Asia-Pacific Images Studio/E+ via Getty Images

Investment thesis

Bullish consensus estimates indicate stable medium-term growth for Yamaha (OTCPK:YAMCF), but we believe piano demand will remain sluggish in China and for entry-level digital instruments worldwide. We expect the company to lower FY3/2024 guidance and with further downside risk, we rate the shares as a sell.

Quick primer

Established in 1887, Yamaha Corporation is the largest global manufacturer of musical instruments. Well known for its range of traditional pianos, the core sales driver is digital musical instruments such as digital keyboard workstations and synthesizers. It also produces wind, string, percussion instruments, guitars, and audio studio equipment (such as mixers and speakers). The company has a 4.62% stake in Yamaha Motor (OTCPK:YAMHY) which was spun out in 1955.

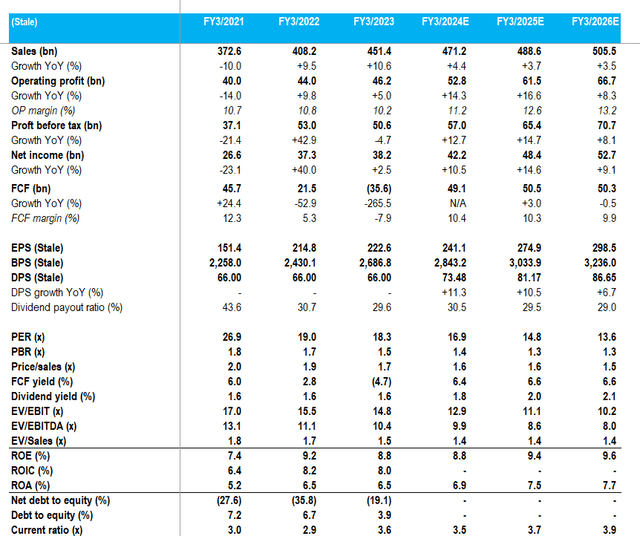

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

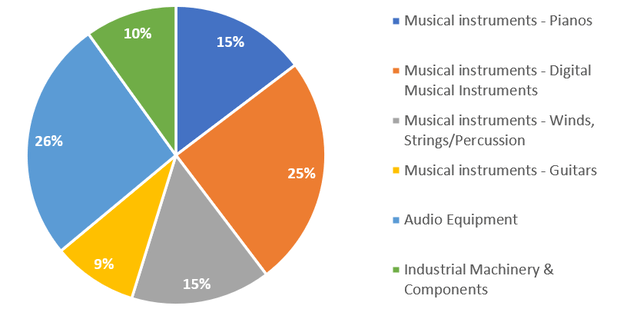

FY3/2023 sales split by product

FY3/2023 sales split by product (Company)

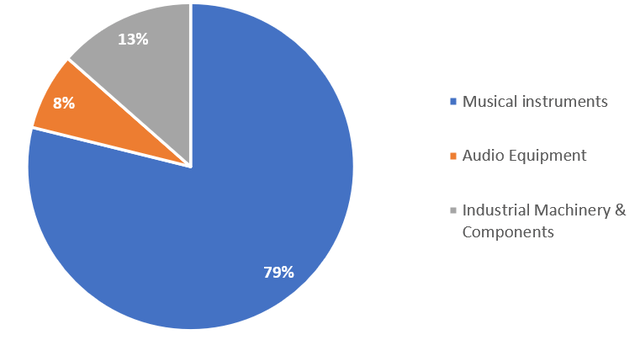

FY3/2023 operating profit split by product

FY3/2023 operating profit split by product (Company)

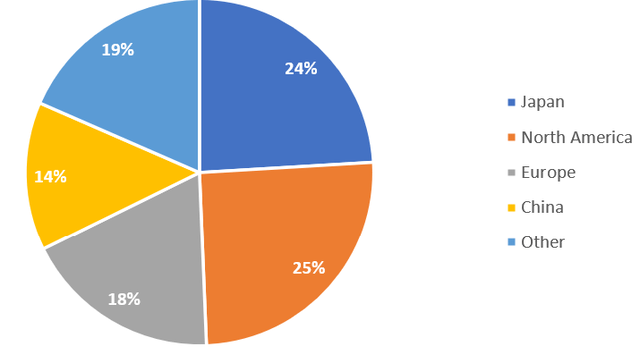

FY3/2023 sales split by geography

FY3/2023 sales split by geography (Company)

Updating our view

We are updating our view from August 2021 where we rated the shares as neutral, as growth prospects looked relatively limited in terms of raising profitability and increasing geographic market expansion.

The current concerns facing the company are 1) a slower-than-expected demand recovery in the China market, and 2) sluggish demand for entry-level models, which indicate that the addressable market is not growing as robustly as before. Consumption of musical instruments can be influenced by cyclical factors, and the rising cost of living may have a negative impact on outright instrument purchases, as well as replacement and upgrade demand.

We want to assess whether demand is likely to recover in the next 1-2 years and whether there are other themes that may unlock value in the company.

Tough market conditions

Q1 FY3/2024 results highlighted underlying weak demand for Yamaha’s musical instruments, with sales falling 3.3% under constant currencies YoY. Despite a tailwind from a depreciating Japanese yen, operating profits fell 39% YoY driven by a deterioration in the sales mix combined with price cuts, and falling piano sales in China. The key weakness was in digital pianos on a worldwide basis with a fall in entry-level products. Wind, string, and percussion instruments were said to be robust but also fell YoY due to high hurdles YoY from post-pandemic demand.

With a much weaker start to the year, the company revised down FY3/2024 guidance, lowering core operating profit from JPY56 billion (+21.2% YoY) to JPY50 billion (+9.0% YoY); sales guidance of JPY470 billion remained unchanged. The company is expecting robust B2B demand for audio equipment driven by entertainment events, but for musical instruments, the current stance is that a delayed recovery will materialize.

