da-kuk

The Russell 2000 (RTY)(IWM) took extra of a breather Thursday, however its latest increase has pushed it up +8% YTD, and quite a few drivers put small-cap shares in line for a robust second half of 2024, in response to Carson Group’s Chief Market Strategist Ryan Detrick.

The Russell 2000 (RTY) shot up +10% over a shocking five-day rally that ended Tuesday, adopted by steps again on Wednesday and Thursday. A shift by buyers into small-caps from mega-cap tech shares like Nvidia (NVDA) and Meta (META) helped the Russell 2000 (RTY) reasonably slender its lag to the S&P 500’s (SP500)(SPY) +16% YTD achieve, and the Nasdaq Composite’s (COMP:IND)(QQQ) 19% surge.

“We’ve appreciated small caps all yr and we’ll be the primary to confess they’ve been irritating,” Detrick mentioned in a word. Nevertheless, “we predict this underloved, underappreciated, and underowned space could possibly be due for an enormous second half in ’24,” he mentioned.

Among the many elements:

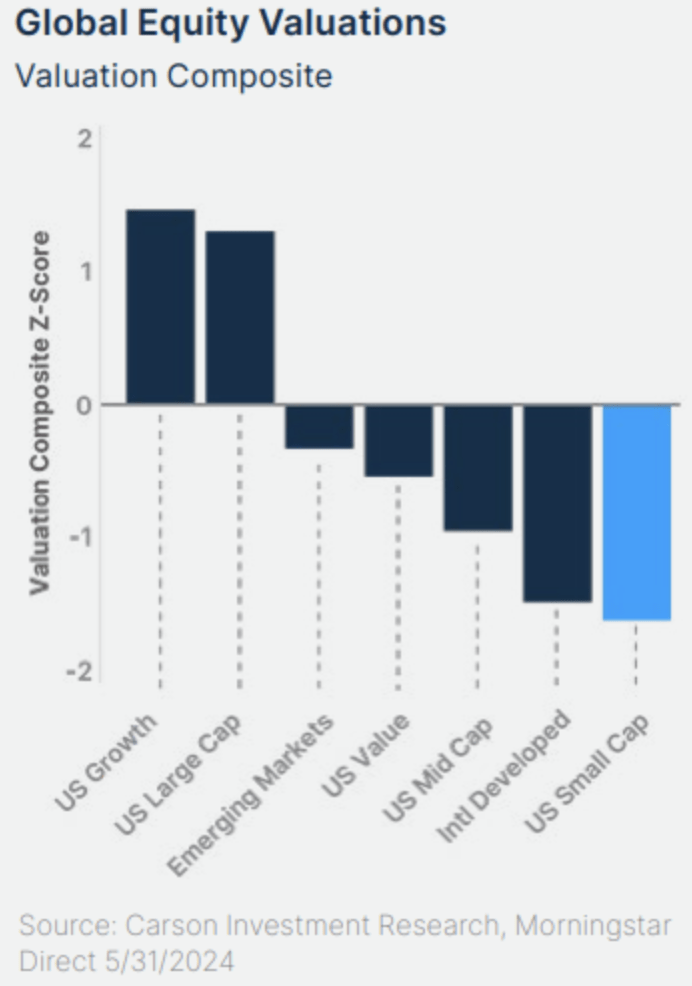

Small caps are traditionally low-cost

Shopping for shares which are low-cost as soon as different drivers are in place might help buyers’ portfolios, he mentioned. “The final time small caps have been this low-cost relative to massive caps was in 1999, which kicked off a 13-year interval of outperformance for small caps.” Right here’s a chart from Carson Group:

“Explosive” earnings progress forward

This yr, earnings progress for the S&P Small Cap 600 Index (SP600) is anticipated at 4.1%. However for 2025 and 2026, analysts are potential enlargement of 17.7% and 12.5% for S&P small-caps.

“Given we stay constructive on the U.S. economic system, we predict these total earnings numbers might even are available higher,” Detrick mentioned.

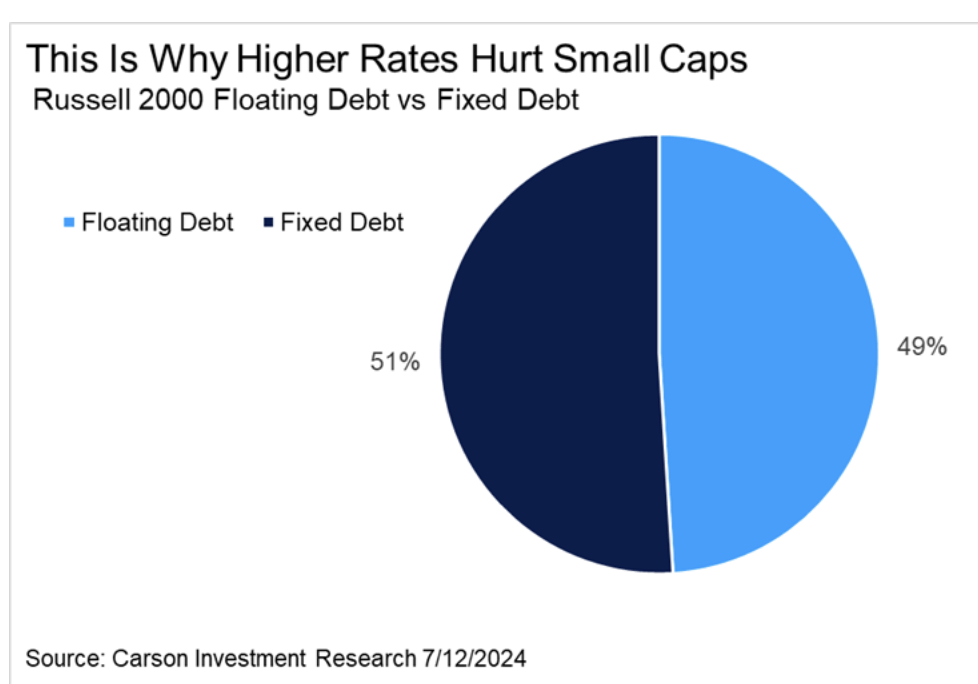

Easing debt ache for small corporations from charge cuts

Slowing inflation has prompted merchants to cost in two Fed charge cuts for 2024, with a 3rd a “coin toss,” Detrick mentioned. S&P 500 (SP500) large-cap corporations have locked in 90% of their debt at possible at very low charges from just a few years in the past, whereas small-caps have solely about half of their total debt in fixed-rate debt.

“Decrease charges (even barely decrease) could possibly be an enormous tailwind for small caps,” he mentioned. Here is one other chart: