BlackJack3D/iStock via Getty Images

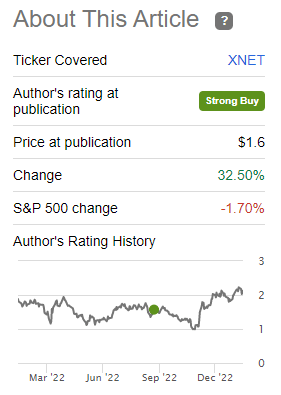

I first started covering Xunlei (NASDAQ:XNET) in November of 2017 when the stock was trading at $24.05 and I deemed it a short that would “soon reverse”. The stock subsequently fell over 90%, which was a sharp enough plunge that by August of 2022 I felt that it had fallen too far and so I rated it a strong buy based on its profitability and cash position. The stock is now up 32% since that call.

Seeking Alpha

Today, at the request of several readers, I’d like to quickly update my stance on the company. Much of what I said in the second article is still true in general, though the specific numbers need today’s refresh.

Company

Xunlei is a Chinese company which is under followed and under covered in the US, in part because there isn’t much English language info available to help investors understand the company and its operations. I believe the best English description of the company’s operations is given in its annual 20F SEC filing. To wit (with my emphasis throughout):

We operate a powerful internet platform in China based on cloud technology to enable our users to quickly access, store, manage, and consume digital media content on the internet. In recent years, we have expanded our products and services from PC-based devices to mobile devices in part through pre-installed acceleration products in mobile phones to further enlarge our user base and offer our users a wider range of access points. We provide a wide range of products and services across cloud acceleration, blockchain, shared cloud computing and digital entertainment to deliver an efficient, smart and safe internet environment.

To address deficiencies of digital media transmission over the internet in China, such as low speed and high delivery failure rates, we provide users with quick and easy access to online digital media content through core products and services below:

- Xunlei Accelerator, our most popular and free product, which enables users to accelerate digital transmission over the internet and has approximately 48.0 million monthly unique visitors in December 2021, according to our internal record; and

- Cloud acceleration subscription services, which are delivered through our product, Green Channel, and offer users premium services for speed and reliability.

In addition to our core product, Xunlei Accelerator, we have also developed cloud computing and other internet value-added services to speed up corporate development and to keep pace with the latest industry trend and users’ changing needs. These value-added services and products primarily include live streaming services and online game services, which provide us with synergies in our business operations.

[…]

Our mobile initiatives also benefit from our relationship with Xiaomi, one of our previous strategic shareholders. Since 2014, we have entered into a pre-installing services agreement with a Xiaomi group company which manufactures Xiaomi phones, a well-recognized brand of smart phones in China. Pursuant to the agreement, we agree to provide our Mobile Xunlei acceleration plug-in, and the mobile phone manufacturer agrees to install such plug-in on its phones, free of charge. Such pre-installment arrangement provides mobile phone users with access to our acceleration services, which we believe enhances our ability to generate more user traffic. Our mobile acceleration software has been officially adopted by Xiaomi’s operating systems and the software has been installed on Xiaomi phones sold in China, including both new phones shipments and system upgrades from existing Xiaomi phones.

Another key part of our strategies is to continue our innovation in crowdsourcing of idle bandwidth capacity and potential storage from users of our cloud computing hardware devices so that we can continuously deliver computing resources to third parties, such as internet content providers, through our CDN services. We started to generate revenue from selling crowdsourced uplink capacity we collected from users of our cloud computing services to third parties in the third quarter of 2015. To further develop our cloud computing business, we launched our decentralized cloud computing product, OneThing Cloud, in 2017. OneThing Cloud is essentially a cloud-based storage and sharing device that allows users to share their idle internet bandwidth and storage resources with our content delivery networks. The third parties that purchased our cloud computing services mainly include internet content providers such as iQiyi and Xiaomi. In 2020, we launched our own reward program, which allows users of OneThing Cloud to share crowdsources idle uplink capacities and external storage with us in exchange for a small amount of cash rewards.

