adamkaz/iStock Unreleased via Getty Images

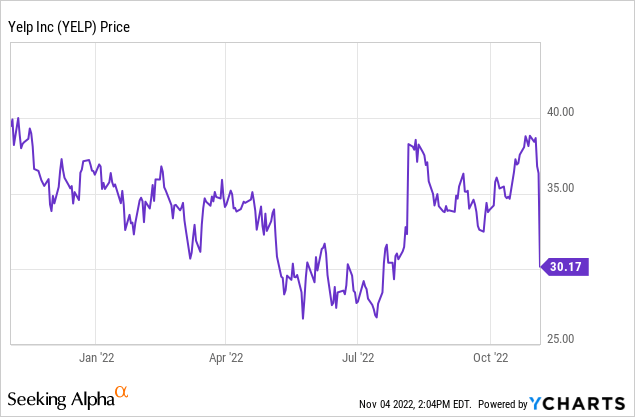

As we head into the final stretch of 2022, one thing is clear: the market seems to have no clear direction. In the absence of clarity, I think that one future-proof move is to invest in beaten-down, value-oriented tech stocks, and I can think of a few names as appealing as Yelp (NYSE:YELP).

Yelp, as many are probably aware, has made itself the premier review site for restaurants as well as local small businesses. Like virtually every other company in the market at the moment, it’s dealing with unprecedented macro headwinds and impending recession fears. In particular, Yelp is anticipating that demand from its advertisers, particularly the multi-location/franchise clients that Yelp has worked hard to target over the past few years, will slow down as they re-assess their ad budgets.

So, in spite of a relatively strong Q3 earnings print, shares of Yelp crashed more than 15% due to the company’s relatively bearish tone for Q4.

As usual, the market is taking an incredibly short-sighted view. To me, Yelp is affected by the same macro conditions that every other company in the market is facing, and we shouldn’t judge the merit of the stock based on a potential temporary slowdown. When I take a step back and assess Yelp, I still find it to have a significant moat in the consumer business/digital advertising space, and remain bullish, especially owing to its low valuation.

Here’s a full rundown of the bullish thesis for Yelp:

- Focus on multi-location customers – In other words, Yelp is shifting away from its traditional stronghold of focusing on local businesses and restaurants and going after large, multi-location national chains. These deep-pocketed advertisers benefit from reaching consumers on a platform known for its truthful and useful reviews, and Yelp benefits from having high-contribution recurring clients. Yelp is reshaping its sales teams to cut down on account executives focused on lower-dollar customers (the Local sales headcount is at 50% of pre-pandemic levels) and is instead hiring much higher-ROI salespeople focused on enterprise customers.

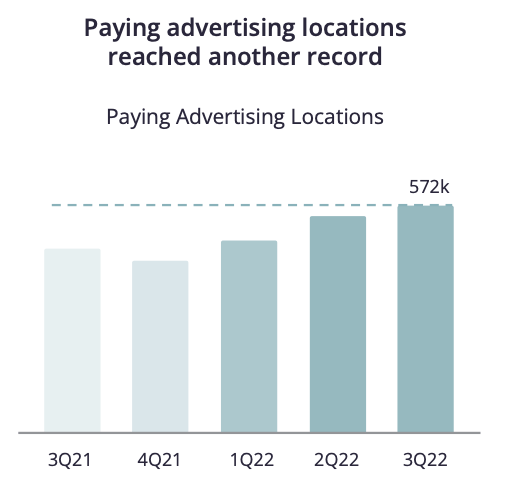

- Sales strategy shift has not impacted account growth – Yelp continues to grow its paid advertiser accounts at a healthy pace thanks to the success of its self-service channel, and average spend per account is also gliding upward.

- The impacts of the pandemic won’t last, but Yelp’s cost cuts will – Yelp was an early reactor to the pandemic and aggressively laid off/furloughed a large portion of its sales team. The company considered this move as part of a broader push (even before the pandemic) to cut down its Local (small business-focused) sales teams, hire more Enterprise-facing account executives, and shift staff away from its San Francisco headquarters and to geographically cheaper locales.

