SCQBJ-JZ

Yum China (NYSE:YUMC) is the China spin-off of Yum! Brands (YUM), and operates the KFC, Pizza Hut, Taco Bell brands, as well as Lavazza (coffee), Huang Ji Huang and Little Sheep (internally generated) brands in Mainland China.

As per the company’s introduction in their 2023 form 10-K, Yum China is the largest restaurant company in China in terms of 2023 system sales with over $11 billion of revenues in 2023 and 14,600+ restaurants, of which they operated c. 86% themselves. Yum China covers c. 2,000 cities in China and has announced further plans for expansion.

In this article, I present a view on Yum China’s 2023 Q4 and FY, as well as an outlook for 2024.

In preview, I believe YUMC is currently undervalued by c.5.2%. Due to a strong shareholder friendly management team that has made Yum China #1 in China, I believe the stock can be an interesting portfolio diversifier offering China and Consumer exposure. That said, due to the low margin of safety, I rate the stock currently as a ‘Hold.’

Review of 2023 Q4 and Full-Year Results

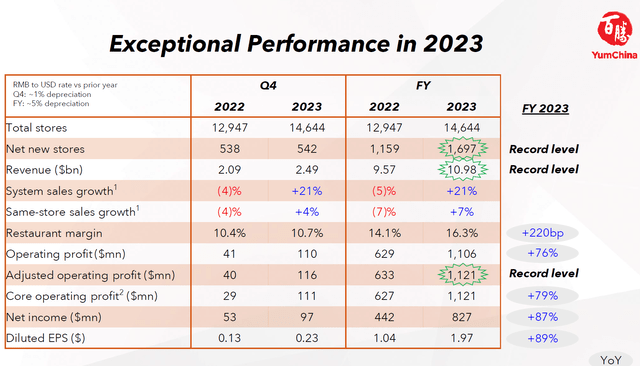

YUMC delivered exceptional performance in Q4 2023 as well as for the full year. New stores, revenue and adjusted operating profit all hit record levels for FY 2023, while store metrics also improved significantly.

System Sales, a measure of total revenue, increased 21% YoY. Total stores reached 14,644 (+1,697 in 2023). Revenue was just shy of $11bn, while adjusted operating profit also reached a record of $1.1bn.

Yum Q4 results presentation

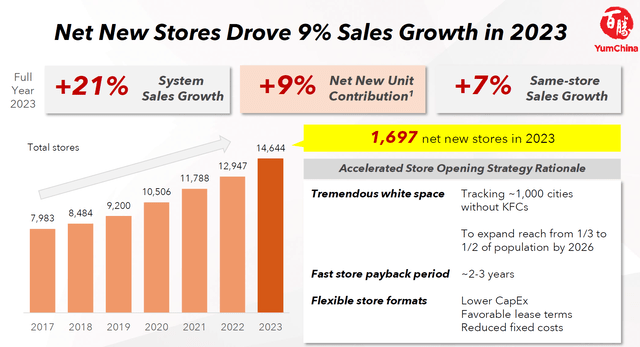

To break this stellar performance down, net new stores were a major growth contributor. Net New Stores – a measure reflecting new stores built minus any stores closed, plus any stores acquired / refranchised – drove 9% sales growth in 2023, while existing stores (Same-Store Sales Growth or SSSG) grew by 7% YoY. KFC stores reached 10,296, while Pizza Hut had 3,312 stores.

Yum Q4 results presentation

What is more interesting to note, however, is that YUMC believes there is tremendous ‘white space’ (new areas for expansion – without existing brand presence), with ~1,000 cities without KFC. The scale of the China market is almost unbelievable.

As YUMC CEO Joey Wat described in the earnings call:

“KFC still only serves 1/3 of the China population. Our next ambitious target is to extend our reach to 1/2 of the population by 2026. How? By being closer to our customers. This means adding store density in existing cities and entering new cities. KFC currently operates across 2,000 cities in China and is tracking an additional 1,000 cities.”

