Up to date on Might 14th, 2022 by Felix Martinez

Specializing in dividend-paying firms – ideally those who improve their payouts each 12 months – is a tried-and-true technique to climate all kinds of financial storms. The consistency of receiving a money cost each single quarter helps alleviate the volatility that inevitably exhibits up in enterprise efficiency and definitely with day-to-day fluctuations in inventory costs.

Extra importantly, a protracted document of paying and growing dividends is a sign of a mature and enduring enterprise that generates extra cash than it requires. For this reason we advocate earnings traders think about high-quality dividend shares such because the Dividend Aristocrats, a gaggle of 65 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

You’ll be able to obtain an Excel spreadsheet of all 65 (with metrics that matter equivalent to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

After all, the counterpoint to this notion is that an earnings investor misses out on all kinds of fast-growing firms that haven’t but determined to begin paying a dividend. A great instance of this may be JD.com (JD), which has returned almost 13.4% per 12 months for the final 5 years.

With such wholesome returns, earnings traders would possibly marvel if JD.com will ever pay a dividend. This text will try and reply that query.

Enterprise Overview

Based in 1998 and headquartered in China, JD.com Inc. is China’s largest on-line retailer and its greatest general retailer. The corporate is a one-stop e-commerce platform offering over 569.7 million energetic prospects entry to merchandise. By means of the corporate’s logistics community and data-driven applied sciences, prospects take pleasure in same- and next-day supply as an ordinary service.

JD Worldwide permits manufacturers from all over the world to promote on to Chinese language prospects, even those who wouldn’t have a bodily presence within the nation. U.S. traders can provoke an possession stake by way of American Depository Shares (ADS), representing two unusual shares, traded on the NASDAQ change with the “JD” ticker.

Final 12 months the corporate generated $149.3 billion in gross sales and earnings-per-ADS of $(0.36). Roughly 88% of the gross sales of the $74.4 billion market capitalization firm’s revenues are derived from merchandise, with the rest from providers.

Development Prospects

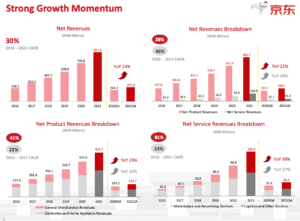

Supply: Monetary and Operational Highlights

JD.com has quite a lot of tailwinds at its again. Maybe the most important of which is being positioned in China, which has exhibited sturdy development tendencies for fairly a while. The full Chinese language retail market has grown by almost 8.3% per 12 months relationship again to 2012. Even so, the market is rather more fragmented than the U.S., with the highest 20 retailers holding lower than 17% of the market, in comparison with virtually half of the marketplace for the highest 20 U.S. retailers.

Not solely is China, on the whole, rising in a short time, however the on-line section is growing quickly as effectively. Penetration is growing considerably, and the scale of the Chinese language on-line retail market is turning into bigger and bigger. In 2012 the web area made up roughly 6% of the market. This 12 months it’s approaching a fourth of the general market.

This has allowed for important development at JD.com because it stands squarely in the course of this tailwind:

Supply: Monetary and Operational Highlights

Web revenues have elevated by a 28% annualized price within the house forex through the 2016 to 2021 interval. Service income particularly is sort of spectacular, however it’s clear that development has been throughout the board. Provided that the corporate’s tailwinds are nonetheless very a lot in place, it seems JD.com’s development runway is way from over.

Aggressive Benefits

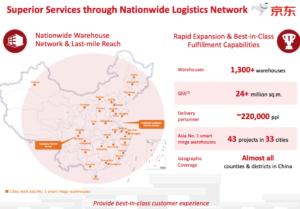

Supply: Monetary and Operational Highlights

An fascinating side of JD.com’s market in comparison with the U.S. is that the potential market is far bigger, however the competitors is smaller. That is useful for 2 causes.

First, because the chief out there, JD.com stands to gather its “fair proportion” of development over time. Second, and simply as importantly, there may be sufficient development to go round, which means that one firm’s acquire will not be essentially one other firm’s loss.

