vorDa/iStock via Getty Images

Even as it begins lapping easier comparables, Zoom (NASDAQ:ZM) has yet to see revenue growth accelerate. It appears that pandemic fatigue has taken hold, and it may take some time before companies get excited about increasing access to remote work, if ever. That said, the stock is trading at such cheap valuations that growth is not really necessary. The stock is trading at just 15x earnings and that is before accounting for $6 billion in net cash making up nearly 30% of the market cap. The stock appears to be trading cheaply due to fears about competition from Microsoft Teams (MSFT), but I am of the view that ZM still offers a superior product and may be able to eventually show an inflection in growth rates. I reiterate my buy rating for the stock as I expect a share repurchase program in the future to eventually be an important catalyst for the stock (even as management claims otherwise).

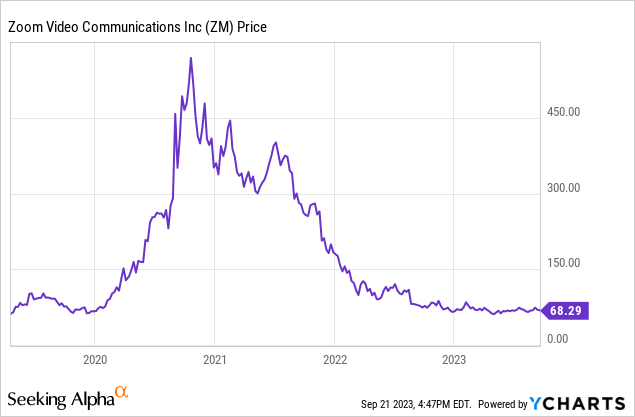

ZM Stock Price

ZM stock “zoomed” during the pandemic as it saw an unprecedented pull-forward in demand. Unfortunately for the stock, those growth investors abandoned the stock once growth disappeared even though the company retained its strong profit margins.

I last covered ZM in July where I reiterated my buy rating for the stock even as management suggested that enterprise revenues would see struggling growth rates later this year. The latest quarter saw management confirm such fears yet again, but I continue to be of the view that the low valuation, net cash balance sheet, and strong free cash flow generation should eventually lead to solid upside in the future.

