Taconic Partners repurposed a 325,000-square-foot office building it owned in Manhattan’s West 50s … [+]

On the surface, the news from the New York City office sector may look grim: vacancy rates nearing 20%, occupancy rates stubbornly stuck at around 50%, interest rates rising, values dropping, anemic investment sales activity and owners giving keys back to lenders.

Fortunately, that isn’t the full story. As I discussed in my previous Forbes article, landlords are holding onto Class A, well- tenanted buildings even as they let go of others. Additionally, four other strategies show long-term health for the office sector:

- Repriced assets are attracting investors to properties with current weak fundamentals but strong potential.

- Entities such as Hyundai, NYU and Enchanté are snapping up buildings for their own use.

- New York City’s housing crisis has prompted developers to consider office to residential conversions, which I explored in a March 2023 Forbes article.

- Also, while office finds its footing, there is another workplace and innovation asset class that continues to see strong demand citywide: life sciences. In fact, this demand is leading a number of owners to explore activity in this appreciating sector.

Life Sciences: Its Own Category

New York City-based developer Taconic Partners, through its subsidiary Elevate Research Properties, is an example of a firm that has seized the opportunity to build life sciences centers after seeing a market gap for options available both to growing innovators and major research institutions and hospital systems. This gap, along with the specialized expertise needed to bridge it, led to the formation of Elevate Research Properties in the first place.

“New York receives the highest amount of National Institute of Health research funding in the country but lags far behind other major cities when it comes to real estate space suitable for life sciences tenants,” said Chris Balestra, President and Chief Investment Officer of Taconic Partners, who was a panelist at Ariel Property Advisors’ July Coffee & Cap Rates event and a recent podcast guest.

New York City has around 2 million square feet of life sciences space compared to 60 million square feet in San Francisco and 40 million square feet in Boston.

And yet, New York City is well-positioned to be a powerhouse in life sciences. The sector already contributes $3.1 billion to the City’s gross metropolitan product and offers unique assets such as:

● Nine major academic medical centers and over 50 hospitals

● 10+ incubators to support early-stage life sciences companies

● New York City research centers that receive over $2 billion in annual funding from the National Institutes of Health (NIH)

● 5,100 life sciences companies, with industry-leading firms attracting more than $1 billion in annual venture capital investment

● 150,000 related jobs

● 7,000+ graduate students and postdocs at universities

“The research is happening here, but then the tenants have to leave to go elsewhere for lab space,” Balestra said. “The vacancy rate for completed and occupiable lab space is practically zero in New York City, so obviously we saw an opportunity to create more space. The imbalance between supply and demand is extreme here.”

The scarcity is showing up in the numbers with the average asking rent for lab exclusive space in Manhattan rising to $122.23/SF NNN in the first quarter, up 19% from 1Q 2022, according to CBRE. In contrast, the overall average asking rent for office space in Class A & B buildings in Manhattan was $74.42/SF gross in 1Q 2023, Colliers reported. There are, however, a range of factors in pricing lab space, including an extensive specialized building infrastructure.

The New York City Economic Development Corporation (NYCEDC) recognizes the potential of the life sciences sector and is committed to seeing it flourish. Through LifeSciNYC, NYCEDC is making a $1 billion investment in life sciences research and development, allocating $430 million for lab and incubator construction and $450 million to spur new research.

