Michael Vi

Palantir Technologies (NYSE:PLTR) started as a company that built software for collecting and integrating data from multiple sources and analyzing the data to deliver insights to data-driven decision-makers and analysts. The formal names for the majority of what the company does are Data Fusion and Big Data Analytics. While Big Data Analytics and Data Fusion are great businesses, what has investors excited about this company is its recent forays into developing an Artificial Intelligence (“AI”) operating system.

The data technologies Palantir created over the past 20 years seem prescient today, as they are custom-made for the AI era. After OpenAI released ChatGPT and sparked the AI revolution in late 2022, Palantir’s management changed its mind about how much impact the company could have on the world and how large it could become — all because of AI. During its second quarter 2023 earnings call, its Chief Executive Officer (“CEO”) Alex Karp said:

In a weird way, in the last couple of months since we launched AIP [Artificial Intelligence Platform], since we had AIPCon [Artificial Intelligence Platform Conference], we have seen the way in which technologies we’ve built that seem to be of moderate utility were built almost in anticipation of the AI revolution, both algorithmatic and large language models. And that convergence has remade Palantir, taking Palantir away from its terminal value being it made the world better by making our institutions in the West stronger, more productive, more efficient, in some cases, more deadly to giving us the aspiration and realistic perspective of being the most valuable enterprise software company in the world.

Source: Palantir second quarter 2023 earnings call

CEO Alex Karp’s statement is bold. Palantir only has a market cap of around $37.34 billion, and Microsoft is the world’s most valuable enterprise software company, at $2.43 trillion! His statement implies that Palantir’s management believes that the market for AI operating systems will be massive and that it can eventually dominate that market to surpass Microsoft (MSFT) in value. Even if the company fails to reach Microsoft’s size, its CEO clearly believes that it will be a significant force on the global enterprise software market stage. Next Move Strategy Consulting has projected the AI market to grow from $95.6 billion at the beginning of 2022 at a compound annual growth rate of 32.9% to reach $1.85 trillion in 2030. CEO Karp mentioned during AIPCon that since launching AIP in April, it already had 150 companies using the product in five months, and the product had grown at a 50% pace in the month before the conference, which the company held on September 14, 2023. If CEO Karp’s vision for AIP comes to fruition, this company will potentially have massive growth over the next decade. If you are a long-term growth investor, that is reason enough to consider buying the stock today.

The company has improved its profitability fundamentals

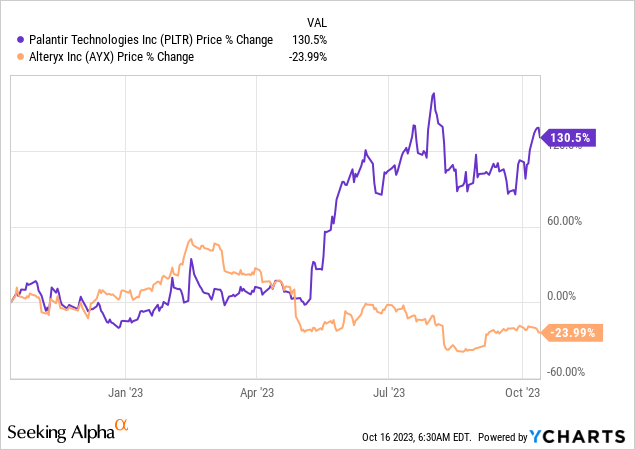

When Palantir released its first quarter 2023 report in early May, the market took it as a sign of a turnaround from a decline in the stock that began in late 2021. It had reported GAAP profitability, beat Wall Street analysts’ revenue and earnings estimates, and raised full-year guidance. Investors responded by bidding the stock up +20% the next day. Additionally, Cathie Woods bought millions of company shares for her Ark Innovation ETF and Ark Next Generation Internet investment funds several days after the report, boosting demand for the stock. The chart below shows that the stock jumped significantly in May and is up over 100% for the year. Meanwhile, a similar data cruncher, Alteryx (AYX), is down over 20% for the year.