KFC currently serves 1/3 of the China population, which is c. 420 million consumers (larger than the entire US market). YUMC believes there is scope in the next 3 years to increase their addressable market by c. 50%.

Pizza Hut and other brands have even more room to grow, although one can argue their product does not hold the same mass appeal as KFC’s does.

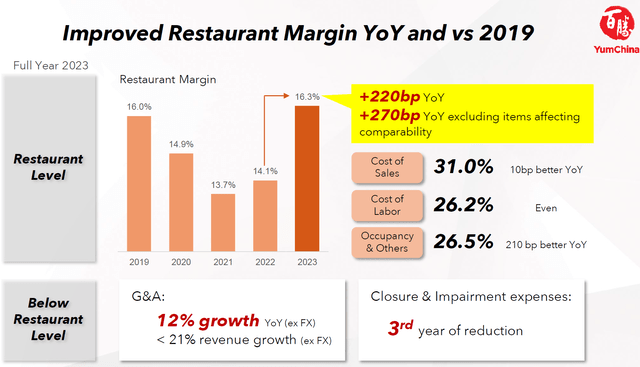

In addition to looking at new unit growth, looking at restaurant margins (profitability at store level, before ‘head office’ costs are incurred) is critical in this industry. Very encouragingly, YUMC saw improved restaurant margins vs 2019. This is a more reasonable comparison as the COVID years had a material impact.

Yum Q4 results presentation

Restaurant margins in 2023 reached 16.3%, up from 16.0% in 2019. Here we can see that overall YUMC managed to improve its Cost of Sales (ingredient / food costs) by 10bp YoY, while Cost of Labour remained unchanged.

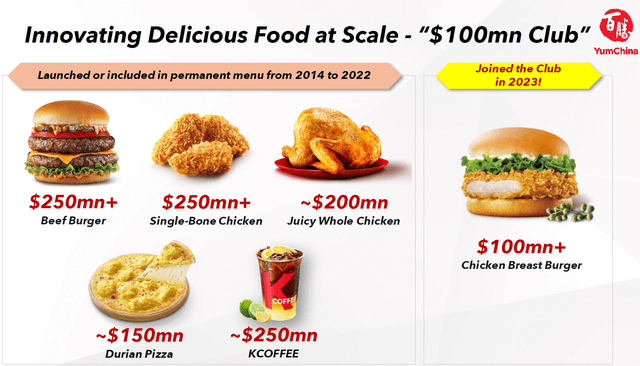

Beyond excellent cost control and execution at store level, another critical success factor for QSR brands is its product quality, menu composition and pricing. I won’t say much about product quality other than that this is good, YUMC operates under relatively strict food safety, quality and operational hygiene standards compared to local Chinese restaurant operators.

Yum Q4 results presentation Yum Q4 results presentation

Regarding menu and pricing, YUMC continues to innovate and broaden its appeal. As consumers in China are facing challenging economic conditions, having strong entry-price offerings is key to maintain brand accessibility to the masses, something both KFC and Pizza Hut are doing. In addition, to capture the Group Gather occasion, KFC (and Pizza Hut) offer several ‘abundant value’ combos to entice various groups. Last, they have strengthened their appeal to children, with ‘awesome toys’ – essentially copying the success McDonald’s (MCD) has had for years with its Happy Meals.

All in all, management is doing all the right things and moving in the right direction.

Outlook – 2024 and beyond

Looking ahead to 2024, I believe the short-term outlook for YUMC remains positive. Similar trends reported in 4Q23 are likely to persist – high growth across the board, while cost headwinds can be largely mitigated. YUMC can grow stores quickly due to low capex and fast store payback periods (2-3 years). While continued economic weakness in China remains a challenge, YUMC is well positioned to weather these conditions as its brand target everyday consumption and is not as much impacted by macroeconomic conditions. Assuming the Chinese economy does better in 2H, there is potential additional upside.

According to Statista, the ‘Chained Foodservice’ retail sales value is set to increase by 8.8% CAGR from 2021 to 2025. This is pretty much in-line with what YUMC expects to grow at through 2026, adding credibility to their projections. Due to the significant scale YUMC has already achieved, being the #1 restaurant operator in China by size, it is difficult to outgrow the market, though I think it is entirely possible due to the brand strength and significant white space outlined by management. Thus, there is still room for surprise upside in the next 2-3 years, depending on how the Chinese economy develops.

Yum Q4 results presentation

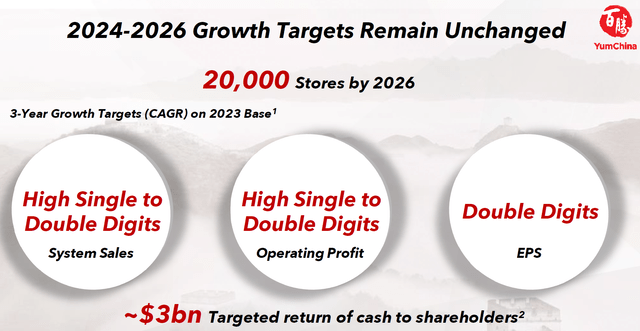

YUMC has an ambitious growth plan of reaching 20,000 stores by 2026 (~1,785 net new stores per year), along with a 3-year CAGR of high single to low-double digit system sales, operating profit, and double-digit EPS growth. Throughout its earnings call, Joey Wat, the CEO, reiterated management’s confidence in achieving this.

To analyze the threats to this ambitious plan, I believe the future of YUMC’s success will depend on three key factors:

- Network Expansion

- Operating Efficiency

- Continued Relevance to Consumers

Network Expansion

The key to YUMC achieving continued high single to double-digit system sales growth is expanding its network (building more stores). Nothing grows the topline faster than opening new stores. This means they need to open in the ~1,000 new cities that currently don’t have a KFC (i.e., serve the c. 300m new customers), as well as build more stores in existing cities to be closer to customers and make it even easier for consumers to choose their brand over their competitors. Continued expansion, especially into more rural and lower income areas as well as increasing penetration into Tier 1 city center areas, is not necessarily straightforward and will require potential new restaurant formats. For the rural / lower income areas, cheaper storefronts, simpler menus, and other enhancements might need to be sought to make stores viable and profitable. For high-rent areas in city centers, smaller stores might be needed to reduce rental costs and maintain profitability, just to name a few.

If YUMC cannot hit its network expansion targets, it will be difficult to achieve its growth targets. Currently, management estimates c. 1,500-1,700 net new units in 2024, the lower end of the average annual new stores required (1,785) to hit 20,000 by 2026. I believe this is prudent, due to economic weakness in the Chinese market, but I would expect to see a ramp-up as economic conditions improve.

Operating Efficiency

Another key area for YUMC to continue to manage is operational efficiency. In 2023, this was done expertly, with an improvement in cost of sales and flat cost of labour. Cost of sales (ingredients / food) do, however, fluctuate quite regularly (e.g., the price of flour will fluctuate based on the size of the harvest of grains etc.), and thus there will naturally be some ups and downs, but in general, through menu and recipe optimization and engineering, YUMC can ensure its food costs do not spiral out of control.

Regarding labour costs, this has more to do with the market, currently the labour market in China is quite weak, so I do not expect major increases in wages anytime soon. However, this too can be somewhat managed in the long term through automation in the kitchen. This is, however, not yet a very commercially viable solution, though one that will be increasingly important in the long run.

