On Wednesday, March 16, 2022, the Federal Reserve introduced it might be elevating rates of interest for the primary time since 2018. Whereas the 25 foundation level hike (one foundation level=0.01%) was largely anticipated, the underlying shift in Fed coverage will influence the housing market, and actual property traders ought to perceive and take note of it.

On this article, I’ll present a short overview of what the Fed is doing, why they’re doing it, and the way it might influence actual property traders.

On the conclusion of the March assembly of the Federal Reserve, it was introduced that the Fed’s goal for the federal funds fee would improve by 25 foundation factors. The goal federal funds fee is the rate of interest at which banks borrow reserve balances from each other. It doesn’t truly influence shoppers straight.

Nonetheless, when the goal fee rises, it units off a domino impact that finally hits shoppers. A rise to the federal funds fee makes it costlier for banks to borrow; this, in flip, makes it costlier for banks to lend to shoppers—the price of which is handed alongside to shoppers.

This week, it received a bit costlier for banks to borrow and lend. It’s a giant shift from the stimulative insurance policies the Fed has embraced since early 2020.

The federal funds fee is likely one of the major instruments the Federal Reserve has to handle the financial system. In troublesome financial occasions, it’s lowered to stimulate financial development. We noticed this after the Nice Recession, after which once more firstly of the COVID-19 pandemic.

By reducing rates of interest, the Fed incentivizes enterprise and shoppers to finance their spending by borrowing cash. For companies, this might imply new hiring or increasing into new markets. For shoppers, this might imply shopping for a brand new automotive or home whereas charges are low and debt is affordable. The influence of low cost debt is a rise within the amount of cash circulating within the financial system, also referred to as financial provide. A rise in financial provide usually stimulates spending and financial development.

There’s a draw back to a lot cash flowing by means of the financial system: inflation. Inflation is usually described as “an excessive amount of cash chasing too few items.” So to battle inflation—and scale back the financial provide—the Fed raises charges. As rates of interest climb, companies and people are much less inclined to borrow cash to make massive purchases, which implies extra money sits on the sidelines, serving to curb inflation.

Elevating rates of interest is a little bit of a dance. Charges should improve to battle inflation, however rising charges additionally put the financial system prone to lowered GDP development—or perhaps a recession. Once more, the potential for lowered borrowing and spending that comes with elevated rates of interest can harm financial development.

This is the reason folks like me watch the Fed’s strikes so carefully; we wish to know the way they’ll steadiness their twin obligations of combating inflation and selling financial development. It’s a tightrope stroll.

What occurred this week was anticipated. As they’ve been signaling for weeks, the Fed raised charges by 25 foundation factors. There’s nothing significantly fascinating about that announcement, in my view.

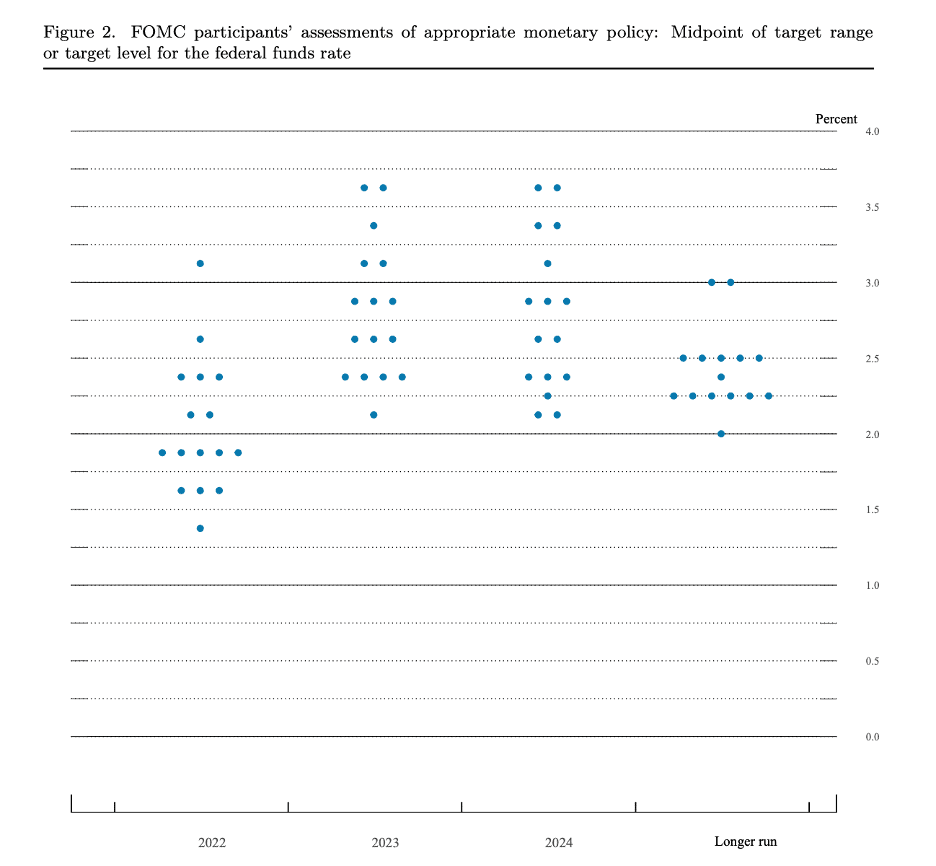

The information that pursuits me probably the most, nonetheless—and the info that can influence actual property traders probably the most—is contained within the dot plot.

