This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

Rishi Sunak has succeeded Liz Truss as the new UK prime minister after winning the Tory leadership contest. The former chancellor, a rightwing but pragmatic Brexiter and Britain’s first non-white premier, has a tough task ahead restoring the country’s credibility with global investors.

-

New PMI survey data suggesting the UK has fallen into recession highlight the scale of the challenge facing Sunak. The reading of 47.1 in October, where 50 marks the line between business activity shrinking and expanding, was a 21-month low. Another survey showed consumer confidence plunging.

-

Philips, the Dutch health tech company, plans to cut 4,000 jobs or 5 per cent of its workforce to meet the costs of legal action on faulty medical devices as well as supply chain pressures.

For up-to-the-minute news updates, visit our live blog

Good evening.

Disappointing growth data have added to investor concerns about the future direction of China after a landmark congress of the Communist party handed president Xi Jinping an unprecedented third term in power.

Today’s GDP numbers — postponed from last Tuesday when the congress was in full flow — show the economy expanded 3.9 per cent in the third quarter, far short of the full-year target of 5.5 per cent, already the lowest in three decades.

The news knocked Chinese stocks and added to the unease of overseas investors in Hong Kong over Xi’s appointment of hardliners to his leadership team. Tech companies such as Alibaba, already suffering from a domestic regulatory clampdown, were also hit in US trading.

Ruchir Sharma, chair of Rockefeller International, writes in the FT today that the slowdown in growth means China is unlikely to overtake the US as the world’s largest economy until 2060 — if at all. Xi’s goal of making China a mid-level developed country in the next decade implies a growth rate of around 5 per cent, but the current outlook suggests just half of that, Sharma says.

The country is still suffering from the crippling effects of zero-Covid lockdowns that have hit consumer spending, as well as a continuing property crisis. Other headaches for Xi include new tech export controls from the US that will affect companies such as chipmaker SMIC: read our explainer to get the full picture.

Today’s data follow a consolidation of Xi’s power at the congress, with rivals purged from his team and the promotion of loyal Shanghai chief Li Qiang — who presided over the city’s draconian lockdowns — to become the Communist party’s second-highest-ranking official.

As Xi strengthens his grip — graphically illustrated by the sight of former president Hu Jintao being forced to leave the stage — he faces a renewed effort by the US and its allies to forge a new “global west” in opposition, writes chief foreign affairs commentator Gideon Rachman.

This grouping, led by a reinvigorated G7, aims to reduce countries’ economic reliability on China by measures such as “friendshoring” and increased investment in global infrastructure to match Beijing’s Belt and Road Initiative.

Former Australian prime minister Kevin Rudd, also writing in the FT, says Xi’s congress performance is confirmation of an aggressive and statist worldview, with national security replacing the economy as China’s central focus. It also marks the return of “ideological man”, Rudd argues, elevating Xi in the pantheon of the country’s leaders and putting him on a par with Mao Zedong.

Join FT journalists for a subscriber-only briefing on what the Communist party’s national congress signifies for China, the world and business. Register here.

Need to know: UK and Europe economy

The PMI reading for the eurozone was as gloomy as the UK’s, showing a bigger than expected contraction in output in manufacturing and services and the same score of 47.1, the lowest for the bloc since November 2020.

The UK energy industry said the government’s de facto windfall tax on low carbon electricity companies would have “catastrophic consequences” for investment in green technology. The policy, still progressing through parliament, would impose a revenue cap on low carbon generators.

Need to know: Global economy

The PMI reading for the US showed business activity shrinking for a fourth straight month in October, hitting 47.3, thanks to inflation and slowing demand. President Joe Biden’s adviser Brian Deese told the FT the US economy was strong enough to avoid recession, experiencing instead a “soft landing” with a shift to slower growth rather than a deep contraction.

1970s and 1980s-stye “austerity shopping” by European, US and Asian consumers is back as inflation hits household budgets. New data show an increase in packed lunches, buying out-of-date food, cutting back on booze and visiting multiple supermarkets to secure the cheapest deals.

The Brazilian presidential election run-off takes place on Sunday. As campaigning intensifies, incumbent Jair Bolsonaro has hit out at the supposed bias of the judiciary towards his rival Luiz Inácio Lula da Silva as it clamps down on disinformation.

Despite pledges to learn the lessons of Covid-19, fears are growing that the darkening economic outlook will hit funding for global health emergencies such as antimicrobial drug resistance, Ebola in Africa, cholera in Haiti and polio and monkeypox in the US and other developed economies. Read more in our special report: Communicable Diseases.

Need to know: business

Profit warnings at FTSE-listed companies this quarter are at the highest level since the global financial crisis as the cost of doing business soars while demand is hit by worsening economic conditions. Several UK companies are offering staff perks to help offset rising living costs.

US tech giants are set to report slowing revenues in third quarter announcements this week, ending the pandemic-fuelled surge in digital activity over the past two years.

The head of WFS, one of the world’s biggest air cargo handlers, said that despite the darkening global trade outlook, the rise of ecommerce and demand for faster deliveries were driving a long-term shift towards moving goods by plane.

A lack of blockbusters means box office takings at global cinemas are still far from hitting pre-pandemic levels. Consumers are also becoming more discerning, says one forecaster: “Cinemas’ main competition isn’t Netflix, it’s other out-of-home options, and there’s a lot of stuff you can do nowadays, from laser quest to golf to escape rooms. You have to compete with all that on price and experience.”

The World of Work

The work-from-home trend is driving “productivity paranoia” on the part of certain managers as they look for new performance metrics, writes columnist Rana Foroohar. But increasing employee surveillance is causing stress and resentment among workers and isn’t that effective anyway, she argues.

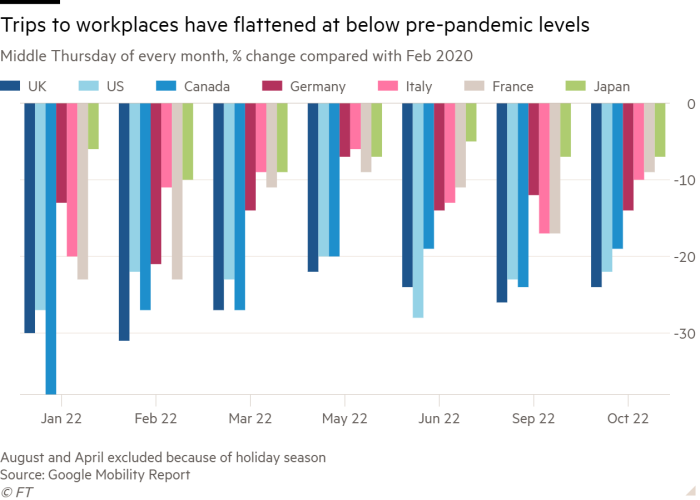

One definite consequence of hybrid working in large economies is the noticeable drop in commuting. The shift poses challenges for dense urban centres that are organised around a high concentration of commercial activity.

Moving Beyond the Great Resignation is a free FT webinar on November 1 focusing on changing employee expectations and how businesses can retain talent in an increasingly challenging market. Register here.

Covid cases and vaccinations

Total global cases: 620.1mn

Total doses given: 12.9bn

Get the latest worldwide picture with our vaccine tracker

Some good news

The NHS in England says it is on course to become the first country in the world to stop new cases of HIV before 2030, thanks to a new wave of drugs, including long-acting injections to replace daily tablets.

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you