brightstars

By Bob Iaccino

At a Look

- Gold’s efficiency can fluctuate considerably relying on financial, geopolitical and market elements

- Traditionally, gold performs nicely when rates of interest are falling as traders search safe-haven belongings

Gold has lengthy been thought of a safe-haven asset, with traders turning to the dear metallic throughout financial uncertainty. Nonetheless, its efficiency can fluctuate considerably relying on the prevailing financial circumstances. With the Fed’s subsequent motion prone to be rate of interest cuts, how has gold traditionally carried out beneath totally different combos of falling or steady rates of interest, financial progress and inflation?

1. Falling Curiosity Charges, Slower Economic system, and Falling Inflation (Smooth-Touchdown)

Gold has usually carried out modestly during times characterised by falling rates of interest, a slower economic system and falling inflation. A main instance occurred within the early 2000s, notably from 2001 to 2003.

The U.S. economic system slowed considerably after the dot-com bubble burst and the 9/11 assaults. The Federal Reserve responded by slicing rates of interest aggressively, from 6.5% in January 2001 to 1% by June 2003. Inflation declined throughout this era, falling from 3.4% in 2000 to 1.6% in 2002.

Gold’s efficiency throughout this time was usually optimistic, although not spectacular. The worth of gold rose from round $270 per ounce in early 2001 to about $350 per ounce by the top of 2003, representing a achieve of roughly 30% over three years.

The comparatively modest efficiency of gold throughout this era will be attributed to a number of elements. Whereas decrease rates of interest usually help gold costs by decreasing the chance price of holding the non-yielding asset, the deflationary atmosphere and slower financial progress created conflicting pressures.

Seeking to the Fed’s September resolution and past, a hybrid state of affairs the place inflation is managed with out triggering a recession – involving gradual charge cuts and steady progress – might nonetheless help gold costs by means of a mixture of inflation considerations and accommodative coverage. This might probably make gold an efficient hedge within the coming months.

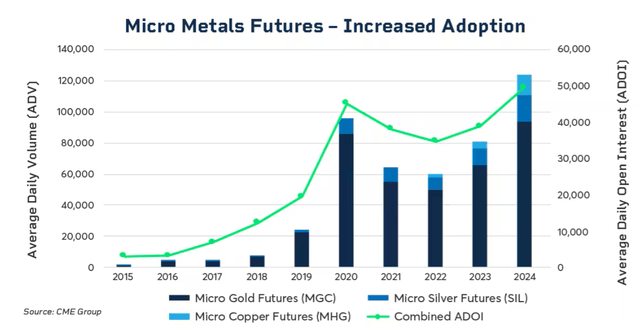

As of the top of Q2 2024, Micro Gold futures had been already buying and selling 27% extra YTD at 93K contracts per day on common, predominantly from value volatility available in the market. The newest information from August exhibits Micro Gold futures ADV elevated 170% in comparison with August 2023 to 124,000 contracts.

2. Quickly Falling Curiosity Charges, Quickly Slowing Economic system, and Falling Inflation

Intervals of quickly falling rates of interest, a shortly decelerating economic system and falling inflation have usually been optimistic for gold as traders search safe-haven belongings. A main instance occurred through the 2008 International Monetary Disaster.

In response to the disaster, the Federal Reserve slashed rates of interest from 5.25% in September 2007 to successfully zero by December 2008. The U.S. economic system contracted sharply, with actual GDP falling by 2.5% in 2009. Inflation additionally declined, dropping from 3.8% in 2008 to -0.4% in 2009.

Gold carried out exceptionally nicely throughout this era of financial turmoil. The worth of gold rose from round $700 per ounce in late 2007 to over $1,000 per ounce by early 2009, and it continued to climb within the following years, reaching a peak of almost $1,900 per ounce in 2011.

Gold’s robust efficiency throughout this disaster will be attributed to its standing as a safe-haven asset. Because the monetary system teetered on the point of collapse and conventional belongings like shares and actual property plummeted in worth, traders sought the perceived security of gold. Whereas the economic system stays comparatively steady as of early September, any indicators of a extra extreme downturn might immediate extra aggressive Fed motion and emphasize gold’s function as a protected haven.

3. Falling Curiosity Charges, Steady Economic system, and Rising Inflation

The interval from 2003 to 2006 supplies one other attention-grabbing case research. The U.S. economic system was comparatively steady throughout this time, with GDP progress averaging round 3% yearly. Inflation rose reasonably, growing from 1.6% in 2002 to three.2% by 2006. The Federal Reserve, which had saved rates of interest low within the early 2000s, started a gradual tightening cycle in 2004 however maintained a usually accommodative stance.

Gold costs carried out strongly throughout this era, rising from about $350 per ounce in early 2003 to over $700 per ounce by mid-2006, representing a achieve of roughly 100% in simply over three years.

The optimistic efficiency of gold throughout this time will be attributed to a mix of things. Rising inflation created a requirement for gold as an inflation hedge, and since rates of interest had been solely elevated regularly, the chance price of holding gold remained comparatively low. As of early September, the Fed is signaling potential charge cuts whereas inflation stays above goal. This atmosphere may gain advantage gold, echoing the 2003-2006 interval.

Patterns Aren’t Predictive

The historic examples show that gold’s efficiency as an asset can fluctuate considerably relying on the prevailing financial circumstances. Nonetheless, some normal patterns emerge:

- Gold tends to carry out nicely during times of financial uncertainty, primarily when rates of interest are falling and traders search safe-haven belongings.

- Rising inflation, particularly when mixed with low or falling rates of interest, creates a very favorable atmosphere for gold costs.

- In deflationary environments, gold’s efficiency could also be extra muted, however it could possibly nonetheless appeal to traders in search of a retailer of worth throughout financial downturns.

- Steady financial progress can present a supportive backdrop for gold funding, notably when mixed with accommodative financial coverage and rising inflation expectations.

It is necessary to notice that whereas these historic patterns can present insights, the gold market is influenced by a posh interaction of financial, geopolitical, and market elements, and its conduct can generally deviate from historic norms. Because the Fed continues to evaluate and regulate U.S. financial coverage, gold will probably be an space to observe for a lot of market contributors.

Authentic Publish

Editor’s Notice: The abstract bullets for this text had been chosen by In search of Alpha editors.