Up to date on Could nineteenth, 2022 by Aristofanis Papadatos

Superior Micro Units (AMD) is a high-growth tech inventory, with sturdy enterprise momentum and thrilling progress prospects forward. The inventory was buying and selling beneath $2.00 in early 2016 but it surely rallied as much as a peak of $164 in late 2021, thus rewarding its shareholders with life-changing returns.

The expansion of AMD accelerated in 2020-2021 because of the coronavirus disaster, which compelled folks to make money working from home and keep at house greater than ever, thus rising the necessity for computer systems and gaming gadgets.

The pandemic additionally triggered shortages within the world semiconductor market and thus provided supreme circumstances for AMD, which raised its costs significantly. Because of the tailwinds from the pandemic, AMD reached an all-time excessive of $164 in late 2021.

Nonetheless, the inventory of AMD has plunged 41% off its peak, principally resulting from its wealthy peak valuation and the continued bear market of the complete NASDAQ, which has resulted from the surge of inflation to a 40-year excessive and fears of an upcoming recession because of the aggressive rate of interest hikes of the Fed. However, regardless of its decline within the final six months, the inventory of AMD nonetheless has a 744% return over the past 5 years.

With a market cap of $153 billion, Superior Micro Units is a large-cap inventory.

You’ll be able to obtain your free copy of the large-cap shares record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Earnings traders might have missed the distinctive returns of AMD, as the corporate doesn’t pay a dividend. That is pretty frequent amongst progress shares, significantly these within the expertise sector, as it’s way more worthwhile to reinvest the earnings within the enterprise than to distribute them to the shareholders. Of the five hundred shares that comprise the S&P 500 Index, almost 90 don’t pay a dividend to their shareholders.

Earnings-oriented traders who’re attracted by the extraordinary returns of AMD might surprise if the corporate pays a dividend anytime quickly. Whereas the initiation of a dividend can’t be excluded sooner or later sooner or later, AMD is just not prone to provoke a dividend for a lot of extra years.

Enterprise Overview

AMD operates as a semiconductor firm worldwide. Its merchandise embrace x86 microprocessors as an accelerated processing unit (APU), chipsets and graphics processing models (GPUs). The most important section of AMD is the Computing and Graphics, which generates roughly two-thirds of the revenues of the corporate.

AMD at present has the strongest pocket book processor portfolio in its historical past. Quite a few AMD-based notebooks have come to the market within the final two years, as the corporate has expanded its presence in divisions like gaming, business and schooling, during which it has historically been a minor participant.

Associated: 5 High Gaming Shares.

Furthermore, AMD acquired Xilinx in February, in an all-stock deal valued at $50 billion. As the worth of the deal is 33% of the present market capitalization of AMD, it’s clearly a serious deal for the corporate.

Supply: Investor Presentation

Because of its acquisition of Xilinx, AMD has gained entry to new markets, which embrace many high-margin, long run income streams.

