kropic/iStock via Getty Images

Introduction

What’s the most hated industry to invest in right now? While I don’t have the data to give you a scientific answer, I am sure commercial office real estate is one of the areas people avoid right now.

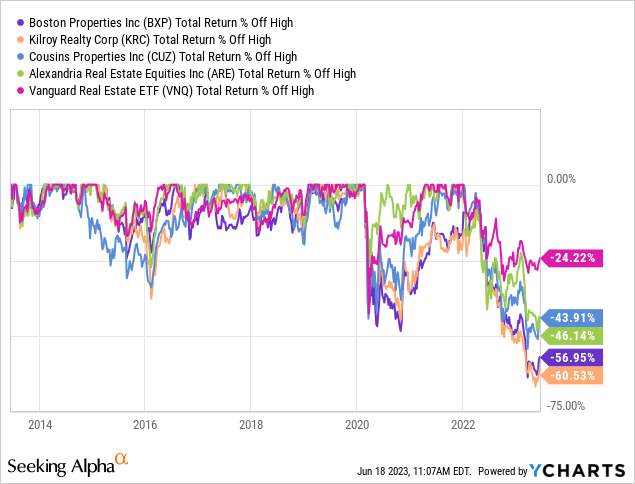

Looking at the chart below, we see that all major office REITs in America have underperformed the Vanguard Real Estate ETF (VNQ) – which is already performing poorly – by a wide margin.

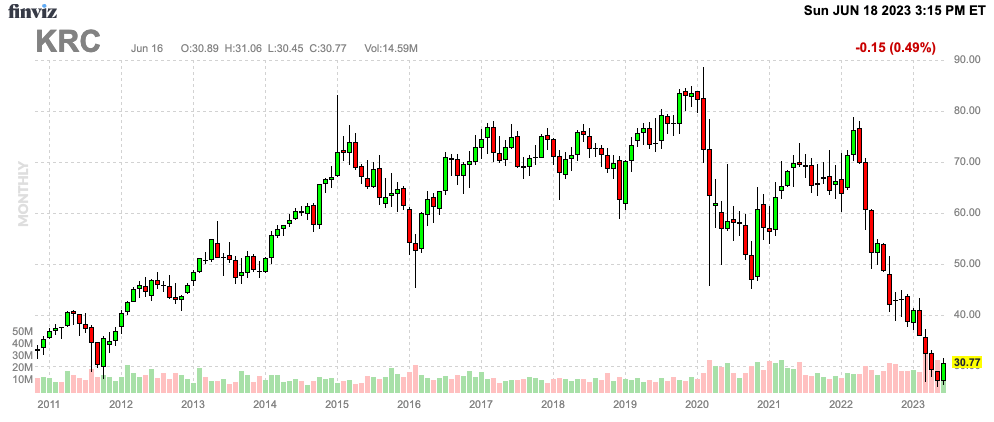

The worst performer of this group is the Kilroy Realty Corporation (NYSE:KRC), a stock that currently yields 7% after falling 60% from its all-time high – including reinvested dividends.

In this article, we’ll assess the attractiveness of this company, which has most of its assets on the West Coast.

So, let’s get to it!

What’s Kilroy Realty?

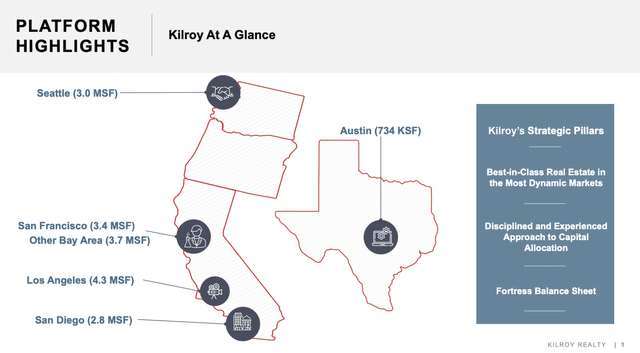

Kilroy is an office REIT. The company specializes in premier office, life science, and mixed-use properties. The company owns, develops, acquires, and manages real estate assets, focusing on Class A properties in key markets like Greater Los Angeles, San Diego County, the San Francisco Bay Area, Greater Seattle, and Austin, Texas.