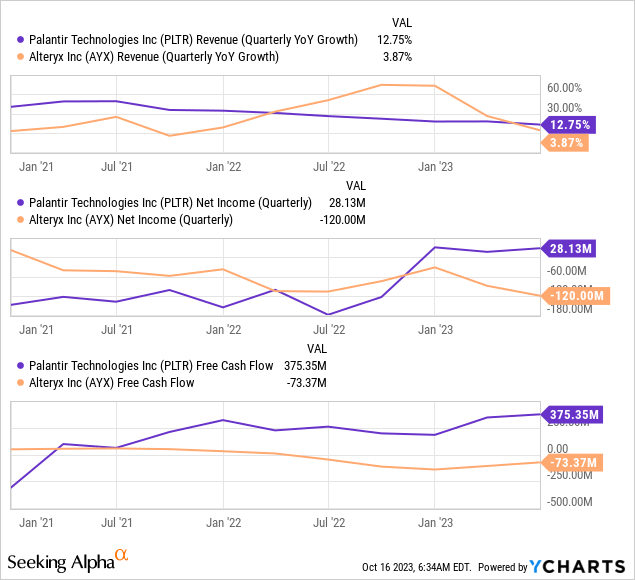

The chart below explains the difference in fortunes between the two companies. While both companies’ revenue growth has eroded since 2021, Palantir has achieved bottom-line profits for its third quarter in a row at the end of its second quarter. One more quarter of producing profits and the company will be eligible for addition to the S&P 500, which could lift the stock price due to index funds tracking the S&P 500 adding shares. Additionally, Palantir has been growing positive free cash flow (“FCF”) since mid-2021, while Alteryx’s FCF on a trailing 12-month basis is $73 million underwater.

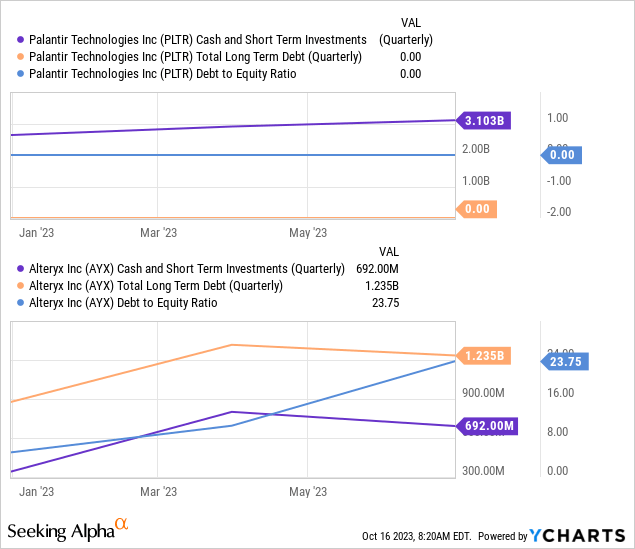

Last, in the second quarter, Palantir recorded $3.1 billion in cash and short-term investments and zero long-term debt. Its debt-to-equity (D/E) ratio was 0.08. A D/E ratio below one means a company is financially solid. Alternatively, a D/E above two is a sign of a risky stock. No wonder Palantir has outperformed a similar data-crunching company, Alteryx, in 2023.

The Bulls’ thesis for Palantir is that an improving economy will significantly assist a growing AI business to reaccelerate revenue growth while the company continues to grow more profitable. As a result of improving fundamentals, it will grow into its current valuation.

Valuation and a few risks

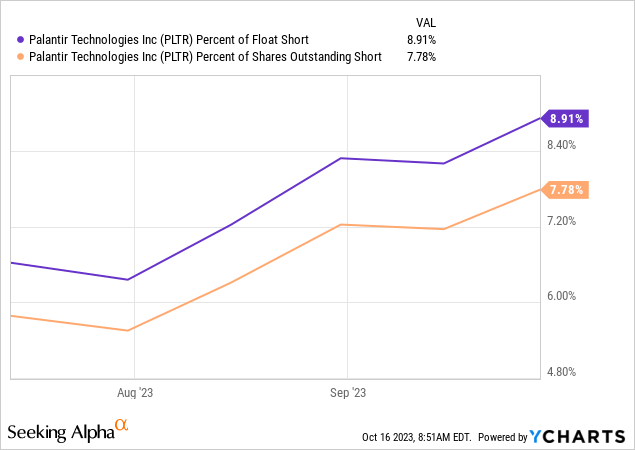

Despite Palantir’s improving profitability and the promise of AI reaccelerating growth, the market has grown more bearish on this stock over the last several months. As seen on the chart below, the percentage of the float sold short, and the percentage of shares outstanding have jumped higher recently.