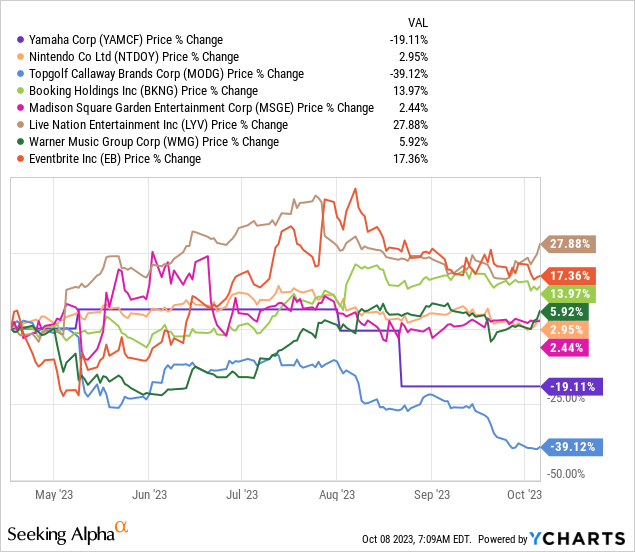

It is difficult to find external data points for musical instrument demand. We have therefore selected the following stock performances to give an indication of expectations over consumer spending for leisure activities. We have used Nintendo (OTCPK:NTDOY) for electronic entertainment, Topgolf Callaway (MODG) for sports excursions and equipment, and Booking Holdings (BKNG) for travel and hotels. For concerts and events, we have chosen Madison Square Garden Entertainment (MSGE), Live Nation Entertainment (LYV), and Eventbrite (EB), and for the music industry Warner Music Group (WMG).

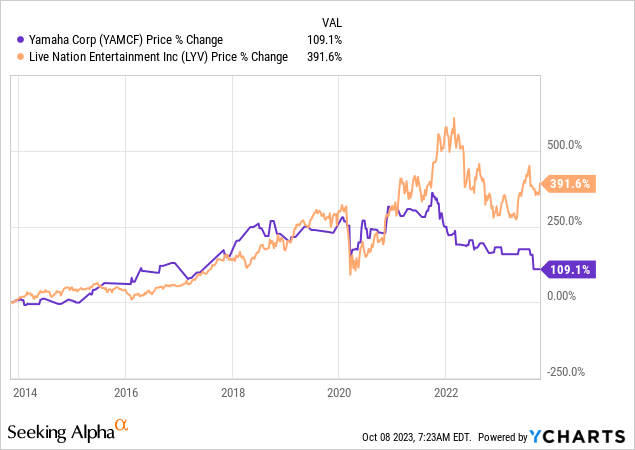

From this we infer the following: 1) business hospitality remains a low priority as seen with Topgolf Callaway, 2) Event activities look relatively brisk with strong performances from Live Nation Entertainment and Eventbrite, indicating that demand for musical performances is just as brisk as travel. This should be a positive indication of Yamaha’s B2B demand as well as consumer appetite for musical instruments. However, on a 10-year basis, we note Yamaha’s shares diverged from Live Nation Entertainment from later 2021 – we see this stemming from the delayed post-pandemic recovery in mainland China which is affecting Yamaha’s business significantly.

The key question for Yamaha is whether piano demand will recover in mainland China. Most macroeconomic data continue to weaken, and the falling birth rate points to a falling addressable market down the line. Whilst we still believe that China will remain one of the world’s largest piano markets, with increasing competition from local players as well as a lack of consumer confidence, we believe it is too early to state that the worst is over.

Options for the business

Yamaha holds 4.62% of Yamaha Motor (OTCPK:YAMHF), which is worth JPY60 billion/USD410 million. Whilst there may be a tax liability from any profitable gains, an outright sale would generate cash that can be utilized for shareholder returns or M&A in order to boost future growth prospects – Yamaha acquired US classical guitar manufacturer Cordoba in February 2023. Apart from legacy ties, there is no major crossover in businesses between the two companies. However, the company is cash-rich and hence may not take this step as a high priority. Small bolt-on M&A appears likely, although this would not make a huge impact on the bottom line.

The company is making inroads into developing India as a key future market and opened a manufacturing site in 2019. However, despite the high potential this market is currently not viewed as a major driver for the business.

Overall, the company operates a focused business on musical instruments and peripheral areas and consequently is unlikely to diversify for growth. Consequently, current growth prospects appear relatively muted.

Valuation

The shares are trading on consensus PER FY3/2025 14.8x, with a 2.0% dividend yield and PBR of 1.3x. These are not expensive multiples, but highlight an ex-growth business with limited upside potential. The dividend yield is quite low and hence not attractive and does not act as valuation support in our view.

Consensus forecasts expect stable operating profit growth for the medium term. Despite the FX tailwind, we believe China will continue to be a sluggish market, and believe these estimates to be too optimistic.

Thesis catalysts

Q2 FY3/2025 results will indicate no recovery in China or for entry-level model demand for digital instruments worldwide. The outlook for the festive season will be under pressure, and the company will downwardly revise its guidance for the second time.

Risks to the thesis

A major upturn in musical instrument demand in North America and Europe offsets the weakness in the China market. The company may introduce major cost-cutting initiatives to prop up profitability.

Conclusion

The difficulties in the China market and a deteriorating sales mix with falling entry-level product demand indicate that current consensus estimates are too bullish. Although market expectations should not be high, we believe downside risk remains in the shares with no valuation support. With negative newsflow expected in Q2 FY3/2024, we rate the shares as a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.