Up to date on Might twelfth, 2022 by Quinn Mohammed

Earnings traders is likely to be reluctant to even contemplate shopping for shares of an organization that doesn’t pay a dividend.

However, capital allocation selections usually are not written in stone.

Whereas tech large Meta Platforms, Inc. (FB)–previously referred to as Fb–doesn’t supply a dividend at the moment, we consider it might provoke a dividend in time.

Meta Platforms has grown so giant that it’s now extremely worthwhile, with large free money circulation, and an enormous amount of money on the steadiness sheet.

Consequently, it might be part of many different know-how shares which have begun paying dividends to shareholders lately.

You’ll be able to obtain a free spreadsheet of our complete know-how shares record (together with vital monetary metrics equivalent to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

This text will talk about Meta Platform’s enterprise mannequin, progress prospects, and why a dividend is just not an unreasonable expectation in some unspecified time in the future sooner or later.

Enterprise Overview

Meta Platforms is a social media large, with a market capitalization of ~$531 billion. Fb is the unquestioned chief in social media.

Its household of choices additionally contains Instagram, WhatsApp, Messenger, and extra.

Fb started as many start-ups do, with rising income however a scarcity of profitability. Nonetheless, all that modified when the corporate successfully monetized its huge person base.

Fb and its numerous properties symbolize huge promoting platforms.

And, given the period of time customers spend on the location, Fb is solely a gold mine for promoting potential. Cellular promoting income represents the overwhelming majority of complete promoting income.

Supply: Earnings Presentation

The result’s that Fb is now enormously worthwhile.

Over the primary quarter of 2022, income elevated 7.0% in contrast with the identical interval in 2021. Earnings-per-share decreased 18% within the first quarter of 2022, in comparison with a yr in the past.

For the reason that fourth quarter of 2021, Meta Platforms reorganized its reporting segments. The corporate now has two reporting segments.

Its Household of Apps (FoA) phase contains its conventional social media platforms equivalent to Fb, Instagram, Messenger, WhatsApp, and different providers. In Q1 2022, FoA income elevated 6.1% year-over-year to $27.2 billion.

The Actuality Labs (RL) phase contains augmented and digital actuality associated client {hardware}, software program, and content material. In Q1 2022, RL income elevated 30.1% year-over-year to $695 million.

Development Prospects

Fb’s progress potential stays engaging. Whereas the corporate is nearing saturation within the U.S.— general the Fb neighborhood continues to develop.

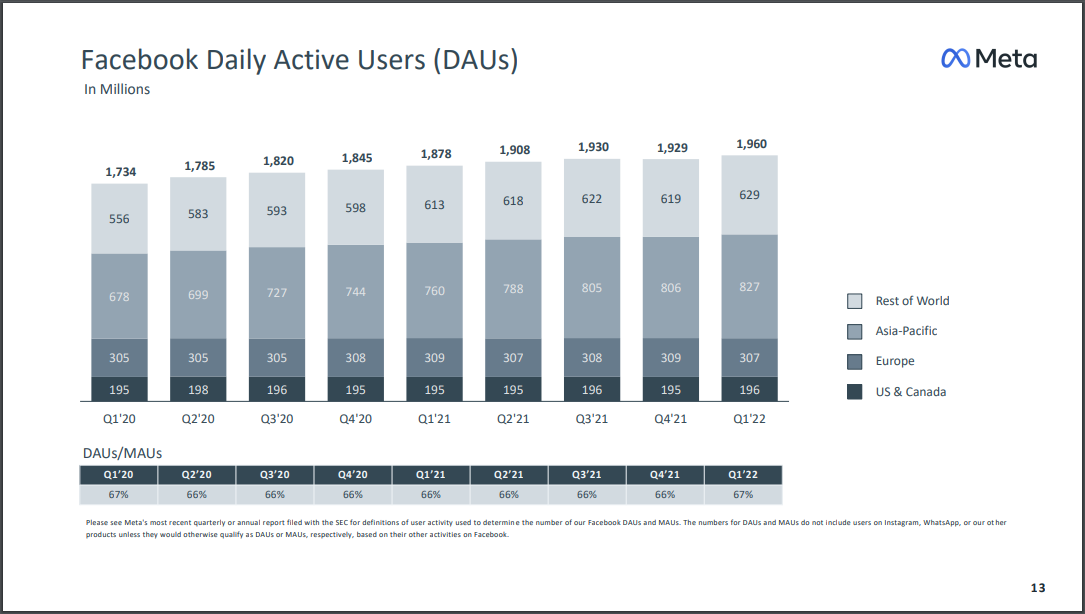

Every day energetic customers have been 1.96 billion on common on the finish of the primary quarter, a rise of 4% year-over-year.