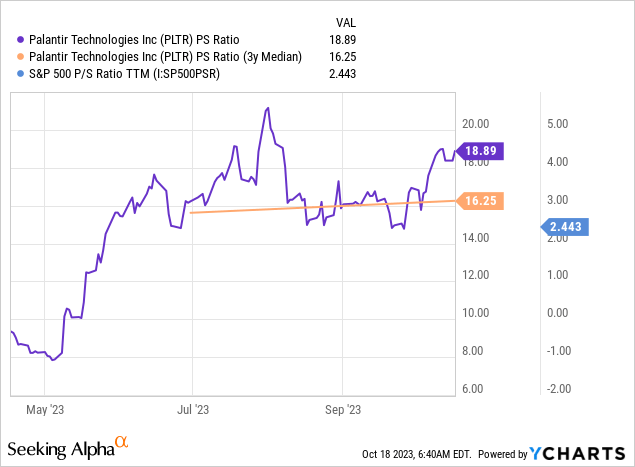

Some bears have a big issue with the company’s valuation. Palantir has a price-to-sales (P/S) ratio of 18.38 compared to the Software & Programming Industry’s P/S ratio of 4.82. and the S&P 500’s P/S ratio of 2.44. Additionally, it currently sells above its median P/S ratio for the past three years. It is hard to question that the stock has an elevated valuation.

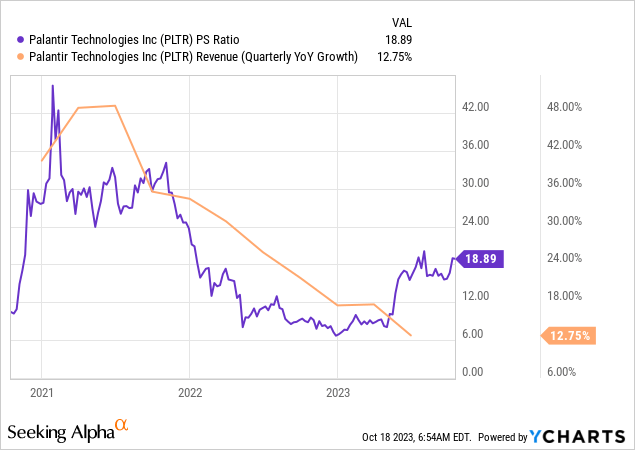

Last but not least, according to Investopedia, a “P/S ratio shows how much investors are willing to pay per dollar of sales for a stock.” So, when a company’s quarterly sales growth rate declines, and its P/S ratio remains the same or rises, investors pay more for its current sales growth rate. Although it’s not a hard-core rule, I prefer to see a company’s growth rate exceed its P/S ratio before buying a stock.

Palantir’s P/S ratio is well above its diving second-quarter year-over-year growth rate of 13%. The market can sometimes quickly turn sour on a stock where the P/S ratio exceeds the sales growth rate, as it may have heavy expectations for growth to increase. And if those sales fail to pick up, the stock price could quickly decline. It has yet to be determined how long the market will give Palantir to reaccelerate its sales. Still, at some point, if the company’s sales growth rate doesn’t pick up, the market would likely punish the stock.

The problem is that Palantir’s future sales growth can be unpredictable over the short term because of its unique, often long, and uncertain sales model. The company allows potential customers to test its platform at no or low cost. It hopes that the trial period can demonstrate the platform’s worth and result in sales. There is no guarantee that this approach will result in a deal; when sales come, they can be very lumpy from quarter to quarter.

Another problem is that historically, Palantir has been a company that sold big, tightly integrated products like Foundry to a small number of large commercial customers that paid the company a considerable amount of money. However, only some companies can afford a product like Foundry, limiting customer growth. Management decided to solve its customer growth limitations by using a “modular” sales approach where customers can select only the modules they need at a more affordable price — allowing the company to achieve more mass-market sales. At first glance, the modular sales approach looks like it will bring the company more deals; however, there are potential issues with Palantir taking the modular approach to go mass market. For instance, modular sales could potentially erode sales to existing large commercial customers.

Additionally, the modular products could be less effective than competing products and may not have the advantages of the full Foundry product. The most significant advantage of Foundry is the tight integration of all its functions, something that customers lose with the modular approach. So, the execution of its sales strategy is a significant risk for Palantir.

