Hispanolistic

Global business activity stalled in October, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. The data signal an ongoing loss of economic growth momentum at the start of the fourth quarter after the robust global expansion seen earlier in the year.

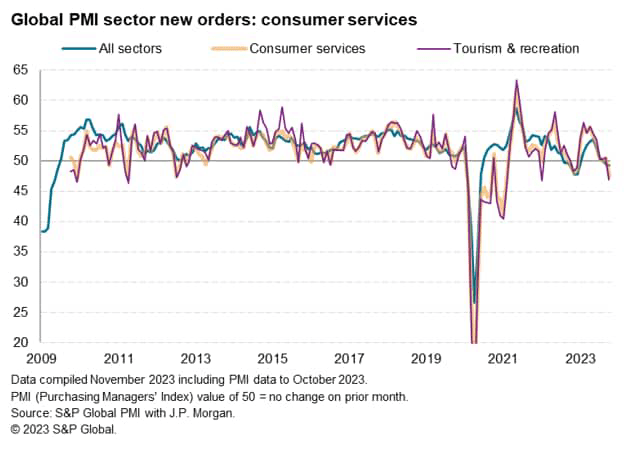

A post-pandemic surge in demand for consumer-oriented services such as tourism and recreation has moved into reverse, though the growing malaise is broad based, encompassing an ongoing manufacturing downturn and declining demand for financial and business services.

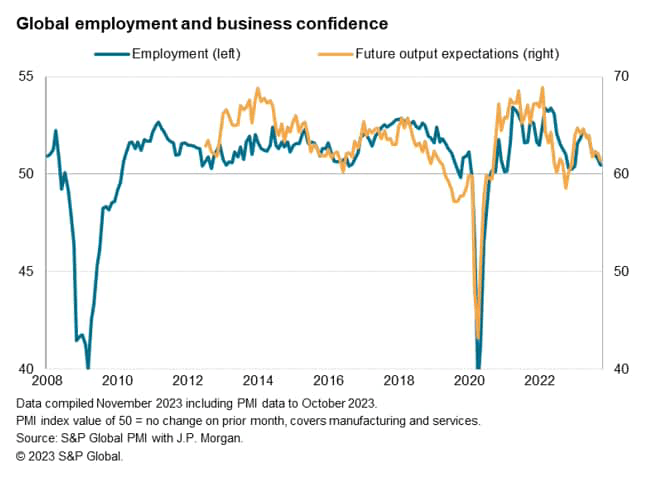

Businesses, hit by worsening order books, have meanwhile grown gloomier about the outlook and hence pulled back on their hiring.

The worsening global economic climate is being led by Europe but newly-released data also show a gathering downturn in Canada and very subdued growth in the United States. Growth has also stalled in mainland China, leaving India as the remaining bright spot in an otherwise subdued global economic picture, and even here the rate of expansion showed signs of cooling in October.

Global recovery stalls

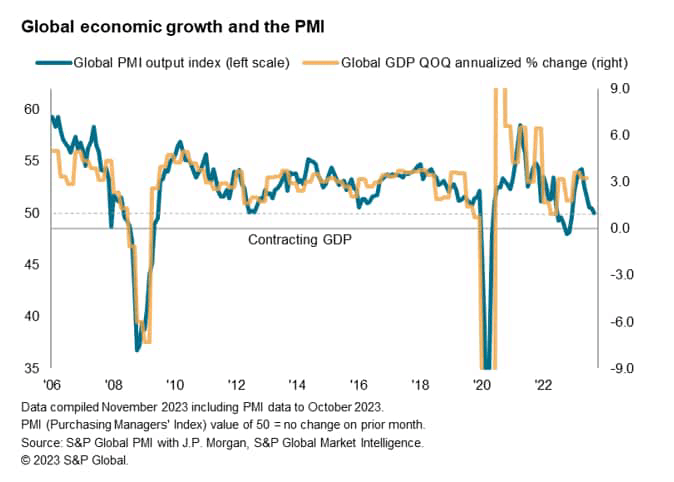

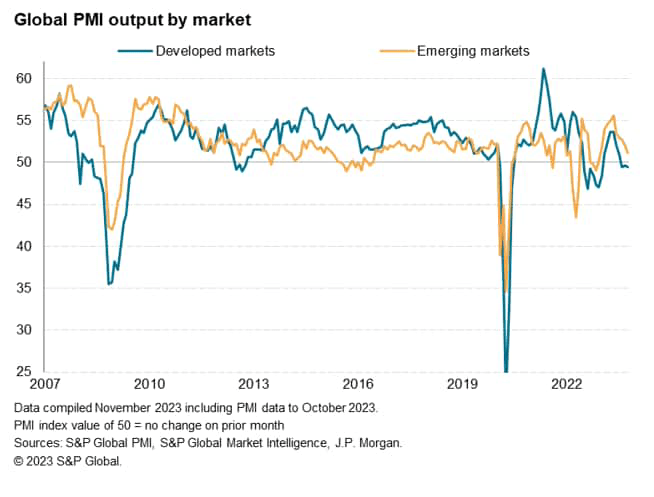

Worldwide business activity stagnated in October, according to the Global PMI data compiled by S&P Global. The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, fell to 50.0 from 50.5 in September, its lowest since the current global economic upturn began in February.

The current reading takes the PMI further below the survey’s long-run average of 53.2 and is broadly consistent with annualized quarterly global GDP growth of just under 1%, well below the pre-pandemic ten-year average of 3.0%.

To underscore the recent weakening of the global economic growth trend, prior to the pandemic and tightening of financial conditions seen late last year, the PMI has not fallen below 50 since the global financial crisis.

Malaise spreads from manufacturing to services

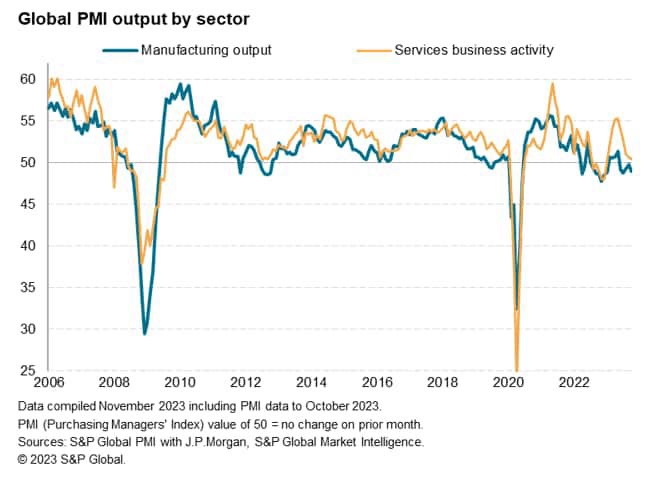

The survey data therefore point to a further cooling of the global economic expansion since the robust growth spurt seen earlier in the year. This deterioration reflects an ongoing decline in manufacturing output, which fell for a fifth successive month in October and at an accelerated rate compared to September, alongside a near-stalling of service sector growth, the latter representing an especially marked contrast to the strong rates of expansion seen during the second quarter of the year.

Both sectors saw demand conditions deteriorate. New orders for goods fell for a sixteenth successive month, accompanied in October by a second monthly fall in demand for services.

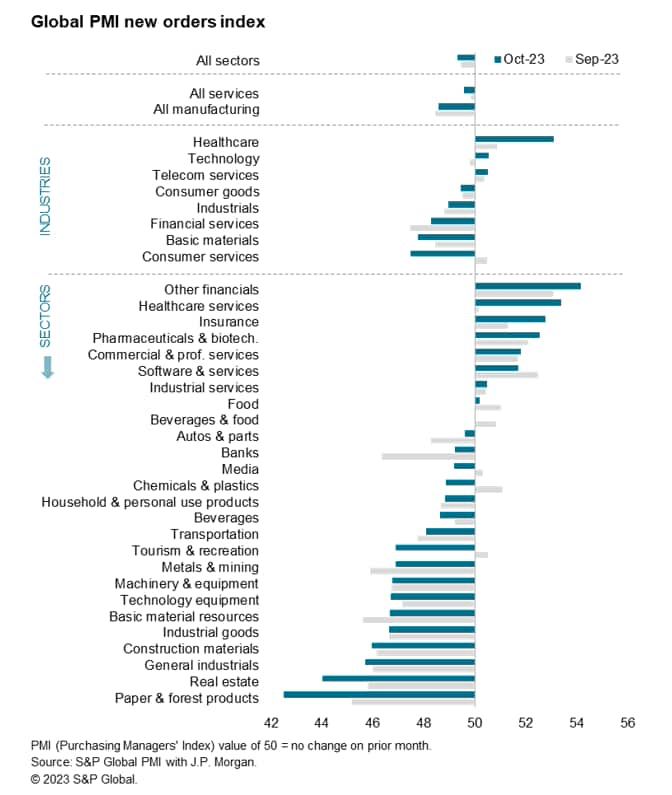

Looking by broad industry, rising demand was evident only for healthcare and, to lesser extents, technology and telecom services.