This graph exhibits what the individuals who truly make choices about rates of interest imagine about the place the federal funds fee will probably be going ahead. Every dot represents the opinion of 1 Federal Open Market Committee (FOMC) participant.

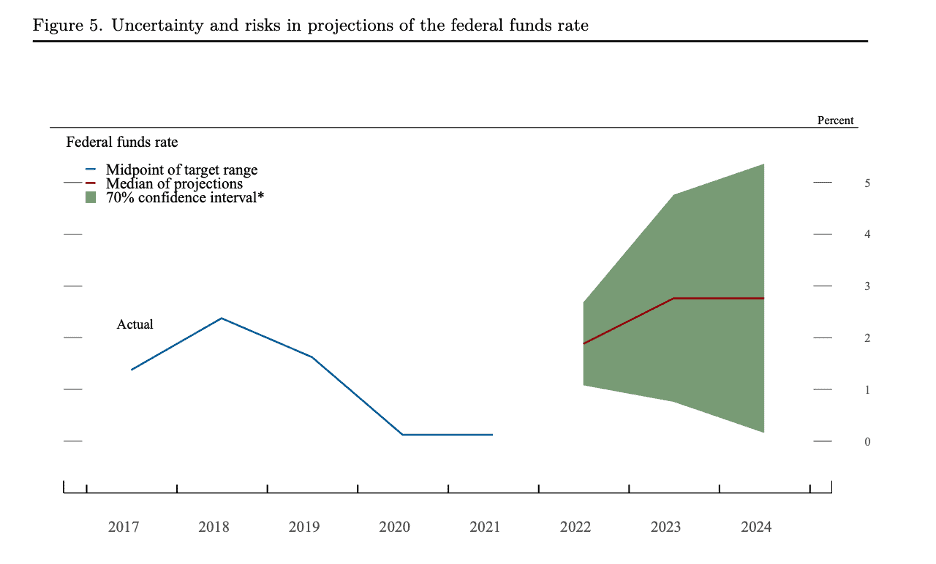

One other manner to take a look at this information is offered right here:

From this, you may see that the median projection of FOMC members is now about 1.875% for 2022—a really dramatic improve from the place we’re at present. This exhibits a transparent place by the Fed. They intend to boost rates of interest aggressively by means of 2022 and count on charges to maintain climbing to 2.8% in 2023 earlier than flattening out in 2024. Over the long term, the FOMC want to see charges at round 2.4%.

For context, the best the higher restrict of the goal fee has hit for the reason that Nice Recession was 2.5%, which is the place it sat for many of 2019. The Fed is planning to go increased than we’ve seen in years, after which convey it again down a bit, presumably as soon as inflation is within the 2%–3% year-over-year vary that the Fed targets.

For actual property traders, rates of interest are massively necessary. As I’ve mentioned already, they influence the complete financial system. Importantly, charges additionally influence actual property traders and the housing market extra straight—by means of mortgage charges.

