Bitcoin’s

worth (BTC) is making important positive factors on Tuesday, January 14, 2025, including

over $2,000 to its worth. Nevertheless, Monday noticed the market shaken, with the value

briefly dropping to a two-month low beneath the crucial $90,000 psychological

stage.

On this

article, I overview what triggered the sudden drop, why the Bitcoin worth is

going up as we speak, and the right way to interpret the bullish pin bar above the 50-day

exponential shifting common—a doubtlessly sturdy purchase sign.

On Tuesday,

Bitcoin is buying and selling above $97,000 on Binance, marking its highest worth in a

week. The cryptocurrency is presently up 2.7%, with altcoins following go well with.

Ethereum (ETH) has gained 4.9% over the previous 24 hours, reaching

$3,200, whereas XRP, the third-largest cryptocurrency by market cap, has

risen 7% to $2.56.

As proven in

the chart beneath, Bitcoin’s worth stays in a consolidation section that has been

in place since November, with the decrease boundary close to $92,000 and the higher

restrict at its earlier excessive of $98,000.

Bitcoin worth is presently inside a consolidation. Supply: Tradingview.com

Nevertheless,

Monday painted a much less optimistic image as

Bitcoin briefly dipped to only $89,398, inflicting important panic and

confusion amongst retail buyers.

The

short-term panic was additionally evident within the derivatives market: inside 4 days,

buyers pulled $1.6 billion from cryptocurrency exchange-traded funds (ETFs),

marking one of many longest promoting streaks in latest instances.

Over the

previous 24 hours, each bulls and bears have incurred losses. Roughly $500

million in leveraged positions had been liquidated throughout the market, with almost

equal distribution between lengthy and quick positions. Bitcoin accounted for over

20% of this exercise, with $44 million liquidated from lengthy positions and $72

million from shorts.

Supply: Coinglass.com

Analysts

attribute the latest decline in Bitcoin and the broader cryptocurrency market

to 2 main elements: so-called “Trump Commerce” and financial coverage.

Why Bitcoin Fell? Fed

Coverage and Market Uncertainty Shake BTC Value

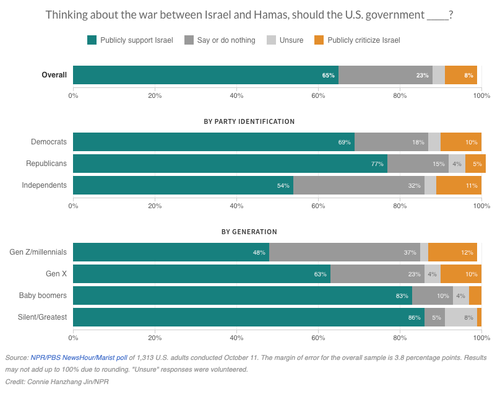

The

cryptocurrency market’s downturn is primarily pushed by shifting expectations

about Federal Reserve (Fed) rate of interest insurance policies. Sturdy financial indicators

have led buyers to anticipate an extended interval of upper rates of interest. The

sturdy U.S. job market, with 256,000 new nonfarm payrolls and a 4.1%

unemployment charge, has significantly influenced this outlook.

In accordance

to the CME’s FedWatch software, the chance of a charge lower on the subsequent assembly,

scheduled for January 29, is simply 2.7%. The market is presently pricing in a

stronger probability (round 40%) of a lower to the 4.00–4.25% vary within the second

half of the yr. Earlier expectations had been for a extra aggressive path of charge

cuts, which was anticipated to gas threat belongings reminiscent of cryptocurrencies and

shares.

The probabilities that the Fed will decrease charges this month are nearly zero. Supply: CME

Furthermore, the

preliminary euphoria surrounding Trump’s pro-crypto stance has given approach to extra

cautious market sentiment. Whereas Trump’s upcoming presidency promised to make

the U.S. the “crypto capital of the world,” buyers at the moment are

specializing in instant financial realities relatively than future coverage guarantees.

The

cryptocurrency decline is not occurring in isolation. The selloff in Treasury

markets has created a ripple impact throughout varied asset lessons, affecting

each crypto and conventional markets. This broader market response demonstrates

Bitcoin’s rising correlation with standard threat belongings.

Will Bitcoin Hold Going

Up? BTC Value Prediction and Technical Evaluation

The

candlestick I wish to spotlight within the technical evaluation of Bitcoin ‘s worth

chart could appear modest and even barely noticeable. Nevertheless, in my opinion, it

carries important power and shopping for potential. This can be a bullish pin bar

(or doji candle) with an nearly invisible physique and a really lengthy decrease wick,

indicating that bears had been in management however needed to concede to bulls by the

session’s shut.

