We must learn from history or be doomed to repeat it. This includes honestly assessing the economy in 2023 so that we have better information for making decisions in 2024.

Starting with a bang on many people’s minds is housing affordability.

The year commenced with a surge in the average 30-year fixed mortgage rate from 6.5% in January to nearly 8% in October but has declined recently to about 6.6%. These higher mortgage rates and record-high housing prices contributed to an unaffordable housing market.

While existing home sales were up 0.8% in November, they are down 7.3% over the last year, indicating a struggling housing market for families that will unlikely improve much in 2024.

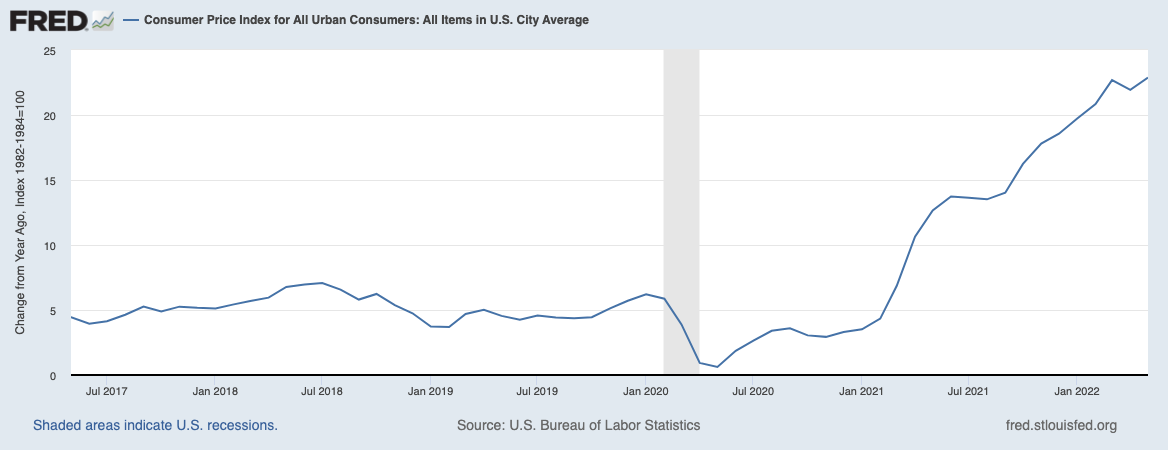

Another concern is costly inflation.

Rampant hikes in the cost of a typical basket of goods and services have meant less purchasing power for us. This contributes to making housing, food, education, and other expenses for that basket less comfortable or worse for many families.

As of November 2023, the core consumption personal expenditures increase was 3.2% year-over-year. This price measure of a basket of goods and services excludes food and energy and is what the Federal Reserve prefers to watch. While core PCE inflation has moderated from close to 6% in 2022, the recent 3.2% inflation rate remains 60% higher than the Fed’s average inflation target of 2%.

Although moderating inflation represents some relief for many Americans, the challenge is that average weekly earnings adjusted for core inflation declined in 23 of the last 35 months since January 2021. In total, these real average weekly earnings are down 0.8% since then, indicating why inflation is a top concern.

An additional problem is debt.

Because earnings haven’t been keeping up with inflation, credit card debt soared to more than $1 trillion as people struggled to make ends meet, which is a bad sign for 2024. And many people have been going through their savings and retirement funds quickly.

What about jobs?

The White House recently celebrated “total job gains achieved under the Biden administration reached 14.1 million through November 2023.” But this metric becomes less impressive considering that 9.4 million of those jobs were just recovering jobs lost during the pandemic lockdowns. So, there have been 4.7 million new jobs added since January 2021, which is 134,000 per month. While this is positive, it is not record-breaking.

The weaker labor market in recent months indicates that 2024 could be tough for many workers.

Most people’s pocketbooks did not grow but diminished this year, and the job market similarly lags. But what about the nation’s overall growth? Hasn’t GDP soared? Not exactly.

In the third quarter of 2023, the annualized real GDP growth hit 4.9%, which appears robust. But when you dig into the details, it’s more complicated.

Government spending, which is a drag on the economy as it must take taxes from the private sector and distort market activities, threw in 0.99 percentage points. And private inventories, influenced by the whims of fluctuating interest rate expectations, chipped in 1.27 percentage points. When you exclude those contributions to consider stable real private GDP, there was just a 2.6% bump up.

This slower pace didn’t just pop out of nowhere. It’s been a saga since early 2022, when we hit a two-quarter decline in real gross domestic product, waving a big red flag for a recession. And when you consider the valuable metric of real gross domestic output, which is the average or real gross domestic product and real gross domestic income, the economy has declined in three out of the last seven quarters.

While these economic issues suggest stagflation triggered by misguided pandemic lockdowns and subsequent trillions of new money printing of deficit-spending, there may be some relief.

The Fed’s slow correction to its bloated assets of $9 trillion at its peak to $7.7 trillion contributed to interest rates soaring since March 2022. But with Congress continuing to deficit spend of about $2 trillion per year and net interest payments soaring to $1 trillion per year, there are massive economic challenges ahead.

These deficits will make it more difficult for the Fed to correctly normalize its assets quickly to get them back to at least the pre-pandemic $4 trillion. This is because the budget deficits would contribute to higher interest rates, so the Fed will likely monetize the debt more to help Congress avoid needed spending restraint.

While these truths are tough to swallow, many beacons of hope also emerged throughout the year that should be noted.

In 2023, a momentous shift unfolded with a transformative surge in educational choice.

Twenty states expanded school choice, and a record-breaking 10 states passed some form of universal school choice, making 36% of American students eligible for a private choice program.

Some states have been slow to increase educational freedom, but this revolution’s overall impact is historical. Recognizing that children are the cornerstone of our nation’s future and acknowledging that improved education is a pivotal predictor of their success, the catalyst for change is undeniably rooted in more universal school choice.

The second bright light is the flat state tax revolution.

Many states took bold steps to enhance their economic landscapes. Notably, prominent states like California and New York faced ongoing out-migration as individuals sought refuge from progressive policies, and less heralded states embraced free-market principles, propelling them onto the national stage. More conservative Florida and Texas continued to lead the way in places where people moved in 2023.

The third thing to cheer is a responsible movement toward a sustainable state budget revolution.

Some states are pushing toward improving their spending limits to one that covers more of the budget, limits budget growth to no more than population growth plus inflation, and has a supermajority vote to bust the limit or raise taxes.

The synergy of these reforms demonstrates the power of federalism as states experiment with policies, revealing effective strategies and fostering a healthy laboratory of competition. We need lawmakers at the federal, state, and local governments to recognize what works and implement them.

The trajectory in 2024 and beyond hinges on embracing free-market capitalism, which is the best path to let people prosper. This includes less government spending, less money printing, more school choice, and more tax relief. In short, less government.

That’s how we get a more prosperous 2024. Happy New Year!

Vance Ginn, Ph.D., is the president of Ginn Economic Consulting, host of the Let People Prosper Show, and was previously the associate director for economic policy of the White House’s Office of Management and Budget, 2019-20. Follow him on X.com at @VanceGinn.