BlackSalmon

General Overview

The post WW2 era witnessed a radical industrial, economical, and societal transformation. Europe needed rebuilding, the British Empire was falling apart (or had already), and the scene was paved for fanfare entry by the United States as the up-and-coming world superpower.

This was a time of economic revival – an epoch that was the era of supra-national organizations tasked with world stability. Breton Woods, an agreement paving the way for the dollarization of trade and the vast opening of frontiers, also was a product of this period of restoration.

A lasting period of economic growth marked the 50s – the advent of mass consumerism, cheap goods and continued economic rebuilding saw some of the biggest equity price action upside in the history of capital markets. It was a good time to be long stocks.

Fast forward to an America today – a nation that has guided the world through a hyper rapid period of economic growth, now has a resoundingly underpinning characteristic – that of widespread political divide.

The right has moved further to the right with ideals of ultra-liberal free markets, small government, and few protections afforded to the needy.

The polar opposite is true of the left – inclusiveness in extremis, a meaningful focus on the environment (sometimes despite data), and an extensive beating up of the rich. This perhaps makes for a fitting setting for external powers waiting in lay for the country to self-implode. For creative fund managers, it makes also for a curious ETF pitch.

God Bless America (NYSEARCA:YALL). Literally. For lovers of quirky odd-ball ETFs with a penchant for some form of exoticism – Tidal’s packaged Americana themed fund may be a possibility. It’s a low AUM, no index, alpha-seeking ETF pureplay perhaps geared for catching attention as an outlier in the ETF landscape. All in, my outlook is neutral.

Let me provide more details to explain why.

Fund Introduction

YALL is Tidal’s actively managed fund providing exposure to a disparate set of US-listed equities. It distinguishes itself by filtering out firms emphasizing politically left &/or liberal political activism and social agendas. It does this at the expense of return maximization and perhaps fits best with money managers embracing specific right leaning value-sets or politically motivated agendas.

Its prime stomping ground remains US public equity markets, with assessment of political party not including internal policies regarding employee relations, or political charitable donor practices. Low PE stocks are a fund favorite, with the manager also preferring enduring job growth in its targets. As mentioned earlier, active management provides the fund manager with the flexibility of buying, holding, or selling at their discretion.

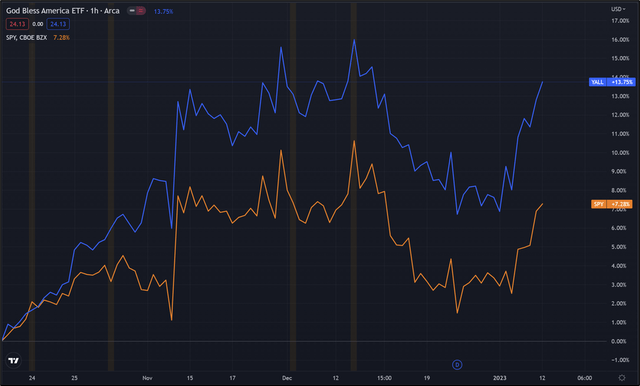

TradingView

YALL has tended to outperform the S&P 500 over the past 6 months (+13.75% v +7.28%)

Structure

There is nothing terribly out of the ordinary for this fund. No leverage, no exotic derivative-laden underpinnings or hybrid composition. It’s a thematic actively managed package with North American purebred on a select number of holdings. Assets under management is comparably miniscule ($31M) and expense ratios (0.65%) fall in line with what you would expect from an actively managed set-up.

Fund weighting broadly sits across 4 major sectors – industrials (+16.95%), information technology (+14.22%), consumer discretionary (+13.66%), and healthcare (+13.38%). It’s a relatively good spread and offsets well between an offensive gambit with the likes of growth focused information technology and consumer discretionary, married conveniently with some of the more defensive characteristics of health care, for example. That means that economic outlook will factor sizably into returns, more so than something more heavily focused on utilities, commodities, and staples.

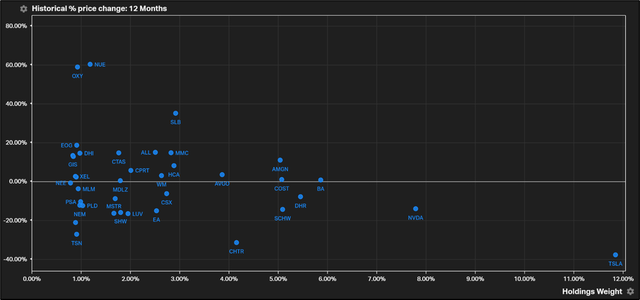

Consumer discretionary has weighed on returns, particularly given Tesla’s (TSLA) importance in fund make-up. With an 11.85% fund weighting and woeful YTD returns of -37.64%, the Texas-based electric vehicle manufacturer represents roughly 6.5% of fund losses. That is considerably big – given that the next is Charter Communications, Inc. (CHTR) sapping -1.7% from total assets.

Koyfin

Scatter plot diagram shows fund holdings as being a disparate group of relatively large-cap US equities. Tesla weighting remains a meaningful outlier.

Simply said, Tesla makes up a large part of the fund, so its fortunes are going to dictate how fund returns fare. The fund is a newbie in the ETF space, having been launched solely at the end of last year. (October 10, 2022).

That is particularly telling and reflective of the current politico-economic climate – if indeed, investors are seeking to un-lever passively managed instruments from leftist stock-picking ideals.

Fund inflows since inception have been hardly anything to write home about – $4.98M over the past 3 months. Should growth continue like this, it is unlikely this highly thematic fund will survive. Options markets for the ETF do not exist either, making additional income generation via call selling on holdings impossible.

Risk

It’s an all-in Americana play so concentration risk does exist, but as does sound liquidity in one of the world’s most prominent capital markets. The top 10 holdings make up roughly 57% of the package and nothing exists in terms of options markets to protect gains by holding long puts.

Additionally, the fund is significantly exposed to Tesla. The real question investors need to ask themselves when positioning in the ETF is, what can this fund achieve that I cannot replicate myself on the open market?

Key Takeaways

While America is great, there are some big limitations to YALL. It’s a thinly traded thematic ETF trying to appeal to conservative money managers by getting rid of some of the left-leaning investment mantra plaguing capital allocation.

Consider it the kryptonite of ESG investing. The problem is – funds under management are negligible, optionality using derivatives is nonexistent and the package is essentially holding the same old, same old of large cap publicly listed equities and story stocks.

With only 39 holdings, any savvy capital allocator could simply replicate the package and avoid the 65-basis point charge by doing so.