XRP’s current worth surge has sparked rising curiosity from institutional gamers, with Worksport and The BC Bud Co. asserting plans to incorporate the token of their treasury methods.

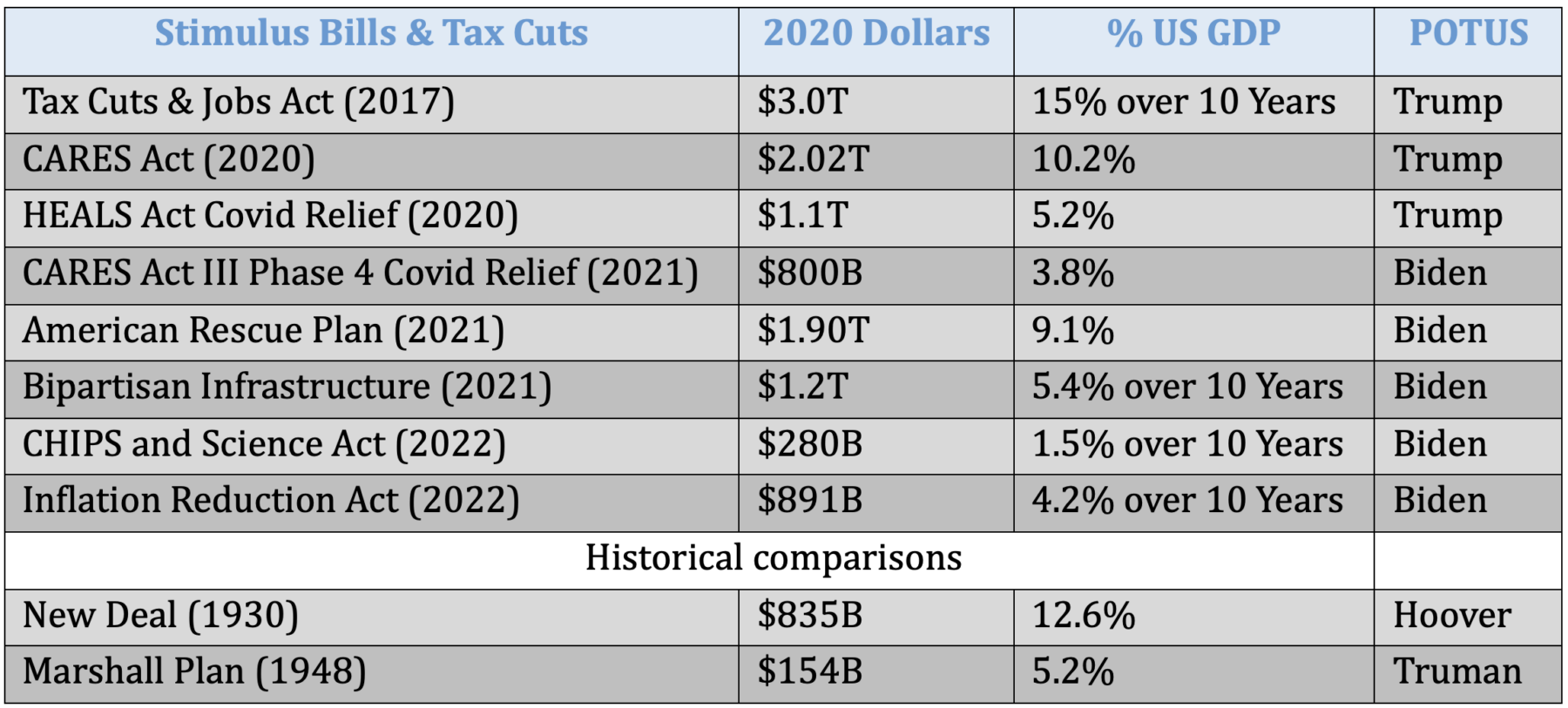

Historically, company crypto investments have centered on Bitcoin, a pattern set by corporations like MicroStrategy. Nonetheless, XRP’s spectacular 300% rally over the previous month has propelled it into the highest three digital property by market capitalization.

Market observers recommend that this rally has inspired smaller companies to discover XRP, aiming to learn from the rising momentum across the token.

Workspot eyes $5 million Bitcoin and XRP allocation

On Dec. 5, Worksport, a Nasdaq-listed truck cowl producer, unveiled plans to diversify its treasury by investing as much as $5 million in Bitcoin and XRP.

In keeping with its assertion, the corporate intends to allocate 10% of its surplus operational money to those digital property to hedge towards inflation and improve its monetary technique.

Moreover, Worksport plans to just accept crypto funds on its e-commerce platform, anticipating transaction price reductions of as much as 37%. The corporate additionally goals to reinvest curiosity earned from cash market accounts into Bitcoin and XRP whereas contemplating future capital allocations to construct long-term crypto reserves.

Steven Rossi, CEO of Worksport, described Bitcoin and XRP as resilient property well-suited for a contemporary treasury method. He emphasised their potential to protect worth and function instruments for monetary innovation.

BC Bud Co. invests in XRP.

Canadian hashish firm The BC Bud Co. introduced a CAD 250,000 (equal to $178,000) funding in XRP utilizing money reserves held in Canadian accounts. This transfer displays the corporate’s technique to maximise shareholder worth by way of publicity to rising monetary property.

CEO Brayden Sutton famous XRP’s current authorized and market developments as proof of why it’s a compelling funding selection for his firm. He pointed to world curiosity in XRP exchange-traded funds (ETFs) and pro-crypto sentiment within the political panorama as elements bolstering the asset’s enchantment.

Sutton additionally highlighted XRP’s potential to align with evolving monetary tendencies whereas driving long-term returns for shareholders.