Sakorn Sukkasemsakorn

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on March 12th, 2023.

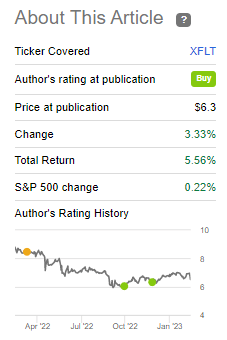

XAI Octagon Floating Rate & Alternative Income Trust (NYSE:XFLT) continues to benefit from rising interest rates. If we simply looked at the fund’s share price over the last year, one might think otherwise. Higher rates and credit risks have decreased the value of their underlying holding. Still, we’ve also seen a significant drop from a high premium to a more moderate discount. Both of those factors have contributed to a dropping share price.

On the other hand, distribution coverage has now risen to over 100% with the latest quarterly report. This would be thanks to being invested in primarily floating rate debt securities, which includes a hybrid approach of senior loans and debt and equity collateralized loan obligations.

This was something that I’ve been mentioning in the last two updates of XFLT, that coverage was improving, and we should eventually see distribution coverage over 100%. Now, with that latest quarterly report, distribution coverage came to 119%. When the last two updates were posted, it also presented a fairly attractive time to consider adding to the fund.

XFLT Performance Since Previous Update (Seeking Alpha)

This isn’t risk-free, of course. Some serious risks to consider include being highly leveraged on top of higher credit risks due to being invested in below-investment-grade debt. We also must consider that while rising rates benefit the fund, it’s putting pressure on the companies that must pay these loans. At some point, the rate can become too elevated, and the underlying business can start to default. Being below investment grade means these are sorts of companies that are already financially unstable for the most part. The way these risks are counteracted is through significant diversification. Each CLO is backed by hundreds or thousands of loans.

The Basics

- 1-Year Z-score: -0.83

- Discount: 0.00%

- Distribution Yield: 13.46%

- Expense Ratio: 3.81%

- Leverage: 40.57%

- Managed Assets: $411.046 million

- Structure: Term (anticipated liquidation date Dec. 31, 2029)

XFLT’s objective is to “seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle.”

They will do this through “a dynamically managed portfolio of floating-rate credit instruments and other structured credit investments within the private markets. Under normal market conditions, the Trust will invest at least 80% of managed assets in senior secured loans, CLO debt and equity.”

The fund is highly leveraged, with borrowings from a 2026 Term Preferred (NYSE:XFLT.PA), 2029 Convertible Preferred and a leverage facility that gives them plenty of flexibility to adjust leverage as needed. With public debt via the preferreds, they are limited to a 50% leverage ratio. In sharp crashes in the broader market that can take XFLT down with it – it’s good to have that added flexibility that they can maneuver more nimbly. Either way, high leverage means higher risk as moves are amplified to both the upside and downside.

Leverage also means that we have a higher total expense ratio of 6.29%. That’s above 3.81% for management and operating expenses. I’ve touched on this before. That it is certainly high, but compared to peers, it’s actually low. It’s much lower as XFLT doesn’t have incentive fees, unlike the other pure-play CLO funds.

With a portion of their leverage having a fixed rate, they aren’t entirely susceptible to rising interest rate costs of their leverage. The convertibles are $49 million of their debt, with the leverage facility being $162.25 million at the end of 2022. Rising interest rates impact the portion of their leverage through the credit facility. That’s based on SOFR plus 1.45%, so as rates rise, so do the costs. Fortunately, as rates rise, so do the yields on their floating rate exposure, which offsets the increases in borrowing costs.

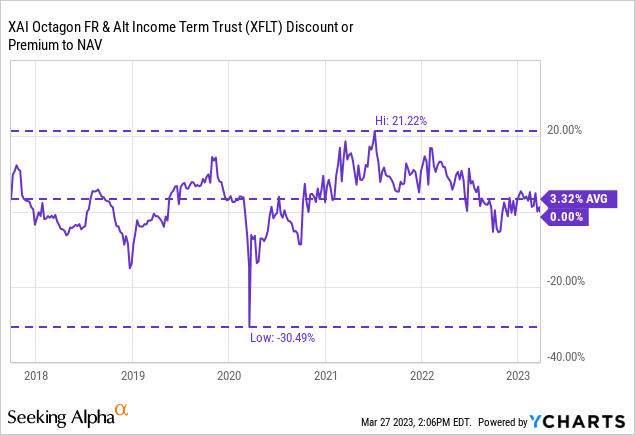

Performance – Flirting With A Discount

As mentioned, the actual share price of the fund might turn an investor away. No doubt, if you are looking for capital appreciation, you have to look elsewhere. However, a large portion of the hit came from the fund’s premium simply coming down from much more elevated levels. This was especially true if you were a buyer in 2021 when we saw XFLT’s premium hit a 20%+ premium. The low we see at over 30% was due to COVID, but we saw an almost immediate recovery. The fund has recently been flirting with a discount, but the latest finish had the fund arrive right at its NAV per share at close.

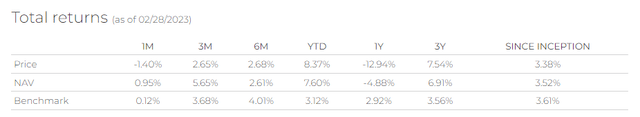

Compared to the fund’s benchmark, XFLT has also outperformed in the last 3 years and YTD. Their benchmark is the S&P/LSTA U.S. Leveraged Loan 100 Index. Since its inception, it has also been competitive despite the fund’s higher expenses. So whatever the fund is doing, it’s working against the appropriate benchmark, even if the share price alone doesn’t reflect it, as returns are coming from their distributions entirely. Where the fund underperformed meaningfully was the last year – particularly on the market price performance due to that disappearing premium.

XFLT Annualized Performance (XA Investments)

That puts us in a position where XFLT seems to be a much better valuation today.

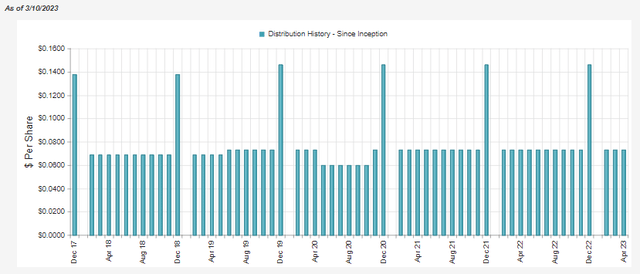

Distribution – 13.99% Distribution Yield That’s Covered

During COVID, the fund dropped its distribution but quickly raised it back up to the pre-COVID level.

XFLT Distribution History (CEFConnect)

The fund’s current distribution comes to 13.99%, with an identical NAV rate of 13.99%. It might seem insane, but due to how strong the coverage is in the last report, we could see another increase in the distribution. Alternatively, if coverage continues this strongly through 2023, a year-end special could be something else we see if they don’t increase the regular.

The reason is that it is a regulated investment company or RIC that must pay out most of its earnings during a fiscal year or pay excise tax. Some excise tax might not be a terrible thing, but too much and it’s simply a waste of cash that’s paid to Uncle Sam.

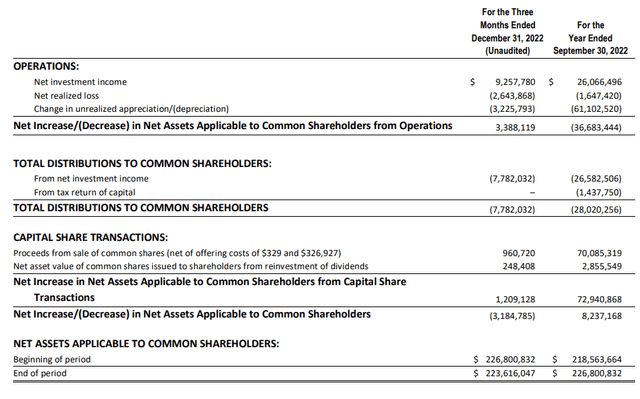

XFLT Quarterly Report (XA Investments)

Of course, that requires this sort of trend to continue. With interest rates higher now than we saw in Q4 2022, and if the Fed is still on course for a few more raises, this trend would appear set to continue. Given the failure of Silicon Valley Bank and the unknown fallout at this point, they could become more cautious going forward.

On a per-share basis, the fiscal year 2022 reported $0.82 NII compared to 2021 NII of $0.76. The last quarter came to $0.26, annualizing out to $1.04. With a shorter period of time, it can be skewed due to timing. So the exact amount won’t be known until fiscal year-end, but given the current information, we know we should expect it to be higher.

That is, if the financial system doesn’t collapse and we end up in a deep recession or depression. Barring those sorts of black swan events that could cause that, things look promising. A bit tongue in cheek, but that’s basically the standard risk of any investment, particularly in a year where market participants expect a recession at some point.

Additionally, they took their leverage facility up from $113.15 million at the end of September to $162.25 million at the end of December 2022. It could have had a sizeable impact on last quarter’s coverage depending on the timing of when they increased their borrowings. The reason is that this capital being put to work would have been generating income for the fund. The benefit would have been higher if it had happened shortly after the fiscal year-end. Closer to the end of the quarter would mean a more minimal impact but also could suggest a higher benefit in the future should they continue to maintain this higher credit facility leverage amount.