ZM Stock Key Metrics

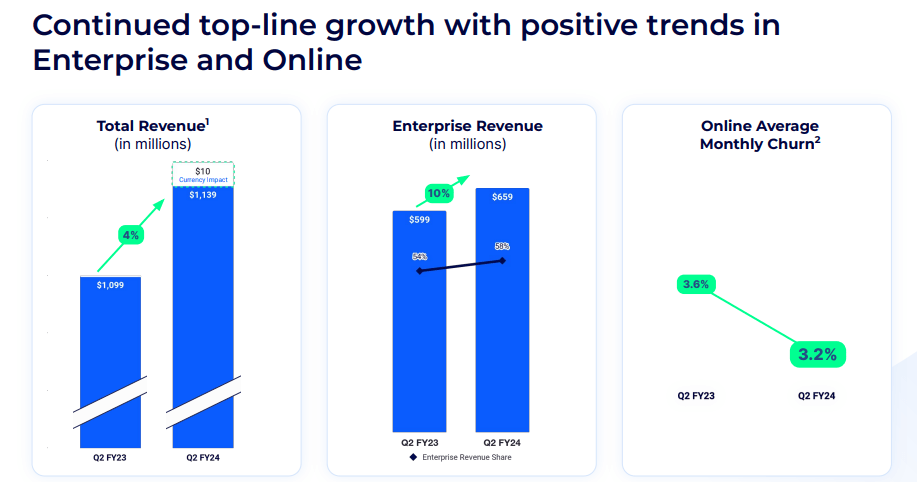

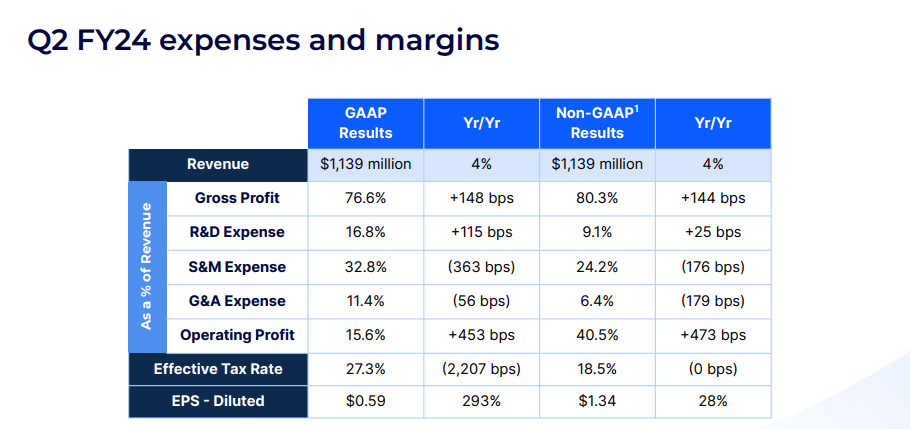

In its most recent quarter, ZM delivered 4% YoY revenue growth to $1.139 billion, coming ahead of guidance for $1.115 billion (but I doubt many investors cared about the guidance beat given the low nominal growth rate).

FY24 Q2 Presentation

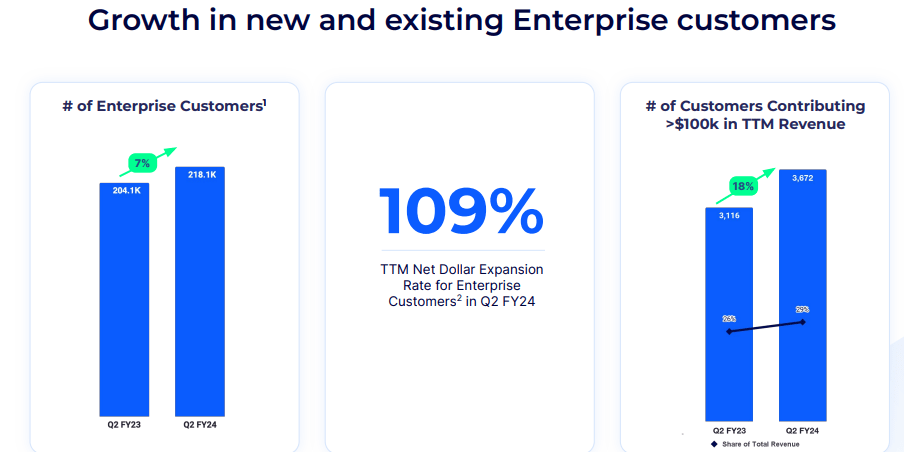

ZM saw its online average monthly churn dip to 3.2% (emphasis on “monthly”) and enterprise revenues once again led the way with 10% YoY growth. ZM, however, did see its enterprise net dollar expansion rate dip sequentially from 112% to 109%. On the bright side, ZM continued to add enterprise customers.

