FooTToo

Investment thesis

André Kostolany, a very old-school European investor from Hungary, used to say that the relationship between the economy and the stock market is like that of a man walking his dog. They move along in the same direction, but sometimes the dog is running ahead, and sometimes he is behind.

To use this metaphor, I believe Tesla, Inc. (NASDAQ:TSLA) shares are running ahead of their fundamentals quite a lot at the moment. With a P/E ratio of over 70, shares are priced for perfection, and Tesla trades with a material difference from other auto manufacturers.

There is a lot of hype behind this. The essence of it can maybe be found in the transcript of the Q2 earnings call, where Elon Musk said that there will be infinite demand for the company’s robotaxi products (which do not exist), and Tesla is going to manufacture the revolutionary design of the robotaxis in a revolutionary way.

I am not qualified to judge whether this will be so or not. However, I believe the Tesla share price currently faces several different risks, and each will more likely than not result in a price drop if it materializes. Adyen (OTCPK:ADYEY, OTCPK:ADYYF) is an excellent recent example of what can happen to a mispriced stock if the market gets disappointed suddenly.

Tesla shares were down almost 70% between September 2022 and January 2023. I hypothesize this will happen again over the next 3-12 months. Therefore, I decided to short Tesla, and I will describe how I am doing it in the article. As always, I welcome comments and constructive criticism.

But before that, I will go through each of the risks individually.

1. Further reducing profitability

EY recently published a study regarding the profits and revenue of the 16 largest auto manufacturers in Q2 2023 (the article is in German). Revenue increased by 18% and earnings by 31% across all 16 manufacturers. With an operating margin of 9.6%, Tesla was only at number 6 regarding profitability. Mercedes (OTCPK:MBGYY, OTCPK:MBGAF) was at number one with a 13% operating margin. Regarding absolute profit growth, Tesla was even doing worse (relative to the other manufacturers).

I would focus though on the fact that Tesla, founded only in 2003, is among the 16 largest auto manufacturers, which is undoubtedly impressive. However, shares are priced as if the company were already number one.

I hypothesize that Tesla’s operating margins are primarily a function of the low number of car models and the (relatively) small (and cost-optimized) manufacturing footprint. You do not hear Volkswagen (OTCPK:VWAGY) or Toyota (NYSE:TM), which both have a global manufacturing base, say they will produce fewer cars next quarter because they need to remodel factories. They do this all the time.

As an example, Tesla does not produce the Model S and Model X anymore in a right-hand drive configuration. It seems this is because the production cost is too high compared to the relatively low number of cars sold.

There is a risk, in my view, that increasing either the model line-up or the manufacturing footprint will result in further margin erosion. Tesla has switched from talking about their profit margin to sales growth, saying that profits could come later through autonomy and robotaxis – see, for example, the transcript of the last earnings call. But I assume there are limits to what the market will tolerate.

2. Growth below expectations

Tesla is doing well here, growing faster than almost any large car manufacturer. BYD Company (OTCPK:BYDDF, OTCPK:BYDDY) is the one exception.

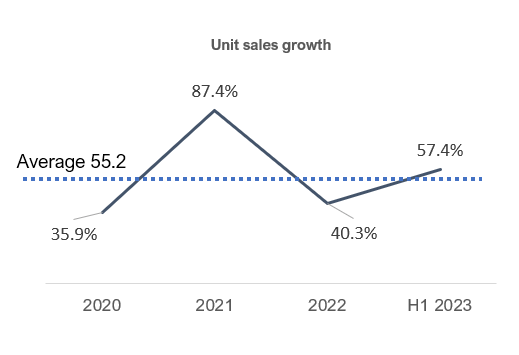

Tesla intends to grow unit sales by around 50% per year. The guidance is somewhat flexible; the company says it will be more than 50% in some years and less in others. Over the last three years and YTD, the growth rates have aligned with that guidance.

Annual unit sales growth rate (Source: Bellasooa Research, Tesla)

But the bigger Tesla gets, the harder it will be to keep up the growth rate. Tesla is not the undisputed king of the hill anymore. While it still sells the most EVs in the U.S., Volkswagen has overtaken Tesla in Europe, and BYD has done so in China.