Supply: Earnings Presentation

On the similar time, billions of individuals around the globe nonetheless don’t use Fb or considered one of its different platforms, leaving an enormous world progress alternative for the corporate within the years forward.

To make certain, Meta Platforms should dedicate an enormous quantity of economic assets to acquire this progress. Certainly, 2022 capital expenditures are anticipated to succeed in $29 billion to $34 billion.

Meta Platform’s progress potential is amplified by the corporate’s huge aggressive benefits. Particularly, it has come to dominate social media.

Shoppers merely love social media and look like unwilling to do with out it (evidenced by the variety of each day energetic customers who use Fb daily and each month).

It is vitally troublesome for one more social media model to enter the area and efficiently take customers away from Fb, Instagram, or its different worthwhile properties.

As well as, Meta Platforms is investing in various new avenues for future progress, in digital actuality, synthetic intelligence, and the metaverse.

These are thrilling areas of potential progress for the tech business, and Meta Platforms is poised to be on the forefront of those new applied sciences.

Why Meta Platforms May Pay A Dividend

There are good causes for a corporation to announce a dividend.

Along with enhancing investor sentiment by rewarding loyal shareholders with dividend earnings, initiating a dividend payout opens up a brand new and enormous group of institutional traders who handle income-oriented funds.

Earnings traders who beforehand wouldn’t have invested in a non-dividend paying inventory equivalent to Meta Platforms, would doubtless be enticed by a dividend payout.

Plus, Meta Platform’s fundamentals appear to assist a dividend fee, as the corporate is very worthwhile.

Based mostly on consensus analyst estimates, Meta Platforms is anticipated to generate earnings-per-share of $11.63 for 2022.

The corporate might theoretically announce a major dividend, whereas nonetheless leaving loads of money circulation for reinvestment into progress initiatives.

For instance, if Meta Platforms maintained a goal payout ratio of 25% of annual EPS, the corporate might declare an annual dividend payout of ~$2.91 per share primarily based on 2022 EPS estimates.

This is able to symbolize a dividend yield of ~1.6% primarily based on the present share worth.

Whereas this would definitely not high quality Meta Platforms as a excessive dividend inventory, traders shouldn’t count on excessive yields from the know-how sector.

For context, a dividend yield of 1.6% would give Meta Platforms a comparable, albeit barely increased, yield to different dividend paying tech giants equivalent to Apple Inc. (AAPL) and Microsoft (MSFT).

And, Meta Platforms might develop its dividend at a excessive fee annually, notably with a beginning payout ratio of simply 25% and the corporate’s future EPS progress potential.

Initiating a dividend would hardly impression the corporate’s monetary place, as Meta Platforms ended the 2022 first quarter with money, money equivalents, and marketable securities of $43.89 billion.

Meta Platforms has a present ratio (which compares short-term property to short-term liabilities) of two.8x, which is pretty excessive and signifies greater than sufficient short-term liquidity.

By just about any measure, Meta Platforms has huge monetary assets and ample liquidity, definitely sufficient to distribute a portion of its money circulation to shareholders with out jeopardizing its present monetary place or future progress.

Closing Ideas

The standard cause an organization chooses to not pay dividend to shareholders is that it merely doesn’t have the monetary energy to take action.

Small firms in a high-growth stage, or cyclical firms with inconsistent profitability, have to protect as a lot money circulation as doable.

Associated: Dividend shares versus progress shares.

Nonetheless, Meta Platforms is clearly not in its start-up section. It’s a huge firm and a money circulation machine.

It additionally has a fortress steadiness sheet with an enormous amount of money. Essentially, there may be little cause for Meta Platforms to not pay a dividend. It has loads of money for progress funding, after which some.

Dividends have turn out to be way more commonplace within the know-how sector lately.

Meta Platforms doesn’t but pay a dividend, however traders shouldn’t be fully shocked to see a dividend payout introduced in some unspecified time in the future within the coming years.

See the articles beneath for evaluation on whether or not different shares that at the moment don’t pay dividends, will at some point pay a dividend:

- Will Twitter Ever Pay A Dividend?

- Will Shopify Ever Pay A Dividend?

- Will PayPal Ever Pay A Dividend?

- Will Superior Micro Units Ever Pay A Dividend?

- Will Chipotle Ever Pay A Dividend?

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].