FY24 Q2 Presentation

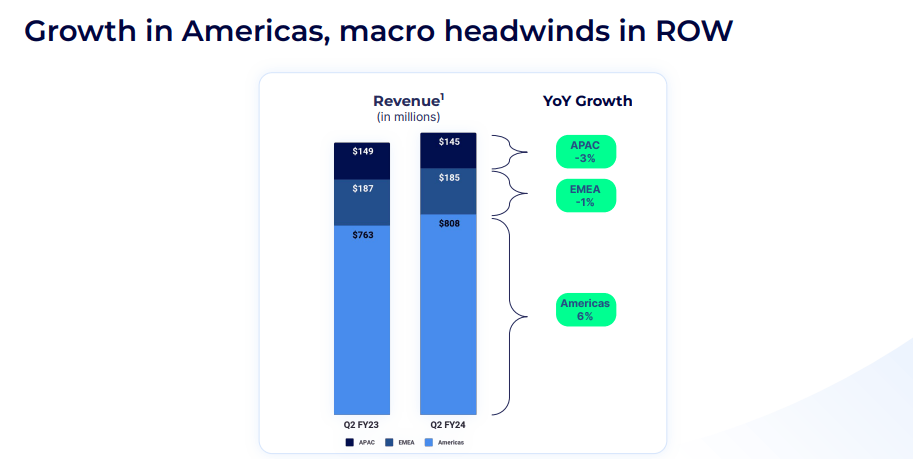

It should be noted that ZM has seen considerable headwinds in regions outside of the Americas. At some point, I expect these headwinds to eventually become tailwinds as the company laps easy comparables.

FY24 Q2 Presentation

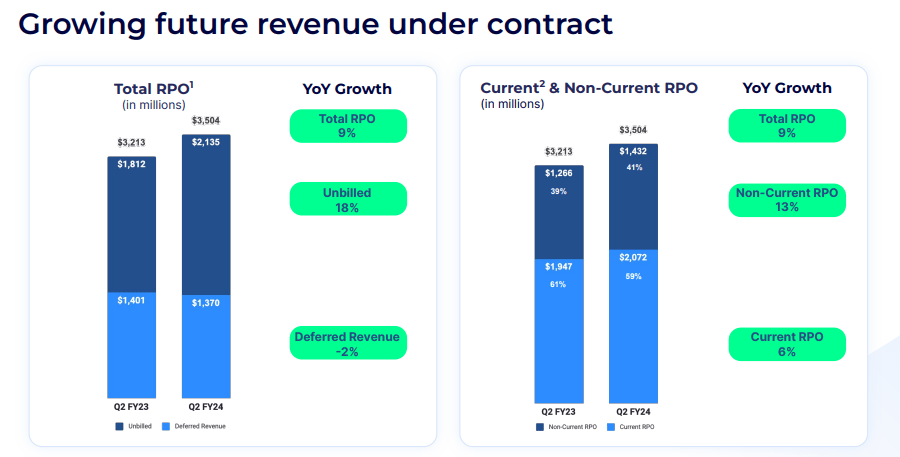

Another positive note is that ZM has seen solid growth in remaining performance obligations (‘RPOs’), though current RPO growth stood at just 6% in the quarter. Current RPOs are often a predictor of future revenue growth.

FY24 Q2 Presentation

ZM showed some operating leverage with its operating margin jumping over 450 bps on a GAAP and non-GAAP basis.

FY24 Q2 Presentation

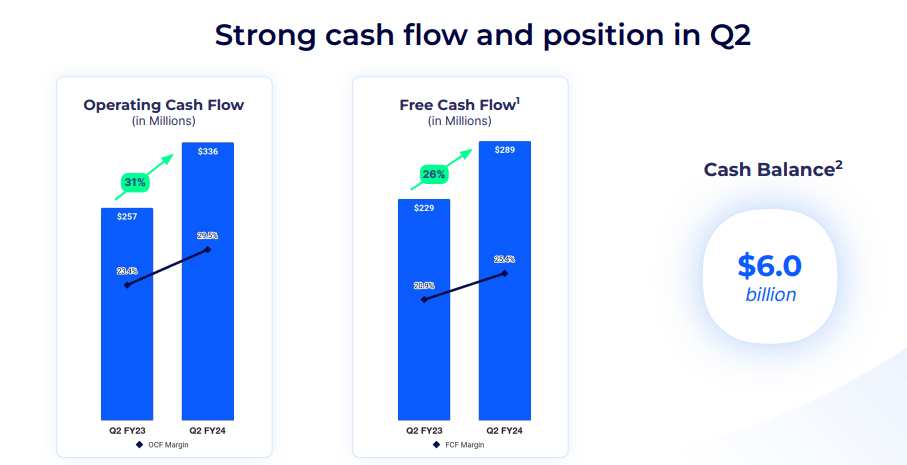

ZM ended the quarter with $6 billion in cash versus no debt. That net cash balance represents just under 30% of the current market cap.

FY24 Q2 Presentation

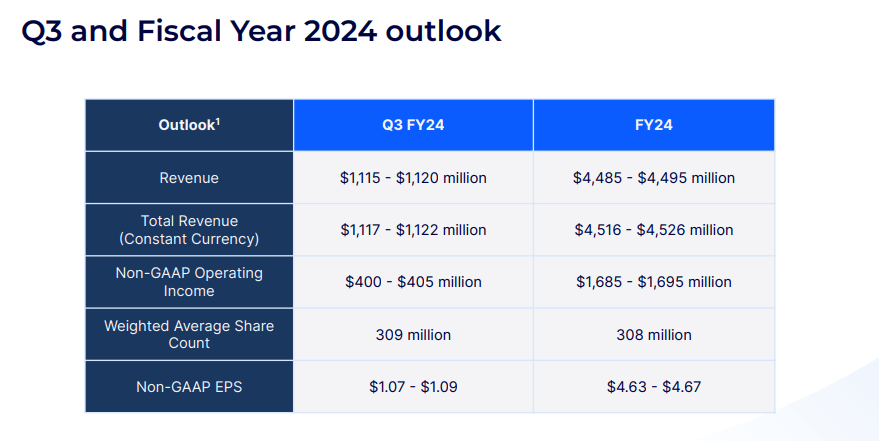

Looking ahead, management has guided for $1.12 billion in revenue in the third quarter, implying just 1.6% YoY growth. For the full year, management now expects up to $4.495 billion in revenue (representing 2.3% YoY growth) and higher than the prior guidance of $4.485 billion. Management did also raise guidance for non-GAAP operating income to $1.695 billion, up from $1.65 billion.

FY24 Q2 Presentation

On the conference call, management discussed the news that the company is requiring employees to return to the office twice a week. That news initially sent the stock dipping in August. Management stated that the motivation for the decision was to help them understand the “hybrid journeys” for their customers. I personally thought the sell-off was unwarranted and this explanation makes sense. ZM’s mission was never to transform the world to a fully remote workplace environment in the first place.

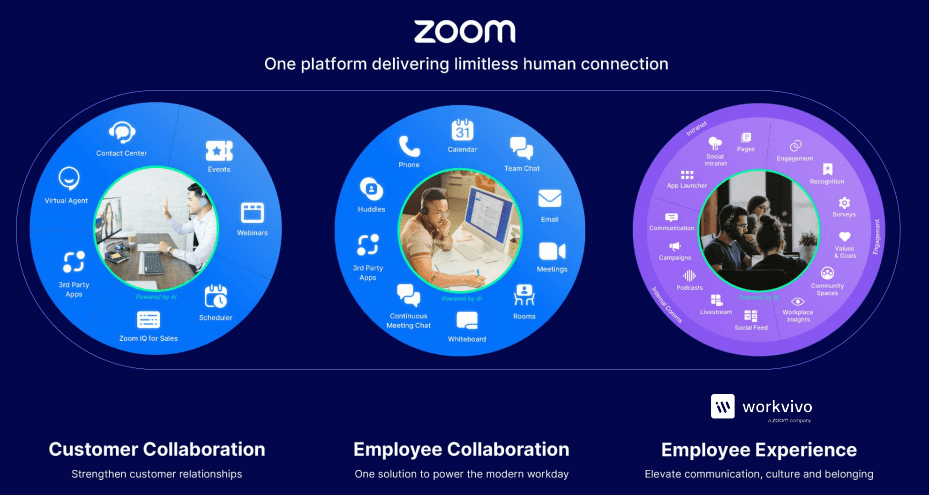

In this call as well as subsequent conferences, management was repeatedly asked about how they intend to reaccelerate revenue growth rates. Management touted Zoom Phone as a key initiative as the company aims to become more than just a video conferencing company but instead a complete collaborations platform for its customers. Management did not give any potential growth rate target (but again, not a lot of growth is needed at these valuations).

