Earlier in November, new Consumer Price Index (CPI) data was released, revealing that inflation had dropped on a year-over-year basis from 8.2% in September to 7.7% in October. This is welcomed news. Don’t get me wrong, 7.7% inflation is still unacceptably high, and no one should be cheering yet. But the fact that the year-over-year inflation rate has fallen four months in a row is a good sign, and I believe it will fall even further. I ran some numbers and believe it’s very likely that inflation has peaked and will decline (albeit slowly) throughout 2023.

There are several reasons for why inflation has likely peaked: Fed action, supply-side fixes, and the “base effect.” I’ll quickly touch on the first two, but I am excited to share my research on the base effect, so make sure to check that out.

Fed Action

As we all know, the Federal Reserve has been raising its Federal Funds Rate for most of 2022 in an effort to reduce inflation. Inflation is often described as “too much money chasing too few goods,” and by raising interest rates, the Fed targets the “too much money” part of the equation.

Raising interest rates makes it more expensive to borrow money. When borrowing is more expensive, people tend to spend less (otherwise known as lowering demand). Less demand removes money from circulation in the economy and helps to tamp down inflation.

The thing is—this takes time. It’s not as if the Fed raises rates and suddenly, people stop buying things. The reduction in demand takes time, and interest rate hikes are not fully felt in the economy for several months. So it’s very likely that we’re only now beginning to feel the impact of interest rate hikes. And since the Fed has indicated they intend to keep raising rates, we’ll likely feel the impact of lower demand in the economy for the foreseeable future, helping to tame inflation.

It’s also worth mentioning that the rapid increases in money printing have stopped. Below is a graph that shows the year-over-year change in M2 monetary supply in the U.S. As you can see, after a wild ride the last few years, annual increases in money supply are back to normal rates and the lowest they’ve been in 10 years.

Supply-Side Fixes

While the Fed is attacking the “too much money” part of the inflation problem, there has also been a more silent contributor to inflation: supply-side shock. This is the “too few goods” part of the “too much money chasing too few goods” equation. When there’s not enough stuff to buy, prices go up.

Supply-side issues arose from Covid when manufacturing was limited across the globe. There were just fewer products made, and that causes inflation. The U.S. and most of the world resumed manufacturing gradually throughout 2021, but China, which manufactures a ton of goods for the U.S., has been much slower to ramp back up. This has constrained supply and helped inflation stay stubbornly high. This is starting to change, though, and manufacturing is ramping up now, which should help curve the supply-side issues.

The second main issue that caused supply-side issues was the Russian invasion of Ukraine. Russia is a major exporter of food and energy, and western sanctions have cut those goods off from most of the world. Furthermore, Ukrainian exports, particularly wheat and grain, are having a hard time hitting the market. This has further constrained global supply chains and pushed up inflation.

While the war in Ukraine is unfortunately still raging and sanctions still exist, the world is adapting to the new reality. This means other suppliers of goods normally supplied by Russia will step up production and help stabilize the marketplace. This could help inflation cool as well.

The Base Effect

While the Fed’s actions and supply-side fixes should help cool inflation, there’s another reason why you should expect to see inflation numbers come down in the coming year: the base effect. Check this out.

We talk about inflation in the United States on a year-over-year (YoY) basis. When the recent data said inflation was at 7.7%, what it’s really saying is prices went up in the U.S. by 7.7% between October 2021 and October 2022.

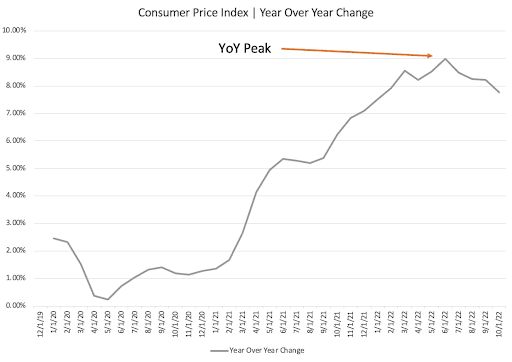

Because of this, it doesn’t just matter what prices are today. It also matters what prices were a year ago because we’re comparing the two. When we compare high prices this year to low prices last year, the difference looks huge, and that’s what’s been happening for most of 2022. When we compare high prices this year to low prices last year, the difference looks smaller, which is what is starting to happen. This is known as the base effect. It matters what data you’re comparing today’s numbers to.