Supply: Monetary and Operational Highlights, JD.com

JD.com additionally has an immense nationwide community that serves as an enduring aggressive benefit. It might be very tough for an upstart to match the size and attain of JD.com. This benefit offers three noticeable advantages: 1) conserving would-be opponents at bay, 2) permitting for an improved price construction by way of scale, and three) conserving the client proud of fast and reliable service.

As of the newest report, JD.com held $11.1 billion in money, $47 billion in present property, and $77.9 billion in whole property towards $34.8 billion in present liabilities and $39.2 billion in whole liabilities. Lengthy-term borrowings had been zero which is sort of spectacular for such a big firm that’s rising as quick as it’s.

Will JD.com Ever Pay A Dividend?

Any profitable enterprise works by way of totally different phases of needing and allocating capital. To start with, firms are often capital-intensive, requiring important funds. Fairness is issued and debt is sought, whereas money flows haven’t but materialized.

Within the development section profitability is feasible, however the focus is commonly on reinvestment as a substitute. This often means reinvesting all money flows and persevering with to hunt extra capital by way of debt or fairness.

As soon as an organization begins to mature, the cycle begins to unwind itself. Debt and fairness can nonetheless be used, however usually the earnings being generated are greater than sufficient to service, maintain, and even develop (albeit at a slower price) the now a lot bigger enterprise. Additional, debt is decreased to a manageable stage and an organization could start repurchasing shares. Lastly, a dividend could also be thought of, indicating that the corporate is sustainable and producing extra funds.

When interested by JD.com in that framework, JD.com remains to be very a lot within the development section. The income development price of JD.com has been improbable – rising from $27 billion in 2015 to an expectation of over $150 billion this 12 months – however that has not but translated into terrific bottom-line outcomes. JD.com misplaced cash in 2015, 2016, and 2018 and barely broke even in 2017. Additionally, final 12 months the corporate did publish $(0.40) in earnings-per-ADS. Nonetheless, this 12 months we anticipate the corporate to make $0.84 per ADS. Nonetheless, consistency in outcomes has not but been established.

If JD.com started paying out a $0.50 annual dividend – a large quantity for this 12 months’s anticipated earnings – this may suggest a present dividend yield of 0.1%. Nonetheless, this may interrupt the expansion trajectory of the corporate. Within the brief to intermediate-term JD.com will not be anticipated to pay a dividend. The main target will proceed to be on sturdy top-line development and reinvesting within the enterprise, very like Amazon.com (AMZN).

Nonetheless, this doesn’t imply that the corporate won’t ever pay a dividend. Typically, there are three issues to search for to supply some perception into when this will happen: a manageable debt load, a stabilizing share depend, and maturing development.

The debt load is already manageable, as JD.com has executed a pleasant job of rising rapidly with out placing undue strain on the stability sheet. Certainly, the stability sheet seems fairly wholesome.

The share depend exhibits some indicators of being leaned on. JD.com’s ADS share depend stood at ~1.36 billion in 2015, in comparison with ~1.60 billion as of the newest report. This isn’t extreme, however it does provide you with an concept of the place further funds are being sourced. When the share depend begins stabilizing, with out the corporate taking up extra debt, this might point out a turning level in capital allocation.

Lastly, when the top-line development begins to gradual, or extra importantly when the bottom-line begins to point out consistency, this is also an inflection level in capital allocation.

Ultimate Ideas

JD.com has been a really profitable funding as of late, compounding shareholder cash at almost 13% per 12 months for the previous 5 years. This success is pushed by very sturdy top-line enchancment, however the bottom-line has not but demonstrated the identical consistency.

The corporate remains to be very a lot centered on development and reinvestment. In that vein, a dividend will not be doubtless within the brief or intermediate-term.

Over the long run, if JD.com is ready to convert its sturdy top-line development into constant bottom-line outcomes, there could come a time when the corporate has extra funds out there. At this level, the corporate might deal with the stability sheet, acquisitions, retiring shares, or sending money to shareholders.

See the articles beneath for evaluation on whether or not different shares that at present don’t pay dividends will at some point pay a dividend:

- Will Alphabet Ever Pay A Dividend?

- Will Shopify Ever Pay A Dividend?

- Will PayPal Ever Pay A Dividend?

- Will Pinduoduo Ever Pay A Dividend?

- Will Adobe Ever Pay A Dividend?

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].