Kilroy Realty Corp.

In other words, if we exclude Texas, the company operates in a state that hasn’t been too popular since the pandemic, mainly because of the migration from blue to red states that came with the migration of some major corporations.

Kilroy Realty Corp.

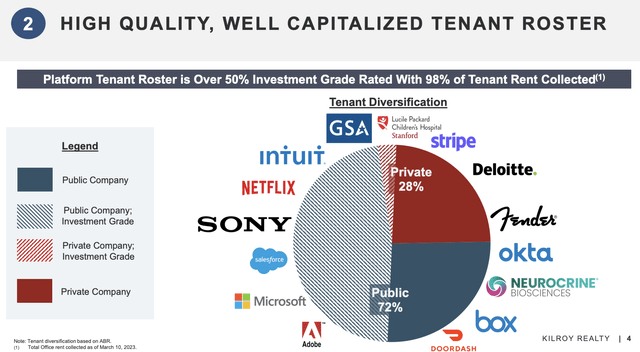

As of December 31, 2022 (and according to its 10-K), Kilroy Realty’s stabilized portfolio included 119 office properties, totaling 16,194,146 rentable square feet.

These properties had 406 tenants and an overall occupancy rate of 91.6%. The percentage of leased space was 92.9%. The stabilized portfolio also included three residential properties with 1,001 units and an average occupancy rate of 93.5%. Almost 75% of its tenants are public companies.

These numbers aren’t bad at all.

The problem is that the trend is bad, which includes the general health of the markets it serves.

Problems Facing Commercial (Office) Real Estate

Earlier this month, I wrote an article focused on the looming crisis in commercial real estate.

In that article, I mentioned that the shift to remote work diminished the value of office spaces, and with nearly $1.5 trillion of commercial property debt due for repayment by the end of 2025, the rising interest rates have made many properties less valuable.

