Habrovich/iStock via Getty Images

The global medical devices market was ~$489B in 2021, and is projected to increase to ~$496B in 2022. However, it is expected to expand to ~$719B by 2029, according to Fortune Business Insights, meaning several companies are set to benefit handsomely.

The consulting firm sees a CAGR for the industry of 5.5% between 2022 and 2029.

There are several reasons for the increase. The first is that there is an increase in the prevalence of chronic disease around the world. Citing data from the International Diabetes Foundation, there were 537M people with diabetes in 2021. That figure is projected to jump to 643M in 2030 and 783M in 2045.

Fortune Business Insights noted that increased healthcare spending in developed and emerging countries, as well as improved reimbursement policies, is also fueling growth.

The firm also noted that due to a shift in preference among the elderly for home healthcare services, there has been growth in portable and wearable devices for treatment of chronic conditions.

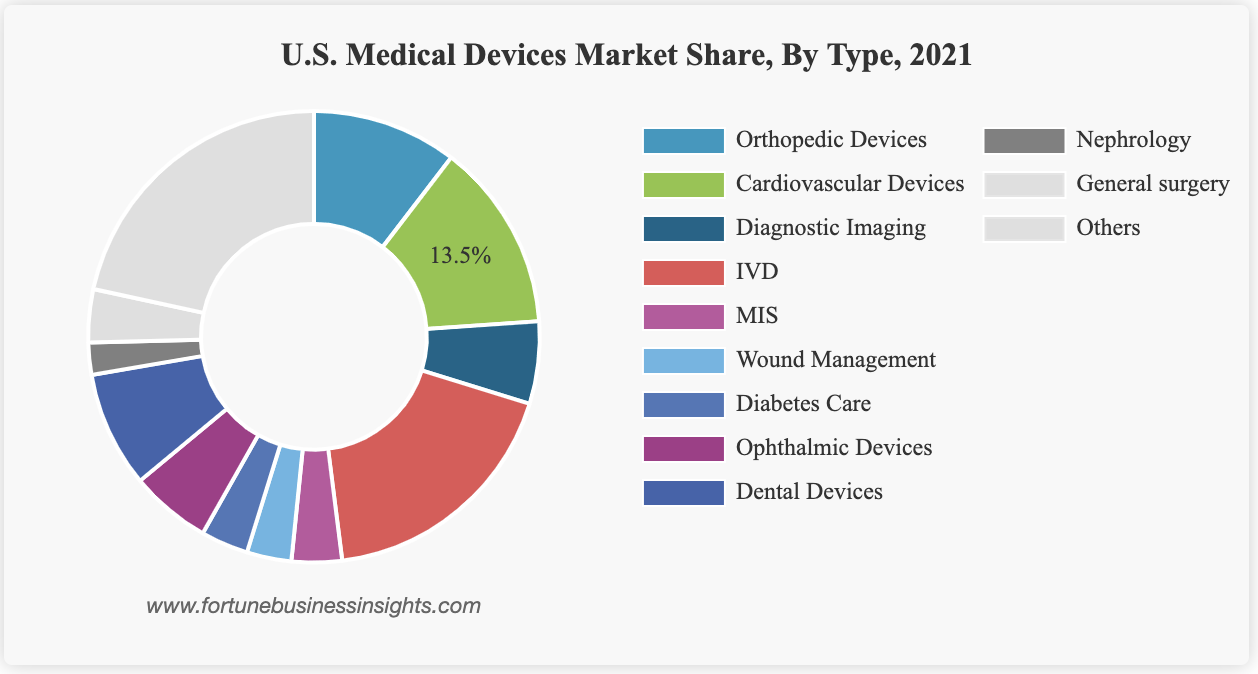

The US accounts for 40% of the global medical device market, according to AdvaMed, a trade association. Fortune Business Insights found that the largest device segment in the U.S. is in-vitro diagnostics (IVD), followed by cardiovascular devices and orthopedic devices.

Fortune Business Insights noted that the IVD segment is expected to grow at a higher CAGR due to an increase in the use of real-time diagnostics tests used in the diagnosis of diabetes, cancer, and HIV/AIDS.

Based on these insights, there are several companies set to benefit from an increase in demand for medical devices. These include the top three medical device companies based on 2021 revenue: Medtronic (NYSE:MDT), Abbott (NYSE:ABT), and Johnson & Johnson (NYSE:JNJ).

Fortune Business Insights noted that Medtronic (MDT), Abbott Laboratories (ABT), Johnson & Johnson (JNJ), and Stryker (NYSE:SYK) accounted for the majority of the global share of the device market in 2021.

Although Medtronic (MDT) operates several segments, it is perhaps known for its cardiovascular portfolio. But its products in medical surgical, neuroscience, and diabetes show that the company is well-positioned to benefit in multiple device areas. Seeking Alpha contributor Michael Dolen, who sees Medtronic (MDT) as a buy, argues the company could see massive growth over the next 5-15 years.

Abbott’s device portfolio is focused on diabetes care, cardiovascular (pacemakers, cardiac mapping), pain and movement products (spinal cord stimulation, deep brain stimulation), and a host of diagnostics products. Its Freestyle Libre line of glucose monitors are among the most popular in the US.

In its recently released Q3 2022 earnings, revenue in the medical device segment declined 0.5% globally to ~$1.7B compared to the prior-year period.

Johnson & Johnson (JNJ) division DePuy Synthes houses its orthopedics division (joint reconstruction, spine, sports medicine, and cranio-maxillofacial devices) and the Ethicon division provides surgical systems and instruments. Its interventional solutions business provides tools for heart rhythm disorders and neurovascular care.

In its Q3 results, J&J (JNJ) reported that revenue in its medtech segment increased ~2% year over year to ~$6.8B.

Stryker (SYK) operates in two major segments: medsurg/neurotech and orthopedics/spine. Seeking Alpha contributor Wolf Report noted that these areas have a total addressable market of ~$72B together. The company has also been on a bit of an M&A streak having acquired TMJ, Gauss, and Thermedx in 2021.