dbvirago/iStock Editorial via Getty Images

Despite trading at ridiculously low levels and having total equity to be significantly greater than the current market capitalization, the market continues to obliterate ZIM Integrated Shipping Services (NYSE:ZIM) share price due to the overall decline in freight rates. Even though the business has recently reported great financial results for Q3, there’s a risk that until additional catalysts appear and improve the overall container demand, which would lead to an increase in ocean freight orders, ZIM’s stock could continue to fall.

Luckily, despite the ongoing decoupling from China by the U.S., several additional geopolitical developments could improve the situation for ZIM, which could strengthen the bullish case for the company’s stock, and this article is about to highlight most of them.

Extremely Undervalued Business

A few weeks ago, ZIM revealed its Q3 earnings report, which showed that its business continues to generate high returns despite falling freight prices. During the quarter, the company managed to make $3.23 billion in revenues, up 3.2% Y/Y, while its GAAP EPS of $9.66 was above the street estimates by $0.21.

At the same time, despite being in an industry that’s known for its capital-heavy requirements, ZIM’s biggest advantage is that it’s an asset-light company, which gives it more financial and operational flexibility in comparison to its peers. The company heavily relies on the chartered-in capacity strategy, under which it directly owns only a handful of over 130 ships that are in its fleet, while the rest are chartered for a fixed period from their respective owners.

On top of that, as I’ve already mentioned in my previous article on the company, ZIM also heavily relies on various digital solutions to improve the overall efficiency of its business. Thanks to investing in various tech startups earlier this year, ZIM has substantially improved its big data and AI capabilities, which resulted in the overall improvement of its freight rates, which recently were higher in comparison to others.

What’s also important to mention is that ZIM has a very healthy balance sheet. At the end of Q3, its total debt stood at $4.7 billion, while the total liquidity was $4.45 billion. At the same time, most of the debt is in the form of financial leases, as lease obligations are its biggest expense under the chartered-in capacity strategy, but the interest expenses on them are more than manageable since ZIM’s net leverage ratio at the end of the latest quarter was 0x, down from over 3x two years ago.

In addition to all of this, despite lowering its annual outlook, the company would nevertheless be able to report record earnings for the year. As of now, ZIM’s management expects to generate EBITDA in the range of $7.4 billion to $7.7 billion in FY22, while the adjusted EBIT is expected to be between $6 billion and $6.3 billion during the same period. On top of that, ZIM’s total equity stood at $5.8 billion at the end of Q3, significantly above its current market cap of ~$2.6 billion, while its P/E ratio is below 1x.

Considering this, it’s safe to say that the company trades at ridiculous levels solely based on the fundamentals, which is why Seeking Alpha’s Quant rating system gives the company an A+ rating for its current valuation. However, the events of recent months showed that a ridiculous valuation is not enough to revive the stock and ensure the appreciation of ZIM’s share price. At least for now.

Geopolitics To Save The Day

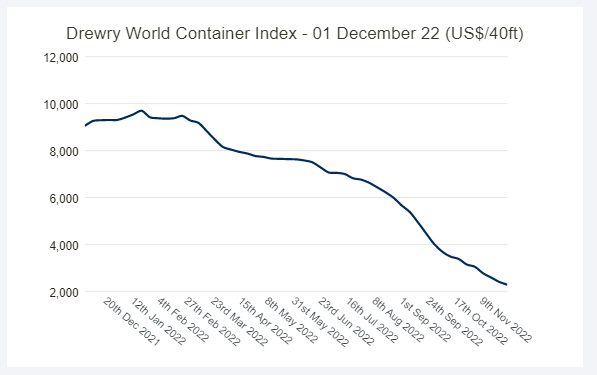

The collapse of freight rates, which have been depreciating in the last 40 weeks, is the main reason why ZIM’s stock has declined by ~65% YTD despite reporting an exceptional performance in Q3 and trading at ridiculously cheap levels.

Drewry World Container Index (Drewry)

The good news though is that despite such a decline in freight rates, ZIM nevertheless managed to show a decent operational performance in the recent quarter. Even though the company’s carried volume in Q3 was 842,000 TEU, down only 5% Y/Y, its average freight rate per TEU was $3353, up 4% Y/Y, although rates were significantly higher a year ago than they are today. At the same time, carried volume in FY22 is expected to be flat Y/Y and the main question that investors are asking right now is how successful ZIM could be in 2023 in the new environment with lower freight rates.

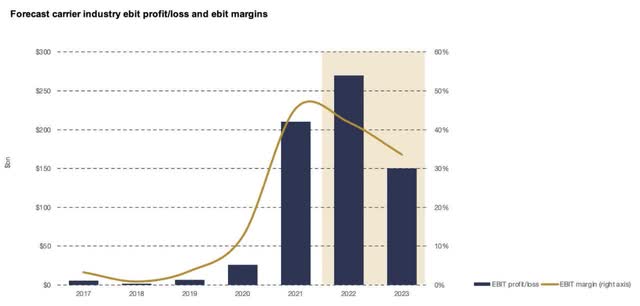

I have already mentioned in my previous article on the company that shipping companies won’t be able to replicate the successes of 2021 and 2022 in the foreseeable future, as the increase of supply along with the decline in demand won’t help them to set new financial records. Nevertheless, there’s still an indication that the container shipping business is in for a treat next year, as the margins are expected to remain at relatively high levels in comparison to the pre-pandemic days.

Forecast Carrier Industry EBIT Profit/Loss And EBIT Margins (Drewry)

Considering this, there’s a possibility that great profitability coupled with several positive catalysts could prevent further deceleration of freight rates and improve the overall outlook for the shipping industry. In one of his recent interviews about this issue, Jefferies veteran analyst Omar Nokta, who was covering shipping companies for almost two decades, said the following:

My sense when talking to investors is that it’s a bit different in this cycle for container shipping. Investors don’t want to be involved right now as freight rates are still declining. But the moment we start to see some stability in freight rates, I think buyers are going to be flocking into this sector because of the value these stocks hold. People are really chomping at the bit to buy these stocks the moment there’s stability in freight rates.

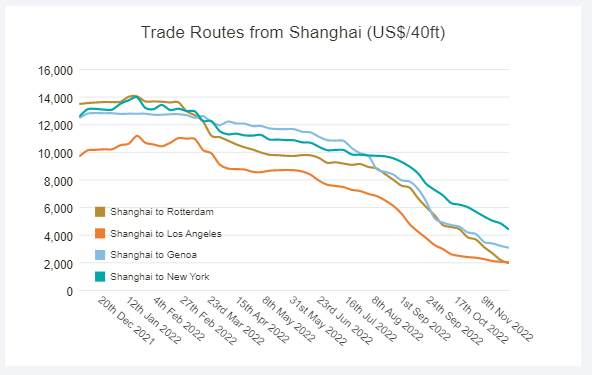

Currently, we’re already seeing freight rates for the Shanghai-Los Angeles trade route slowly normalizing, which could be the first sign of price normalization that could lead to the reversal of the declining trend in the foreseeable future.

Freight Rates For Trade Routes From Shanghai (Drewry)

As we approach a price normalization, several catalysts could accelerate the reversal mentioned above, which in the end could lead to the appreciation of ZIM’s shares.

First of all, even though China and the U.S. are in the middle of decoupling from each other, which negatively affects freight rates, trading between different sovereign parties on which our civilization is built is not going anywhere. Even though we would see a shortening of supply chains, cross-border trading would nevertheless remain an important part of both Chinese and American economic systems to achieve their respective national interests.

We already saw in ZIM’s latest earnings presentation that while the volume carried through the Pacific and Atlantic trade routes has slightly deteriorated Y/Y this year so far, the carried volumes through the Intra-Asia, Latin America, and Cross-Suez trade routes are nevertheless up Y/Y. The Cross-Suez route in particular is likely to see an increase in carried volume going forward, as China’s Belt and Road Initiative experienced a setback earlier this year after Russia invaded Ukraine, which resulted in railway traffic disruption that hasn’t fully recovered to this day.

At the same time, both the U.S. and the EU economies are continuing to grow despite facing high inflation and an energy crisis, while the possible easing of the zero-Covid policy in China could return the demand for the ocean freight orders on the Pacific trade route soon. On top of that, the IMF predicts that the global economy would nevertheless grow in 2023 despite all the challenges, while there’s also an indication that the feared inventory overhang is not as big as previously thought. This could also encourage retailers once again to buy more supplies, especially after having relatively successful Black Friday and Cyber Monday sales.

Overall, all of those macro and geopolitical developments could ensure the normalization of the freight rates and act as the biggest catalysts of ZIM’s bullish case in the coming quarters.

The Bottom Line

With the increased presence of retail investors, ZIM has become a battleground stock. On the one hand, we have bears, who repeat their doomsday scenarios about how the global economy is about to enter a 1929-style depression that would push the freight rates to unimaginably low levels. On the other hand, we have bulls who think that ZIM could easily have an even greater performance in the future in comparison to its successes in 2021 and 2022. The truth is somewhere in the middle.

Yes, there are potential overcapacity and demand destruction issues, which could continue to obliterate ZIM’s shares. However, there are also some positive macro and geopolitical developments, which could easily reverse the trend and push ZIM’s stock higher after months of underperformance. At the same time, after the recent depreciation of ZIM’s shares, we could safely say that the lower earnings in 2023 in comparison to the previous two years are more than priced in at this stage.

What’s also certain at this stage is that if the current freight rate normalizes and stays at the current levels for a while, then we could assume that we’ve reached the bottom. If that’s going to be the case, then there’s a high chance that investors would begin to once again favor ZIM over stocks from other industries, because you can’t deny the ridiculously cheap prices at which ZIM already trades right now.