Latest Financial Results

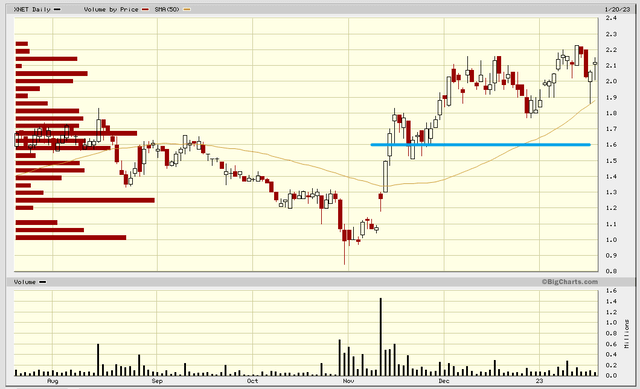

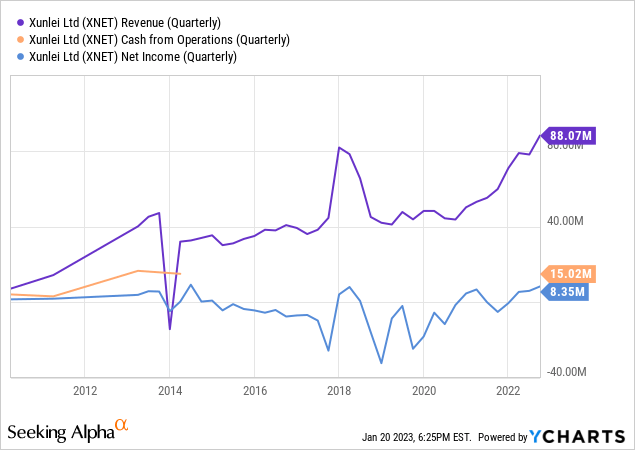

As I mentioned in my previous article, XNET was attractive not only for its cash position (which we’ll get to below) but because its revenues and income were increasing. Recent results bear this trend out.

From the November 2022 earnings release we learn that third quarter revenues grew 12.8% sequentially and 47.1% year over year. This performance was the result of the following numbers in the company’s three reporting segments (with my emphasis):

Revenues from cloud computing were US$29.1 million, representing an increase of 2.7% from the previous quarter. The increase of cloud computing revenues was mainly due to the increased demand from our major clients for our cloud computing service…

Revenues from subscription were US$25.0 million, representing a decrease of 1.7% from the previous quarter. The number of subscribers was 4.37 million as of September 30, 2022, compared with 4.46 million as of June 30, 2022…

Revenues from live streaming and other IVAS were US$34.2 million, representing an increase of 39.4% from the previous quarter. The increase of live streaming and other IVAS revenues was mainly driven by the rise in the number of paying users of our live streaming products, which were launched in 2021, and our enhanced monetization capability.

This increased revenue (which are a record for the company) also resulted in a new all-time high in net income for the quarter. The chart below helps visualize this.

In other words, the company is executing very well.

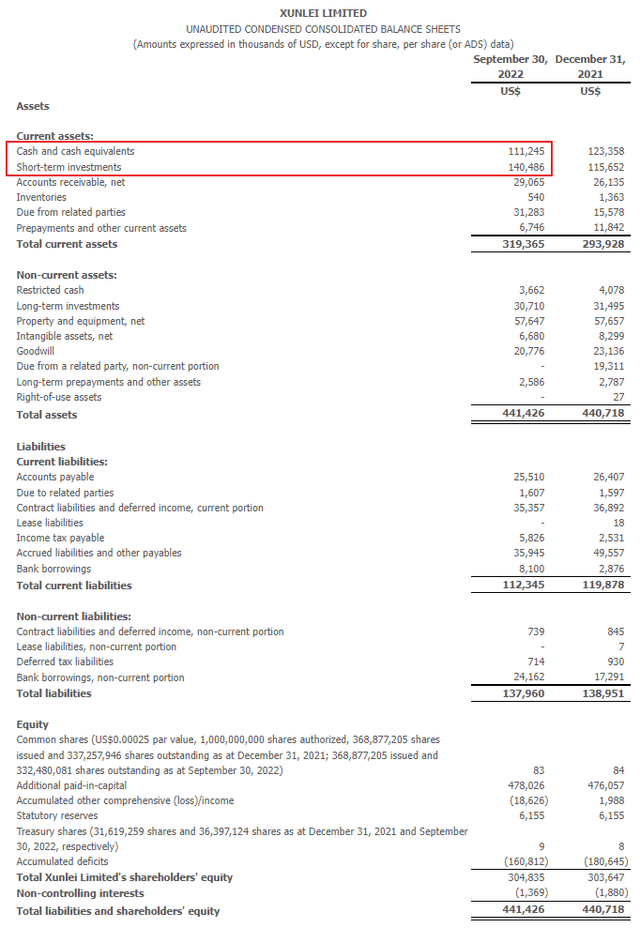

Cash on Hand

The company’s performance has continued to bolster its balance sheet, with cash and short term investments once again increasing.

Earnings release

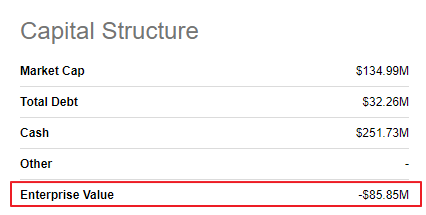

With 66.5M ADS outstanding, the company has about $3.75 ($251M/66.5M) of cash and short term investments per ADS on hand. With the stock trading at $2.12 that’s 178% of the share price. This explains why the company still sports an appreciable negative enterprise value of ($85.8M).

