Sohl/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Big Money Is Still Doing Its Thing

The selloff in 2022 has been long and painful for retail investors and no doubt for many funds too. Market observers will each have their own category name for this kind of dumpage – in our world this is a Wave 4 down which can take a long time to resolve, so long that they feel that they are forever. This is in contrast with the most recent market resets, the COVID crisis – a shock and awe Wave 2 down which by the time you realized what was happening, the market was going up again. This isn’t that. That was a skirmish; this is a campaign. The protagonists in this war of attrition are retail, who made far too much money far too easily in 2020-21 to get away with it, and Big Money, which didn’t make enough money in 2020-21 because they were too busy being sensible, whereas the right strategy for that time was simply to YOLO, BTD, and generally meme your way to stock market nirvana. If you managed risk, in the way Big Money is paid to manage risk, well, 2020-21 was good but not great for you, because you were too sensible to win from the nuttiest of nuts moments.

Big Money has more than got its ball back however. Thanks to the Great Leveller, the Internet, and very specifically, FinTwit, in 2020 everybody became a Vix expert meaning they learned what it was and learned how to use homestead-threatening complex instruments like UVXY and SVXY to YOLO too. So this time around Big Money has engaged in a controlled destruction of retail accounts without much of a sneeze by the Vix. This has been achieved using a put-heavy strategy which has dragged the main indices down by virtue of the consequent delta-neutral rebalancing of the market makers selling these puts in the first place.

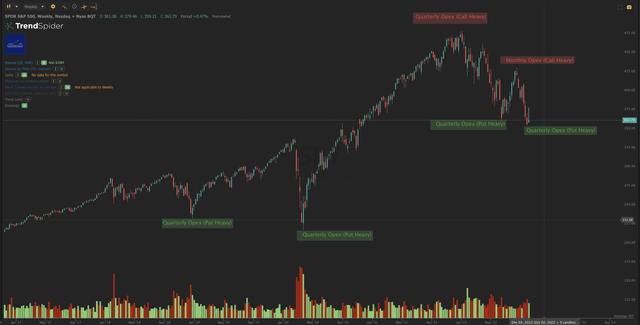

For instruments with heavy options volume – particularly the SPY, the QQQ and so forth – it has been a continuous wall of pain for retail, by design. While options are not our thing, we have come to use options market analysis more and more in our index work, because if you want to know where the index is going to be at the end of the month or the quarter? You could spend a long time on illusory comfort blanket calculations involving p and e, or, you could just take a look at whether puts or calls were dominant at the relevant expiration date. Here’s a little chart we put together based on work with our friends at SpotGamma. You can open a full page version of this chart, here.

SPY vs Opex Chart (TrendSpider, Cestrian Analysis, SpotGamma Analysis)

2022 in the indices has been the story of value destruction by momentum brought about by institutional put buying in large volume. As large dollar values of puts have been bought in the indices, market makers (who, having sold the puts, are long the market) have had to short stocks in large dollar quantities, leading to downward momentum, causing momentum funds to chase stocks downwards, leading to retail scaring itself silly, leading to retail buying a lot of puts, leading to …. you see the problem. The pressure release valve gets hit each quarter end when options expire; if put-heavy, after the expiry, dealers rebalance back to delta neutral by buying back stock, causing a short-covering rally. Which then scares retail (it’s not real!! sell the rip!!!) and gives institutions a higher level from which to short via puts once more. And so the cycle repeats. At some point institutions will switch this up to start deploying the money made from those bloated puts back into long positions, and the pendulum shall swing, and retail won’t believe it, and will get left behind as usual. And thus the Revenge Of Big Money shall be exacted. First on the way down (gaining via puts whilst retail 401ks bleed) and then on the way up (gaining via calls and/or long stocks whilst retail is too scared to buy back in lest it drops once more). This is why Big Money is big money and retail, er, isn’t.

You doubt us? Well here’s some supporting evidence. Specifically, let’s look at a very scary stock that doesn’t have anything like the options tomfoolery that can be seen in indices.

Zscaler (NASDAQ:ZS). You may have heard of it. Cybersecurity stock. Doesn’t matter what it does, it should be complete toast, dashed on the rocks till it be drownded, for it hath committed many sins including (1) being EPS negative (BAD!) on account of (2) a big ole pile of stock based compensation (DOUBLEPLUS BAD!) and further (3) trading at a flying-rodent-feces crazy multiple of revenues not least because oh did we mention it doesn’t have any e so it could hardly trade on a p/e even if it wanted to. Urgh! Declares literally all of FinTwit, who are all rates trading experts now.

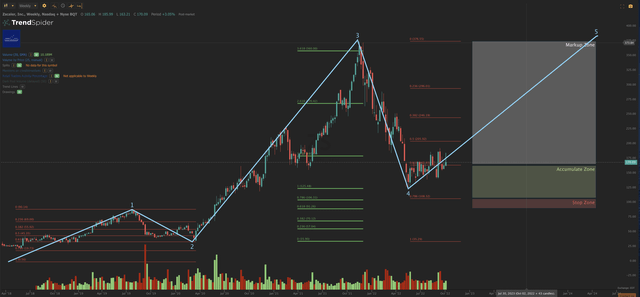

Institutions, however, have been busy buying this thing. Open a full page version of this chart, here.

ZS Chart (TrendSpider, Cestrian Analysis)

The stock is quietly, very quietly, 35% up off of its Q2 lows. We’ve had the name rated at “Accumulate” in our subscription service, Growth Investor Pro, for some time now, while it plumbed the depths of the Wave 4 you see in the chart above. We flagged it as a buy opportunity between around $108-165, that range defined by two key Fibonacci retracement levels as we show. And the stock has moved up and reached into the “Markup Zone” we highlight which, with deference to a Mr Wyckoff, is the zone in which other people buy stocks you already owned and give you free money as the thing rises in value in your account whilst you do … nothing except congratulate yourself on your prior wisdom.

With today’s big selloff the name is just about in our “Accumulate” zone once more, so we rate it as such here in this note. We don’t expect it to hang around very long. We believe it can perform very nicely through 2022 and into 2023 and we would go so far as to say we think this stock can make new highs in maybe 2024. That would be a gain of more than 120% from here, and even if you placed a stop loss below those Q2 lows you still have a risk/reward ratio of say ($377-$165):$65 = >3:1. A better ratio if you place a tighter stop of course.

So, want to dodge the Big Money index-wrecking crew? Consider picking up some scary high beta names, which oddly (as it seems before you realize the options point above) are holding up better over the Q2 lows than are the indices.

ZScaler comes with superb fundamentals too.

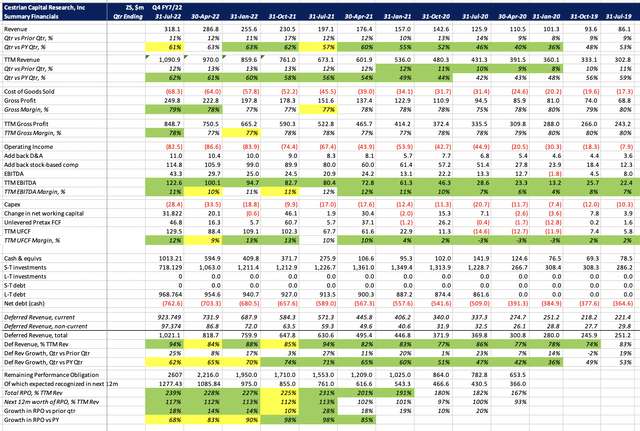

ZS Financials (Company SEC Filings, YCharts.com, Cestrian Analysis)

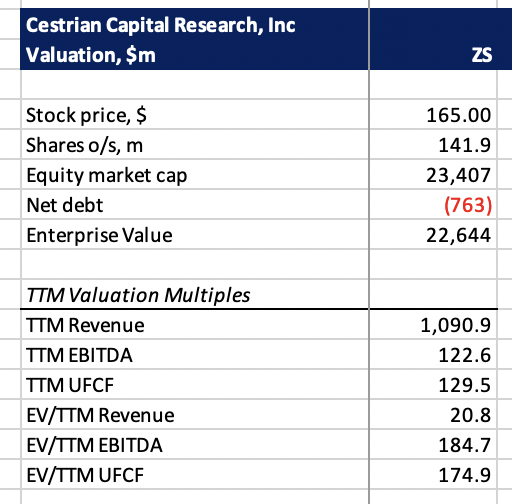

ZS Valuation (Company SEC filings, Cestrian Analysis)

You may have to hold your nose at the valuation. Still 22x TTM revenue, even after all this in 2022. But then look back at the chart and ask yourself, does that look like a going-up stock or not.

We say it does. So – Accumulate rating.

Cestrian Capital Research, Inc – 8 October 2022.