Worldcoin, which as soon as made headlines for its futuristic imaginative and prescient, is now on the middle of turmoil. This time, battle is making information, not innovation. Sam Altman of OpenAI’s cryptocurrency mission is on the coronary heart of this tempest because it struggles to perform its formidable objective of a worldwide digital identification system.

Considerations about token dilution, market manipulation, and authorized obstacles have put the mission—which goals to scan irises for digital IDs and reward individuals with free WLD tokens—underneath shut investigation.

The Dilution Dilemma

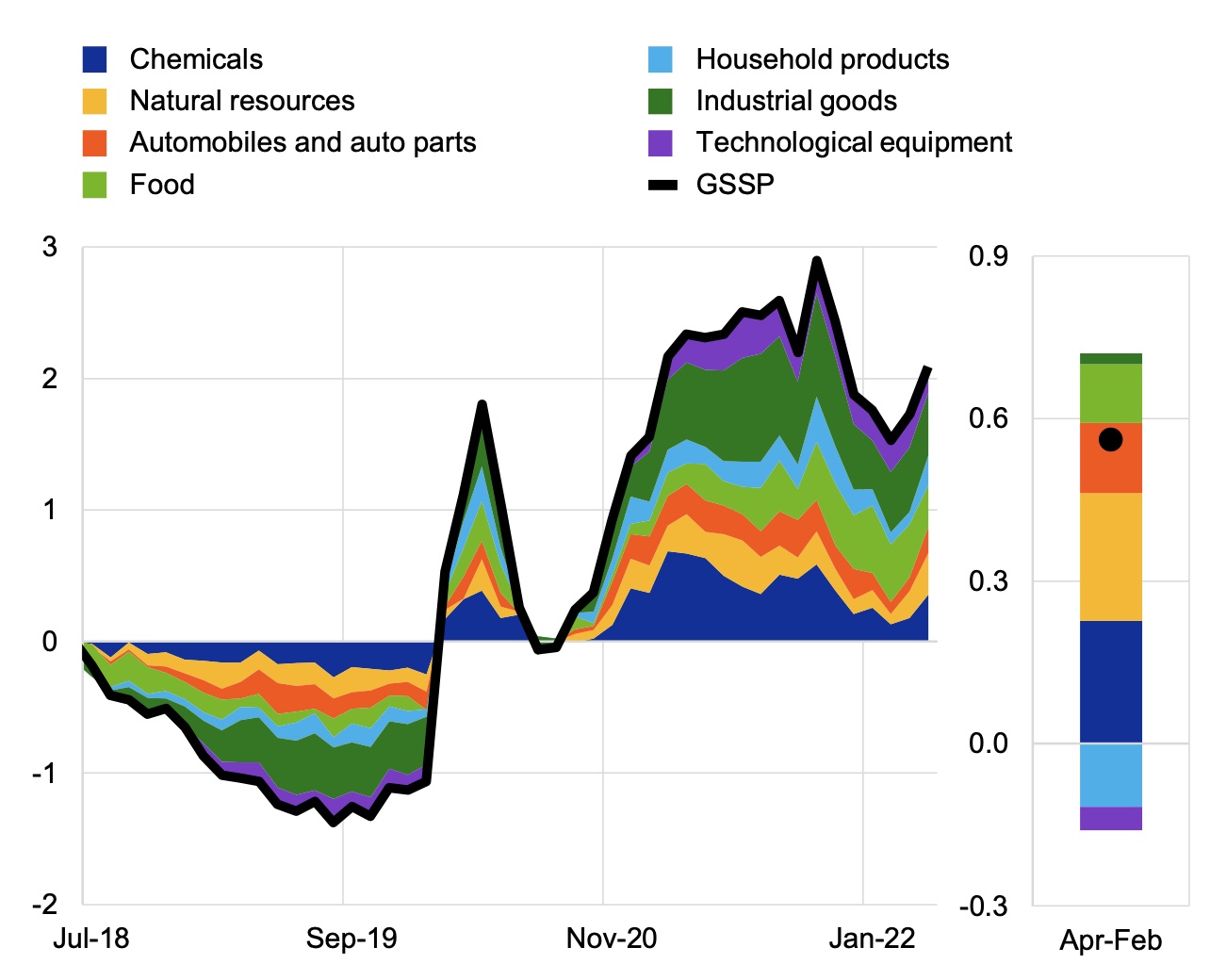

The crypto neighborhood has opposed Worldcoin’s tokenomics. With simply 2.7% of its whole WLD tokens in circulation, the mission’s fully diluted market valuation is shockingly $22.4 billion, whereas having a present price of $648 million.

This distinction highlights the grave danger of token dilution. As extra tokens turn into accessible and the worth of every token appears to be dropping, present buyers discover themselves in a harmful scenario. The truth that only a tiny fraction of the entire amount is exchanged aggravates the issue as a significant infusion of tokens would possibly considerably have an effect on the market worth.

WLDUSD buying and selling at $1.98 on the each day chart: TradingView.com

Allegations Of Market Manipulation

Allegations of insider buying and selling and market manipulation increase considerations. DeFi Squared, an on-chain specialist, believes the Worldcoin administration could have an effect on the token worth by controlling launch dates and timing optimistic information with unlock occasions.

The declare is that market makers obtained 100 million tokens to create favorable situations that might have allowed the mission staff to keep up a excessive worth for the mission regardless of market realities. Regardless that a Worldcoin consultant denies these accusations, the fees have tarnished the initiative’s credibility.

International Considerations And Authorized Difficulties

Including to its miseries, legislative hurdles are getting in the best way of Worldcoin’s aspirations for world development. Citing safety and biometric knowledge processing considerations, some nations have banned the programme both completely or briefly.

A person has his eyes scanned by a Worldcoin orb. Supply: Remainder of World.

Worldcoin’s incapacity to serve China, India, and the US makes it more durable to perform its formidable consumer acquisition objectives. Worldcoin aimed to register 1 billion customers by 2023, however authorized points have slowed growth, casting doubt on its long-term sustainability.

Lengthy-Time period Survival

Worldcoin’s long-term survival is unsure because it navigates these turbulent waters. Robust rules, market manipulation claims, and token dilution difficulties threaten Worldcoin’s objective of creating a world digital identification system.

Even when digital identification administration offers a variety of room for inventiveness, Worldcoin should remedy these crucial challenges to be related within the fast-changing world of cryptocurrencies and blockchain expertise.

Featured picture from Fortune, chart from TradingView