The worst that could happen to Tesla shares is a reduced growth rate and low margins.

3. A forever FSD beta

As we know, FSD is formally just a level 2 autonomous driving system. Tesla released the first FSD beta in October 2020, so it is almost three years in beta. Like practically every year, Elon Musk claims that Tesla will achieve full autonomy by the end of 2023, but few people seem to believe that (or care). This year is no different, but the wording is somewhat more vague. At least I am not sure what he means with full autonomy. Being capable of driving at a level safer than humans does not strike me as a measurable goal.

Boris Johnson famously said about Brexit that his policy on cake is pro having it and pro eating it (I have been living in the UK for a few years, so I understand the importance of cake there). This attitude has certainly not worked well for Boris Johnson, but in my view, Tesla and Elon Musk are doing the same with FSD. On the one side, they use superlatives when describing how capable it is, but when it is not working, it is the driver’s fault because he has not paid attention.

Whether there is a path from what Tesla is selling now as FSD beta to a car with L4 or even L5 autonomy, I do not know. Maybe the lack of precise data on FSD progress and goals is not even a coincidence but a marketing feature. A few days ago, Elon Musk posted a video on X of him driving in a Tesla with an early version 12 of the FSD, which he had described as mind-blowing.

I found the video disappointing. The video starts nicely with the car navigating a construction site, and after not much more than one minute, the car is driving in the wrong lane. I stopped watching after that (obviously missing some red-light issues) because: what is the point? From my experience designing and building software, I would say that it is incredibly easier to create something that works sometimes or even usually than something that works all the time.

There is a clear risk here that Tesla will have a the-emperor-has-no-clothes-moment (as in the children’s story, where nobody wants to say that the emperor is naked until a child points it out). This could happen if another company has something which is clearly superior.

Both Waymo and Cruise are now offering commercial robotaxis across San Francisco. I find that impressive (I would not want to drive in San Francisco), and a lot can happen here in the next 6-12 months. The pro-FSD argument is that Waymo and Cruise use inferior technology due to their pre-mapping approach. But if it works across major cities, at least I would not care.

Another key difference is that the Waymo and Cruise robotaxis are full of sensors like Lidar and Radar, whereas Tesla relies only on cameras. With its Hardware 4.0 Telsa seems to be coming around and including Radar. However, Elon Musk still maintains that Tesla will achieve full self-driving with cameras only – understandably, as otherwise, only the most recent Tesla cars will be able to achieve it. The sensors increase the cost of the vehicle, but Lidar prices have declined rapidly. They already appear in standard production vehicles that aspire for enhanced Level 2 or even Level 3 autonomy. It is not hard to see why. Cameras and software interpret and calculate depth, but Lidar sensors can measure distances with millimeter precision.

Mercedes had a big win earlier in the year, becoming the first automotive company to receive a certification for an SAE Level 3 system in the U.S. for a standard production vehicle. In contrast to Tesla’s Full Self-Driving product, Mercedes takes full responsibility for its DRIVE PILOT system, like any other car part. DRIVE PILOT also includes Lidar sensors.

A typical school of thought is that FSD and robotaxis will provide Tesla with considerable future revenue streams. I have to admit that – for various reasons – I am not a believer. For example, I do not understand how auto manufacturers will sell more cars if every car is a robotaxi. But that is me, and maybe a the-emperor-has-no-clothes-moment will not come anytime soon or ever, but it is a risk to consider. Any disappointment here will most likely dramatically affect the share price.

4. Issues with the Cybertruck release

The Cybertruck is maybe the most anticipated car ever to be released. Looking at it, you want to be thankful that a company like Testa exists. For me (I am a computer geek), it is like looking at the first iMacs from Apple (NASDAQ:AAPL) in 1998. They were boldly different than any other computer – and as we know, that boldness worked out nicely for Apple.

Having said that, when Apple announced the iMac G3 in May 1998, there was a specification, and the first computers were sold three months later in August – and back then, people thought that the three months were a disappointingly long time.

