iQoncept

Why are share repurchases so common?

When corporations have further money, they could pay dividends to shareholders, carry out inventory buybacks (additionally known as share repurchases), make investments the cash again into the corporate, or a mixture of the three, which is mostly the case.

Corporations typically select buybacks over dividends as a result of there are a number of benefits.

1. The corporate will increase its earnings-per-share ((EPS)) by decreasing the variety of shares excellent.

This additionally lowers the price-to-earnings (P/E) ratio, which often drives up the inventory value. Briefly: it makes the corporate’s outcomes look marvelous and offers us, the traders, a much bigger piece of the pie.

2. Inventory buybacks have huge tax benefits for shareholders holding investments in taxable accounts.

Certified dividends are taxed on the long-term capital good points tax fee, which is 0%, 15%, or 20%, relying in your tax bracket. The 15% fee applies to most individuals because it encompasses incomes between $41,675 and $459,750 for single filers.

Firms protect traders from this tax through the use of further money for buybacks as an alternative of dividends. This manner, traders will not have a taxable occasion till they promote the shares.

There are different ancillary advantages however let’s not get fully slowed down in weeds.

What’s the new excise tax on inventory buybacks?

The U.S. company tax fee has modified many instances in its historical past. It now stands at 21%, the bottom fee for the reason that Nineteen Forties. Earlier than the Tax Cuts and Jobs Act of 2017, the speed was 35% going again to 1993 and far larger going again to the Nineteen Fifties.

This has left some corporations with hoards of money and precipitated inventory buybacks to blow up – one thing cheered by shareholders and never appeared upon fondly by some folks and politicians. Complete buybacks in 2021 have been round $850 billion.

With Apple (NASDAQ:AAPL) main the best way.

The brand new tax seems fairly easy – a 1% excise on the worth of share repurchases to be paid for by the corporate.

How will the brand new tax have an effect on Apple and its shareholders?

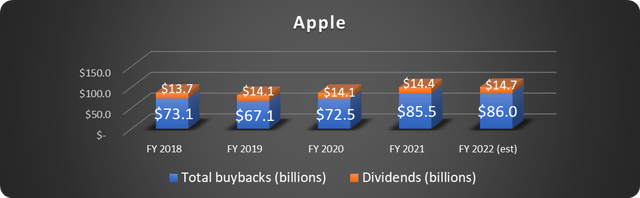

Apple buys again its inventory at an unimaginable tempo. Buybacks will complete practically $385 billion over the past 5 fiscal years as soon as 2022 is within the books, as proven under.

Knowledge supply: Apple. Chart by writer. 2022 estimate by writer primarily based on figures by Q3.

$385 billion quantities to just about 14% of Apple’s present market cap.

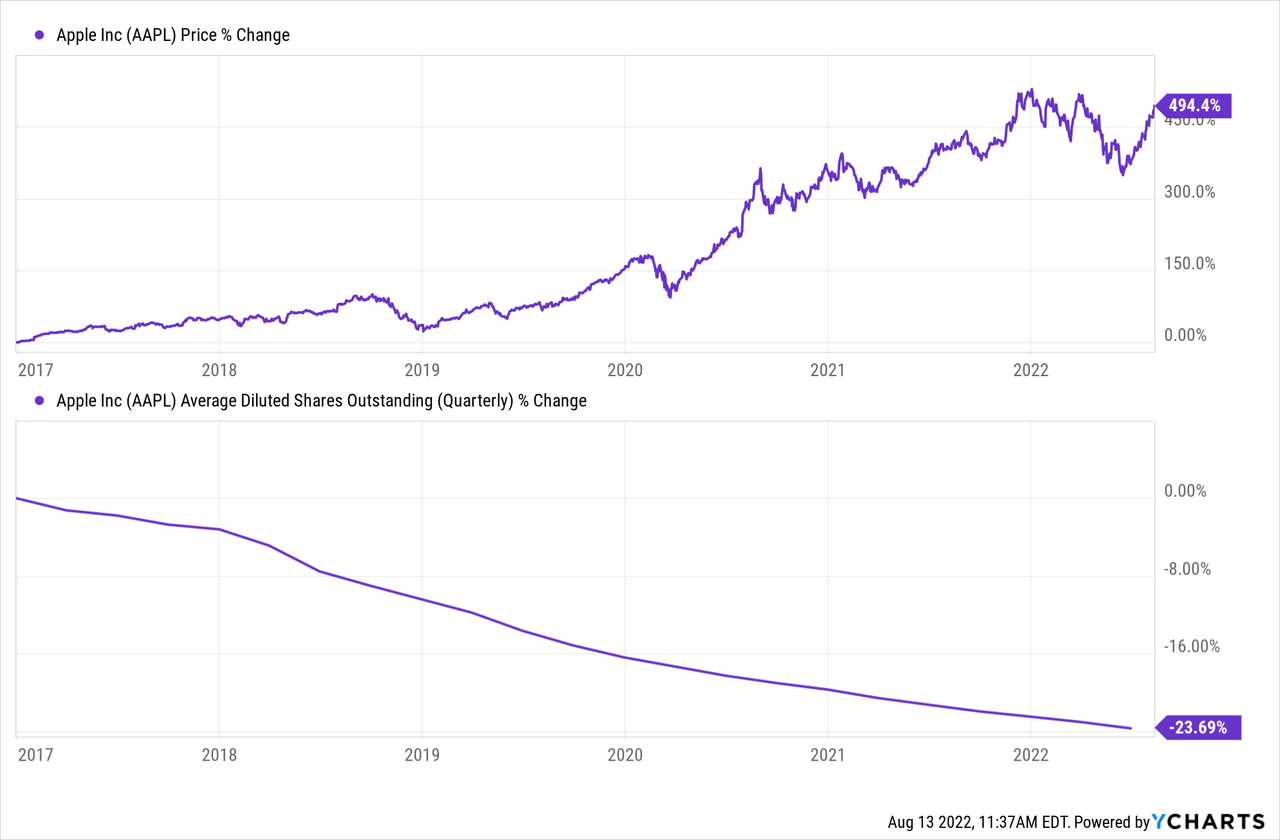

The inventory’s value has soared because the excellent shares have shrunk significantly, as proven under.

The brand new tax would price Apple about $860 million yearly on the present tempo of buybacks.

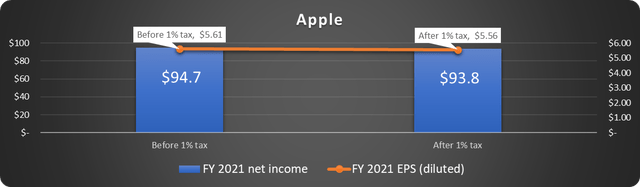

Apple reported $94.7 billion in web earnings for fiscal 2021. The 1% buyback excise tax would scale back this to round $93.8 billion. It could additionally cut back diluted EPS from $5.61 to about $5.56, as proven under.

Knowledge supply: Apple. Chart and after 1% figures by writer.

Apple inventory at present trades at 30.7 instances fiscal 2021 EPS. Making use of the identical ratio to the decrease EPS determine would theoretically drop the share value by about $1.50 – hardly a market-moving determine.

After all, it isn’t that easy. Many different ratios that traders use to worth shares will not be affected in any respect, so the inventory value is just not destined to fall a certain quantity.

What choices does Apple have?

Apple has a number of maneuvers it may possibly make.

First, corporations will doubtless considerably speed up buybacks by the tip of 2022 as a result of the tax will not take impact till 2023.

Subsequent, many have prompt that corporations merely repurchase 99% of the deliberate quantity and use the 1% saved to pay the tax. This can be a terrific plan if money circulate is the chief concern. However it can nonetheless damage web earnings and EPS barely.

Apple might additionally select to extend the dividend and decrease buybacks. This may decrease the corporate’s tax burden. Nevertheless it has two vital drawbacks. First, the share rely will not shrink as rapidly, so EPS will nonetheless be affected. Second, it basically shifts the tax burden to shareholders. That is exacerbated as a result of many shareholders pays 15% tax on these dividends – properly above the 1% excise tax fee.

So what is the backside line?

It boils right down to figuring out essentially the most advantageous solution to reward shareholders with billions of {dollars} of free money circulate – what a superb drawback to have!

The tax will in all probability have a trivial adversarial impact on shareholders of corporations who spend super quantities of cash on buybacks. Alternatively, the company tax fee remains to be the bottom in lots of many years, and shares proceed to be premium autos for wealth accumulation.

The perfect path ahead for Apple is to proceed enterprise as normal and foot the 1% tax for shareholders.