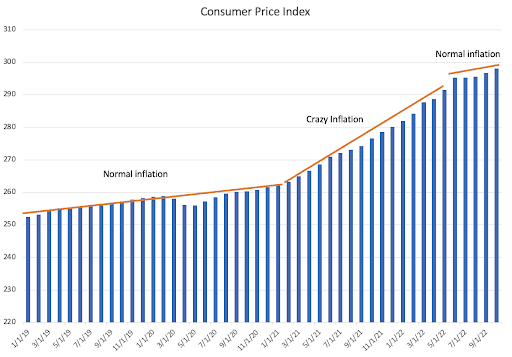

Just check out this chart. Remember, during the beginning of the pandemic, inflation was pretty normal. In fact, we had deflation for a few months! Things didn’t really start to go crazy until the middle of 2021. So for the first half of this year, we’ve been comparing high 2022 prices to relatively lower 2021 prices, which makes the difference (YoY change) look really high. In the second half of 2022, we’re comparing high 2022 prices to already-high 2021 prices, which makes the difference look smaller.

For this reason, inflation on a YoY basis (which is what the Fed cares about and how we generally evaluate inflation in the U.S.) peaked back in June and has fallen for four straight months.

This is likely to continue, and I expect YoY inflation to decline slowly but considerably in 2023. Why? Because I did the math!

In the most recent CPI report, prices rose 0.44% month-over-month from September 2022 to October 2022. That’s pretty high, yet YoY inflation still fell. That’s the base effect in action!

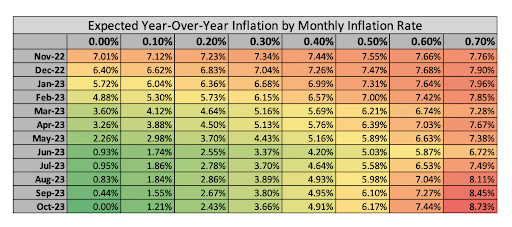

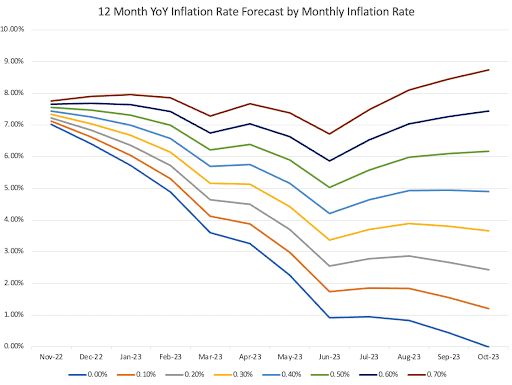

If we continue to see prices go at a similar monthly rate for the next year, we will see inflation fall to somewhere around 5.5% next year. Again, the same monthly increases, but year-over-year inflation goes down. And if prices start to increase at a slower rate, we could see inflation come down even more.

Check out this colorful chart I made. Across the top, you see potential scenarios for monthly price increases from 0% to 0.7%. Each row represents a forecast for YoY inflation by month for the next year. As you can see, the only way inflation starts to go back up YoY is if monthly price increases accelerate to 0.7% (remember, we are at 0.44% now).

Conclusion

Personally, I think it’s unlikely that we see monthly inflation increase unless there is some big, unforeseen geopolitical shock again. Instead, I think it’s pretty likely we will see monthly inflation rates decrease, perhaps to somewhere between 0.2% and 0.4%. If that happens, we can expect the inflation rate to be between 2.5-4% in 2023. Still not where the Fed wants us to be (around 2%), but way better than where we are today! As long as the monthly rate of price increases stays close to where it’s been the last four months, inflation should come down.

None of this is to say that the Fed will stop raising rates soon (they’re not). But it should offer some relief to Americans who are struggling to keep up with inflation. If this trend continues, it should also give us a clearer picture of when we can expect normal inflation, which will help us forecast when rate hikes might stop and when economic conditions become more predictable.

Of course, something unforeseen could change this trajection. But if the status quo continues, we should see inflation come down. Let’s all hope that’s true. It’s the best thing that could happen to the U.S. economy.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Learn more about Fundrise

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.