ilkercelik/E+ by way of Getty Photos

YieldMax Magnificent 7 Fund of Possibility Earnings ETFs (NYSEARCA:YMAG) is a portfolio technique that consists of every of YieldMax’s choice earnings methods, masking the person names inside the Mag7. The gathering of single-name, actively managed choices methods is meant to offer buyers an funding automobile that collectively owns an curiosity in every of the seven constituents. The aim of the technique is to offer earnings to holders of the ETF by investing within the actively managed single-name choices methods and to offer a collective and “diversified” funding automobile. Given each the earnings part and publicity to the Mag7 firm cohort, I like to recommend YMAG with a HOLD ranking with a 2% allocation goal in tax environment friendly portfolios.

Mechanics Of YMAG

YMAG is the gathering of YieldMax’s single-name earnings methods that covers everything of the MAG7 cohort. Just like the holdings in YMAG, the ETF doesn’t straight spend money on equities and solely invests within the portfolio firm’s ETF methods that comprise the Mag7. This consists of Amazon (AMZY), Apple (APLY), Meta (FBY), Google (GOOY), Microsoft (MSFO), Nvidia (NVDY), and Tesla (TSLY). Along with this, YMAG holds a small place in money and cash market funds.

The portfolio holdings’ main goal is to offer earnings by means of managing short-short and short-long, and sometimes long-long and long-short choices methods as a way to generate earnings for buyers. The person portfolios oftentimes handle straddle choices positions across the underlying’s worth as a way to generate earnings. From there, extra returns are returned to holders of the ETF by means of month-to-month distributions that may oftentimes thwart earnings realized by means of fastened earnings methods.

One of many largest dangers related to investing in these methods is the potential tax burden because of the high-income part. That is primarily why I like to recommend using a tax-efficient retirement account for those who elect to spend money on such a technique.

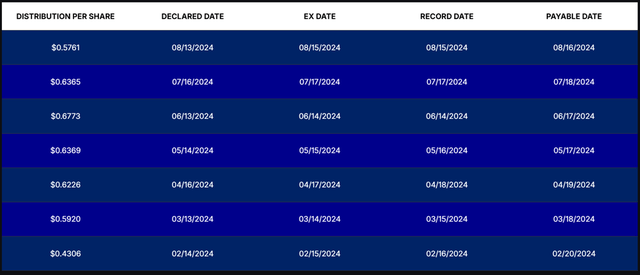

YMAG’s ahead distribution price is 37.25% at $0.5761/share. Given the quick lifespan of YMAG, I like to recommend reviewing the historic price throughout the constituents, as they could differ considerably from month-to-month. YMAG’s distribution has been as little as $0.4306/share and as excessive as $0.6773/share.

Company Studies

With the high-income part comes a comparatively excessive payment of 1.28% gross expense. The gross expense ratio is made up of a 29bps administration payment and a 99bps acquired fund payment and expense. The acquisition fund payment is the cumulation of fund charges related to investing in YieldMax’s single-name firm ETFs.

When contemplating the funding technique, I imagine it’s prudent to weigh one’s threat tolerance because it pertains to the underlying choices methods and focus threat associated to the Mag7 tech names.

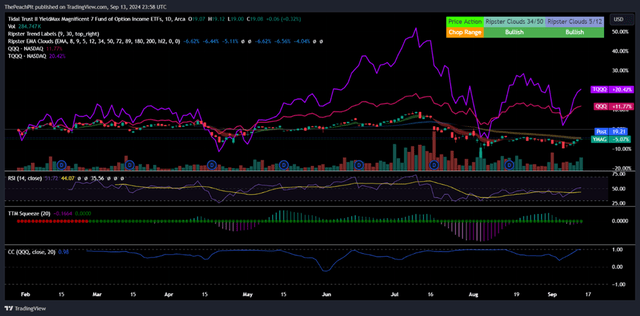

When it comes to worth efficiency, YMAG is very correlated with the Invesco QQQ Belief ETF (QQQ) NASDAQ Index, as depicted beneath. Given the excessive correlation between the 2 ETFs, I imagine that YMAG presents a extra compelling funding alternative for these searching for publicity to the index and earnings. Because it pertains to the NASDAQ, the highest 10 constituents make up 49.79% of the portfolio weight, suggesting vital focus and directional pull by the highest 10 names. Given this issue, I imagine that an investor can notice comparable worth returns by concentrating down their technique to the Mag7 with the additional benefit of earnings. For reference, I included ProShares UltraPro QQQ ETF (TQQQ) to offer a distinct perspective for leveraged portfolios.

TradingView

Market Outlook

I just lately reported on ProShares UltraPro Brief QQQ ETF (SQQQ) with a sturdy outlook available on the market. For essentially the most half, I imagine that sturdiness will stay within the hyperscalers and AI-related tech shares that cater to enterprises for automation and operational effectivity. One issue that’s talked about in my report is that customers have been tightening their grip on spending, allocating extra of their incomes to staples over discretionary, a theme that I’ve remained per for all of 2024. Given the heightened stage of inflation and regardless of the slowing of the speed of development, I imagine shoppers on the low-to-mid-income bands will stay pressured by greater prices as they pertain to the day-to-day price of dwelling.

This features a give attention to housing, meals and beverage, insurance coverage, electrical energy, and gasoline. Although these elements don’t essentially straight affect the Mag7 when it comes to enterprise spend for knowledge consumption, storage, and different tech-related spending, I do imagine the final financial sentiment might play a much bigger position within the course of the index. Because of this, I like to recommend warning when investing in YMAG because the ETF is closely correlated with its respective index and will expertise a sharper flip given the underlying choices methods.

Along with this, there are two main occasions on the horizon that will affect volatility. First, the September 18, 2024 Fed assembly that may set the course of the Federal Funds Price. Secondly, the November 5, 2024 Presidential election. As mentioned in my report masking SQQQ, economists are leaning in the direction of a price reduce following the September Fed assembly, which, I imagine, will drive worth appreciation within the NASDAQ Index.

If the Fed decides to maintain charges stagnant, I imagine the market might expertise a heightened stage of volatility that will push down the NASDAQ Index, which can in flip affect the value of YMAG.

Although presidential elections aren’t essentially catalysts for course available in the market, I imagine volatility might be heightened because of the occasion. A better stage of volatility might affect the underlying ETF holdings in YMAG given the short-straddle choices methods throughout the underlying ETFs. This will likely have the power to affect the underlying property, and in flip affect the worth of the portfolio.

YMAG has a comparatively low stage of buying and selling quantity available in the market, with a mean of 284k shares altering fingers. This will likely affect an investor’s means to purchase or promote their positions within the occasion of a extremely risky market.

Conclusion

YMAG is an income-generating portfolio technique that focuses on the Mag7 corporations, holding YieldMax’s respective income-generating ETFs. Given the excessive stage of correlation with the NASDAQ Index, I imagine that YMAG can supply buyers comparable worth returns with a further earnings part. Given the quick lifetime of the technique, historic distributions might not present an correct studying on efficiency and is probably not mirrored in future intervals.

For buyers searching for publicity to the NASDAQ Index and earnings, I like to recommend YMAG with a BUY ranking with an allocation of two%. Given the volatility threat because of the September Fed assembly and the November election, I like to recommend easing into the place as these two occasions could also be catalysts for heightened volatility.