Cunaplus_M.Faba

When I last wrote an article on Seeking Alpha, I mentioned back in June that all of this “hype” over death and destruction to the Midwest corn (CORN) and soybean (SOYB) crop was likely overdone. Indeed drought easing Midwest rains are often associated with El Nino and grain prices collapsed. It is soft commodities that can be the most adversely affected by El Nino.

Ah, El Niño! Picture this: a climate superstar strutting its stuff with warm sea surface temperatures in the central and eastern tropical Pacific Ocean. But here’s the twist – it’s not just about impressing the ocean waters. No, no. El Niño loves to throw weather patterns around the world in a whirlwind dance, and guess who gets a front-row seat to the show? That’s right, various industries, including our friendly neighborhood agriculture scene.

So, let’s talk sugar – the sweet stuff that makes life just a little more exciting. When El Niño takes the stage, it’s like a symphony of effects on our sugar production and prices. Some effects are right in your face, while others are more subtle, like the balloon in your favorite song.

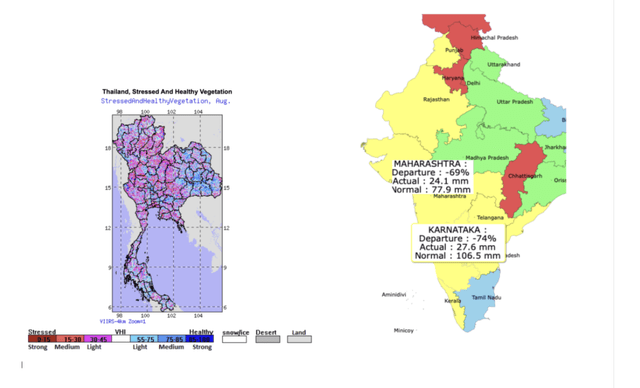

Rainfall Patterns and Crop Production? El Niño’s got the power to switch things up. Picture this: some places get their socks soaked with heavy rainfall and floods, while others are stuck with the “drought chic” look. And guess what? Our sugarcane and sugar beet crops get in on the action. Too much rain and our fields start doing the waterlogged tango – cue disease outbreaks and not-so-fancy yield quality. But wait, there’s more! Drought conditions make our crops sweat it out, stressing them out and giving us smaller yields. Right now, my biggest concern for sugar crops is in Thailand and India. While India (#1 sugar exporter in the world had a great Monsoon, El Nino is now kicking in and August will be one of the driest in recent memory. Notice the dryness and crop stress on the maps below.

India and Thailand sugar crops are in trouble (Jim Roemer WeatherWealth newsletter (www.bestweatherinc.com))

Let’s not forget about Sugarcane Growth – the ultimate water lover. El Niño isn’t one to hold back, giving sugarcane fields a watery embrace that’s a bit too tight. Those roots can’t dance when they’re swamped, and the crop’s health takes a hit. But when El Niño’s feeling shy, drought conditions take center stage, leaving sugarcane thirsting for more water than it can find.

Transport and Logistics? Hold onto your hats, folks. El Niño’s not just about crops. It can whip up a storm of heavy rain and flooding that mess with the smooth moves of transporting sugarcane and sugar beets. Suddenly, getting those sweet crops from the fields to the processing centers is like navigating a wild obstacle course.

Last but not least, the Global Supply and Prices roller coaster. El Niño’s not just here to tease – it can seriously shake up the sugar market. When production takes a hit due to El Niño’s weather pranks, sugar becomes rarer than a unicorn sighting, potentially spiking prices.

Last Thursday, the International Sugar Organization (ISO projected 2023/24 global sugar production will fall -1.2% y/y to 174.8 MMT and that the global sugar market in 2023/24 will fall into deficit by -2.12 MMT from a 2022/23 global sugar surplus of +852,000 MT.

