Earnings season happens every three months. This is when companies share details on their recent financial performance, which helps investors understand how the company is operating.

Companies file these reports because they have to. Under SEC regulations, they’re required to do so within 45 days of the end of the quarter.

Investors can spot trends in the reported data. They can also use the numbers to determine whether a stock is a buy or sell.

Analysts also pay attention to the reports. They use that data to update their models. Timely data should help analysts provide accurate forecasts. However, that doesn’t exactly happen.

A Typical Earnings Season

The most recent quarter was typical. Over three-quarters of companies in the S&P 500 Index beat analysts’ expectations. Generally, about 15% miss expectations. In an average quarter, less than 10% of companies deliver earnings equaling the estimate.

These are the most widely followed companies in the world. Yet analysts almost always underestimate earnings. Over the past 20 quarters, an average of 77% of companies beat expectations in a quarter. Over 10 years, the average beat rate is 73%.

Even though they’re wrong, earnings estimates are useful.

All of those errors don’t really amount to much. For the companies in the S&P 500 Index, all those earnings beats increased earnings by about 4.8%.

Reported earnings for the second quarter are $54.80, up $2.50 from the estimate when earnings season started. That’s a little below average. Typically, earnings beat estimates by an average of 6.4%.

Earnings for the S&P 500 aren’t the sum of the earnings for the companies in the index. Results are weighted by the size of the stock. Apple (Nasdaq: AAPL) carries the most weight in the S&P 500, about 7.6%. That amount of its earnings are applied to the index earnings figure.

We can use estimated earnings to find price targets for the index.

Finding Price Targets for S&P 500

For the end of 2023, analysts expect S&P 500 earnings of $219.41. Earnings in 2024 are expected to be $244.06.

A price-to-earnings (P/E) ratio provides a price target. The current P/E ratio for the index is about 20.5. That’s near the long-term average. The 10-year average is 20.3. The 25-year average is 19.95.

Based on 2024 earnings and an average P/E ratio, the price target is 5,003, about 2% higher than the current price.

But the P/E ratio has been much higher than average. The 25-year high is 30.7. At that level, the price target is 7,492, a gain of more than 53%.

The P/E ratio could also be lower than average. The 25-year low is 11.95. That yields a price target of 2,916. That’s 40% lower than where we are now.

Using earnings estimates, we see that prices could move significantly higher or lower. The direction of the trend will depend on sentiment.

For now, sentiment is bullish. That points to potentially higher prices.

Regards,

Michael CarrEditor, Precision Profits

Retail Sales Reports Show How “Real America” Is Doing

I’ve been covering the plight of the American consumer for weeks now, and we have a real treasure trove of new data to sort through…

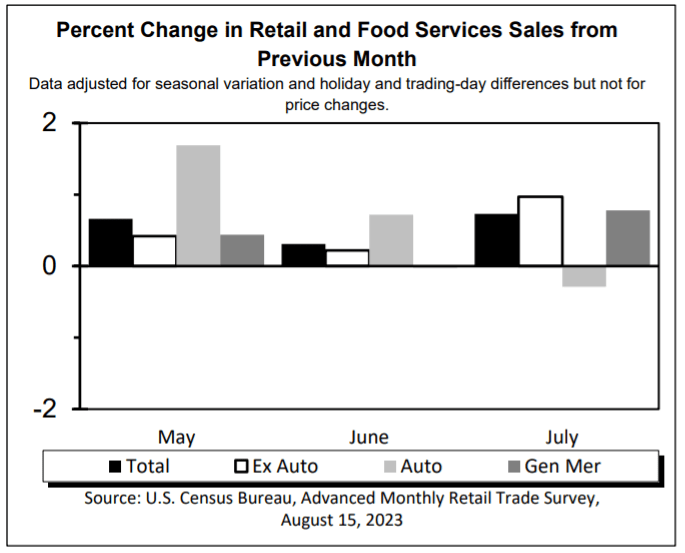

Let’s start with the retail sales report for July. At first glance, it didn’t look too shabby. Total retail sales were up 0.7% over June and up 3.2% over July of last year.

Of course, those numbers aren’t adjusted for inflation.

And inflation has been running hotter than 3.2% over the past year.

But while this growth isn’t robust, the numbers don’t seem to paint a picture of the American shopper sheathing their credit cards either.

Digging deeper, the numbers get more interesting…

Furniture stores saw sales down 6.3%, and electronics stores and home improvement stores saw shrinkage of 3.1% and 3.3%, respectively.

And what do these have in common?

They’re all related to the home.

With these high mortgage rates, Americans are moving less, and are therefore buying less.

Now, the real bright spot on the report was in restaurants and bars, where spending was up nearly 12% over last year.

Again, some of this is inflation, but certainly not all of it. Americans, despite feeling the pinch, are still enjoying dinner and drinks away from home.

How “Real America” Is Navigating the Economy

Target, the retail store, also released its earnings this week.

This is something I read every quarter. If you want to see how Main Street Americans are doing in this economy, read the quarterly reports of Target and Walmart.

And then listen to what management is saying.

This is mainstream, mass-market America and you can often see trends forming here before they show up in government statistics, months later…

Well, the news coming out of Target isn’t great. The retailer slashed its estimates for the remainder of the year. It indicated that consumers are focusing on necessities and delaying their purchases of discretionary items.

But there was one comment by Michael Fiddelke, Target Chief Financial Officer, that got my attention:

“The resumption of student loan repayments is one of many factors that we’re watching really closely.”

Sound familiar?

I’ve been warning about this for months.

Economics is an exercise in what people do with that next marginal dollar. If the cost of your basic necessities has risen by a dollar, then it’s one dollar less you have available to spend elsewhere or save.

Hence, Target’s comments that higher grocery prices mean less money to spend on clothes and home goods.

The typical student loan payment is anywhere from $200 to $500 per month. Well, wages aren’t automatically rising by $200 to $500 per month. So again, that means that every dollar spent on debt repayment is a dollar coming out of other spending.

Now, I mentioned yesterday that Warren Buffett is implicitly betting on the American consumer, via his $700 billion investment in homebuilders (and also credit card issuers).

But also remember this: Sometimes segments of the population do well, even while other segments really struggle.

I’ll be keeping an eye on this, as I expect this tug-o-war in conflicting economic data will continue to create opportunities for us for the rest of this year — especially in short-term trading strategies.

Mike Carr is an expert when it comes to this kind of trading: efficient, targeted, with a focus on high-quality investments. If you want to learn more about what he’s working on in his Trade Room, go here for more details.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge