At least we got a little holiday cheer in the markets this week.

Athletic apparel leader Nike (NYSE: NKE) helped breathe some life into stocks when it came in with stronger-than-expected quarterly earnings.

But it was Nike’s comments on its inventory that are really noteworthy.

Nike — along with much of the rest of the retail world — got into a real mess earlier this year. Consumer tastes changed much quicker than most retailers expected, as what remained of the pandemic economy this time last year quickly morphed into the reopening economy.

And then on top of that, raging inflation forced consumers to rethink some of their spending and prioritize where they spent their precious dollars.

The result was retailers had too much of the wrong merchandise and not enough of what people actually wanted. This meant heavy discounting to clear out inventory … and lower profits as a result.

Nike’s CEO John Donahue reported a decline in inventories on its earnings call, and emphasized that he believed Nike was over the hump.

We’ll see. Nike is just one company and the results were for just one quarter. But it’s encouraging and (hopefully) a sign that inventory issues will normalize across the economy in the first quarter or two of 2023.

Of course, there are still plenty of issues that won’t be solved in a day … or in a quarter.

The trend of deglobalization is real. Uncle Sam really is “firing China,” as Ian King pointed out last week, and we’re looking at a reordering of the world’s supply chains that might take a decade or more to complete.

We’re good with that. We view the challenges ahead as a once-in-a-lifetime profit opportunity.

But of course, tomorrow is Christmas. It’s a time to step back from the markets. Spend some time with your family. Reflect on the year behind you and gently ponder the one ahead.

I, for one, am penning this from my father-in-law’s ranch in Paijan, Peru. It’s a balmy 90 degrees today … but we’re still firing the grill later this evening. I have a nice, juicy entraña in the fridge waiting for me.

But before you mentally check out from the financial world and get busy with the eggnog and holiday movies, check out our top recent insights to tide you over until the market opens on Tuesday…

- Am I “Insane” to Buy This in a Bear Market? by Ian King.

It’s a dark time for cryptocurrencies. It seems that every other day, there is a new scandal or some new story of fraud. And the prices of virtually all cryptocurrencies are down sharply this year. Ian goes so far as to call it a “crypto winter.”

But as Ian points out, this isn’t the first time. Bitcoin has been declared dead 467 times and yet is still alive and kicking. Click here to see why Ian believes crypto is still a no-brainer … and answers all the questions you were too embarrassed to ask.

- The Dirty Truth About “Clean” Energy by Charles Mizrahi.

We all love the idea of clean, abundant renewable energy. It feels so good to drive a Tesla and feel like you’re doing your part for the planet. There’s just one problem.

You still have to plug in that Tesla, and the electricity charging the battery — or at least a large chunk of it — comes from fossil fuels. As Charles points out, even after untold billions of dollars have been spent in building renewable infrastructure, 95% of global energy production is still good ol’ fashioned fossil fuels. Charles gives his outlook and tells you where to invest in 2023 right here.

- The Less Than 5% of Stocks You Should Buy in 2023 by Michael Carr.

Not much has worked in 2022, but energy is a major exception. And as Mike explains, this is where you should focus your trading as we start 2023.

Buying stocks that have recently fallen feels good. We all like to buy things that are on sale. But as Mike points out, that’s generally a terrible way to invest. Stocks that are trending lower often continue to trend lower for far longer than you expect.

But the opposite is also true. Stocks trending higher often continue trending higher as improving business fundamentals follow the stock higher. And today, that momentum is in energy.

- The Golden Trifecta: Why This Sector Will Top 2023 and Beyond by Adam O’Dell.

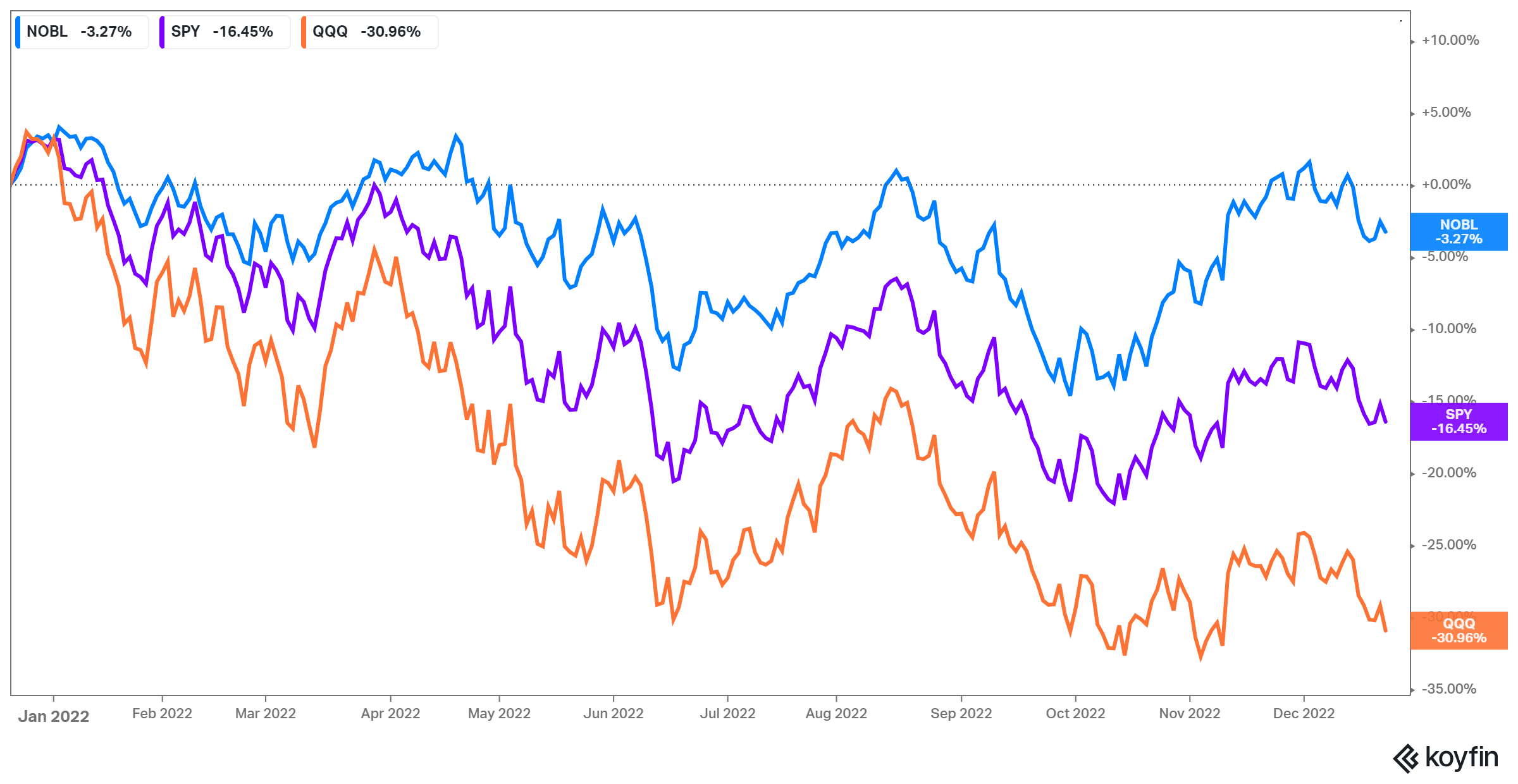

Adam O’Dell had some tough love for tech stock buy-the-dippers in our Friday dispatch. In short, what worked in the last bull market won’t necessarily work in the next one. And if you’ve been counting on the same FANG names to dominate after this bear market bottoms, you might be in for a bit of disappointment.

You already know where Adam’s focus is… He believes energy stocks will be THE story of 2023, and the rest of the 2020s. And here, Adam dives into the numbers of his Stock Power Ratings system to prove that energy is firing on all cylinders.

With our offices closed and our inner circle of experts in the middle of holiday celebrations, we’re taking a rare break from The Banyan Edge Podcast. You’ll be hearing more from the team next week, so be sure to tune in. We’ll be looking ahead to the themes to follow in 2023, so this isn’t something you’ll want to miss.

That’s it from me this week. Thanks for reading The Banyan Edge — we couldn’t do what we do without you.

I’ll eschew the mishmash of “Happy Holidays” and give it to you straight…

Merry Christmas, Feliz Navidad, Happy Chanukah, Happy Kwanzaa, Io Saturnalia for any pre-Constantine Roman pagans, and for those who still enjoy 1990s Seinfeld reruns, a hardy Happy Festivus for the rest of us.

To an incredible 2023,

Charles SizemoreChief Editor, The Banyan Edge

P.S. Are you enjoying The Banyan Edge? We’d love to get your take on our research, and we’d love to answer your questions on The Banyan Edge Podcast.

So, if you have any questions, insights, or just want to leave us a note, please send an email to BanyanEdge@BanyanHill.com.