onuma Inthapong/E+ through Getty Pictures

Xylem Inc. (NYSE:XYL) has been performing properly over the previous 12 months, with the share worth growing 45% since November 2023.

On this article, I thought-about reviewing Xylem’s current monetary efficiency, with a concentrate on the headwinds and pressures that the corporate is at present dealing with, together with a major decline in orders of their water infrastructure phase on account of delays in giant infrastructure tasks in China.

In my opinion, shareholders have totally priced within the good efficiency of the corporate and the graceful integration of Evoqua Water Applied sciences.

I imagine the overbuying exercise in Could, adopted by a ten% decline within the share worth could possibly be an early signal of shareholder pleasure cooling off, which can proceed by the second half of the 12 months.

I’ll present the rationale behind my Maintain ranking within the outlook part. For now, I’ll begin with a quick firm overview for these readers new to this inventory.

Enterprise Overview

Xylem is an American-based firm that designs, manufactures, and providers merchandise for water-related functions. They’re targeted on the whole water cycle, from delivering, treating, and measuring consuming water, to amassing and treating wastewater earlier than returning it to the setting.

I thought-about together with beneath a breakdown of their income per enterprise phase over the previous 3 years.

| Enterprise Phase | 2023 Income (in hundreds of thousands USD) | 2022 Income (in hundreds of thousands USD) | 2021 Income (in hundreds of thousands USD) |

|---|---|---|---|

| Water Infrastructure | $2,967 | $2,364 | $2,247 |

| Utilized Water | $1,853 | $1,767 | $1,613 |

| Measurement and Management Options | $1,729 | $1,391 | $1,335 |

| Built-in Options and Companies | $815 | – | – |

| Complete | $7,364 | $5,522 | $5,195 |

Creator’s compilation from the newest 10-Ok out there.

As a facet be aware, their newly built-in options and providers phase was launched in 2023 following the acquisition of Evoqua Water Applied sciences.

Regardless of the water infrastructure phase accounting for 40% of their complete income in 2023, I like that the opposite segments aren’t too far behind; utilized water accounts for 25%, which is about the identical because the measurement and management options, and their built-in options phase accounts for 11%.

As a facet be aware, my funding type favors companies with diversified income streams that don’t closely depend on one single phase.

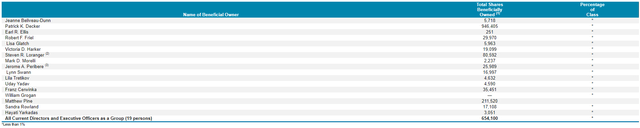

Regarding the firm possession, their newest revealed 14A exhibits that the overall stake amongst all 19 administrators and govt officers is lower than 1%. Frankly, I want to see administration have extra pores and skin within the sport.

SEC | 14A

Current efficiency

As all the time, I like to start out with the dessert, so I’ll cowl the headwinds first.

Their measurement and management options phase skilled an 18% decline in new orders, with a backlog discount of 12% YoY. In my opinion, it is a sturdy indication of their excessive sensitivity to delays in giant infrastructure tasks.

One other instance of those delays is the decline in orders from China within the water infrastructure phase in the course of the first half of 2024 on account of broader financial challenges in China, the place authorities funding for giant infrastructure tasks is changing into more and more constrained.

One other stress comes from a requirement softness in developed markets, significantly in industrial actual property and manufacturing (primarily the US and Europe), which led to a 4% decline in income within the utilized water techniques phase. In my opinion, this phase is very cyclical and delicate to macroeconomic situations, which may trigger large fluctuations within the complete income.

Other than these headwinds, their Q2 outcomes had been fairly favorable, beating each EPS and income estimations, and elevating their full-year steering.

EPS elevated by 78%, and income elevated by 26%, reaching $2.2 billion. This was primarily pushed by a 26% income development of their measurement and management options phase.

Moreover, the water infrastructure phase additionally carried out properly, with a 22% enhance in income.

Profitability-wise, I favor the 1.7% enhance YoY of their adjusted EBITDA regardless of the challenges that include the combination of a newly acquired firm.

With reference to their newly revised steering, administration raised full-year income steering to $8.55 billion, up by 16%, with an natural income development forecast of 5% to six%. Adjusted EPS steering has been elevated from $4.18 to $4.28.

Regardless of these good outcomes and a rise in steering, the share worth dropped by over 5% in the course of the Q2 earnings launch day. I view this as a powerful indication that good outcomes are already priced in by shareholders. I focus on extra particulars within the subsequent part.

Outlook

Let’s begin with a fast take a look at the weekly chart beneath.

Buying and selling View

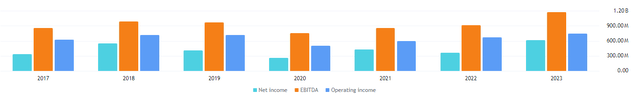

I just like the clear uptrend that began in 2020, which, I imagine, is backed up by stable development. A fast take a look at the chart beneath exhibits a rise in each working earnings, web earnings, and EBITDA since 2020.

Buying and selling View

Nonetheless, the weekly chart above exhibits the RSI at a stage above 80 throughout mid-Could 2024, which signifies overbuying exercise. Subsequently, I’m not stunned to see a ten% decline within the share worth because the peak in Could this 12 months.

From a technical evaluation perspective, I don’t like seeing the assist line of the upward development far beneath the present share worth. I’m not saying the value will drop to that assist line—actually, I imagine there’s a really low probability of it reaching the $100 stage. Nonetheless, if the pressures and headwinds that I mentioned earlier persist and so they miss their full-year steering, this decrease assist line could possibly be an attention-grabbing entry level for an extended place if there’s a main selloff.

The primary motive I imagine now might be not a great second to enter an extended place is because of their excessively excessive valuation ratios.

EV/EBITDA is 53% above the sector median, worth to gross sales is 152%, worth to money circulation is 83% and worth to guide worth is 9% above the Industrials sector median.

One other key consider my funding type is current insider shopping for exercise within the open market. Frankly, I’m discouraged by the shortage of insider shopping for exercise previously 2 years, which along with the administration’s low stake within the firm (<1% possession amongst all 19 administrators and govt officers) will not be one thing I favor.

Conclusion

To conclude, I imagine that regardless of a great second quarter, with sturdy income, adjusted EBITDA development, and a raised steering, the nice efficiency of the corporate is most definitely totally priced in.

The overbuying exercise in Could, adopted by a ten% decline within the share worth could possibly be a sign of shareholder pleasure cooling off, which I view as a wholesome signal, contemplating the RSI was over 80 in mid-Could.

Nonetheless, I imagine there may be nonetheless a threat for a continued decline towards the assist of the upward development line within the weekly chart, particularly if the delays in giant infrastructure tasks in China persist in the course of the second a part of the 12 months.

One other issue that motivates my Maintain ranking is the excessive valuation ratios when in comparison with the industrials sector, particularly for the value to gross sales and EV/EBITDA ratios.

Nonetheless, I imagine it’s price retaining this inventory in your watch checklist in case a selloff drives the share worth all the way down to the upward development line assist stage. This may be near the $100 worth mark, which I imagine is an efficient worth to provoke an extended place. Nonetheless, till then, my ranking for this inventory is a Maintain.