Este artículo también está disponible en español.

In keeping with knowledge from CryptoQuant, Bitcoin (BTC) reserves on cryptocurrency exchanges have dropped to a multi-year low. This decline coincides with the continuing bull market, which has pushed the digital asset’s worth nearer to the $100,000 mark. This vital decline might have main implications for the asset’s supply-demand dynamics.

Investor Confidence Growing In Bitcoin?

Throughout a bull market, Bitcoin reserves on exchanges enhance as long-term holders (LTH) and short-term holders (STH) switch their holdings to buying and selling platforms to take earnings. Nonetheless, the present bull market is breaking this pattern, as BTC trade reserves dwindle.

Associated Studying

Knowledge from Cryptoquant signifies that over 171,000 BTC have been withdrawn from crypto exchanges since pro-crypto Republican candidate Donald Trump received the November US presidential election. The excessive quantity of BTC being withdrawn from exchanges means that holders are doubtless transferring their holdings to chilly wallets, signaling long-term confidence in BTC.

In keeping with the chart under, BTC trade reserves witnessed a pointy decline beginning in November 2022 – falling from 3.33 million BTC on November 5, to 2.93 million BTC on December 21.

One other notable drop started in February 2024, doubtless in anticipation of the Bitcoin halving in April and the following provide shortage of the digitally-programmed asset. Throughout this era, reserves decreased from 3.05 million BTC to 2.63 million BTC by October 30 – a decline of 13.77% over eight months.

Trade reserves stand at simply 2.46 million BTC, the bottom degree in years. This ongoing decline hints at a possible provide crunch for Bitcoin, which might propel its worth upward within the coming months.