Almost four years after its announcement (in November 2019), social media is full of pictures and short movies of Cybertruck release candidates driving around. However, Tesla still has not announced a delivery date, price, or specification for the Cybertruck.

During the last earnings call, Elon Musk said there would probably be a launch event at the end of September. Obviously, Cybertrucks are being produced in specific numbers already – there have been sightings on highways of them being transported. But we do not have any details and investors should remember that the Semitruck is still in pilot production almost a year after the first vehicles were delivered.

So, there is a risk that Tesla’s share will take a nosedive if anything goes wrong with Cybertruck deliveries.

5. Dependency on government subsidies

EV sales depend heavily on government subsidies, direct or indirect, like the tax credits in the U.S. Tesla is a significant beneficiary here. This is the case in all three of its major markets: the U.S., China, and Europe.

It seems that the transition to electric vehicles is accelerating. This development is not market-driven but caused by government policies to meet a climate emergency. Those policies, which are pretty costly, can change. Over the last couple of years, subsidies have mostly gone up. But this is not set in stone.

We are talking about such huge sums here that I find it hard to believe that the money will flow indefinitely, especially when the number of EVs sold is going up from around 15 percent of vehicles sold (the share in Europe YTD) to 30 percent and more.

Such a reduction is already happening in Germany. From January 2024 onwards, private buyers of smaller electric cars will get a reduced subsidy (called environmental bonus) of 3,000 instead of 4,500 euros, and vehicles with a net list price above EUR 45,000 will no longer receive any subsidies. The support will be removed entirely at the end of 2025. From September 1, 2023, companies will no longer be able to receive an environmental bonus for their new car purchases.

It remains to be seen what effect this will have on BEV sales and how elastic those are. The few data points we have would indicate that sales are quite elastic. Looking again at Germany, subsidies for PHEVs (plug-in-hybrids) were removed from January 1, 2023. As of the end of July 2023, PHEV sales were down 43.3% YTD compared to 2022.

So, something will likely have to happen sooner or later. Consumers could still buy more and more EVs and pay more money, but I think that is unlikely. This does not mean that EV sales will go down. To me it looks like the transition to electric vehicles is unstoppable. But it might not be a linear trajectory and sales growth could slow down. Tesla, with its 50% annual growth expectation, would suffer disproportionally. Competition from other manufacturers, especially outside of the U.S., is also growing. I am not sure that Tesla can rely on a bigger and bigger share of the pie, especially if that pie does not keep growing fast enough.

How I am doing it

Going short directly on a U.S. stock is difficult for a European retail investor (I live in Austria). Even if I found a broker who would let me do it, I would probably have to invest quite a significant amount of money, and more than I am willing to lose.

Therefore, I decided to buy Put options with a duration of 4 to 6 months. I plan to roll over the options to the next 4 to 6 months at about the midpoint of the duration, so every 2 to 3 months.

The Put options limit my losses if things do not go too well, but this is of course still possibly a total loss. However, the duration and rolling-over process together give me the time to see my investment thesis play out.

Rolling over the options to the next duration comes with a transaction cost, so I do not want to do that too often. Having that transaction cost every 2 to 3 months is acceptable to me.

I decided to go for options that are not quite in the money but with a strike price not more than 10% below the share price. This limits the loss rate, but on the flip side also the leverage of the options. The first options I bought expired in mid-December with a strike price of $275 USD. Tesla shares stood at USD $279 at the time of buying.

How is it going so far?

I started buying the first Put options at the beginning of July, and it has been going quite well so far – although none of the mentioned risks has materialized (yet). Due to the leverage of the options, I am currently up more than 40% (but it had already been 80% at some point).

I intend to keep going for at least six to nine months – until I have significantly more money or nothing is left.

This is an important point, and I want to add a warning here: with options, be it Put or Call, there is a possibility that you lose all of your money. You should never invest more than a very small part of your portfolio in options. If you are new to options, there are a lot of websites with good information. The SEC website may be a good start.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.