Dragon Claws

ETF Overview

The SPDR FTSE International Government Inflation-Protected Bond ETF (NYSEARCA:WIP) seeks to provide investment results that track the FTSE International Inflation-Linked Securities Select Index, which seeks to provide exposure to inflation-linked bonds of developing and emerging market countries outside of the U.S.

WIP currently has net assets of ~$409 million and has an expense ratio of 0.50%. The fund currently holds 176 securities, has an average maturity of 10.95 years, and a yield to maturity of 6.78%.

High Management Fee

WIP has a fairly high expense ratio of 0.50% for a passive product. To put that into context, the average fixed income ETF expense ratio is ~0.11%. Comparably, the Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) has an expense ratio of just 0.04% while the iShares TIPS Bond ETF (TIP) has an expense ratio of 0.19%.

As an investor, I work diligently to avoid high management fees (active or passive), as I believe they are often an overlooked headwind when investing.

WIP’s fee of 0.50% strikes me as particularly high given the fact that investors are not getting any active management but rather passive index replication. Moreover, the fund is invested primarily in high quality fixed income assets which have a lower return potential than most securities and thus the management fee represents a larger percentage of the fund’s expected return overtime.

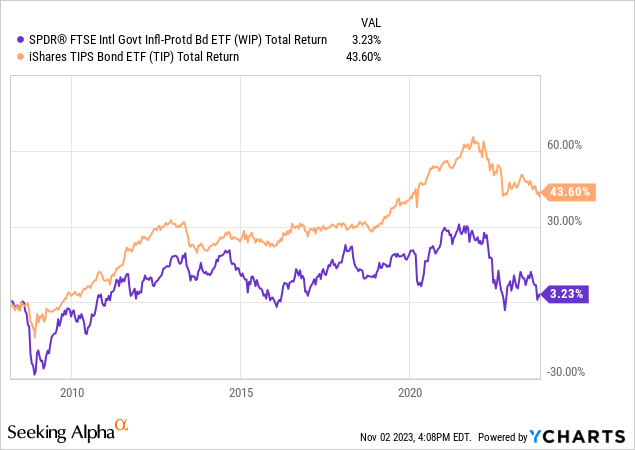

Weak Relative Historical Performance

WIP launched in March 2008 and has significantly underperformed other fixed income inflation-protected vehicles. Since inception, WIP has delivered a total return of ~3.2% compared to a total return of 43.6% delivered by the iShares TIPS Bond ETF (TIP) during the same period.

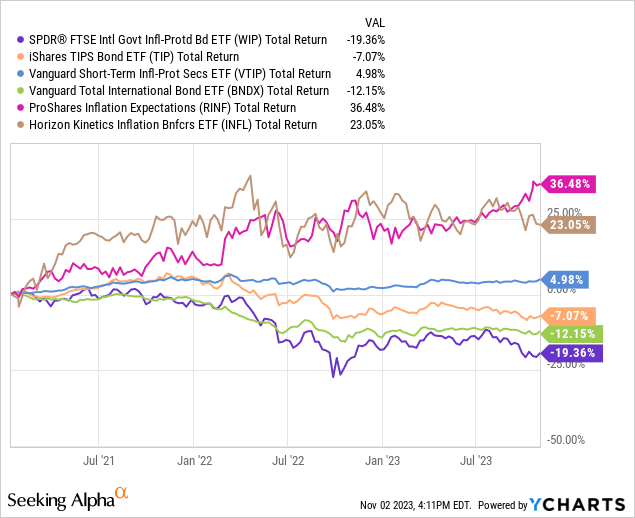

Over the past three years, which has been a highly inflationary period, WIP has performed very poorly compared to host of alternative inflation products. Over the past three years, WIP has delivered a total return of ~-19.4%. This compares to a total return of ~-12.1% delivered by the Vanguard Total International Bond ETF (BNDX) which is focused on fixed rate securities. Inflation protected fixed income products have fared better with TIP delivering a total return of ~-7% and VTIP delivering a total return of ~5% over the past three years.

One of the best performing inflation products over the past three years has been the ProShares Inflation Expectations ETF (RINF) which bets on long-term breakeven rates and has delivered a total return of ~36.5%. Another strong performer has been the Horizon Kinetics Inflation Beneficiaries ETF (INFL) which I recently featured in a separate piece: INFL: Consider A Lower Cost Approach To Bet On Inflation.