What

does the chart present?

- The bullish

pin bar examined the 50 EMA and two crucial help ranges: $92,000 and $90,000. - All three

ranges held, and the value responded with a direct improve the next

day. - This sturdy

bullish sign confirmed the decrease boundary of the consolidation vary,

signaling that patrons are prone to actively defend the green-marked help

zone.

Bitcoin technical evaluation: BTC worth chart drew a bullish pin bar candle. Supply: Tradingview.com

Whereas

Bitcoin stays in consolidation, this response suggests, from a purely

technical standpoint, the potential for a transfer in the direction of $103,000 (the 2025

highs) and in the end $108,000, the all-time excessive (ATH) thus far.

Bitcoin Value Key Help

and Resistance Ranges

Help | Resistance |

$90,000 – psychological spherical | $100,000 – psychological spherical |

$92,000 – native lows examined in | $103,000 – highs from 2025 |

50 EMA – presently at $94,482 | $108,000 – present ATH |

Breaking

above the present all-time excessive is a crucial situation for contemplating

formidable forecasts for 2025 and past. A few of these projections are

really daring.

Bitcoin Value Prediction:

Will BTC Attain $1 Million?

Late final

yr, I explored the query, “Will

Bitcoin hit $1 million?” In response to Jeff Park, Head of Alpha

Methods at Bitwise Asset Administration, this could possibly be attainable if the U.S.

authorities had been to undertake a Bitcoin reserve technique. Nevertheless, he presently

assigns solely a ten% chance to this state of affairs.

Arthur

Hayes, the Founding father of the cryptocurrency trade BitMEX, has steadily

talked about such formidable ranges as $1 million. Final week, he appeared as a visitor on

Tom Bilyeu’s present, the place he mentioned the present state of the

cryptocurrency market throughout an almost two-hour interview. Hayes advised that

Bitcoin is progressively heading towards seven-figure valuations and will

doubtlessly attain them throughout the subsequent 5 years.

“It’s the bull market. When the music is taking part in you gotta $DANCE.” ~ Arthur Hayes x Tom Bilyeu#crypto #dance #memecoin #solana #bullrun pic.twitter.com/g9MdkEtIZe

— DANCE MEMECOIN 🤩 (@dancememecoin) January 7, 2025

“Bitcoin

has already survived for 15 years. This makes buyers begin to imagine that

it could actually final for many years to come back.” – Hayes commented. “BTC will likely be right here for

the subsequent 15, 20, 100 years. I feel it will likely be a retailer of worth. I can use it

to pay for issues I want, so I’ll take 2%, 3%, 4%, 5%, 10% of my

retirement revenue or financial savings and begin shopping for that asset now.”

Different

consultants, together with VanEck analysts, predict extra right down to earth numbers. Month

in the past, they

forecasted that Bitcoin worth may attain $180,000 in 2025.

JUST IN: $118 billion VanEck predicts $180,000 #Bitcoin and the U.S. will embrace a Strategic BTC Reserve in 2025 🇺🇸 pic.twitter.com/s7lnNgkyhn

— Bitcoin Journal (@BitcoinMagazine) December 13, 2024

Bitcoin Value, FAQ

Why Is the Value of

Bitcoin Going Up?

Bitcoin’s

worth is rising because of a robust bullish pin bar forming above crucial help

ranges, signaling sturdy shopping for exercise. Market sentiment improved as Bitcoin

rebounded from a two-month low of $89,398 to commerce above $97,000. This motion

displays consolidation throughout the $92,000–$98,000 vary, supported by technical

indicators and broader market optimism.

Will Bitcoin Rise Once more?

Bitcoin’s

worth is predicted to rise additional based mostly on technical evaluation. If it breaks

by key resistance at $103,000, it may check the all-time excessive of

$108,000. Lengthy-term projections stay optimistic, with some consultants predicting

important positive factors by 2025, assuming market circumstances stay favorable.

Why Is Bitcoin So Helpful

At this time?

Bitcoin’s

worth stems from its standing as a decentralized digital asset with restricted

provide, serving as a hedge towards inflation and a possible retailer of worth.

Its rising adoption, community safety, and potential as a worldwide reserve

asset contribute to its excessive valuation.

Why Did Bitcoin Fall

Just lately?

Bitcoin’s

latest decline was pushed by market reactions to expectations of extended

larger rates of interest from the Federal Reserve. Sturdy U.S. financial knowledge

lowered the probability of charge cuts, pressuring threat belongings like

cryptocurrencies. Moreover, shifting sentiment round pro-crypto insurance policies

beneath the upcoming U.S. administration added to market uncertainty.

How A lot Will Bitcoin Price

in 2025?