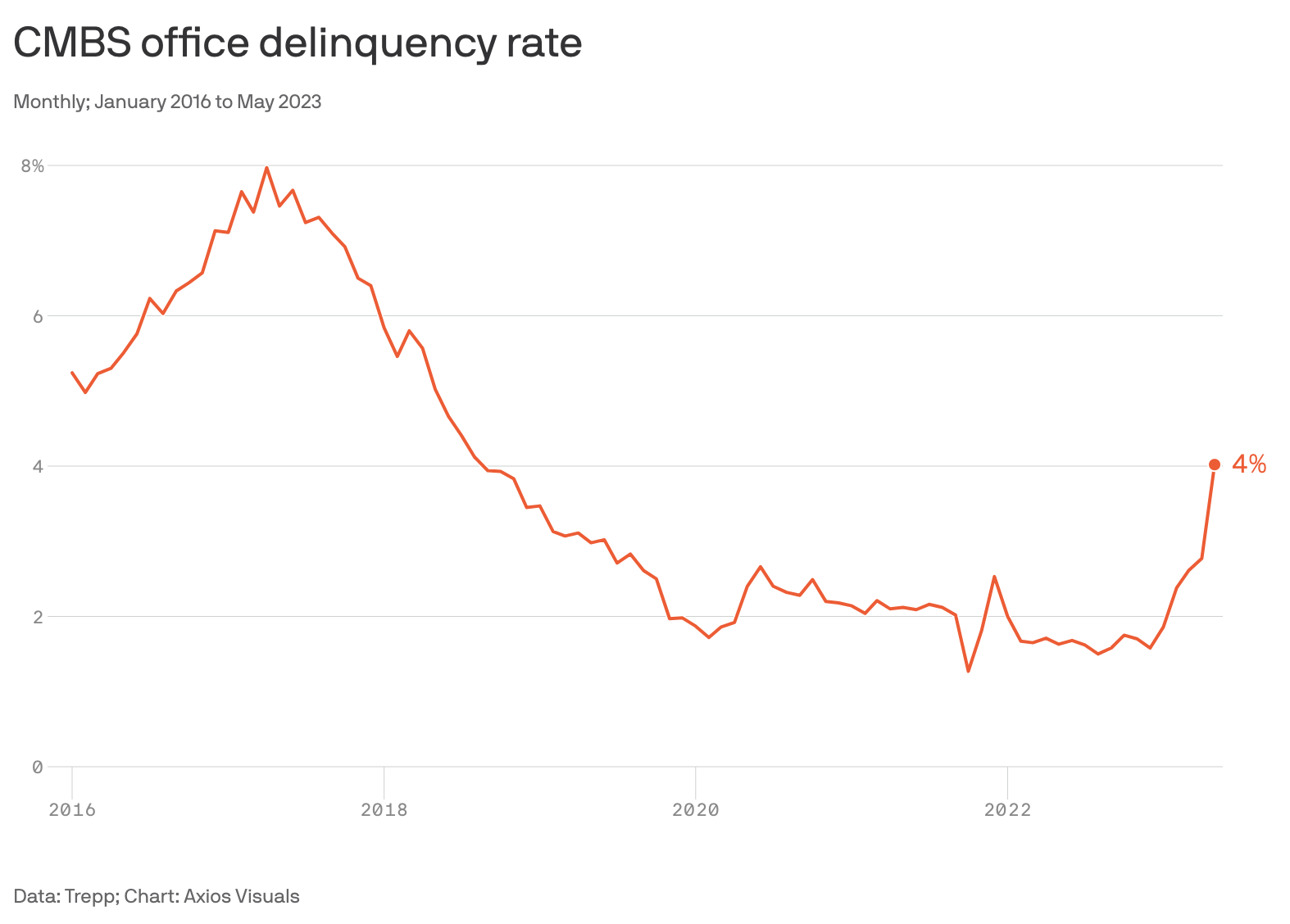

Office delinquency rates are rapidly rising, headed for 4% in the next few months – unless something changes.

Wells Fargo

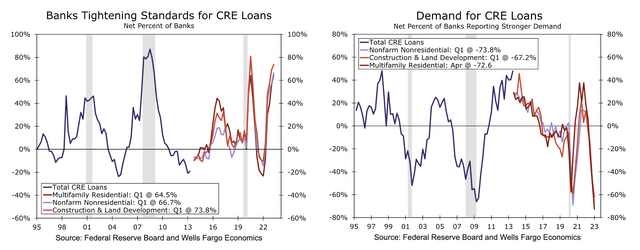

Meanwhile, demand for CRE loans has plummeted, caused by rapid tightening in lending standards. This makes it even harder to service debt in the future, putting even more pressure on an already weakening industry.

Wells Fargo

Roughly one month ago, this is what Bloomberg wrote with regard to office CRE:

While the stress on the office sector may not be new, the shift to working from home has exacerbated the problem. However, much of the damage could already be priced into the stocks after this latest selloff, analysts said.

In addition, fears about commercial real estate have added to the woes of regional bank stocks that typically fund local projects like strip malls and small office buildings. The sector has been pressured since the collapse of Silicon Valley Bank in March sparked industrywide turmoil. Now some investors fear that its exposure to office weakness could be the next shoe to drop.

With that said, KRC is down more than 60% from its pre-pandemic high, which means a lot has been priced in.

Where’s The value?

Kilroy currently yields 7%, which is covered by a forward FFO payout ratio of 49%. That is well below the sector average of 60% and a fantastic number.

Over the past three years, the average annual dividend growth rate was 3.3%. The most recent hike was announced in September 2022, when the company hiked by 3.8%.

This juicy yield, steady growth, and low payout ratio got me interested in covering this company.

During its 1Q23 earnings call, the company highlighted the lack of certainty and challenges in sentiment, particularly in financial stocks such as Silicon Valley Bank, which went bankrupt.

As we already briefly discussed, the company noted that the real estate market was (and still is) impacted by reduced liquidity in investment sales, downward pressure on leasing fundamentals, and a pullback in financing and investment activity within the banking and venture capital community, which is a bigger issue in the Golden State than anywhere else in the US.