Holdings Analysis

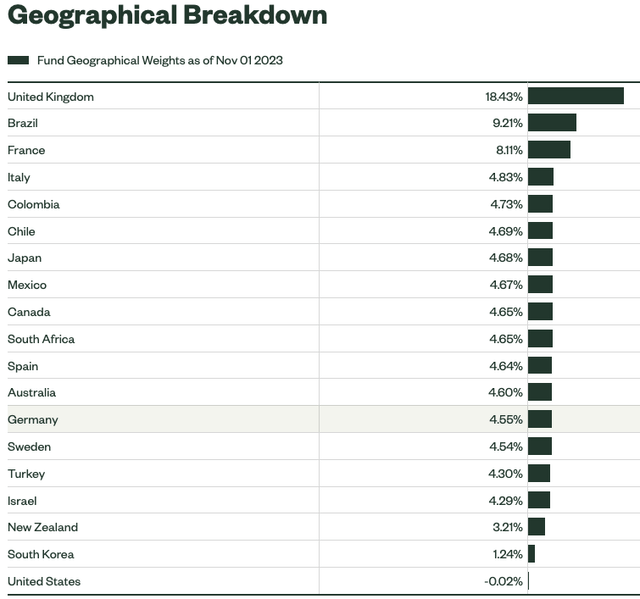

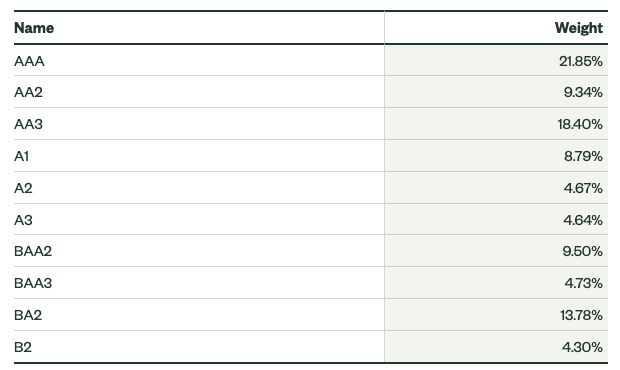

As shown by the table below, WIP is fairly diversified but exposure to the United Kingdom stands out as particularly large at 18.4% of the fund total.

One thing that I believe it is important to point out is that WIP includes significant exposure to emerging market countries including Brazil, Colombia, Chile, Mexico, South Africa, and Turkey. Holdings of securities in these countries make up ~32% of the total fund. Given the high percentage of WIP that is exposed to these countries, I believe it is important to note that WIP has material credit risk. Additionally, WIP has significant exposure to Italy and Spain which also carry some degree of credit risk.

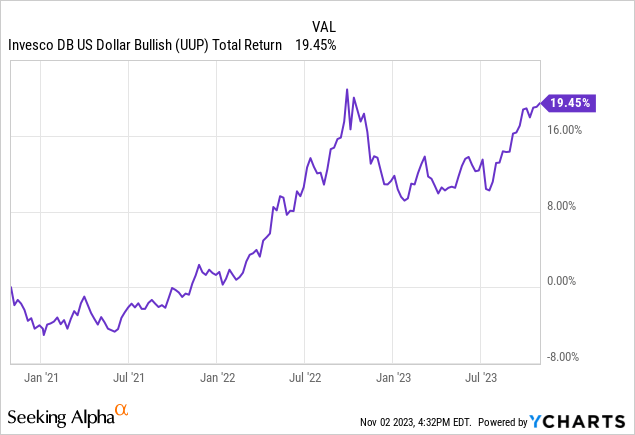

In addition to having credit risk, WIP also carries foreign exchange risk as the fund is exposed to currency moves related to each holding. Exposure to foreign currencies has proved a major headwind over the past three years due to a strong dollar. As shown by the chart below, the U.S. Dollar proxied by the Invesco U.S. Dollar Bullish ETF (UUP) has rallied ~19.4% over the past few years.

State Street State Street

My Preferred Alternatives to WIP

WIP is driven by many risk factors including duration, emerging market credit, emerging market fx, and developed market fx. For this reason I do not believe WIP represents a high quality way to bet on inflation.

Fixed income investors who want to bet on rising inflation should consider an ETF such as the ProShares Inflation Expectations ETF (RINF) as a viable alternative. RINF is effectively a pure play on inflation as it targets exposure to the 30-year TIPS (Treasury Rate-Hedged ETF.) Thus, RINF is a more isolated bet on future inflation as it hedges out all duration and focuses on providing exposure to changes in breakeven levels. RINF has performed very well over the past three years and I would expect that to continue in the event inflation expectations increase from current levels.

Equity investors should consider overweighting equities that benefit from rising inflation such as energy companies, mining companies, and exchanges. I cover this strategy in more detail in another piece I recently published here.

Conclusion

WIP represents a relatively unique ETF as it is one of the only ETFs to focus on international inflation protected bonds. However, WIP charges a very high management fee for a passive product. WIP has a history of relative underperformance compared to the other inflation products such as TIP, RINF, INFL, and VTIP

WIP is not a pure play on inflation as it also includes a significant amount of credit risk and foreign exchange risk.

Fixed income investors who want to consider expressing a bullish bet on inflation may want to consider RINF as a viable alternative to WIP. Additionally, investors who prefer to express a bullish view on inflation via equities should consider high quality companies in the energy, mining, or exchanges sectors.