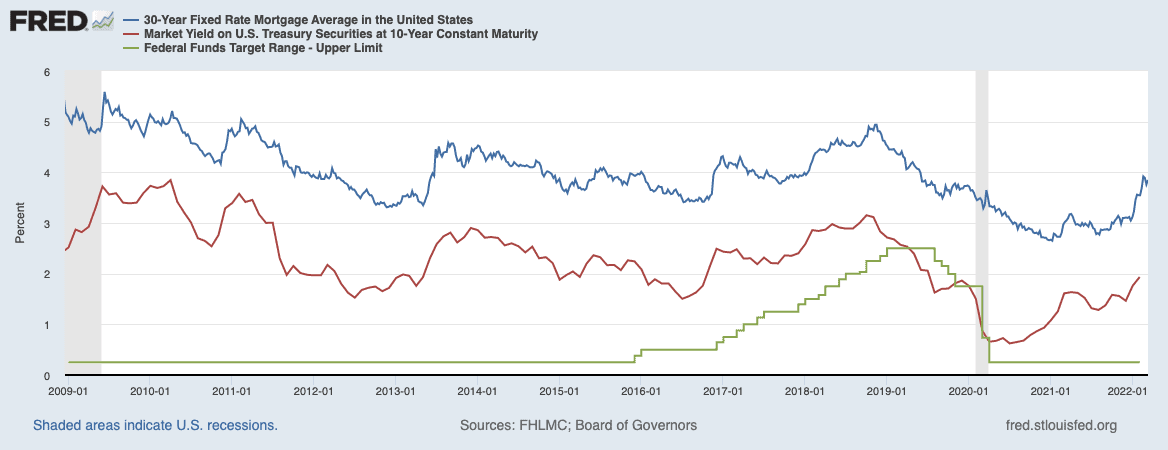

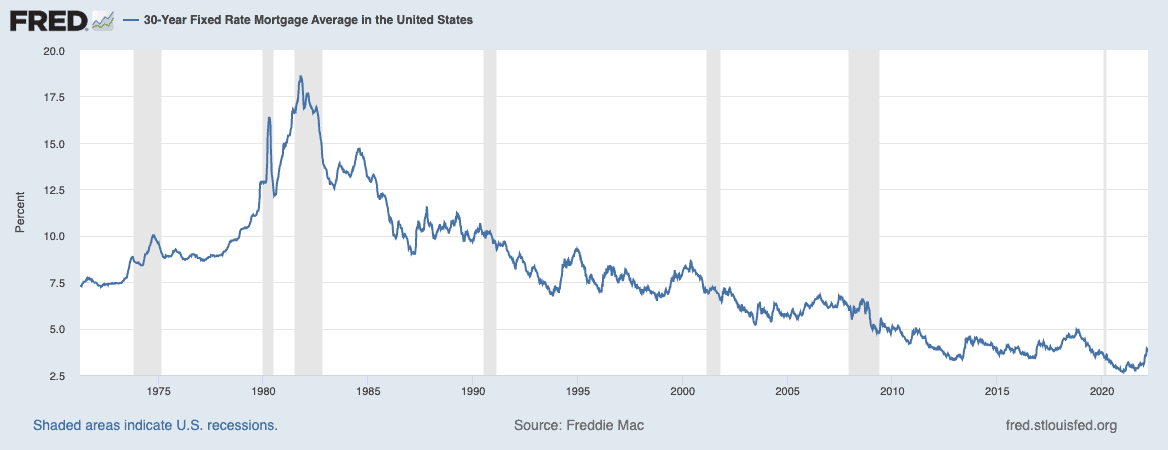

The truth is that this: Though the Fed bulletins make for lots of reports, the Fed’s goal fee doesn’t influence mortgages that a lot. Try this chart:

The inexperienced line is the federal funds fee (the chart hasn’t been up to date to replicate the introduced fee hike), the blue line is the typical fee on a 30-year fixed-rate mortgage (owner-occupied), and the pink line is the yield on the 10-year U.S. Treasury bond.

For those who eyeball the connection between the inexperienced line (federal funds fee) and the blue line (mortgage charges), you may see that there hasn’t been a very robust correlation between the 2 variables, not less than for the reason that Nice Recession.

As a substitute, take a look at the connection between the pink line (yields on 10-year treasuries) and the blue line. There’s a sturdy correlation. If you wish to know the place mortgage charges are going, it is advisable to study the yield on 10-year U.S. Treasuries—not the Fed’s goal fee.

Sure, bond yields are impacted by the federal funds fee, however they’re additionally influenced by geopolitical occasions, the inventory market, and lots of different variables. I’m not a bond yield skilled, however bond yields have risen quickly this yr, and given current occasions, I wouldn’t be shocked to see yields hit 2.5% or increased this yr.

If that occurs, I feel mortgage charges for a 30-year fastened owner-occupied property might be round 4.50%–4.75% by the tip of the yr. That might be a major improve from the place we’ve been over the previous couple of years, though nonetheless very low in a historic context.

Earlier than the Nice Recession, charges have been by no means beneath 5%, for way back to I’ve information. Preserve that in thoughts as you navigate the present investing atmosphere.

Mortgage charges will rise, and it will put downward strain on the housing market. Rising mortgage charges lower affordability, which then lowers demand. In a extra typical housing market, this might have a reasonably instant influence on housing costs. However the present housing market is completely different, and “downward strain” on housing costs doesn’t essentially imply “adverse worth development.”

Keep in mind, there are different forces driving the housing market proper now, lots of which put upward strain on costs. Demand remains to be excessive, pushed by millennials reaching peak homebuying age, elevated investor exercise, and better demand for second properties. Moreover, provide stays severely constrained, and so long as that’s the case, there will probably be upward strain on housing costs.

What occurs subsequent is difficult to foretell. On the one hand, we’ve got rising charges placing downward strain on the housing market. However, we’ve got provide and demand exerting upward strain. And not using a crystal ball, it stays to be seen how this all performs out.

If I needed to guess, I imagine costs will proceed to develop at an above-average fee by means of the summer season, after which come again all the way down to regular (2%–5% YoY appreciation) and even flat development within the fall. Previous that, I received’t even enterprise a guess.

Though I wish to make projections to assist different traders perceive the financial local weather, in unsure occasions like these, my private method to investing is to not attempt to time the market. As a substitute, I attempt to look previous the uncertainty. In my thoughts, the housing market’s potential for long-term development stays unaffected by at present’s financial local weather. Brief-term investments, to me, are dangerous proper now. (Full disclosure, I don’t flip homes even throughout extra sure financial occasions.) However long-term rental property investing stays an excellent choice to hedge in opposition to inflation and set your self up for a strong monetary future 5 years or extra down the highway. I’m nonetheless actively investing as a result of inflation will eat away at my financial savings if I do nothing. And I do know that even when costs dip quickly within the coming yr, investing now will nonetheless assist set me as much as hit my long-term monetary targets.