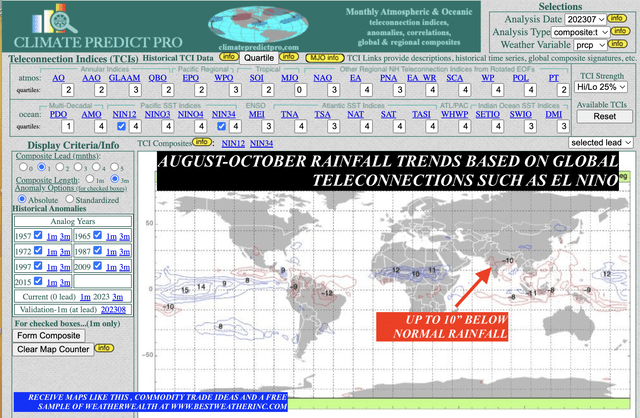

Sugar also has been supported by crop projection from sugar trader Czarnikow that Thailand 2023/24 sugar production would drop -31% y/y to a 17-year low of 7.4 MMT due to dry weather. The deficit situation for global sugar may become even tighter if my in-house ClimatePredict software is correct about the Indian Monsoon failing for the rest of the summer and early fall.

Global rainfall trends with El Nino (WeatherWealth newsletter)

The duration and intensity of the El Nino show also matter. And hey, let’s not leave out the other actors in this drama: demand changes, government policies, and those global trade dynamics that can turn the plot in a snap. Sugar prices are also watching the crude oil market and the Brazil Real. Both of these outside fundamental factors appear bullish and could help prices trend higher later this summer and fall.

So, buckle up, my friends. The El Niño roller coaster might just be the ride of the season, keeping us on the edge of our seats with its weather theatrics and the story it writes for our sweet, sweet sugar world.

Conclusion:

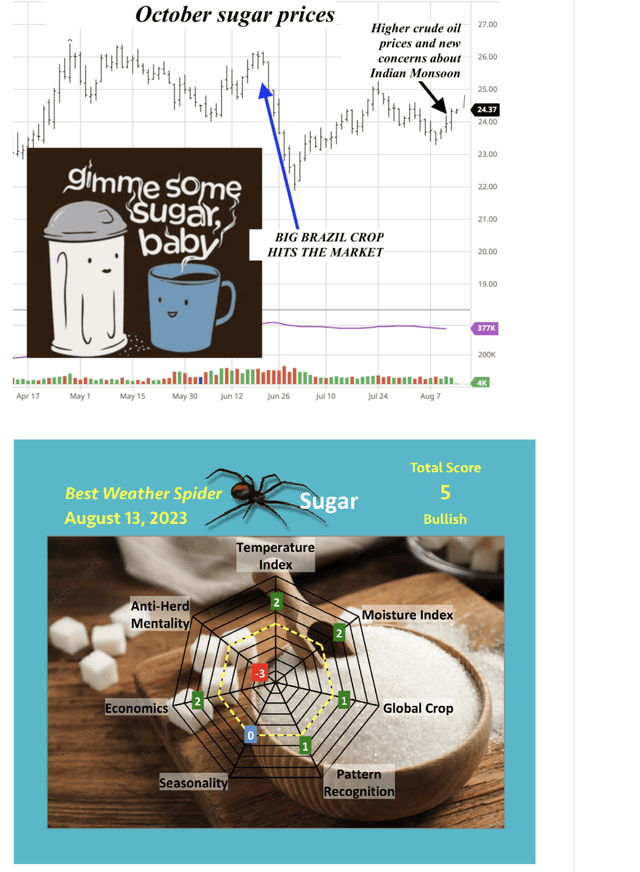

My Best Weather spider featured in my WeatherWealth newsletter has been in the slightly bullish camp again. The reason my weather spider is not super bullish (+10 or higher), is due to the potential of a big Brazilian crop (#3 largest sugarcane producer, behind Thailand and India). In addition, there is a heavy long position in the market by speculators. Nevertheless, my overall bias is cautiously friendly to the ETF (NYSEARCA:CANE), and buying any break below 23-24 cents could be a potentially profitable play in the futures market in the weeks ahead.

Sugar prices and BestWeather spider (www.bestweatherinc.com)