Notably, the steepest decline in demand was seen for consumer services, which had – in marked contrast – led the global expansion in the first four months of the year. Demand for consumer services, and its sub-sector tourism & recreation, is now contracting at steep rates by historical standards.

Demand also continued to fall sharply for basic materials, reflecting destocking amid the ongoing factory downturn, and financial services – the latter having seen business inflows hit by higher borrowing costs in recent months. Demand for real estate is being hit particularly severely.

Hiring slows amid gloomier prospects

The worsening new orders trend contributed to a further deterioration in business confidence. Expectations of output growth in the year ahead sank across manufacturing and services to its lowest since last December, descending further below its long-run average to signal a subdued level of sentiment by historical standards.

Weakening optimism in turn fed through to reduced hiring. Global employment growth slipped to its lowest since January, registering only a marginal rise in overall private sector payroll numbers.

Factory headcounts were trimmed for a second straight month, with the rate of job losses accelerating to the highest since the global financial crisis barring only the initial pandemic lockdowns. Concurrently, service sector payroll growth remained unchanged on the sluggish pace seen in September, which had been the weakest since January.

Developed markets contract

The global stagnation was led by a third consecutive month of falling developed world output. Although the rate of decline remained only very modest, the ongoing contraction represents a marked contrast to the strong growth seen earlier in the year.

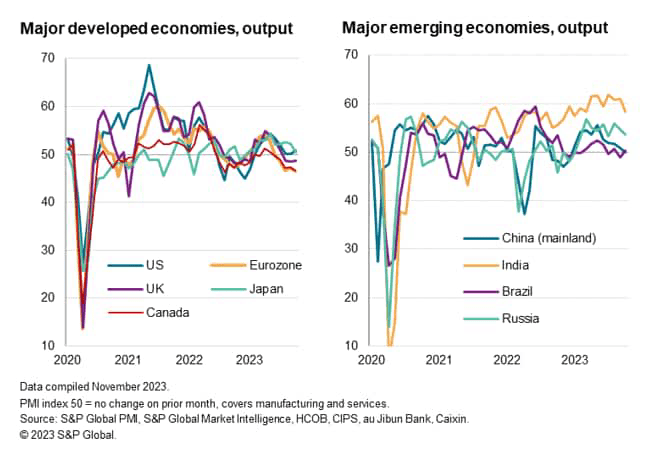

US growth across manufacturing and services remained very subdued for a third successive month, the rate of expansion picking up only marginally compared to August and September. Newly available PMI data for Canada meanwhile showed a worsening economic situation, with output dropping for a fifth straight month and at the second-sharpest pace since June 2020. Both manufacturing and services were reported to have been in steep declines.

Japan’s previously-robust upturn also lost momentum, a cooling of services growth resulting in only a marginal rise in overall output and the smallest gain recorded so far this year.

Meanwhile, Europe remained in decline, with output falling for a fifth straight month in the eurozone and for a third month in the UK. The latter’s decline remained relatively modest, however, and moderated, contrasting with a steeper and accelerated downturn in the eurozone.

India remains sole bright spot

The broad developed market malaise contrasted with a more varied picture in the major emerging markets. India remained the stand-out performer in October, extending its current boom that has resulted in output across manufacturing and services growing at some of the fastest rates seen over the past 15 years in recent months. That said, the upturn lost some momentum at the start of the fourth quarter.

Robust growth was also reported in Russia, but China’s mainland expansion stalled after nine months of post-pandemic recovery, amid a renewed drop in manufacturing output and only marginal services growth. Brazil likewise remained largely stalled, as a steepening manufacturing downturn largely offset a return to growth in the services economy.

Measured collectively, the major emerging markets expanded for a tenth successive month in October, but the latest expansion was the smallest recorded over this period.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.