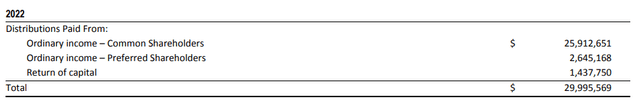

As a debt-focused fund, the tax character of the distributions is primarily ordinary income. However, some return of capital also made an appearance in 2022.

XFLT Distribution Classification (XA Investments)

XFLT’s Portfolio

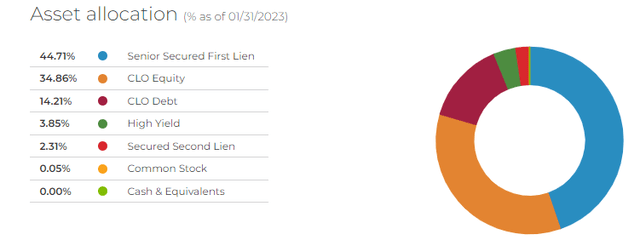

True to the fund’s hybrid focus, we see that there is a fair split between senior loans and CLO exposure.

XFLT Asset Allocation (XA Investments)

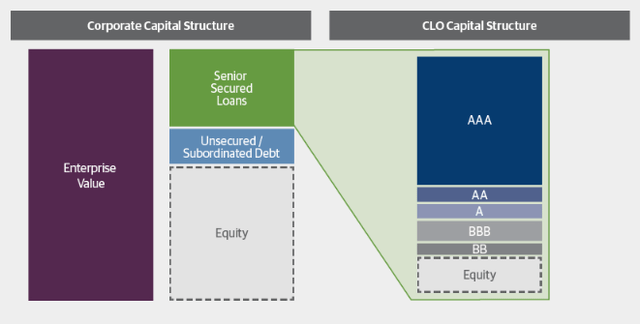

CLO equity makes up a larger portion of the pie relative to the CLO debt. The equity tranches only get paid when all the other tranches of CLO debt are paid above it. During economic stress, the equity and even some of the lower-rated debt tranches can be impacted with losses.

However, these are still pooled senior loans inside the CLO, so it’s still above the issuing company’s unsecured and subordinated debt and equity. The chart below from Guggenheim helps illustrate the CLO capital structure as well as where it sits within a corporate capital structure.

Corporate Capital Structure (Guggenheim)

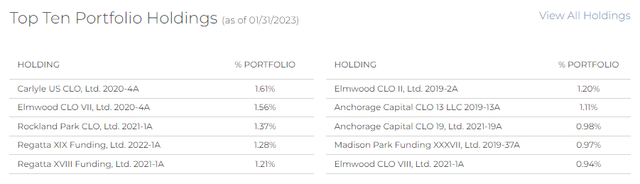

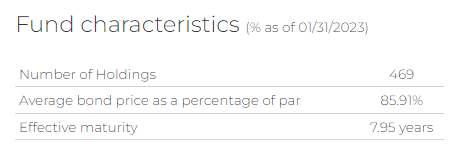

Since these are pooled loans, they can provide further diversification compared to senior loans that are issued to an individual company. For XFLT, they hold 469 holdings. With around 50% being CLOs, the actual exposure here could be to hundreds of other companies. Guggenheim says that it’s “typically more than 200 loans.” Speaking of diversification, the top ten reflect that no single position makes up an outsized portion of its portfolio.

XFLT Top Holdings (XA Investments)

The average bond price as a percentage of par at the end of January 2023 stood at 85.91%. So not only does XFLT carry a small discount, but even if it were at a slight premium, it would mean the actual underlying portfolio is still discounted as well. This price is slightly above where it was in our last update at 82.39%.

XFLT Fund Characteristics (XA Investments)

Conclusion

XFLT’s distribution coverage has improved substantially, as we suggested it would previously.

Not a massive increase [for distribution coverage], but interest rate increases weren’t fully reflected by June 2022 either. Senior loans have a floor to breach first, which was likely only hit after the first couple of raises in most of these investments. With subsequent increases, the income generation should start rolling in.

Another way to look at this to reflect the dilution of added shares would be looking at NII per share in the financial highlights. In that case, we see an NII of $0.58 for the nine months compared to the prior fiscal year 2021 of $0.76. If we annualized out that latest figure, we would come out to $0.7733. Again, reflecting that the income generation wasn’t overly accretive at this point, but it should start ramping up in subsequent reports.

Pushing the coverage significantly was floating rates in their underlying portfolio, and the Fed continued raising interest rates. However, they also had increased their credit facility, which would have also helped generate more income for the fund.

There are headwinds for the economy going forward, and rates can hit a point where they rise too high for these below-investment-grade loans, but some of that is reflected in the discount on the portfolio. On top of that, XFLT’s shallow discount makes it a fairly attractive time to consider this fund. Historically, the fund has traded at a premium more than a discount.