Successful startups follow a typical pattern.

An entrepreneur has an idea. They start a business. After a short time, the business makes money.

Starting the business is challenging. Entrepreneurs generally need capital. Starting a small business on Main Street might require $100,000, for example.

To get the money, the founder goes to the bank. Bankers review the business plan. They also review the owner’s assets. Bankers want to ensure they get repaid with interest.

This is hard work. But all around the world, small businesses secure capital and many find success.

The process is a little different in the tech sector.

You still need the idea. You still need to find money. But, at least for the past 15 years, profits weren’t very important.

Tech stocks operated on a different dynamic, absent of profitability. And, thanks to the economy of the last 15 years, that worked.

But if that economy was Kansas, we’re not in Kansas anymore. As obvious as it sounds, companies will now need to actually make money to keep the lights on.

This all has to do with a major change that occurred in the economy last year. One that put profitless tech companies in peril…

But simply avoiding those won’t save your retirement. Even great stocks are caught in the crossfire in this new era. And since those great stocks make up a majority of the entire market, there’s almost no place to hide.

Today, I’ll share exactly why tech companies are in so much trouble, and why that trouble is really just getting started.

But I’ll also show you the one thing you should change about your investing style if you’re going to keep making money in spite of tech’s continued downfall…

The Broken Model of Funding in the Tech Sector

Let’s look at an example that perfectly illustrates what I’m talking about…

Snap (SNAP) is a social media company. They run an app called Snapchat.

This app lets you send messages or pictures to other users. The twist is the messages disappear after a few minutes.

It sounds like a small market, basically for people who have something to hide.

They also allow public sharing of messages and images. That’s probably a cover for those who want the private messages that disappear.

While I don’t use Snapchat, about 375 million people do.

375 million customers sounds great … but the product is free. So how does the company make profits?

It pushes ads to users of its free app, and in theory, that’s how they make money.

This won’t surprise you, but the reality is different from the theory.

The chart below shows the company’s revenue and net income since it went public in 2017. Companies going public must file data from previous years, so the chart goes back to 2015.

The green bars show the company’s total revenue. Up, up and away. Great, right?

But revenue isn’t important if you don’t keep it. The purple bars show Snap’s net income, which has been negative for its entire existence.

Snap has never reported positive income over a 12-month period. The size of the loss ranged from $373 million to $3.5 billion.

So, where did the revenue come from? The users watching the ads, right?

Wrong. The money came from venture capital (VC) investors.

Venture capital firms fund tech startups. These firms don’t always focus on profits. They tend to focus more on their exit strategy.

For Snap, the exit strategy was an initial public offering (IPO). This allowed the VC firms to sell their stake to the general public. VC firms put in a total of about $2.6 billion. The IPO raised more than $32 billion. They made their money — all $29.4 billion of it — the moment SNAP listed.

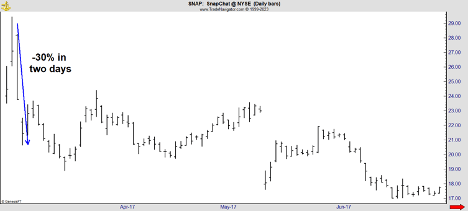

Shares of SNAP immediately dropped.

That makes sense. The business doesn’t profit.

The stock did soar in the pandemic recovery as individual investors chased tech stocks. But while individuals were trading SNAP, VC firms were cashing out of other investments.

In 2021, 1,035 companies and special-purpose acquisition companies came public. Each one of them represents a payday for venture capitalists.

For the last 15 years, VC firms didn’t need many companies to deliver big returns like SNAP. If just 1 out of 10 does, they can make a large amount of money.

But now the game is different. And that brings me to why tech companies were so attractive in the late 2010s, and why they’re so unattractive now.

The Tech Sector Is “Leaving Kansas”

When VC firms first looked at Snap 10 years ago, interest rates were zero. This means they could borrow money virtually for free. They could throw that money around at all sorts of profitless companies and see what worked.

Now, interest rates are higher. Much higher. So businesses now need to show they can deliver returns that are higher than the risk-free yield available in Treasury bonds.

This is a problem for many businesses in the tech sector. If capital carries a cost, they can’t deliver products below cost and they can’t develop a customer base.

Companies like Uber are running into this problem. Customers loved Uber when rides were cheap. Venture capital is what made those rides cheap. Without those funds, rides are more expensive. And Uber isn’t as popular.

