market cap company has raised its dividend every year for the past 19 years.

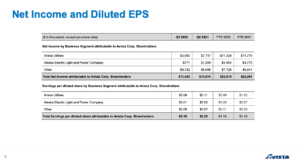

Source: Investor Presentation

Avista reported Q21 2022 earnings on August 3rd, 2022. For the quarter, earnings-per-share equaled $0.16, 4 cents below the $0.20 per share the company reported in Q2 2021. Avista declared a $0.44 dividend payable to shareholders of record at the close of business on August 19th .

This dividend was not well covered by the company’s quarterly earnings, though its year-to-date earnings are sufficient to cover the expense.

The outcomes of the general rate increases in Washington will heavily affect the company’s forward revenue. A settlement there has been reached, but it still requires final regulatory approval. Earnings at Avista Utilities were lower than expected, primarily due to a write-off of the Dry Ash Disposal project at Colstrip as agreed in the 2022 Washington rate case settlement, as well as increased costs due to the impacts of rising interest rates and inflation.

Final Thoughts

The listed widow-and-orphan stocks are ideas only for safe growing dividend income. Due diligence is required to determine if any of these stocks are under fair value price.

Buying widow-and-orphan stocks should help the investor sleep well at night, knowing that the dividends of these companies are safe and goring. Thus, providing the income needed for an acceptable retirement.

A good starting place to find such candidates are the Dividend Kings List, Dividend Aristocrats List, and to a lesser extent, the Blue-Chip Stocks List

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].