Bitcoin’s

2025 worth predictions differ extensively. Analysts forecast potential highs ranging

from $180,000 (VanEck) to over $1 million (Arthur Hayes), relying on adoption

tendencies, macroeconomic circumstances, and regulatory developments. A extra

conservative estimate locations Bitcoin at $180,000, reflecting regular progress

with out speculative extra.

Bitcoin’s

worth (BTC) is making important positive factors on Tuesday, January 14, 2025, including

over $2,000 to its worth. Nevertheless, Monday noticed the market shaken, with the value

briefly dropping to a two-month low beneath the crucial $90,000 psychological

stage.

On this

article, I overview what triggered the sudden drop, why the Bitcoin worth is

going up as we speak, and the right way to interpret the bullish pin bar above the 50-day

exponential shifting common—a doubtlessly sturdy purchase sign.

On Tuesday,

Bitcoin is buying and selling above $97,000 on Binance, marking its highest worth in a

week. The cryptocurrency is presently up 2.7%, with altcoins following go well with.

Ethereum (ETH) has gained 4.9% over the previous 24 hours, reaching

$3,200, whereas XRP, the third-largest cryptocurrency by market cap, has

risen 7% to $2.56.

As proven in

the chart beneath, Bitcoin’s worth stays in a consolidation section that has been

in place since November, with the decrease boundary close to $92,000 and the higher

restrict at its earlier excessive of $98,000.

Bitcoin worth is presently inside a consolidation. Supply: Tradingview.com

Nevertheless,

Monday painted a much less optimistic image as

Bitcoin briefly dipped to only $89,398, inflicting important panic and

confusion amongst retail buyers.

The

short-term panic was additionally evident within the derivatives market: inside 4 days,

buyers pulled $1.6 billion from cryptocurrency exchange-traded funds (ETFs),

marking one of many longest promoting streaks in latest instances.

Over the

previous 24 hours, each bulls and bears have incurred losses. Roughly $500

million in leveraged positions had been liquidated throughout the market, with almost

equal distribution between lengthy and quick positions. Bitcoin accounted for over

20% of this exercise, with $44 million liquidated from lengthy positions and $72

million from shorts.

Supply: Coinglass.com

Analysts

attribute the latest decline in Bitcoin and the broader cryptocurrency market

to 2 main elements: so-called “Trump Commerce” and financial coverage.

Why Bitcoin Fell? Fed

Coverage and Market Uncertainty Shake BTC Value

The

cryptocurrency market’s downturn is primarily pushed by shifting expectations

about Federal Reserve (Fed) rate of interest insurance policies. Sturdy financial indicators

have led buyers to anticipate an extended interval of upper rates of interest. The

sturdy U.S. job market, with 256,000 new nonfarm payrolls and a 4.1%

unemployment charge, has significantly influenced this outlook.

In accordance

to the CME’s FedWatch software, the chance of a charge lower on the subsequent assembly,

scheduled for January 29, is simply 2.7%. The market is presently pricing in a

stronger probability (round 40%) of a lower to the 4.00–4.25% vary within the second

half of the yr. Earlier expectations had been for a extra aggressive path of charge

cuts, which was anticipated to gas threat belongings reminiscent of cryptocurrencies and

shares.

The probabilities that the Fed will decrease charges this month are nearly zero. Supply: CME

Furthermore, the

preliminary euphoria surrounding Trump’s pro-crypto stance has given approach to extra

cautious market sentiment. Whereas Trump’s upcoming presidency promised to make

the U.S. the “crypto capital of the world,” buyers at the moment are

specializing in instant financial realities relatively than future coverage guarantees.

The

cryptocurrency decline is not occurring in isolation. The selloff in Treasury

markets has created a ripple impact throughout varied asset lessons, affecting

each crypto and conventional markets. This broader market response demonstrates

Bitcoin’s rising correlation with standard threat belongings.

Will Bitcoin Hold Going

Up? BTC Value Prediction and Technical Evaluation

The

candlestick I wish to spotlight within the technical evaluation of Bitcoin ‘s worth

chart could appear modest and even barely noticeable. Nevertheless, in my opinion, it

carries important power and shopping for potential. This can be a bullish pin bar

(or doji candle) with an nearly invisible physique and a really lengthy decrease wick,

indicating that bears had been in management however needed to concede to bulls by the

session’s shut.

What

does the chart present?

- The bullish

pin bar examined the 50 EMA and two crucial help ranges: $92,000 and $90,000. - All three

ranges held, and the value responded with a direct improve the next

day. - This sturdy

bullish sign confirmed the decrease boundary of the consolidation vary,

signaling that patrons are prone to actively defend the green-marked help

zone.