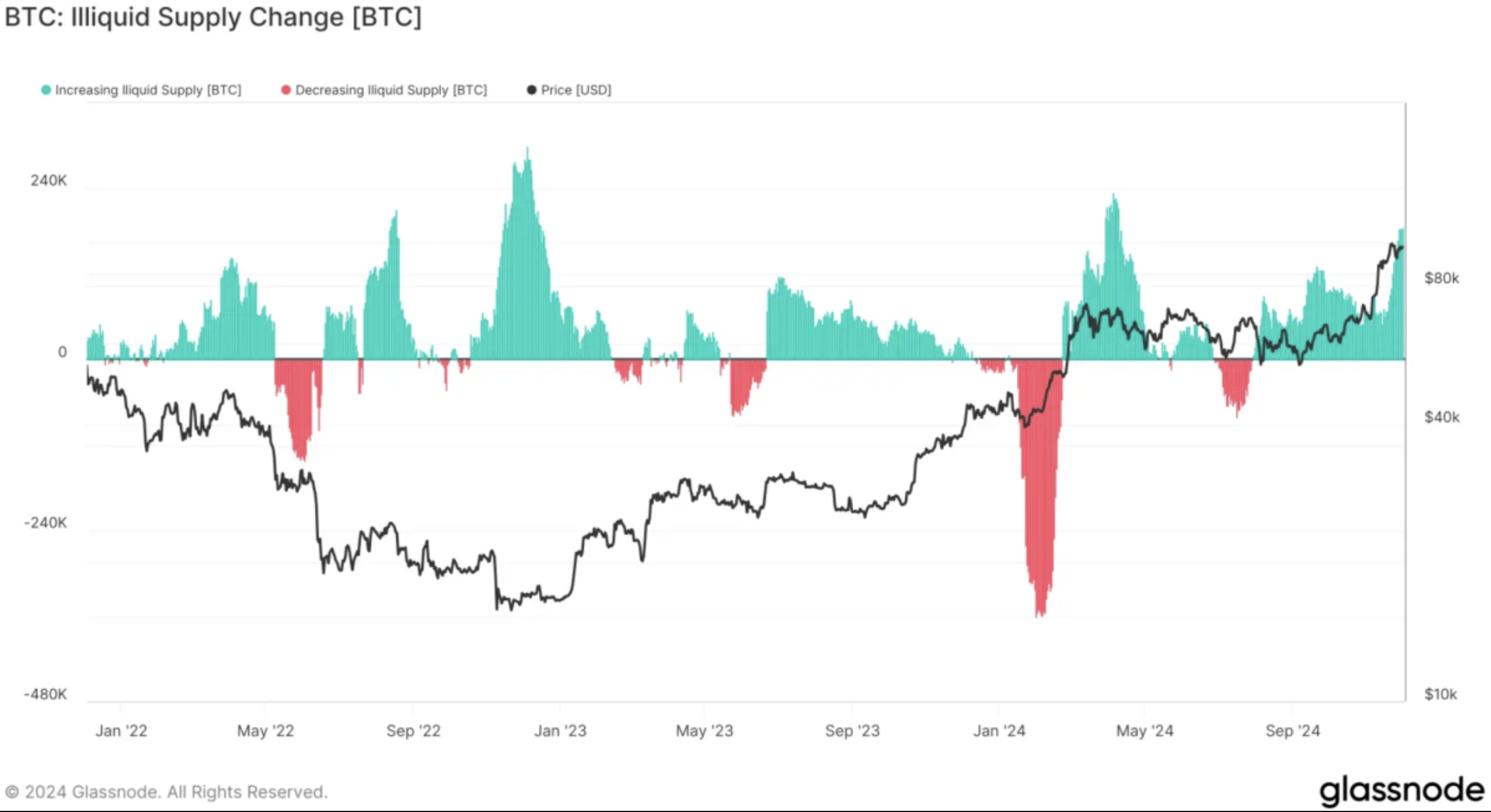

BTC Illiquid Provide Continues To Develop

One other knowledge level that helps the long-term holding speculation for BTC is Glassnode’s illiquid provide metric. The chart shared under exhibits that the digital asset’s illiquid provide has grown by 185,000 BTC up to now 30 days.

Notably, the illiquid provide now accounts for roughly 14.8 million BTC, representing practically three-fourths of the present circulating provide of 19.8 million BTC. If this pattern continues, Bitcoin’s worth might expertise a big surge attributable to provide shortage. Nonetheless, this might additionally introduce heightened volatility.

Associated Studying

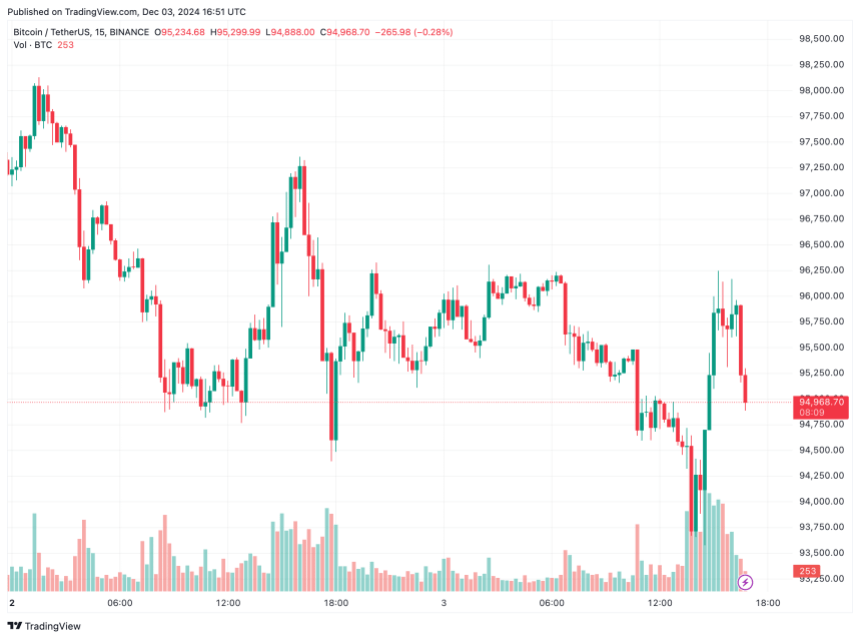

Whereas the decline in trade reserves and rising illiquid provide are long-term bullish indicators for Bitcoin, short-term worth actions might see a short correction. In accordance to crypto analyst Ali Martinez, BTC has shaped a head-and-shoulder sample on the hourly chart, which can set off a sell-off that may push the asset’s worth to $90,000.

That mentioned, one other seasoned crypto analyst, Rekt Capital, mentioned that after briefly touching the $98,000 worth degree, BTC has already entered the parabolic section of the rally. BTC trades at $94,968 at press time, down 1.4% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, Glassnode, X and Tradingview.com