Be aware that the stock has risen recently largely on AI hype, and although AI will likely be a long-term growth driver, we probably won’t see the AI revolution come to the rescue any time soon to help accelerate near-term sales growth. A more crucial factor than AI in the company’s near-term fortunes is the macroeconomy. Until corporate leaders receive the “all-clear” signal on the economy, Palantir may have difficulty growing sales. According to The Conference Board, that all-clear signal may not come until the second half of 2024:

Looking into late 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish. In the second half of 2024, we forecast that overall growth will return to more stable pre-pandemic rates, inflation will drift closer to 2 percent, and the Fed will lower rates to near 4 percent. However, due to an aging labor force we expect tightness in the labor market to remain an ongoing challenge for the foreseeable future.

Source: The Conference Board

Lastly, Palantir invested in about two dozen early-stage companies in 2021 in an ill-fated attempt to boost growth. In exchange, these risky early-stage companies promised to buy Palantir’s software, hopefully promoting sales growth. It invested $450 million in this risky venture, and as of November 2022, one analyst estimated Palantir had taken $333 million in realized and unrealized losses. In August 2023, a pension fund sued Chairman Peter Thiel, company President Stephen Cohen, CEO Alex Karp, and board members, alleging insider trading — not something that helps management’s reputation.

The King of AI

The headlines of many different news outlets have already declared either Microsoft (MSFT) or Alphabet (GOOGL) (GOOG) or both as AI leaders because of their exposure to many of the consumer-facing franchise products that those companies have infused with the latest AI technology. However, the true king of AI is Palantir. Dan Ives of Wedbush Securities calls Palantir “the best pure-play AI name,” in a CNBC interview in August of this year. Since 2003, the secretive company has built custom-made AI or Machine Learning solutions and sold them to the government or large commercial enterprises. Still, because it is not consumer-facing and rarely exaggerates the technology in its solutions, the average person might not think of Palantir as the King of AI. However, large institutions with complex problems no other company can solve often seek out Palantir. According to a Palantir blog:

Palantir is very strong in the AI/ML space specifically because of our healthy realism and our belief in the value of systems over specific technologies. We have spent our time and energy building the operating systems that enable AI/ML to be effectively deployed in the context of complex data environments with varied goals and missions (i.e., AI-OS). Palantir doesn’t focus on the building or selling of AI/ML models. We don’t focus on the building or selling AI/ML libraries. Rather, Palantir is focused on building an AI Operating System that allows an organization to actually use AI/ML models as part of an ecosystem of value creation and continual improvement.

Source: Palantir blog

What has some growth investors excited is the possibility of Palantir’s AIP capturing a substantial chunk of the market for AI operating systems. If you believe in the AI revolution and that Palantir has superior technology and experience to become a leader in the market for AI-based solutions, this company should be high on your watchlist to invest in.

If you invest for the long term, buy the stock

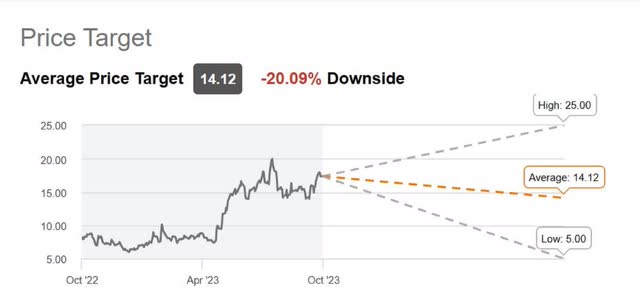

Many analysts believe the near-term prospects for Palantir look bleak, evidenced by Wall Street and Seeking Alpha analysts rating it as a hold. The average Wall Street analyst price target as of October 17 is $14.12, which translates into a predicted downside of 20.09% one year from now.

Seeking Alpha

This stock could be a potential disaster for investors seeking upside over one year. Short-term investors are better off avoiding the stock. Investors should avoid entering the third and fourth quarter earnings period expecting Palantir to achieve top-line and bottom-line beats. The business world is incredibly early into the AI era, and the story could take some time to start playing out for Palantir. However, if you have at least a three to five-year time horizon, it is good stock to begin buying at the current valuation. AI should help sales growth pick up over the long term and wipe away current valuation worries. I recommend long-term buy-and-hold growth investors start dollar cost averaging into the stock today.