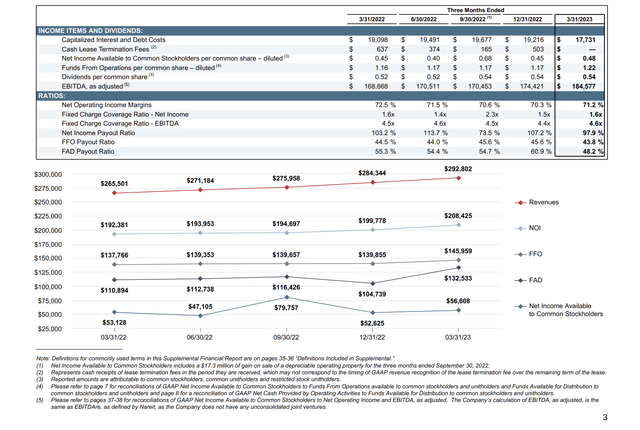

However, despite these challenges, Kilroy Realty delivered a strong quarter and achieved a record FFO per share result, reaching $1.22 in FFO per share.

This increase of roughly $0.05 per share compared to the previous quarter was primarily attributed to a full quarter of revenue from the Indeed lease in Austin. Despite this major event, please be aware that the results included both positive and negative nonrecurring items, which largely offset each other.

Kilroy Realty Corp.

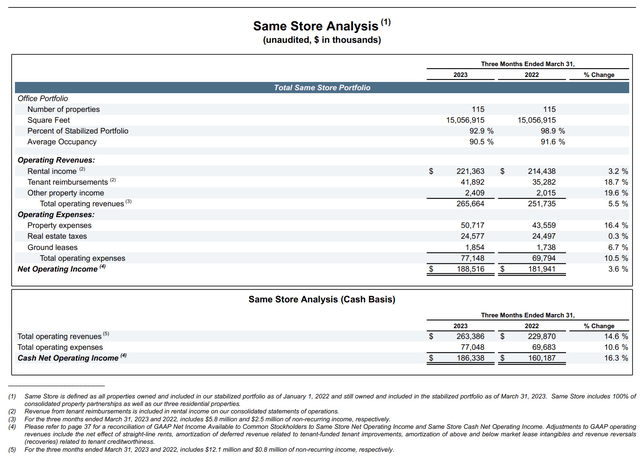

On a same-store basis, the cash NOI (Net Operating Income) for the first quarter saw an impressive 16% growth. This figure incorporated around $12 million in tenant restoration payments associated with two properties.

Excluding this nonrecurring revenue, the same-store NOI would have still increased by approximately 9%.

The strong performance was driven by the burn-off of free rent at Phase 1 of KOP in South San Francisco and an increase in parking income. Please note that KOP stands for Kilroy Oyster Point.

GAAP same-store NOI, adjusted for nonrecurring items, increased by approximately 2%. The stabilized portfolio, at the end of the quarter, maintained an occupancy rate of approximately 90% and a lease rate of 92%.

Kilroy Realty Corp.

Even better, the guidance was good – despite a minor adjustment.

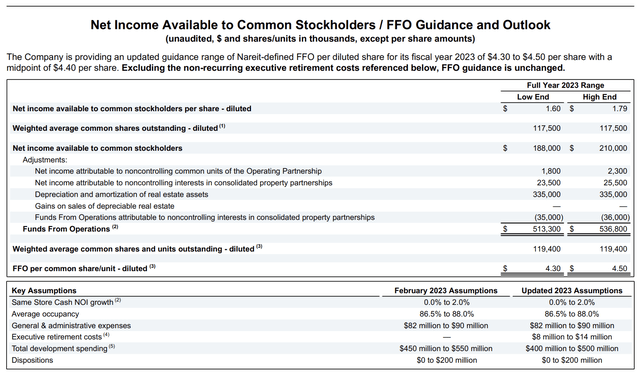

During the earnings call, KRC provided an update on its FFO guidance for 2023. The original range was $4.40 to $4.60 per share, with a midpoint of $4.50. While most underlying assumptions remained unchanged, an adjustment was made to reflect one-time G&A costs.

These costs were estimated to be approximately $0.10 at the midpoint, resulting in an updated range of $4.30 to $4.50, with a midpoint of $4.40 per share. Without the G&A adjustment, the FFO guidance would have remained unchanged.

Kilroy Realty Corp.