- Reducing and shifting real estate footprint – More to the point above: by shifting to a primarily remote-work policy and shuttering offices in large metro areas, Yelp estimates that its savings on real estate alone will drive $9.5-$11.5 million in annual savings, which isn’t a small amount for a company generating just over $1 billion in annual revenue. The hiring of a distributed workforce, and in locations other than the Bay Area, will bring personnel cost benefits on top of these real estate savings.

- Buyback boost – Yelp’s board recently authorized an additional $250 million of buybacks, bringing its total open authorization to $332 million (which, at Yelp’s current market cap, covers more than 15% of its outstanding shares).

Valuation is also quite appealing. At current share prices near $30, Yelp has a market cap of $2.11 billion. After we net off the $421.8 million of cash on Yelp’s most recent balance sheet, the company’s resulting enterprise value is $1.69 billion.

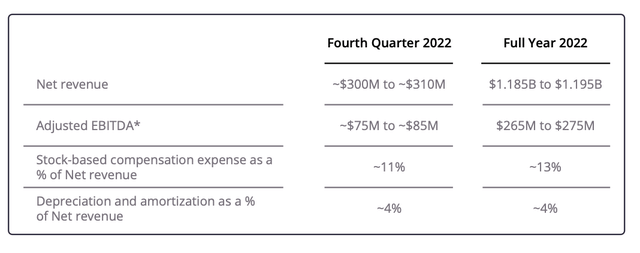

For FY22, Yelp has guided to adjusted EBITDA of $265-$275 million (the same midpoint, but a tighter range, versus a prior outlook of $260-$280 million).

Yelp updated outlook (Yelp Q3 shareholder letter)

This puts the company’s valuation at just 6.2x EV/FY22 adjusted EBITDA. If we look ahead to next year where Wall Street consensus is expecting 10% y/y revenue growth (according to Yahoo Finance) and assume Yelp can hold its Adjusted EBITDA margins flat to FY22, its multiple would be 5.7x EV/FY23 adjusted EBITDA.

Don’t miss the chance to buy Yelp on the dip here.

Q3 download

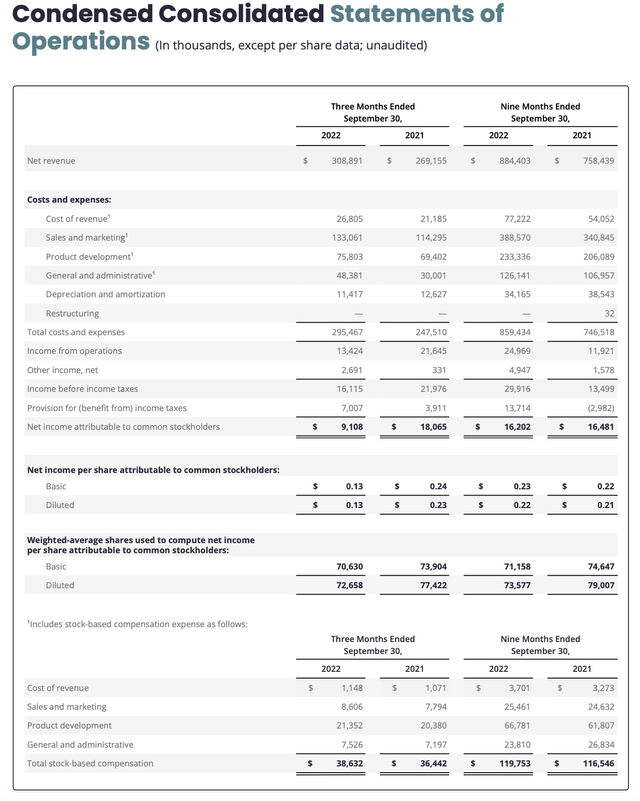

Let’s now review Yelp’s latest Q3 results in greater detail. The Q3 earnings summary is shown below:

Yelp Q3 results (Yelp Q3 shareholder letter)

Yelp’s revenue in Q3 grew 15% y/y to $308.9 million, beating Wall Street’s expectations of $307.7 million (+14% y/y) by a one-point margin. Revenue growth did, however, decelerate relatively sharply versus 19% y/y growth in Q2.