Bitcoin technical evaluation: BTC worth chart drew a bullish pin bar candle. Supply: Tradingview.com

Whereas

Bitcoin stays in consolidation, this response suggests, from a purely

technical standpoint, the potential for a transfer in the direction of $103,000 (the 2025

highs) and in the end $108,000, the all-time excessive (ATH) thus far.

Bitcoin Value Key Help

and Resistance Ranges

Help | Resistance |

$90,000 – psychological spherical | $100,000 – psychological spherical |

$92,000 – native lows examined in | $103,000 – highs from 2025 |

50 EMA – presently at $94,482 | $108,000 – present ATH |

Breaking

above the present all-time excessive is a crucial situation for contemplating

formidable forecasts for 2025 and past. A few of these projections are

really daring.

Bitcoin Value Prediction:

Will BTC Attain $1 Million?

Late final

yr, I explored the query, “Will

Bitcoin hit $1 million?” In response to Jeff Park, Head of Alpha

Methods at Bitwise Asset Administration, this could possibly be attainable if the U.S.

authorities had been to undertake a Bitcoin reserve technique. Nevertheless, he presently

assigns solely a ten% chance to this state of affairs.

Arthur

Hayes, the Founding father of the cryptocurrency trade BitMEX, has steadily

talked about such formidable ranges as $1 million. Final week, he appeared as a visitor on

Tom Bilyeu’s present, the place he mentioned the present state of the

cryptocurrency market throughout an almost two-hour interview. Hayes advised that

Bitcoin is progressively heading towards seven-figure valuations and will

doubtlessly attain them throughout the subsequent 5 years.

“It’s the bull market. When the music is taking part in you gotta $DANCE.” ~ Arthur Hayes x Tom Bilyeu#crypto #dance #memecoin #solana #bullrun pic.twitter.com/g9MdkEtIZe

— DANCE MEMECOIN 🤩 (@dancememecoin) January 7, 2025

“Bitcoin

has already survived for 15 years. This makes buyers begin to imagine that

it could actually final for many years to come back.” – Hayes commented. “BTC will likely be right here for

the subsequent 15, 20, 100 years. I feel it will likely be a retailer of worth. I can use it

to pay for issues I want, so I’ll take 2%, 3%, 4%, 5%, 10% of my

retirement revenue or financial savings and begin shopping for that asset now.”

Different

consultants, together with VanEck analysts, predict extra right down to earth numbers. Month

in the past, they

forecasted that Bitcoin worth may attain $180,000 in 2025.

JUST IN: $118 billion VanEck predicts $180,000 #Bitcoin and the U.S. will embrace a Strategic BTC Reserve in 2025 🇺🇸 pic.twitter.com/s7lnNgkyhn

— Bitcoin Journal (@BitcoinMagazine) December 13, 2024

Bitcoin Value, FAQ

Why Is the Value of

Bitcoin Going Up?

Bitcoin’s

worth is rising because of a robust bullish pin bar forming above crucial help

ranges, signaling sturdy shopping for exercise. Market sentiment improved as Bitcoin

rebounded from a two-month low of $89,398 to commerce above $97,000. This motion

displays consolidation throughout the $92,000–$98,000 vary, supported by technical

indicators and broader market optimism.

Will Bitcoin Rise Once more?

Bitcoin’s

worth is predicted to rise additional based mostly on technical evaluation. If it breaks

by key resistance at $103,000, it may check the all-time excessive of

$108,000. Lengthy-term projections stay optimistic, with some consultants predicting

important positive factors by 2025, assuming market circumstances stay favorable.

Why Is Bitcoin So Helpful

At this time?

Bitcoin’s

worth stems from its standing as a decentralized digital asset with restricted

provide, serving as a hedge towards inflation and a possible retailer of worth.

Its rising adoption, community safety, and potential as a worldwide reserve

asset contribute to its excessive valuation.

Why Did Bitcoin Fall

Just lately?

Bitcoin’s

latest decline was pushed by market reactions to expectations of extended

larger rates of interest from the Federal Reserve. Sturdy U.S. financial knowledge

lowered the probability of charge cuts, pressuring threat belongings like

cryptocurrencies. Moreover, shifting sentiment round pro-crypto insurance policies

beneath the upcoming U.S. administration added to market uncertainty.

How A lot Will Bitcoin Price

in 2025?

Bitcoin’s

2025 worth predictions differ extensively. Analysts forecast potential highs ranging

from $180,000 (VanEck) to over $1 million (Arthur Hayes), relying on adoption

tendencies, macroeconomic circumstances, and regulatory developments. A extra

conservative estimate locations Bitcoin at $180,000, reflecting regular progress

with out speculative extra.