With this in mind, it’s fair to say that these numbers confirm the company’s resilience. It’s also good news for investors. Using this guidance and the fact that the company pays a $2.16 per year dividend, we’re dealing with a 49% payout ratio using the guidance midpoint.

With this in mind, the company was asked about the safety of its dividend during the earnings call.

Caitlin Burrows

Okay. And then maybe separately on the dividend. I mean some peers have reduced suspended or commented that they could cut if the environment persists or weakens. So could you just comment on how you feel about Kilroy current dividend coverage and under what scenario Kilroy could consider modifying the dividend?

Eliott Trencher

So our payout ratio is quite low. We think our dividend is very well covered. And obviously, we have requirements to pay out a certain portion of taxable income. So while ultimately this is a Board decision, we’re comfortable with where we are today.

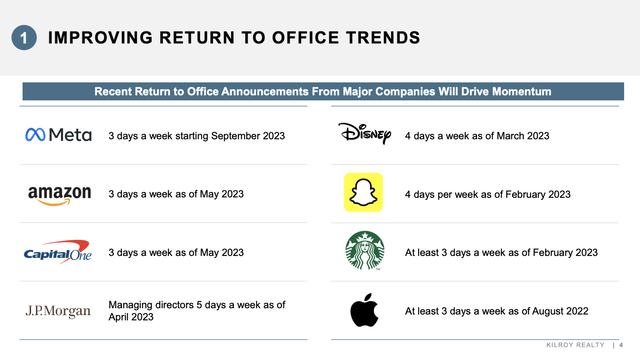

Adding to that, the company feels tailwinds as major corporations are slowly but steadily getting their employees back to the office.

Kilroy Realty Corp.

Austin and San Diego led the way in terms of physical occupancy, with both markets reaching over 70% at the end of the first quarter.

The company signed approximately 338,000 square feet of leases with an average term of approximately five years, indicating ongoing demand for office space.

Specific lease agreements mentioned include a lease at Indeed Tower in Austin and notable leases in the Bay Area and San Diego portfolios with companies like Reddit, MediaTek USA, and Intrepid Studios.

Furthermore, the company aims to capitalize on the strength of AI and technology, including Life Sciences. The company aims to have at least 20% Life Science exposure after KOP Phase 2 is completed.

Moreover, it needs to be said that the company has an extremely young portfolio. The average age of its portfolio is 11 years, which is the youngest portfolio in its peer group. The average is close to 35 years.

This helps to attract and retain tenants, as having a high-quality office is a way for companies to keep employees happy (to put it bluntly). I have heard this from multiple major operators in the industry.

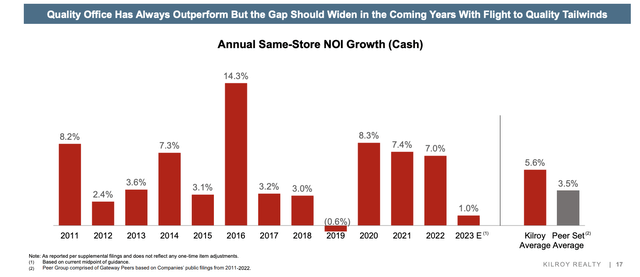

Kilroy Realty Corp.

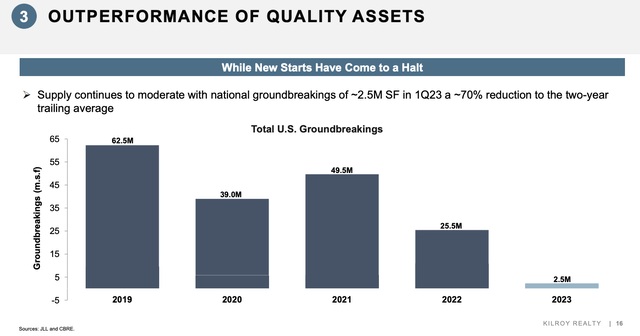

It also helps that construction of new supply has imploded. That makes sense, given the horrible fundamentals of office CRE, in general.

Kilroy Realty Corp.

So, what to make of its valuation?