Seeking Alpha

Being profitable and having a negative EV is a perfect reason to engage in stock buybacks as every purchase is accretive to book value and cash on hand. The company understands this, hence:

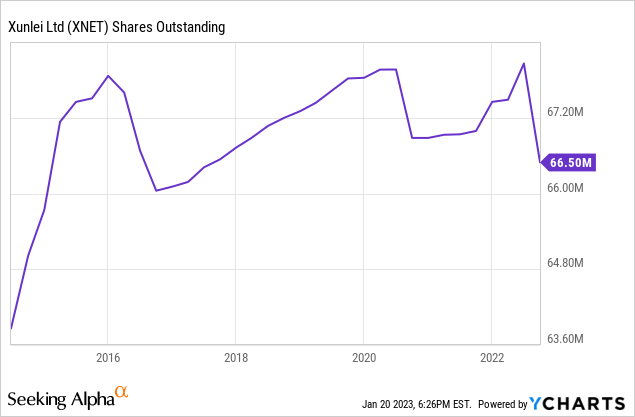

Share Buybacks

Since authorizing a $20M share repurchase plan in March 2022, as of September 30, 2022 the company had used $4.3M of it. This is the result:

Given the company’s profitability and extremely strong cash position, I expect it to continue with its share repurchases, eventually using the full $20M that has been authorized and perhaps following that with another authorization.

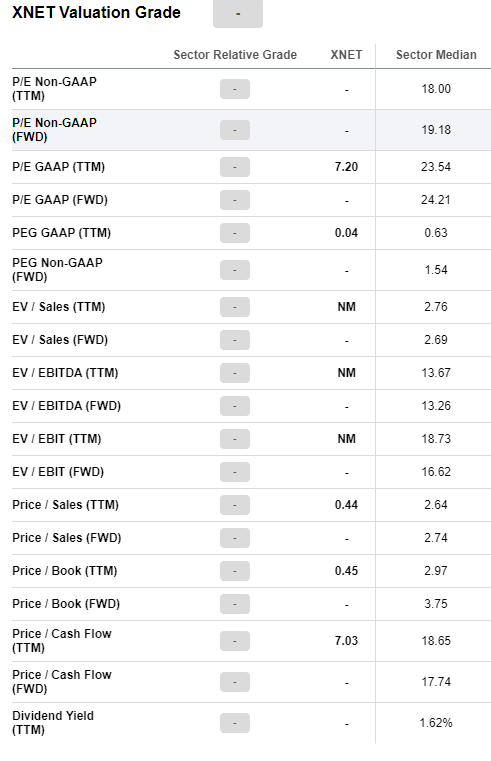

Valuation

Because it has a negative enterprise value, XNET receives a not meaningful rating on any metric that includes EV, but in reality all of those metrics are incredibly strong. With that fact noted, here is Seeking Alpha’s summary of the valuation metrics.

Seeking Alpha

I believe that the valuation numbers coupled with so much cash on hand and growing revenues completely justify a “strong buy” rating on XNET. Nonetheless, Seeking Alpha doesn’t provide a quant rating on this particular ticker, possibly because there is no analyst covering the company. This under coverage, however, is another factor contributing to XNET currently being mispriced by the market.

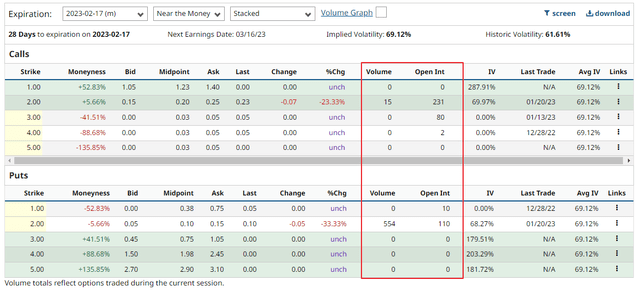

Options

XNET trades options but they are not particularly liquid. Because my positions have been small however, I was able to enter the stock via naked puts and have just had shares called away by covered calls I’d written against my position. I may try to duplicate this strategy going forward.

barchart.com

Risks

The risks here are two fold, first that the company fails to execute, and second, the same one that I identified in my previous article:

The biggest risk with XNET, in my opinion, is the same one that plagues most Chinese stocks, i.e. the company is a VIE and thus shareholders don’t actually own the company. Here is a good link describing this risk.

These risks are, in my opinion, somewhat mitigated by XNET’s net cash position and its growing revenues and income. Nonetheless, as with all Chinese stocks, I have taken a much smaller position in this name than I would were it based in the US.

Summary & Trading Plan

I believe that XNET is currently presenting us with a buying opportunity which arises mainly because the company is so under followed and unknown. There are no Wall St analysts on it, public info (in English) is hard to gather and it doesn’t need financing. But all of that can be an edge for small investors. I recently had my position called away, but plan to be back in the stock, probably buying a little at today’s prices but then trying to get a full position if the stock trades below $1.75 (which is just above short term resistance).

bigcharts