Scott Alexander pushes back against the argument that building more housing in a city will reduce housing prices in that city.

He begins by noting that housing costs tend to be higher in places that are relatively dense, such as New York and San Francisco. He is aware that this argument is subject to the “reverse causality” issue, which I call “reasoning from a price change”. Consider the graph that he provides:

He is aware that the pattern above may show an upward sloping supply curve, not an upward sloping demand curve. But he nonetheless suggests that it’s probably an upward sloping demand curve, and that building more housing in Oakland would make Oakland so much more desirable that prices actually rise, despite the greater supply of housing. I have two problems with this sort of argument.

First, I doubt that it’s true. It is certainly the case that building more housing can make a city more desirable, and that this effect could be so strong that it overwhelms the price depressing impact of a greater quantity supplied. But studies suggest that this is not generally the case.

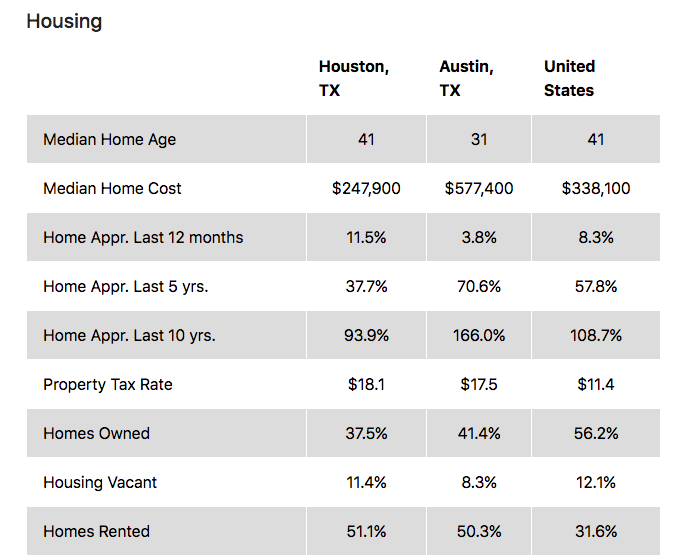

Texas provides a nice case study. Among Texas’s big metro areas, Austin has the tightest restrictions on building and Houston is the most willing to allow dense infill development. Even though Houston is the larger city, house prices are far higher in Austin:

Houston pretty much describes the “Oakland with more housing” outcome that Alexander views as somewhat far-fetched. Only in this case, it’s Austin with more housing. Alexander seems too quick to accept the, “If you build it they will come” idea—that you can build more housing and thereby boost demand so much that prices actually rise.

Alexander relies on the following intuition:

Matt Yglesias tries to debunk the claim that building more houses raises local house prices. He presents several studies showing that, at least on the marginal street-by-street level, this isn’t true.

I’m nervous disagreeing with him, and his studies seem good. But I find looking for tiny effects on the margin less convincing than looking for gigantic effects at the tails. When you do that, he has to be wrong, right?

Here’s the problem with this argument. It mixes up population change due to economic effects such as the benefits of agglomeration, with population changes due to regulatory changes such as less strict zoning. If you look at things this way, then the stylized facts work against Alexander’s argument. Over the past 50 years, increasingly strict zoning has reduced housing construction on big cities like New York and San Francisco. As a result, their populations have increased by less than in cities with less strict zoning, such as Houston. If Alexander were correct, then the price gap between the tightly controlled cities on the coast and the more laissez-faire cities of Middle America should have shrunk over time. Instead, the price gap has widened. New York and San Francisco were always more expensive than other cites, but with tighter zoning and less new construction the gap has become far wider.

Nonetheless, I suspect that there are at least a few cases where Alexander’s argument would be correct, especially in the case where the new housing was luxury homes that replaced slums. For instance, if 100,000 homes in the (poorer) eastern half of Washington DC were replaced with 120,000 luxury townhouses, then prices might rise (due to a lower crime rate). But even in that case, I believe Alexander would be drawing the wrong conclusion:

And it doesn’t violate laws of supply and demand; if Oakland built more houses, this would lower the price of housing everywhere except Oakland: people who previously planned to move to NYC or SF would move to Oakland instead, lowering NYC/SF demand (and therefore prices). The overall effect would be that nationwide housing prices would go down, just like you would expect. But the decline would be uneven, and one way it would be uneven would be that housing prices in Oakland would go up.

This isn’t an argument against YIMBYism. The effect of building more houses everywhere would be that prices would go down everywhere. But the effect of only building new houses in one city might not be that prices go down in that city.

This is a coordination problem: if every city upzones together, they can all get lower house prices, but each city can minimize its own prices by refusing to cooperate and hoping everyone else does the hard work. This theory is a good match for higher-level management like Gavin Newsom’s gubernatorial interventions in California.

Tell me why I’m wrong!

Alexander is implicitly viewing this outcome as a “problem” for the city that builds more housing. They must sacrifice so that the rest of the country can gain. But in his scenario, Oakland is better off. Indeed if it were not better off, then why would more people choose to live in Oakland? In order for it to be true that building more housing boosts housing prices, it must also be true that the quality of existing houses (including neighborhood effects) rises by more than enough to offset the increase in supply. That means the new housing construction must make Oakland such a desirable place to live that the amenity effect overwhelms the quantity effect.

You see the same fallacy with criticism of highway expansion projects. People will complain, “They added two more lanes to the freeway, but the traffic is worse than ever.” But that’s a wonderful result! If the traffic is worse than ever, despite many more people driving on the highway due to the extra lanes, then the welfare of commuters has increased for two reasons. First, more people benefit from using the highway. Second, the fact that they are willing to use it despite a higher time cost means that they value the service much more than before the expansion. Otherwise, the traffic would not be worse.

Of course, economic change always has winners and losers. Here’s how I would describe the impact of allowing more housing construction in Oakland, in the unlikely event that this did raise housing prices:

1. America would benefit.

2. Oakland would benefit.

3. Poor people in America would benefit, in aggregate.

4. Affluent people in America would benefit, in aggregate.

5. Homeowners in Oakland would benefit.

6. Some renters in Oakland would benefit (from a more economically dynamic city.)

7. Some renters in Oakland would suffer from higher rents.

In the much more likely case where new housing construction would lower prices, the impact described in #5 and #7 might reverse. Either way, there is no defensible argument for not building more housing in Oakland, regardless of the impact on price. If building more housing reduces its price, then there is a strong argument for allowing more housing construction. If building more housing raises its price, then the argument for more construction is even stronger.