Continued Relevance to Consumers

As YUMC operates everyday consumer brands, maintaining relevance to these consumers is critical to ensure they keep coming back. What relevance means keeps changing, so it is important for such B2C brands to keep on top of the latest trends and to continue to evolve their menu, brand, and services. This includes delivery capabilities, digital & membership experience (ordering experience through apps, membership points etc.), and more. As mentioned above, YUMC is adapting well to the current challenging economic situation in China, ensuring their brands remain accessible to consumers who are cautious to spend through entry-level pricing options, as well as abundant value combos.

Overall, I am optimistic about YUMC’s long-term prospects, as I believe the company provides an essential product and service to the growing middle-class consumers in China. I believe management is making the right decisions to maintain customer relevance and has an extremely strong track record of executing its growth agenda.

My major concern is another significant macroeconomic event that would materially impact Yum China going forward, especially things like another major pandemic that would result in lockdowns, including epidemics affecting livestock (especially a bird-flue). However, since that is out of YUMC’s control, I have confidence that management will remain shareholder friendly and do what it can to drive business growth and performance.

Valuation and Shareholder Value

YUMC’s shares are down 19.06% in the last year, closing at US$147.5.

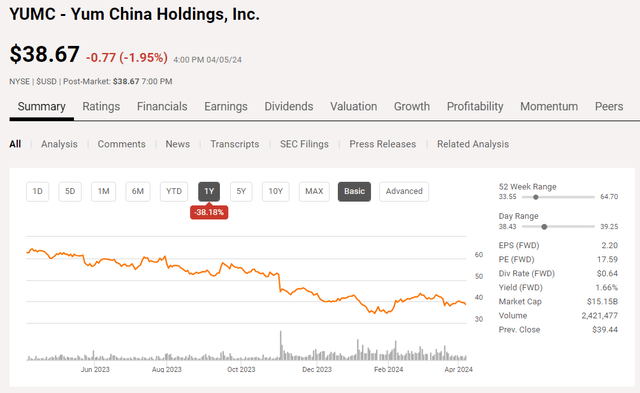

Seeking Alpha

Shares are down 38.2% in the last year, and down 13.4% over the last 5 years (c. 44.3% down from an all-time high of $69.4 in June 2021). When looking at the operating performance over the past few years, the only reason for the decline I would argue is over-valuation before the pandemic, likely due to too much cheap capital in the Chinese market. I believe the major decline in share price has nothing to do with the operating performance or the growth prospects of the business, and rather the stock is being punished by a generally negative China sentiment.

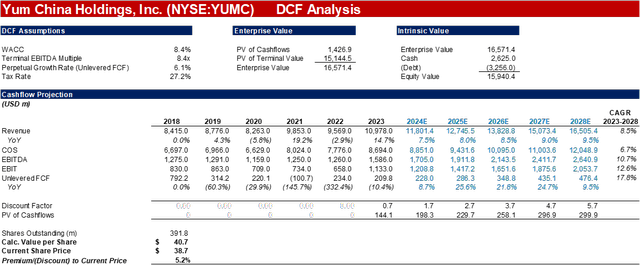

Looking ahead, I am relatively positive about near-term earnings, and optimistic about long-term earnings, mainly due to management’s track record of executing well. That said, due to management’s aggressive growth targets and strong past performance, I do believe some of the upside is already being priced into the current share price. Based on my DCF model, I have a long-term price target of c.$41, indicating YUMC is currently undervalued by c.5%. This does not leave a huge margin of safety, and I will wait for some more decline before considering adding this stock to my portfolio.

Author’s Calculation

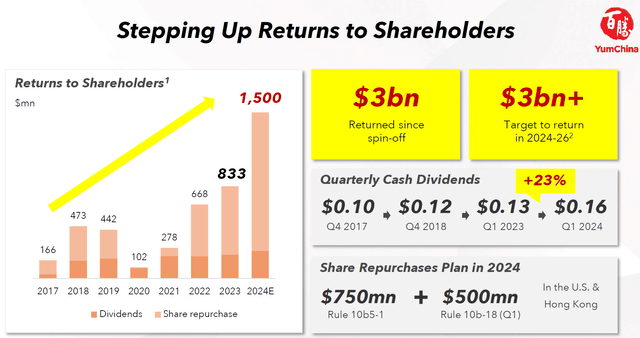

In addition, YUMC currently pays a quarterly dividend with a 1.66% yield – I do not consider this a particularly attractive yield, especially not when interest rates are still quite high. That said, management has a strong track record of returning cash to shareholders in the form of buybacks and dividends.

Yum Q4 results presentation

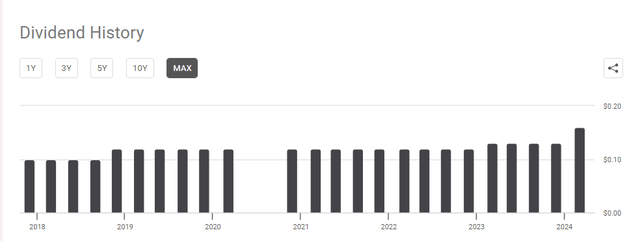

The company has returned $3bn since the spinoff in 2017, and targets to return even more in the next 3 years. In February 2024, Yum China raised its dividend by 23% to $0.16 and announced a share-buyback plan of ~$1.25B buyback in 2024. All of these are encouraging signs that management is shareholder-friendly.

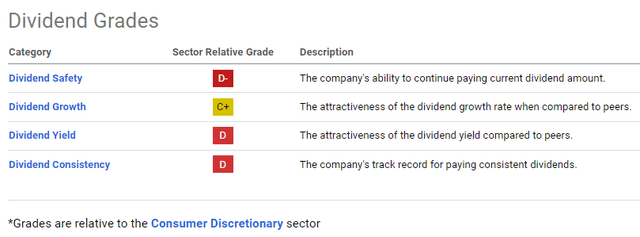

Seeking Alpha Seeking Alpha

Turning to the dividend, YUMC started paying a dividend in late 2018, for c.6 years, as such its dividend consistency score is very low. In addition, they stopped the dividend payment in 2020 due to the pandemic but resumed it later in the year. Since it started paying a dividend, the 5-yr dividend growth rate CAGR is c.4.6%. This coupled with the 1.66% yield is not something I am too excited about but doesn’t hurt.

Seeking Alpha

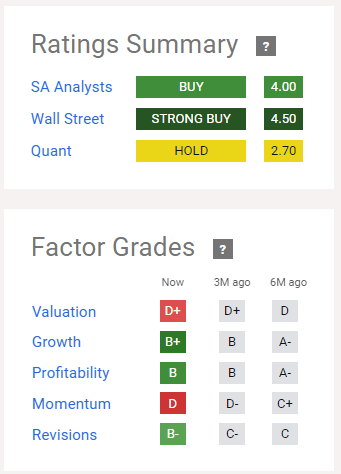

Looking at the ratings summary, I concur with the Quant ratings that YUMC is currently a ‘Hold.’ Despite it being slightly undervalued. Since I do not yet own any shares in YUMC, I will wait for a slightly better valuation before initiating a position.

The SA Factor grades are generally in line with my views, though the valuation metric of ‘D+’ I think is somewhat harsh. I would probably give YUMC a ‘C’ for Valuation.

That said, the Growth, Profitability and Revisions are all extremely positive, and I believe the poor Momentum is actually a benefit for those looking to start a position.

Takeaway

Yum China is currently trading c.44% below its all-time high and offers a dividend yield of 1.66%. Based on a DCF analysis, I believe it is undervalued by 5.2%. Due to a strong shareholder friendly management team that has proven time and again why Yum China is the #1 restaurant operator in China, I believe the stock can be an interesting portfolio diversifier offering China and Consumer exposure. That said, due to the low margin of safety, I rate the stock currently as a ‘Hold.’ For anyone looking to initiate a position in Yum China, I would advise waiting for a correction to provide more of a buffer.