Management confirmed that enterprise revenues may flatline by the end of this year (with Online revenues being a surprising offset), but noted expectations for the dollar-based net retention rate to inflect positively by early next year.

Is ZM Stock A Buy, Sell, or Hold?

ZM is an enterprise tech company which enables its customers to optimize collaboration – the company is most well known for its video conferencing product.

FY24 Q2 Presentation

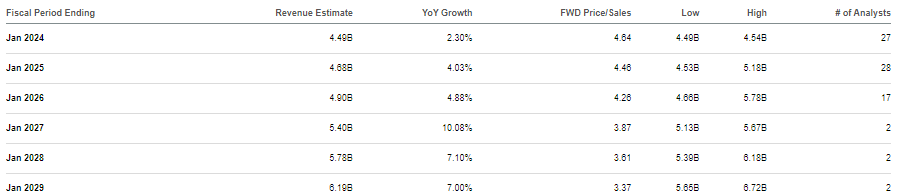

Growth has almost disappeared following the pandemic, but valuations are far less demanding than in the past. ZM recently traded hands at well under 5x sales.

Seeking Alpha

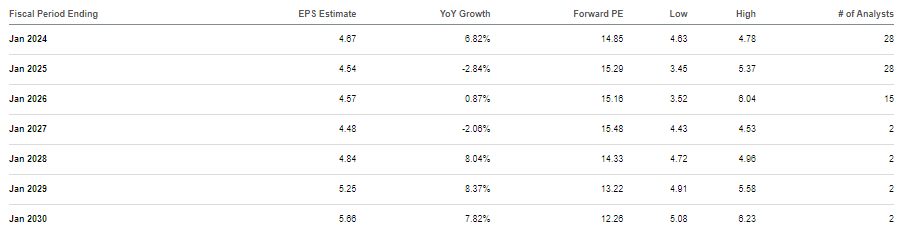

ZM is one of the more profitable names in the tech sector and is trading at under 15x earnings.

Seeking Alpha

I note that these valuations are before accounting for the net cash making up around 30% of the market cap. I was disappointed to see management stating that they are not prioritizing share repurchases due to seeking to invest in accelerating revenue growth, noting that they are “looking at both organic and organic ways of doing it.” While it is possible that any acquisition can be done in an accretive manner, I am of the view that repurchasing the stock is a critically viable option at this point in time.

Assuming revenue growth accelerates to the 8% range, I can see the stock trading at around 18x earnings – justified by the net cash balance sheet and high free cash flow generation. Management has their work cut out ahead of them in terms of accelerating top-line growth, but the valuation looks reasonable even if growth remains muted.

What are the key risks? The main risk is if growth never accelerates again, which may indicate that the company is losing in its competition with Microsoft Teams. While I am of the view that ZM has a superior product to Teams based on my personal experience (Teams did not offer a stable connection whereas Zoom offered a flawless experience), public perception may differ given that MSFT is a cloud tech titan. The fact that ZM has a better product might not matter if customers are OK with a cheaper but acceptable solution. MSFT is under regulatory crosshairs for bundling Teams, but it is not clear if regulatory intervention will benefit ZM. If growth turns negative, then I could see ZM trading down to as low as 8x earnings, though the net cash balance sheet should offer significant downside protection. It is possible that management spends the cash on its balance sheet on an expensive acquisition, which would remove that important part of the bullish thesis.

I rate the stock a buy due to the reasonable valuation and large amount of net cash, as the stock offers considerable upside if management can execute on accelerating growth rates.