Some pandemic dynamics are at play here. The company is now lapping the reopening surge from late 2021 last year, which saw a sharp rebound in business and consumer confidence (hence saw advertising take off again). Yet it wasn’t really the Q3 deceleration that put investors off as much as the anticipated Q4 deceleration: Yelp’s Q4 revenue guidance of $300-$310 million in revenue has growth slowing to just 10% y/y on the low end and came in below the $314.1 million consensus mark.

That being said, some positive trends are important to highlight. The company still grew paid advertiser locations in the quarter to a record 572k:

Yelp advertiser locations (Yelp Q3 shareholder letter)

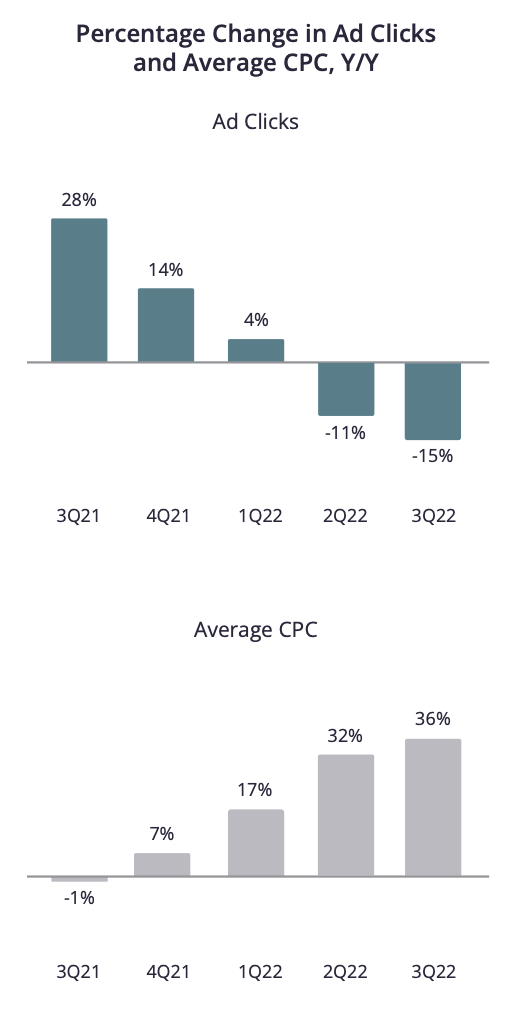

Ad clicks, however, were down, decelerating to a low of -15% y/y (though again, this was due to a strong +28% y/y compare in the prior-year Q3, which was boosted by reopening dynamics):

Yelp advertising dynamics (Yelp Q3 shareholder letter)

In spite of this, cost per click rose by 36% y/y, reflecting as-yet strong demand from advertisers. The company noted that its lead-through rate (a measure of how successful ad clicks are at generating leads) has improved, which in turn has increased the success of its performance-based advertising products. Management also called out special strength in the Home Services space, which saw a 25% y/y growth in advertising revenue.

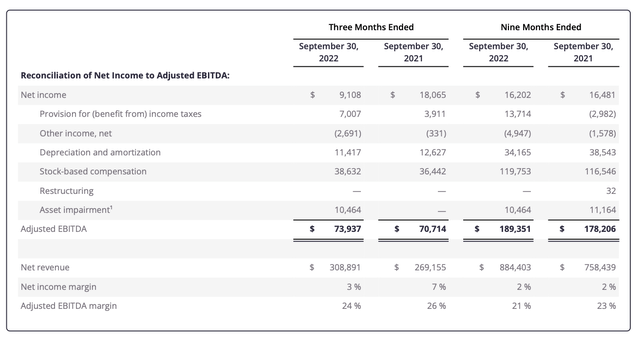

And in spite of broad opex headwinds that all companies are facing, Yelp managed to still grow adjusted EBITDA by 5% y/y to $73.9 million, and margins only shed two points to a still-strong 24%:

Yelp adjusted EBITDA (Yelp Q3 shareholder letter)

Key takeaways

Don’t ignore Yelp on this dip. In my view, Yelp’s headwinds are temporary, and I still like the long-term story here of multi-location advertiser strength, an uptrend in CPC rates, and internal cost reductions.