Aren’t They Dangerous?

Many monetary pundits assume so, and when it comes to volatility and the chance of everlasting principal impairment, they’re proper. However opposite to widespread notion, equities will not be essentially extra dangerous than such supposedly “secure” belongings as US Treasuries.

Let me clarify.

The US 10-year Treasury bond yielded 2.46% in March. So, the US authorities might borrow for a decade at a charge of two.46% a yr, and we might purchase T-bills and lend to the US authorities for 10 years at 2.46% curiosity.

That is thought-about a “secure” funding because the US authorities has nearly zero default danger. So, we’re kind of assured that 2.46% annual return over 10 years if we maintain the funding till maturity.

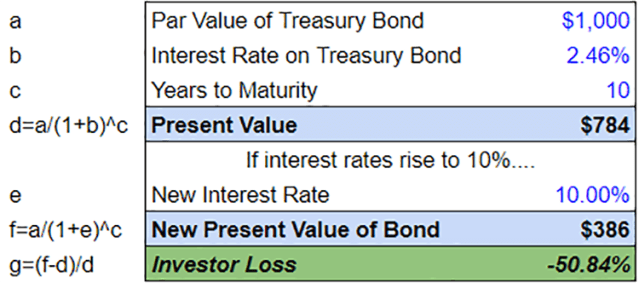

However what if rates of interest instantly skyrocket upwards to 10%? It hasn’t occurred in many years, however a ten% rate of interest is not at all unprecedented for US authorities bonds. Furthermore, measured variously at ~6% or 8.3%, relying on the metric used, inflation like at the moment’s hasn’t been seen in many years both. A return to that 10% rate of interest would lower the worth of our “secure” Treasury bond in half.

However let’s assume US inflation holds at 6% over the subsequent decade and we lend our cash to the federal government at 2.46% over that point. After taking the price of inflation under consideration — a 2.46% rate of interest minus 6% inflation — we might be successfully lending at –3.54% yearly. If we did nothing in any respect and stored our cash in money or stuffed underneath the proverbial mattress, then in actual, after-inflation phrases, our cash would depreciate in worth by 6% a yr.

10-12 months Treasury Bond Efficiency: A Hypothetical

Whereas shares are rather more unstable than bonds, this doesn’t preclude bonds from producing terrible actual (and even nominal) returns for buyers over short- and long-term time intervals.

In fact, firms may be adversely affected by inflation and different macro occasions, too, and there’s no assure that shares will outperform inflation — definitely not over the short-term, at the least. Nonetheless, companies can theoretically evolve and adapt. (“Theoretically” as a result of US nonfinancial company returns on fairness have been remarkably secure, at round 11%, since World Conflict II.) They’ll increase costs to move the prices of inflation on to clients, lower prices elsewhere within the enterprise, dump actual property at inflated costs, and so forth. Thus, as belongings, equities are higher geared up to climate the inflationary storms.

A bond, then again, is solely a locked-in contract with no facility to regulate to inflation or some other outdoors affect or growth. A Treasury bond, “risk-free” as it’s over time, likewise can not adapt to altering circumstances.

As Jeremy Siegel and Richard Thaler observe:

“Most monetary holocausts that destroy inventory values have been related to hyperinflation or monetary wealth confiscation the place buyers are sometimes worse off in bonds than in shares.”

Lengthy-Time period Returns for Equities Are Larger Than for Different Asset Lessons

Fairness markets outperform money and bonds over time by a large margin, albeit with a lot better short-term volatility. Over any transient funding horizon, we could also be higher off in money or bonds. But when we’re investing for the long term — seven years or extra — then shares are most likely the higher wager.

Our “danger,” due to this fact, is inversely associated to our time horizon. The inventory market could also be chaotic over the brief time period, however it’s probably the most constant wealth generator over the long run. Certainly, the y-axis within the chart above is on a logarithmic scale, so shares have outperformed bonds by roughly three orders of magnitude since 1801.

For Lengthy-Time period Buyers, Shares Are Much less Unstable Than Meets the Eye

The annual commonplace deviation of US inventory returns between 1801 and 1995 is eighteen.15%, vs. 6.14% for T-Payments, based on analysis by Siegel and Thaler. Over 20-year intervals, nonetheless, the usual deviation of US inventory returns is definitely decrease than T-Payments: 2.76% vs. 2.86%. That is regardless of shares returning 10.1% CAGR in contrast with 3.7% for T-Payments.

US Inventory Returns vs. US Treasury Bonds: Normal Deviation

The riskiness of shares can’t be discounted, particularly given the turbulence we’ve seen in latest weeks and months. However this evaluation demonstrates that over prolonged intervals of time, they could be each higher-returning and fewer dangerous than bonds. And that makes them value holding for the long term.

Should you favored this publish, don’t overlook to subscribe to the Enterprising Investor.

All posts are the opinion of the creator. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the creator’s employer.

Picture credit score: ©Getty Pictures/Nick Dolding

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can report credit simply utilizing their on-line PL tracker.