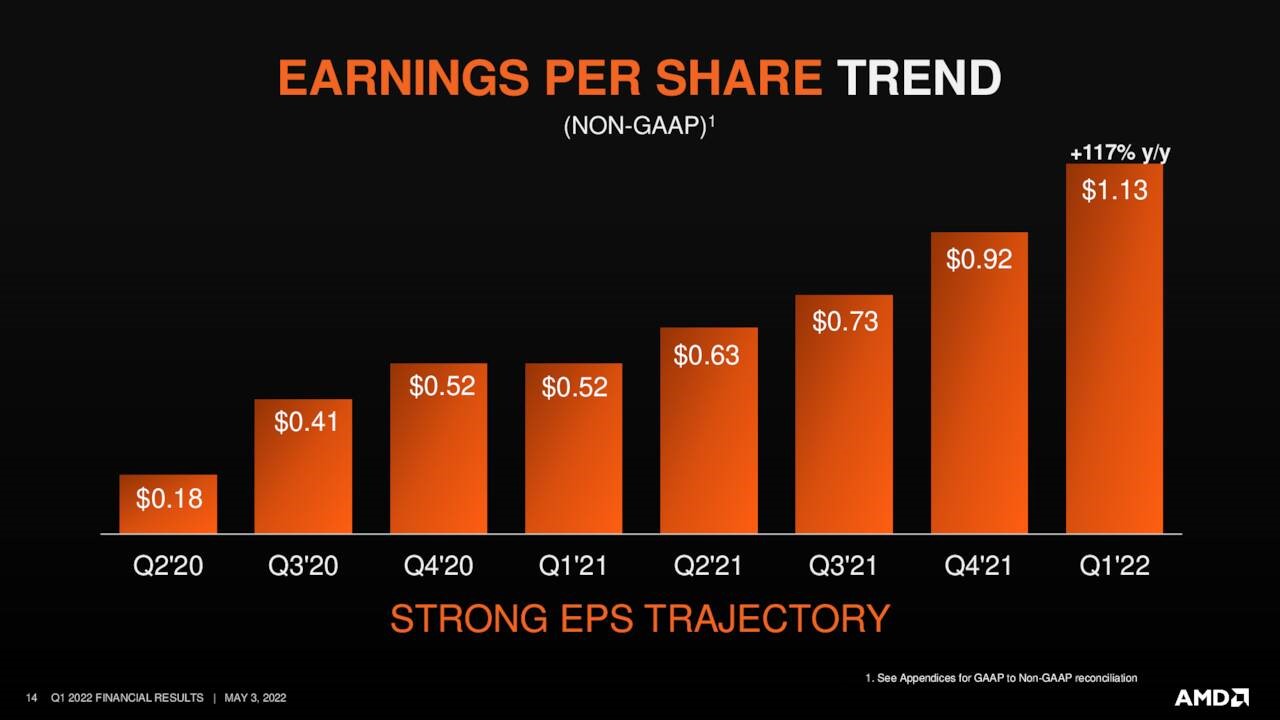

Within the first quarter of 2022, AMD grew its income by a powerful 88% over the prior 12 months’s quarter, to an all-time excessive stage, whereas earnings per share greater than doubled because of file gross sales of EPYC and Semi-Customized processors.

Supply: Investor Presentation

Notably, AMD has exceeded the analysts’ earnings-per-share estimates for 8 consecutive quarters. This can be a testomony to the relentless enterprise momentum of the corporate and its sturdy enterprise execution.

AMD vastly advantages from favorable fundamentals within the semiconductor market. There may be file demand and restricted provide on this market, thus creating excellent circumstances for AMD.

The sturdy enterprise momentum of AMD is clearly mirrored within the income development.

Supply: Investor Presentation

As proven within the above chart, income has grown in each single quarter within the final two years. It has briefly decelerated in just a few quarters however solely resulting from seasonal points associated to the launch of recent merchandise.

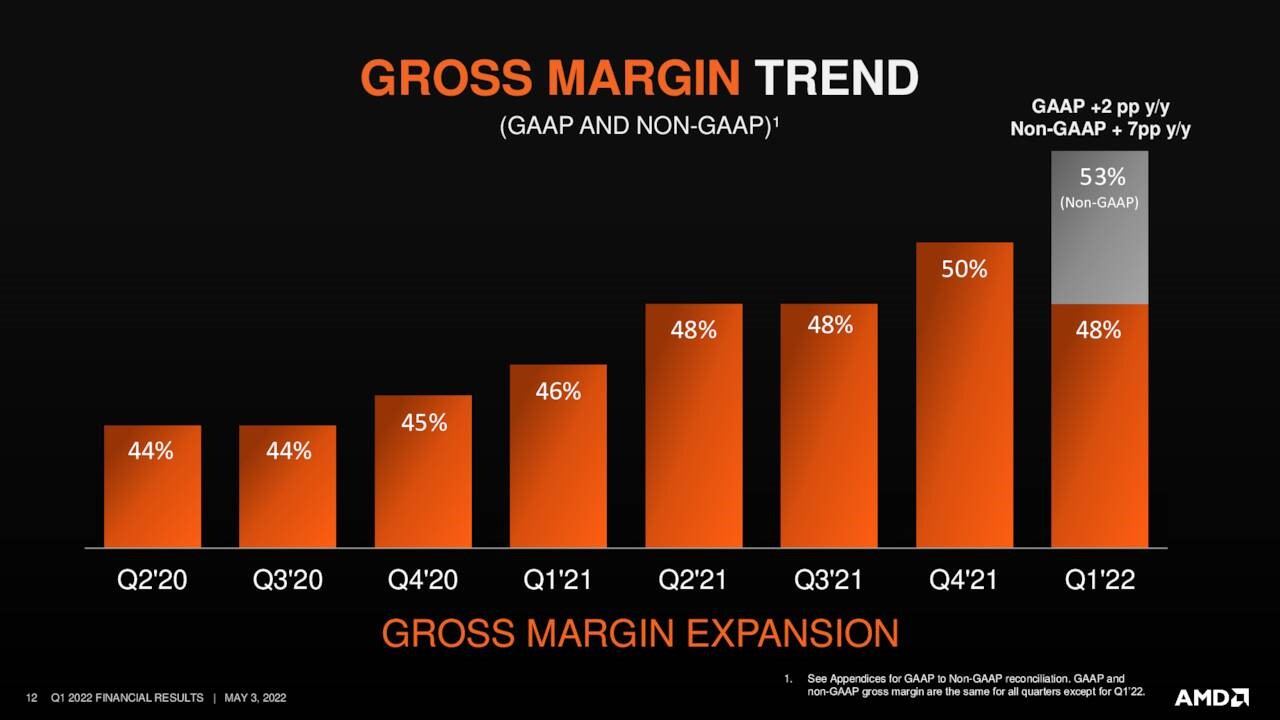

AMD has additionally maintained sturdy gross margins for a number of quarters in a row.