Repurposed Buildings vs. New Development

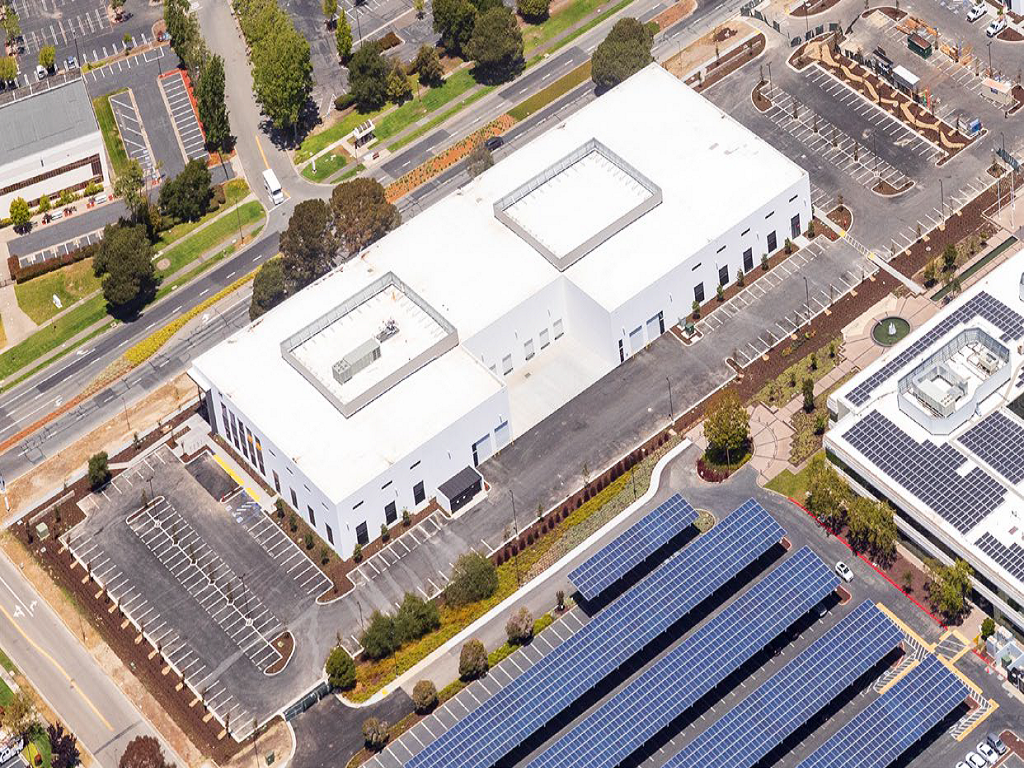

Taconic Partners, which has developed and repositioned over 12 million square feet of office, mixed-use, and retail space, and close to 6,500 units of multifamily housing in the last 25 years, ventured into the life sciences sector after the New York Stem Cell Foundation Research Institute approached the firm about five years ago with a request for lab space.

The Research Institute was specifically interested in a 325,000-square-foot office building Taconic owned in the West 50s that was built in the 1930s as a film-editing house for Warner Brothers Pictures. Taconic agreed to repurpose space for the Research Institute and then constructed additional turnkey lab space and upgraded the building infrastructure to support life sciences tenants, creating what is now called the Hudson Research Center.

Balestra said Taconic Partners and Elevate Research Properties have since expanded their life sciences projects into three additional developments, including the following:

● West End Labs, New York’s newest Class-A research facility, was recently completed and announced its first tenant: Graviton Bioscience. Located at 125 West End Avenue, the $600 million, 400,000-square foot development features a state-of-the-art lab infrastructure, prebuilt lab suites, a 300-person conference and event space and a 15,000-square foot landscaped roof terrace with views of the Hudson River. Originally built by Chrysler as an auto service center and showroom, the property served as part of the New York City headquarters for Walt Disney Company/ABC from 1985-2021.

West End Labs, a $600 million, 400,000-square foot development at 125 West End Avenue, features a … [+]

● A third site, Iron Horse Labs at 309 East 94th Street on the Upper East Side, will combine ground-up construction with an existing structure and stitch the two together to create a brand new 200,000-square-foot, state-of-the-art, purpose-built research laboratory. The building will be near world-class research institutions on the Upper East Side including Memorial Sloan Kettering Cancer Center, Mt. Sinai, The Rockefeller University, and Weill Cornell Medicine.

Iron Horse Labs will be a brand new 200,000-square-foot, state-of-the-art, purpose-built research … [+]

● Finally, Elevate Research Properties is the designated developer for a 550,000-square-foot, new ground-up facility in Kips Bay near the planned Science Park and Research Campus (SPARC), a 1.5 million-square-foot, state-of-the-art jobs and education hub that is being developed by the City and State in partnership with The City University of New York (CUNY). These new developments will join the premier research institutions in the area including NYU Langone Medical Center and NYC Health + Hospitals Bellevue, as well as lab space at the Alexandria Center for Life Sciences and CURE at 345 Park Avenue South.

Candidates for Conversion

So, is every half-empty commercial building in New York City a candidate for conversion to life sciences use? Not really. There is a more specific set of requirements that make these projects viable.

According to Balestra, the list of must-haves for life sciences buildings includes:

● Proper zoning

● The ability to support the addition of a robust infrastructure that includes adequate power, backup power and a sophisticated HVAC system

● Significant floor load ratings, far greater than what is needed for a typical office floor

● Ceiling heights that are in the 13- to 15-foot range

● Ideally, a building that is vacant

● A sufficient budget to cover buildout costs that are far greater than for traditional offices, and on top of that, higher expenses for installing supplemental systems

Decentralized Network

Unlike Cambridge, MA, or San Francisco where life sciences facilities are centralized, new or repurposed buildings in New York City are scattered throughout Manhattan and the boroughs. In addition to the West Side, Upper East Side and Kips Bay locations cited above, I’ve listed a few additional sites below:

● West Harlem has a growing cluster that includes over 500,000 square feet at three private developments: the Taystee Lab, Sweets and Mink buildings.

The 350,000-square-foot Class A, new construction Taystee Lab Building in West Harlem.

● The New York Genome Center’s headquarters at 101 Avenue of the Americas just north of Canal Street, offers over 170,000 square feet for research and development, including 30,000 square feet of sequencing lab space.

● Innolabs, Alexandria Bindery and additional new projects will bring a total of 1.25 million square feet of lab and office space online in Long Island City, Queens, by 2024.

● The Montefiore-Einstein Accelerated Biotechnology Research Center (EMBARC), a bio-manufacturing operation focused on cell, gene, and antibody therapy production is planned for the Bronx; as well as the Einstein Incubator, which will offer premier lab space for early-stage life sciences and biotech startups.

● A new 50,000-square-foot biotech incubator is planned for the Brooklyn Navy Yard that will be supported by a $20 million contribution from the LifeSci NYC initiative.

Evolving Sector

No doubt, the New York City office market is undergoing major structural changes because of post-pandemic occupancy declines and interest rate hikes. However, these challenges are bringing opportunities to investors and owner-users as the basis of the assets are well below replacement costs, and they are forcing owners and developers to see office buildings through a new lens, one that could lead to future conversions to life sciences or residential use.

In the latest Coffee & Cap Rates Podcast, Shimon Shkury, President and Founder of Ariel Property … [+]