Unlock the White Home Watch publication without cost

Your information to what the 2024 US election means for Washington and the world

The Federal Reserve will not be anticipated to chop rates of interest on Wednesday however the US central financial institution’s coverage is already beneath scrutiny from President Donald Trump.

Traders overwhelmingly count on the Fed to carry charges at their present stage of 4.25-4.5 per cent, after three consecutive cuts since September.

Consideration will give attention to any shift in outlook from the accompanying assertion, and on remarks from chair Jay Powell within the subsequent press convention.

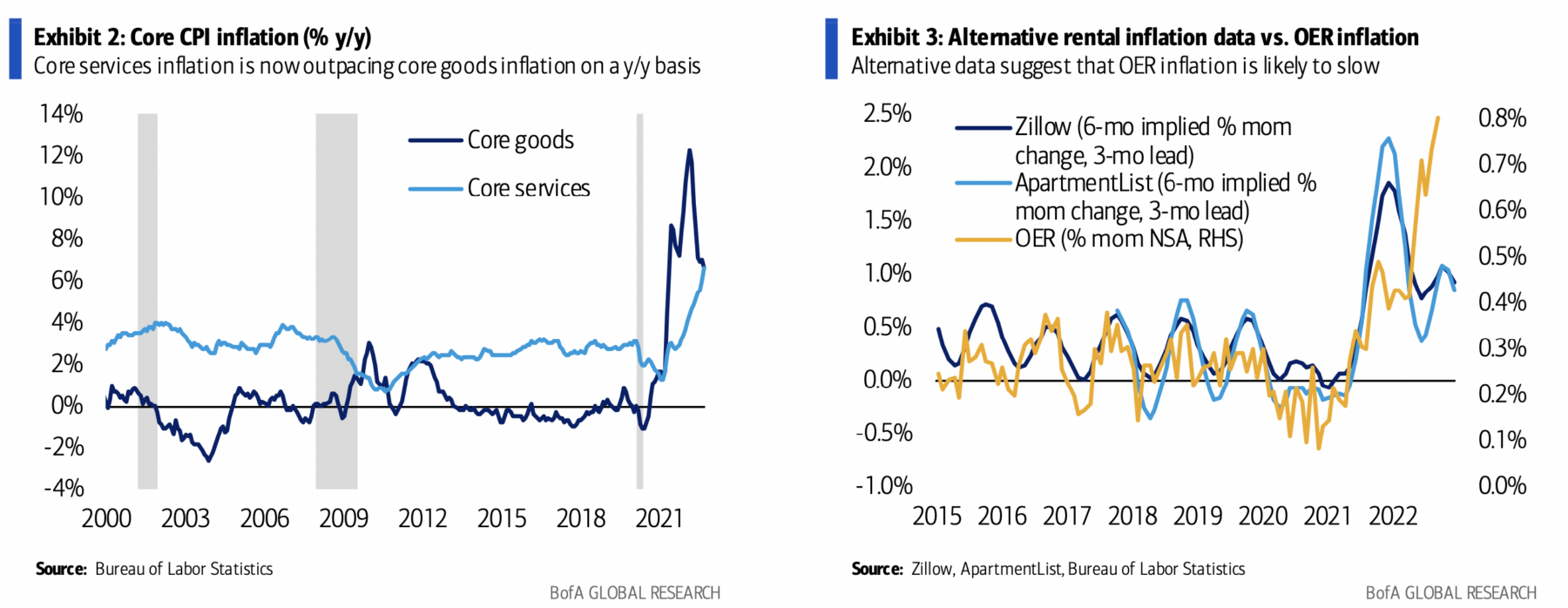

In December the Fed signalled a probable pause in charge cuts and mentioned it could think about the “extent and timing” of any additional adjustments. Since then, information has proven slowing inflation and strong jobs progress — a mixture that has sparked debate over the necessity for, and timing of, any additional charge cuts.

“If the [Fed] wished to ship an additional hawkish sign in January, this sentence might be modified once more,” mentioned HSBC US economist Ryan Wang. “We count on the Fed to chorus from sending such a sign, however it is a hawkish danger.”

However Powell is prone to face questions on early actions and feedback from Trump, who this week mentioned he would demand that rates of interest drop. The president additionally referred to as for decrease oil costs, which may additionally have an effect on inflation.

Trump has beforehand referred to as for Powell’s exit however each have downplayed any friction since November’s election.

The Fed chair additionally made it clear in November he deliberate to serve out his present time period and maintained too that the president couldn’t take away him. Jennifer Hughes

Will the ECB sign a extra aggressive rate of interest coverage?

After European Central Financial institution President Christine Lagarde final month got here nearer than ever to calling victory over inflation, traders expect one other rate of interest minimize on Thursday.

Markets have totally priced in one other 0.25 proportion level charge minimize from policymakers in Frankfurt. If confirmed, that might be the fifth such discount since June and would take the important thing deposit charge to 2.75 per cent, the bottom stage in nearly two years and 1.25 proportion factors decrease than at its peak in 2024.

In doing so, markets count on the ECB to low cost December’s soar in annual inflation again to 2.4 per cent. It’s assured that annual value will increase this yr will probably be near its medium-term goal of two per cent, whereas financial progress is prone to disappoint.

However nearly half of the 72 contributors in a Monetary Instances survey amongst European economists mentioned that the ECB had been too sluggish in reducing charges.

“We don’t see ourselves behind the curve,” Lagarde instructed CNBC in an interview in Davos this week the place she attended the World Financial Discussion board.

Merchants expect two or three additional quarter-point cuts this yr, in response to ranges implied by swaps markets.

With the US Fed turning into far more hawkish in December, a rising transatlantic hole in financial coverage seems to be opening up.

Lagarde instructed CNBC that the ECB was not “overly involved” about potential repercussions for Europe from a possible uptick in inflation within the US. Olaf Storbeck

Will the Financial institution of Canada minimize charges?

Merchants are broadly anticipating the Financial institution of Canada to chop rates of interest by 1 / 4 level at Wednesday’s policy-setting assembly however a small query mark stays, given latest tendencies in financial information.

Swaps markets are pricing in a 90 per cent chance the central financial institution will minimize its benchmark charge by 0.25 proportion factors to three per cent from 3.25 per cent.

However when the Financial institution of Canada took half a proportion level off its in a single day charge in December for the second assembly in a row, responding to weaker than anticipated financial progress, deliberations from its governing council confirmed that the choice between a quarter-point and half-point minimize was a “shut name” given blended information and famous the “substantial” cumulation of latest reductions.

Members could be evaluating the necessity for additional reductions within the coverage charge “one assembly at a time”, the financial institution mentioned in a abstract of their deliberations, and “anticipated a extra gradual method to financial coverage going ahead”.

Knowledge since then present that Canada’s economic system was rising “roughly in line” with the central financial institution’s forecast, in response to Capital Economics. It additionally highlighted inflation information for December, that whereas together with a decline to 1.8 per cent within the headline charge, indicated {that a} measure of underlying inflation tendencies was “uncomfortably excessive”.

Such pressures may give the central financial institution, which has additionally cited uncertainty created by the brand new US administration, the grounds to pause its charge cuts.

“With tariffs clouding the financial outlook, we decide that the governing council will go for a [quarter-point] coverage charge minimize,” mentioned Thomas Ryan, North America economist at Capital Economics. Ian Smith