By Breakingviews

There’s a spanner in the freshly restarted U.S. manufacturing machine. A factory construction boom sparked by President Joe Biden’s industrial policies has led to unbridled optimism about the sector for the first time in decades. The hardest part of the process hangs in the balance, however: filling all the anticipated job openings.

Biden has walked all his predecessor’s talk of a manufacturing revival. The Bipartisan Infrastructure Deal, the Inflation Reduction Act, with its tax credits for renewable energy projects, and the CHIPS and Science Act’s semiconductor subsidies have had the desired effect.

Spending to build new plants surged to an annualized and seasonally adjusted pace of about $200 billion in September, 60% higher than a year earlier and two-and-a-half times the level in 2021, according to Census Bureau figures, before adjusting for the rise in construction costs, which somewhat flatters the eye-popping increases.

Taiwan Semiconductor Manufacturing (TSM), for one, is building a $40 billion chip fabrication facility, or fab, in Arizona that it expects will be operational next year, and another more advanced one due to be ready by 2026.

Samsung Electronics (OTCPK:SSNLF), Intel (INTC), Bosch and Linde (LIN) are among others that have unveiled plans for dozens of similar new and expanded U.S. plants.

More fab construction in turn leads to more investment by suppliers of chemicals, specialty gases, equipment and other materials used in the processes. Additional spending on research and development probably can be expected, too.

Likewise, the United States has rapidly picked up the pace to produce zero-emission vehicles and the batteries used in them, after lagging China, Europe and the rest of Asia until recently.

By 2030, car and truck manufacturers, and battery makers, plan to devote $860 billion worldwide to the EV transition, with nearly a quarter of the sum earmarked for American initiatives, more than any other country, research outfit Atlas Public Policy estimates.

By the end of last year alone, 23 different companies, including Ford Motor (F) and SK Innovation, had allocated at least $1 billion apiece for a specific U.S.-based EV or EV battery plant.

This manufacturing renaissance stands to buttress the U.S. economy, in part by spurring investment from overseas and demand for domestically produced goods.

It also should in some ways smooth out and reduce risk in supply chains, heeding at least one lesson from the pandemic.

And the government incentives give the fight against climate change more of a sporting chance. Despite these notable benefits, however, the widespread enthusiasm warrants circumspection.

Manufacturing accounted for more than a quarter of U.S. nominal GDP in the early 1950s and has steadily declined to less than half that rate, per Commerce Department data.

Any significant rebound in the proportion seems unlikely, as services maintain their dominance in the $23 trillion economy. Moreover, the government’s efforts to revive manufacturing may expose significant shortcomings in the U.S. workforce.

In 1979, manufacturing accounted for almost 20 million, or 22%, of the country’s 90 million nonfarm jobs, according to the Bureau of Labor Statistics.

Today, it’s just 8%, and even assuming that robots will be a big part of all the new and improved factories, it’s unclear that there is enough skilled labor available to handle the rest of the load.

Based in part on the planned construction spending, Goldman Sachs analysts estimate that Biden’s initiatives could lead to as many as 250,000 new manufacturing jobs over the next two years.

There’s already a dearth of workers. The average gap between the number of monthly openings and hires in manufacturing exceeded 400,000 in early 2022; the difference has since eased to about 180,000, but it’s still three times the level of the pre-pandemic rate. In some sectors, including construction and retail, earlier labor shortages have effectively disappeared.

Part of the problem is that the United States has failed to cultivate the requisite workforce. For example, employment marketplace ZipRecruiter is advertising about 60,000 U.S. apprenticeship positions.

In Germany, a manufacturing-focused country with one-quarter the population, there are 500,000 comparable roles available.

The onus, for now, rests with individual employers, who are already facing lower overseas labor costs.

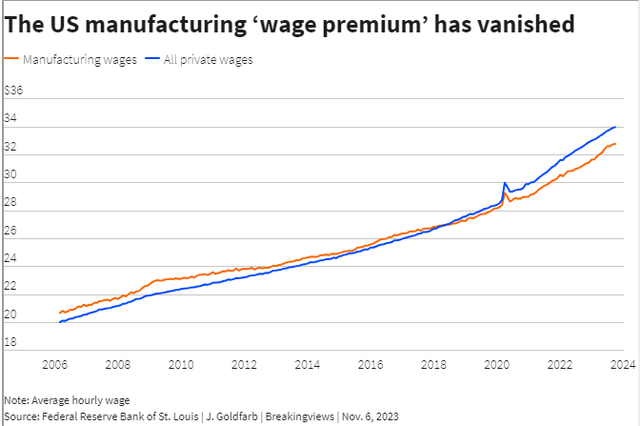

On top of that, workers don’t necessarily covet manufacturing jobs as they used to, with a decline in unionization blamed for the erosion of an average 3% hourly wage premium that existed over other private sector jobs as recently as 2006, a Federal Reserve study found last year.

Pay growth is also cooling faster for production and manufacturing jobs, at 4.2% year-over-year in August, down from an 11% annual peak in December 2021 and compared to the national average of 4.5%, according to jobs website Indeed.

By 2030, technological and cognitive skills in the manufacturing sector will be in far higher demand as the share of physical and manual tasks drops by more than a quarter from 2016, McKinsey says.

Many of the jobs targeted under Biden’s push also are less likely to provide retirement plans and healthcare insurance that compare favorably to national averages, as assessed by the University of Massachusetts-Amherst Political Economy Research Institute.

Whether the private sector is willing to do all this alone is questionable. There are already calls from industry groups for the public sector to do more, including subsidize vocational education and childcare.

Uncle Sam is already financially strapped, however, having committed to plenty of fiscal stimulus that will further bloat the national debt.

Looser immigration policy also might help fill the manufacturing employment void, but opening the borders even a crack more is a political hot button that few elected officials will be ready to press.

The U.S. manufacturing engine may be humming along now, but employment-related complications threaten to throw sand in the gears.

Context News

The number of U.S. manufacturing jobs dipped by 35,000 in October to a seasonally adjusted 13 million, due in large part to worker strikes at automakers, the Bureau of Labor Statistics reported on Nov. 3.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.