Supply: Investor Presentation

The sturdy margins end result primarily from the dominant place of AMD in its enterprise, as the corporate basically operates in a duopoly, with Intel (INTC) as its fundamental competitor.

Furthermore, the sturdy enterprise momentum of AMD is clearly mirrored in its earnings-per-share progress over final 12 months.

Supply: Investor Presentation

AMD is on monitor to develop its income 60% within the full 12 months, obtain a gross margin of 53% and develop its earnings per share by 58%, from $2.79 in 2021 to $4.40 in 2022. All these metrics show the exceptionally sturdy enterprise momentum of AMD.

Development Prospects

AMD has an enviable progress file because of its technological advances and the important duopoly standing in its enterprise. The corporate has greater than doubled its revenues over the past 5 years and has switched from a lack of -$0.60 per share in 2016 to an anticipated revenue of $4.40 per share in 2022.

Even higher, AMD has not proven any indicators of fatigue, whereas it would vastly profit from its main current acquisition of Xilinx. Analysts have sturdy conviction within the progress trajectory of AMD, as they count on the corporate to develop its earnings per share by 13% in 2023 and by one other 18% in 2024, on high of the 58% progress anticipated this 12 months.

Aggressive Benefits

AMD basically operates in a duopoly and thus it has a dominant place in its enterprise. This place is enhanced by the rising scale of the corporate. In consequence, AMD has a significant aggressive benefit.

However, traders ought to at all times needless to say the tech sector is characterised by excessive uncertainty because of the fierce technological competitors amongst its gamers. About six years in the past, AMD was struggling to change into worthwhile.

Luckily, it has managed to create a sustainable progress trajectory in the previous few years because of its technological achievements, which have rendered the merchandise of the corporate very important parts of the pc business. Nonetheless, within the tech sector, the danger of obsolescence because of the achievements of rivals is at all times current, significantly for traders with a long-term investing horizon.

Some tech shares can not pay dividends to their shareholders resulting from their lack of earnings. Uber (UBER) and Lyft (LYFT) haven’t managed to change into worthwhile but whereas Nikola (NKLA) has not managed to generate optimistic free money flows but. This isn’t the case for AMD, which has posted earnings within the final 4 years and optimistic free money flows within the final three years.

Will AMD Ever Pay A Dividend?

The first cause behind the absence of a dividend is the excessive progress of AMD, which makes it way more worthwhile to speculate money stream again within the enterprise as a substitute of distributing it to the shareholders.

As AMD appears to have a few years of double-digit earnings progress forward, it isn’t prone to provoke a dividend anytime quickly. As a substitute, it’s prone to stay centered on its progress initiatives. Shareholders of AMD presumably are utterly glad so long as the corporate retains rising at a quick tempo, with out initiating a dividend.

Furthermore, AMD incurred materials losses in each single 12 months between 2012 and 2017. This means the extraordinary competitiveness within the tech sector, which is characterised by cut-throat competitors more often than not.

Excessive-growth corporations don’t supply a dividend for an additional cause as effectively. Their shares often take pleasure in such a wealthy valuation {that a} dividend is insignificant for the shareholders. To offer a perspective, AMD is at present buying and selling at a price-to-earnings ratio of twenty-two.

Due to this fact, even when the corporate distributes 30% of its earnings within the type of dividends, it would supply only a 1.4% dividend yield. Such a yield might be immaterial in comparison with the expansion potential of the inventory and therefore it makes way more sense to reinvest earnings within the enterprise to stay aggressive.

Last Ideas

AMD has change into a high-growth tech inventory within the final 4 years, with accelerated progress this 12 months because of its high-quality processors, favorable enterprise circumstances and the acquisition of Xilinx. Nonetheless, it’s way more worthwhile to speculate its earnings in its enterprise than to distribute them within the type of dividends.

The corporate additionally wants to speculate closely in its enterprise in an effort to stay aggressive and defend its market share. In consequence, traders shouldn’t count on a dividend from AMD for the subsequent a number of years.

See the articles beneath for evaluation on whether or not different shares that at present don’t pay dividends will in the future pay a dividend:

- Will Amazon Ever Pay A Dividend?

- Will Shopify Ever Pay A Dividend?

- Will PayPal Ever Pay A Dividend?

- Will Pinduoduo Ever Pay A Dividend?

- Will Adobe Ever Pay A Dividend?

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].