Balance Sheet & Valuation

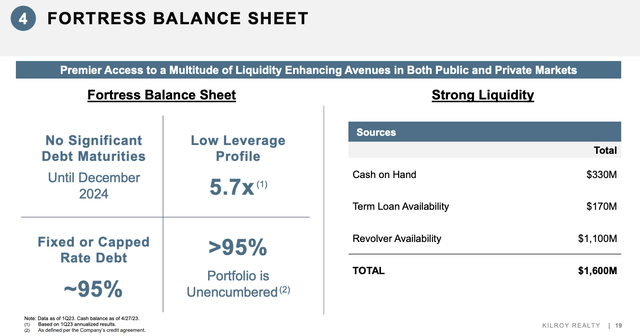

Another piece of good news is the company’s balance sheet.

KRC’s net debt ratio remained stable at about 6x EBITDA. During its earnings call, the company also emphasized its favorable debt maturity schedule, with no maturities until December 2024 and limited interest rate exposure, as over 90% of the debt is fixed.

Kilroy Realty Corp.

Furthermore, KRC reported strong liquidity at $1.6 billion, consisting of $330 million in cash, $170 million in future term loan proceeds, and $1.1 billion in capacity on their line of credit.

For the remainder of 2023, KRC estimated capital requirements of $325 million to $425 million for development spending.

Note that the company is not forecasting any acquisitions.

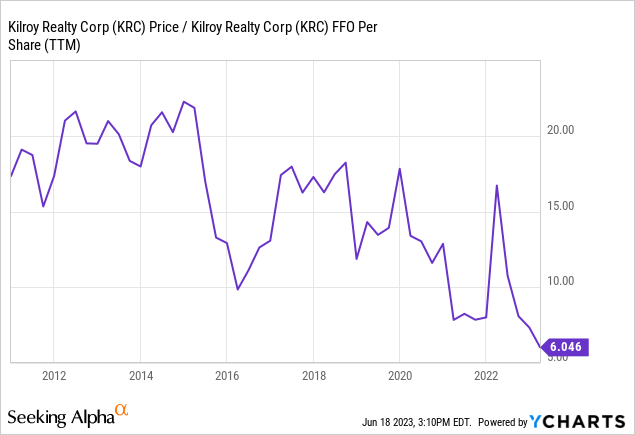

With regard to its valuation, one might assume what we’re dealing with here. Shares have imploded while FFO continues to do well. Hence, the company is trading at 7x 2023E FFO (based on the company guidance midpoint).

The median sector valuation is 12.9x FFO. Faster-growing REITs are trading close to 17x FFO.

Looking at the company’s history, it used to trade above 15x FFO prior to the pandemic. That’s gone, and we won’t see a return to these valuations anytime soon.

It also needs to be said that the market is pricing in long-term risks. For example, while construction is down, mass bankruptcies in the area could make competition fiercer and force companies like Kilroy to refrain from hiking rent – or even cut rent at some point.

I also believe that the Fed will keep rates higher for longer, as explained in this article. The pressure on CRE is likely to increase if that is the case.

With all of that said, I do like KRC shares at $30. A lot has been priced in, and as much as offices and California (in particular) are suffering, I think KRC is in a good position thanks to some of the best tenants in the business and absolute top-tier assets.

FINVIZ

However, I’m not going to be the guy who gets people all excited about office CRE in this environment.

While I do believe that we’re dealing with significant long-term value, I urge everyone interested in office REITs to be extremely careful. Do not go overweight in any office stocks.

That said, I have to say that I’m considering buying a few shares of KRC, as I do like the risk/reward. However, as I prefer industrial REITs and REITs that can more easily expand their business, I won’t take a large position in KRC if I decide to buy it.

Takeaway

While the commercial office real estate industry is currently facing significant challenges, Kilroy Realty presents an intriguing opportunity.

With its focus on premier office, life science, and mixed-use properties in key markets, KRC has a resilient portfolio with strong occupancy rates and a diverse tenant base, including many public companies.

Despite the downward trend in the industry, KRC has demonstrated its ability to deliver solid financial results, with record FFO per share and impressive cash NOI growth.

Additionally, the company’s low payout ratio and favorable debt maturity schedule provide stability.

However, it’s important to approach office REITs cautiously and not overweight investments.

Considering the long-term value and the quality of KRC’s assets, I personally find it appealing and may consider a small position in the stock.