If you read my work, you know I blame the Federal Reserve for everything. The Fed broke the financial system. That led to the current banking crisis.

The Fed also broke the tech sector. Free money allowed bad companies to survive. With higher rates, those companies are failing.

But the Fed is now also breaking things indirectly. Even well-run companies are forced to cut costs. Profitable companies like Meta, Amazon and Google, are laying off thousands of workers.

That doesn’t mean some pampered tech workers are searching for new jobs. This means the economy around tech centers is contracting. And the worst part of the contraction still lies ahead of us.

That’s why it’s important to focus on the short term in this market.

I expect this bear market to last for months. I don’t believe buying all the way down and hoping for a Fed pivot or a market turnaround will be a winning strategy.

I’d much rather take a single trade every day, with high odds of delivering a 50% gain in two hours, than I am waiting potentially years for a long-term 50% gain.

That’s not a hypothetical. That’s the goal of my latest trading system, which I first unveiled to the public one hour ago.

I trade this system every single day in a live Trade Room with my subscribers. I place the trades with my own money. And thus far, results have been highly satisfactory.

If the market delivers poor returns for the entirety of this high-interest-rate era, and it lasts as long as I expect, this skill will be essential to beating both the market and beating inflation.

I’ll teach you this skill in the Trade Room. To learn how you can join, go here for all the details.

Regards,

Michael CarrEditor, One Trade

Michael CarrEditor, One Trade

Tech Isn’t the Only Sector Totally Dependent on Cheap Money

Tech stocks have been rallying this year, even with the fears of a contagion in the bank sector. The tech-heavy Nasdaq is up about 14% year-to-date.

It seems that, no matter what the Fed says, the market is pricing in that the rate hikes will be tapering off soon. As Mike points out, tech stocks are wildly sensitive to interest rates, because their expected profits are often years, or even decades in the future.

But tech stocks aren’t the only winners from this hope that the worst of the credit tightening is behind us.

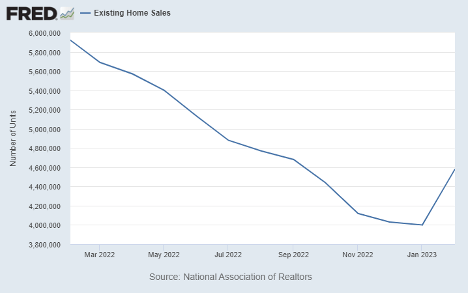

The housing market appears to be back from the dead. Existing home sales jumped by 14.5% last month to an annualized rate of 4.58 million.

Now, those numbers are still down by more than a quarter from the levels of early 2022. But it’s nice to see a really nasty downtrend like that finally break.

Why Are Home Sales Rising?

Well, it boils down to interest rates.

Demand for housing never really slacked. Millennials are in their peak home-buying years, and high rent’s give them that extra nudge to buy.

The big decline in home sales over the past year was the issue of affordability. With mortgage rates more than doubling last year to over 7%, sales fell off a cliff. So many would-be buyers weren’t able to get financing or realistically make the payments.

However, by early February, the average mortgage rate had dipped to 6%. This, combined with a slight decrease in the average home price over the past eight months, was enough to move the needle.

What Happens Next?

We’ll see. Inflation is still running hot, and the Fed is aware it needs to get it under control. But it’s also not particularly excited about having to deal with another banking crisis.

Not that I feel sorry for Chairman Jerome Powell. This was a mess of his own making by keeping interest rates pegged at zero for far too long.

But now, with one hand, he faces the impossible balancing act of trying to take liquidity out of the system. With the other hand, he’s injecting liquidity into the system to avoid a banking meltdown.

This isn’t an environment where I’m confident enough to dump money into an index fund and be done. But that also doesn’t mean I’m good with sitting on my hands for several months, or possibly even years.

If I’m not growing my portfolio, I’m losing ground to inflation.

Today, about two-thirds of my portfolio is invested in short-term trading strategies, with a time horizon generally measured in days. That’s where I’m the most comfortable right now.

Of course, Mike knows a thing or two about short-term trading. He has a strategy with a time horizon measured in hours. To see what Mike is doing, see his presentation called the “9:46 Rule.” It outlines the perfect time for short-term trading, and how you can maximize your investments in this market.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge